Los 10 mejores ejemplos de pitch deck de startups de IA en 2026

Mientras las startups de IA recaudan miles de millones en financiación de capital riesgo, un pitch deck bien elaborado es esencial para captar la atención de los inversores en este competitivo panorama. Este artículo examina diez excepcionales pitch decks de startups de IA que aseguraron financiación con éxito, analizando qué los hizo efectivos y qué lecciones pueden aplicar los fundadores a sus propios esfuerzos de recaudación de fondos.

Resumen rápido de ejemplos de pitch deck de IA

- ElevenLabs - Presentación de 14 diapositivas con muestras de audio integradas mediante códigos QR ($2M pre-semilla)

- Copy.ai - Comenzó con métricas de tracción de $1M ARR en el primer año ($11M Serie A)

- Chattermill - Enfatizó el ROI con resultados cuantificados de clientes ($26M Serie B)

- TensorWave - Comparativas de costos mostrando ahorros del 30-50% frente a AWS ($43M Serie A)

- Oii.ai - Clara articulación del problema con casos de estudio de reducción de costos del 25% ($1.85M semilla)

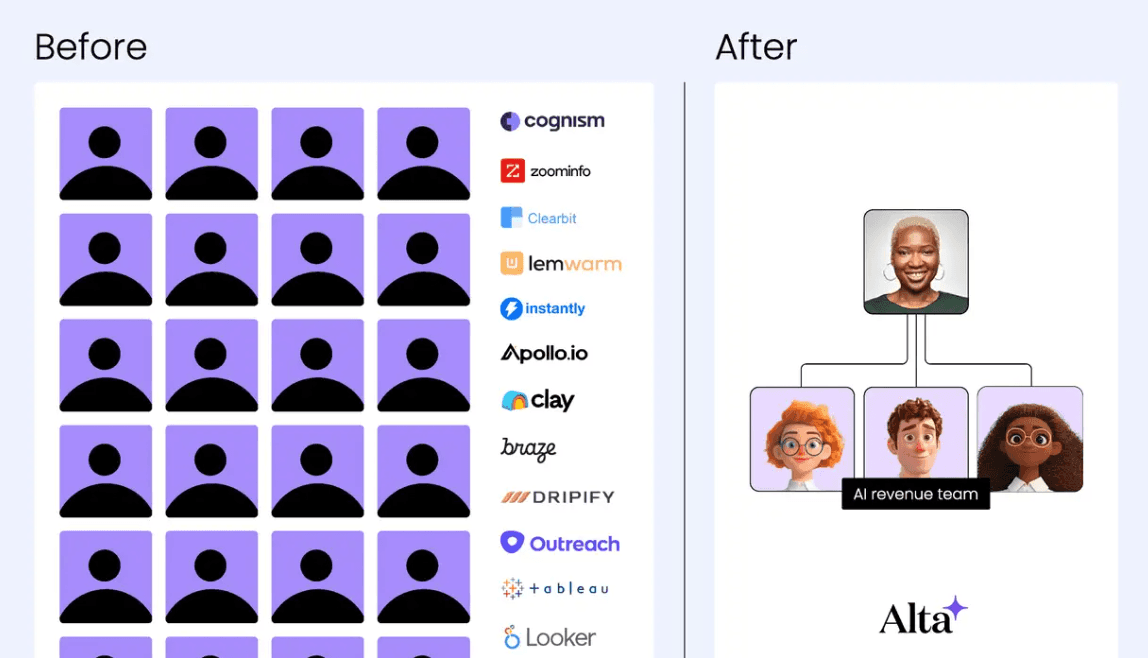

- Alta - Métricas de antes y después mostrando mejoras del 15-30% en tasas de cierre ($7M semilla)

- Alan - Propuesta de valor clara con eslogan simple y fuerte posicionamiento de mercado ($54M Serie C)

