Why investment banks and deal teams use Papermark VDR

A modern VDR helps you run disciplined deal processes with full control and visibility. Replace email attachments with branded, permissioned rooms and know which buyers are actually engaged.

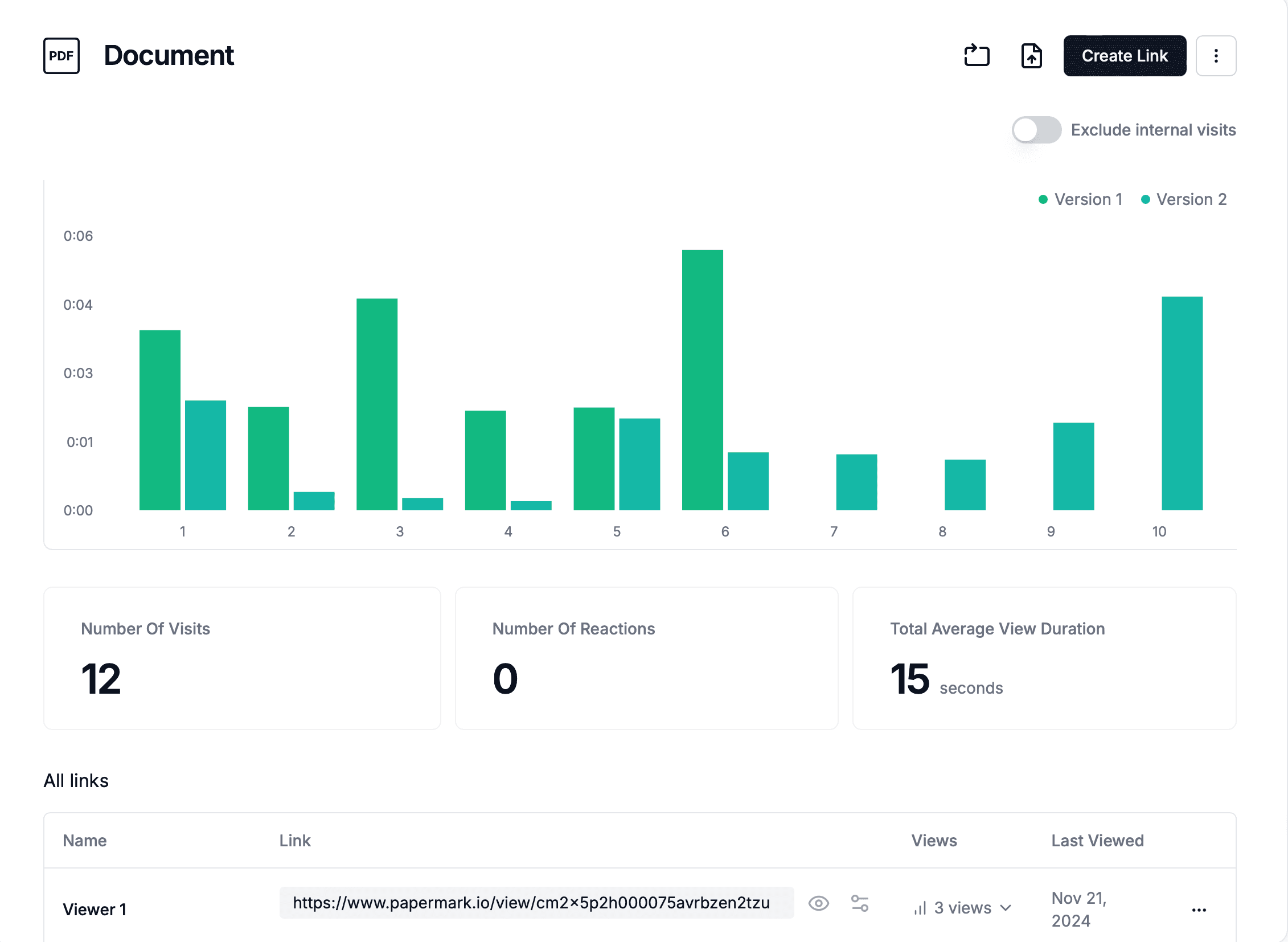

- • Page‑by‑page analytics on deal documents, financials, and materials

- • NDA gating, password protection, expiry, and email verification

- • Unlimited rooms for buyer‑specific or deal‑specific access

- • Multiple custom domains and full white‑labelling

- • Granular group and file‑level permissions with audit logs

VDR investment banking use cases

M&A transactions

Share deal documents, financials, and commercial materials with prospective buyers in a secure VDR. Track engagement to prioritize serious buyers and run a competitive process.

IPO preparation

Centralize company data across workstreams (financial, legal, HR, technology) with audit logs and role‑based access for underwriters and investors.

Capital raising

Manage pitch decks, financial models, and due diligence materials in dedicated rooms for different investor groups and funding rounds.

What to include in an investment banking VDR

Use this quick checklist to structure your investment banking virtual data room and speed up due diligence.

Financial & commercial

- • Historical financial statements (3–5 years)

- • Financial projections and models

- • KPI dashboards and metrics

- • Customer lists and key contracts

- • Pricing strategies and market analysis

Legal, HR & operations

- • Legal contracts and agreements

- • Intellectual property documentation

- • HR records and employment agreements

- • Compliance and regulatory documents

- • Operational procedures and vendor relationships

All essential data room features

For secure investment banking deals

Advanced security

Bank-grade encryption, password protection, 2FA, and screenshot protection to secure sensitive deal documents and financial information.

Granular permissions

Control exactly which documents each buyer can access with file-level permissions, group management, and role-based access controls.

Page-by-page analytics

Track buyer engagement across documents and slides to identify serious prospects and prioritize follow-ups during competitive processes.

NDA gating

Require buyers to accept NDAs before accessing sensitive materials, with automatic email verification and legal compliance tracking.

Custom branding

White-label your data room with custom domains, logos, and colors to maintain your bank's professional brand throughout the deal process.

Audit trails

Complete logs of all user activities, document access, and downloads for regulatory compliance and deal documentation requirements.