Why PE teams choose Papermark for fundraising

Replace email attachments with permissioned rooms and know who is engaged. Pair your VDR with an investor CRM and run a disciplined, auditable process from teaser to close.

- • Page‑by‑page analytics on CIMs, models, and KPIs to prioritize buyers

- • NDA gating, password protection, expiry, and email verification for secure sharing

- • Unlimited rooms and multiple custom domains for sponsor‑specific workflows

- • Granular group and file‑level permissions with audit logs to meet compliance

Private equity fundraising software use cases

Sponsor outreach

Use private equity fundraising software to share teasers and CIMs in buyer‑specific rooms. Track who reads what and prioritize high‑intent sponsors.

Diligence workflows

Centralize financial, legal, and commercial workstreams with audit logs and role‑based access in one fundraising platform.

LP updates & reporting

Use analytics and permissions to deliver board packs, lender files, and monthly updates to LPs.

Benefits of private equity fundraising software

Fund management software

Manage deals, holdings, fundraising activities, and reporting in one place. Link opportunities with rooms for a complete view of pursuits, commitments, and holdings—filter quickly to focus on what matters.

Transparent communication

Keep internal and external stakeholders aligned with activity history, role‑based access, and clear task tracking across the fundraising process.

Adaptive fund administration

Customize stages and data capture to your workflow. Collect inputs with forms, and share updates via a branded investor portal.

Confidential data sharing

Grant granular access levels to protect sensitive information. Provide LPs a clean, visual portal for real‑time updates.

Holistic overview for multi‑asset managers

- Streamline capital calls, distribution notices, and commitments from a single platform

- Organize communication across the fund lifecycle with structured rooms and permissions

- Use dashboards to convert complex data into actionable insights

Who private equity fundraising software is for

Fund of funds & family funds

Diversify across funds, standardize reporting, and reduce risk with better data.

Corporate & real estate funds

Run systematic origination and investor updates with structured, permissioned rooms.

Turn reports into strategic insights

Guided data collection

- • LP and portfolio surveys to capture accurate inputs

- • Optional ESG metrics for impact‑focused strategies

- • Branded reports delivered via investor portal

Actionable analytics

- • Page‑level engagement to pinpoint serious investors

- • Room‑level access logs for audit and compliance

- • Exportable insights for IC materials and updates

What is private equity fundraising software?

Private equity fundraising software combines a virtual data room (VDR), investor CRM, and analytics to run disciplined processes from teaser to close. With Papermark, PE teams securely share documents, control access, and measure investor intent with granular, page‑level analytics.

Core components

- • VDR for document security and permissions

- • Investor CRM for pipeline, notes, and tasks

- • Analytics for page‑by‑page engagement and follow‑up

Key benefits

- • Faster cycles with clear checklists and structured rooms

- • Higher conversion by focusing on engaged sponsors

- • Better governance with full audit trails

Private equity fundraising software comparison

Compare key features across different fundraising software solutions

- Feature

- Papermark

- Traditional VDRs

How private equity fundraising software works

- Create buyer‑specific rooms and invite your deal team

- Upload CIMs, models, legal docs; set NDA gate and link policies

- Share links with sponsors; monitor page‑level engagement

- Prioritize outreach based on time‑on‑page and revisit patterns

- Export analytics and finalize secure closing documentation

All essential data room features

For secure document sharing

- Open Source

- Fully open source and transparent infrastructure

- Secure Link Permissions

- Enterprise-grade security for your documents links

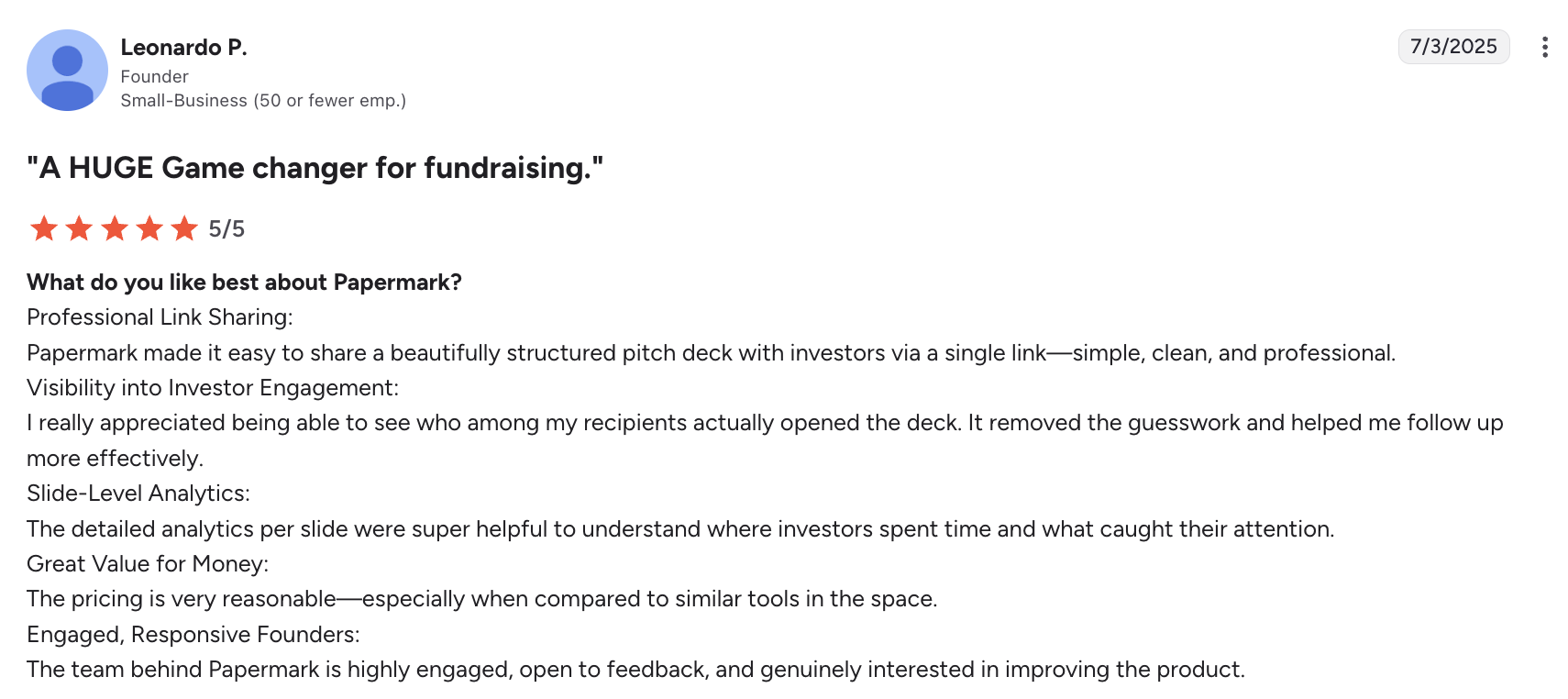

- Page by page analytics

- Track engagement and viewer insights

- Custom Domain & Branding

- Personalize and customize your document experience

- AI-Powered

- Enhanced document intelligence with AI

- Community

- Join our growing community of users and customers

Secure document sharing for private equity fundraising

Papermark is the open-source private equity fundraising software trusted by PE teams worldwide

- Track who views your CIMs, financial models, and due diligence materials

- Custom branding, NDA requirements, and granular access controls

- Page-by-page analytics to understand investor interest and engagement

- Self-hosting option for firms requiring full control and compliance