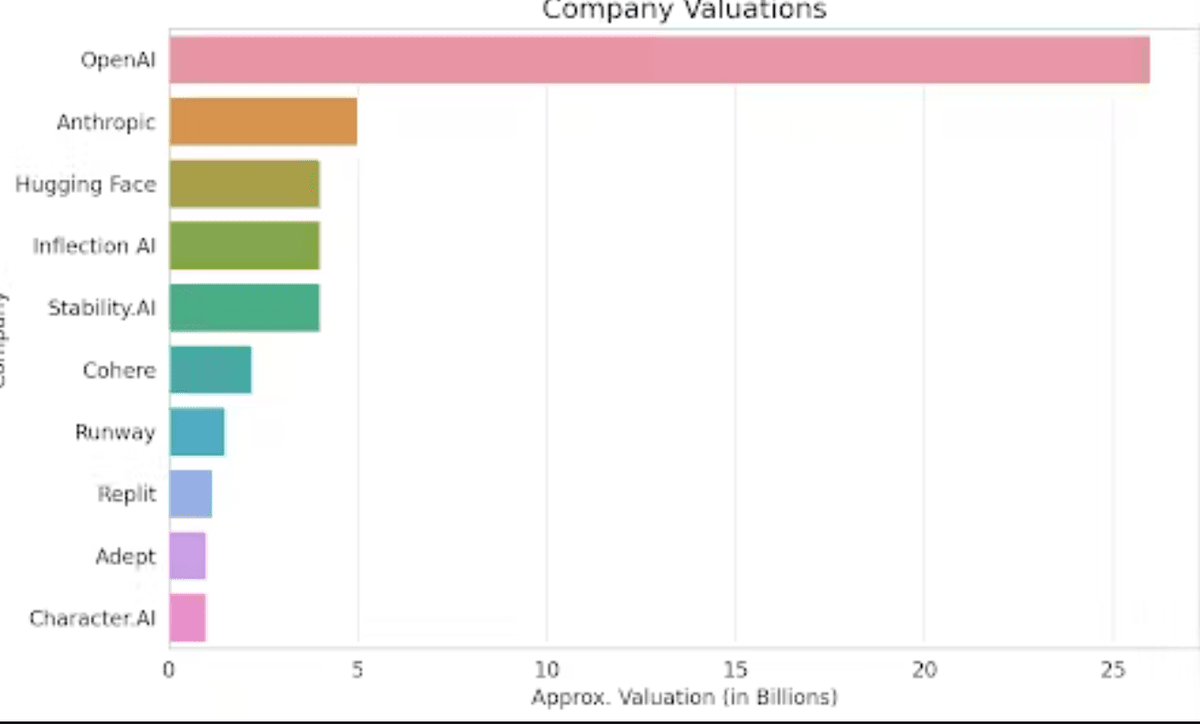

- Anthropic - Asociaciones estratégicas con AWS y Google Cloud validando el enfoque de seguridad primero ($13B Serie F)

- Hugging Face - Métricas de comunidad y posicionamiento de efectos de red ($4.5B valoración)

- Runway - Videos de demostración mostrando la calidad del modelo Gen-2 ($141M Serie C)

1. ElevenLabs

Sitio web: elevenlabs.io

ElevenLabs es una empresa de tecnología de voz con IA que crea síntesis de voz realista y versátil utilizando aprendizaje profundo. Fundada en 2022, la empresa rápidamente ganó atención por su capacidad para generar habla de sonido natural con matices emocionales y capacidades multilingües. Su tecnología sirve a creadores de contenido, editores y desarrolladores que buscan soluciones de texto a voz de alta calidad.

Características de ElevenLabs en su presentación

La presentación de ElevenLabs destacó por cuantificar el problema y la solución con métricas concretas que los inversores podían entender inmediatamente. Su diapositiva de introducción articulaba claramente los puntos de dolor en costos y tiempo: el doblaje tradicional cuesta ~$100 por minuto y toma más de 2 semanas para un video de 10 minutos. Este preciso planteamiento del problema hizo que la oportunidad de mercado fuera tangible y urgente.

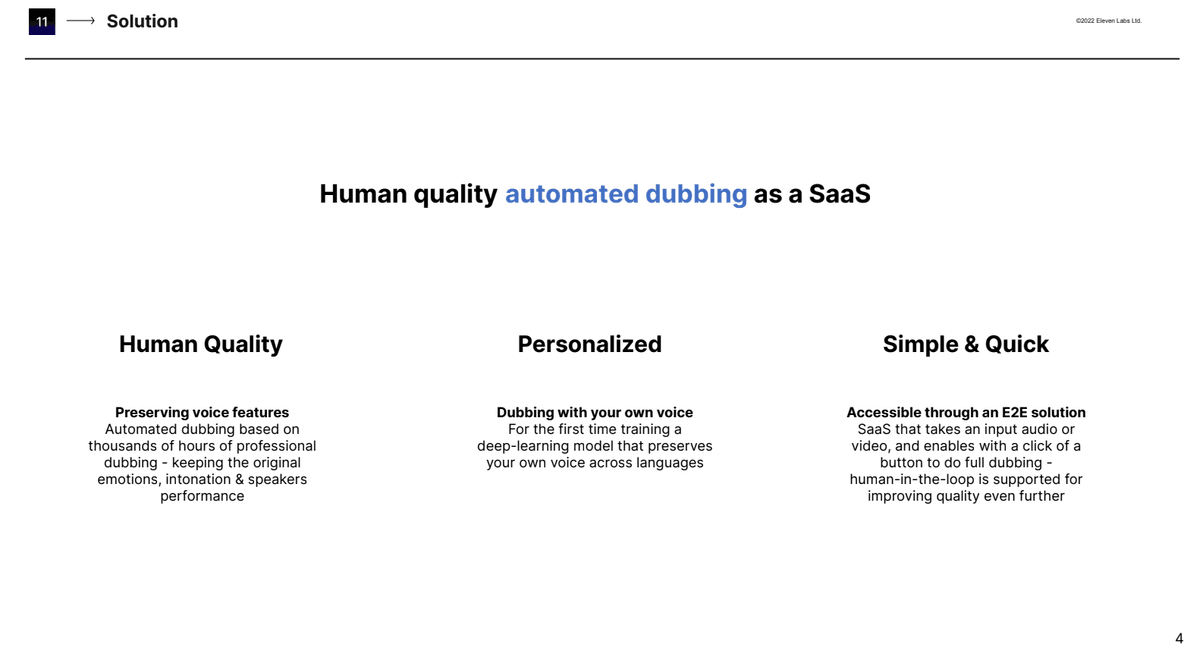

La diapositiva de solución demostró una estructura excepcional al dividir su propuesta de valor en tres pilares claros: Calidad humana (preservando características de voz y emociones), Personalizado (doblaje con tu propia voz en varios idiomas) y Simple y rápido (SaaS integral con doblaje de un solo clic). Este formato de tres columnas hizo que una tecnología de IA compleja fuera inmediatamente comprensible y mostró a los inversores exactamente lo que estaban comprando.

Su diapositiva de análisis profundo del prototipo mostró un flujo de trabajo transparente de seis pasos desde la entrada hasta la salida, construyendo credibilidad técnica. Lo más impresionante fue que cuantificaron la mejora dramática: reduciendo el tiempo de doblaje de un video de 10 minutos de más de 2 semanas a solo 2 minutos. Esta métrica de reducción de tiempo del 99,9% proporcionó un ROI concreto que los inversores podían calcular por sí mismos. La diapositiva también incluía una demostración en vivo de la interfaz de usuario mostrando la transformación antes y después, permitiendo a los inversores ver el producto en acción en lugar de solo leer sobre él.

Lecciones clave para otras presentaciones:

- Cuantificar problemas con números específicos (costo por minuto, duración)

- Estructurar soluciones en pilares comprensibles (3-4 diferenciadores clave)

- Mostrar métricas de mejora dramáticas (reducción de tiempo, ahorro de costos)

- Incluir demostraciones visuales del producto directamente en la presentación

- Hacer que los flujos de trabajo sean transparentes para generar confianza técnica

Financiación de ElevenLabs

⭐ Recaudado: $2 millones en pre-semilla 📅 Año: 2022 🎯 Ronda: Pre-semilla

La empresa ha recaudado rondas de financiación adicionales desde entonces, alcanzando el estatus de unicornio a medida que la demanda de IA de voz se aceleró. El éxito de su presentación provino de demostrar claramente la superioridad del producto a través de comparaciones de audio inmediatas.

2. Copy.ai

Sitio web: copy.ai

Copy.ai es una plataforma de generación de contenido impulsada por IA que ayuda a los especialistas en marketing y empresas a crear textos convincentes para anuncios, redes sociales, blogs y otros materiales de marketing. Lanzada en 2020, la empresa aprovechó la tecnología GPT-3 para democratizar la redacción profesional, haciéndola accesible a empresas de todos los tamaños. Su plataforma aborda la demanda constante de contenido fresco a través de múltiples canales de marketing.

Características de Copy.ai en el pitch deck

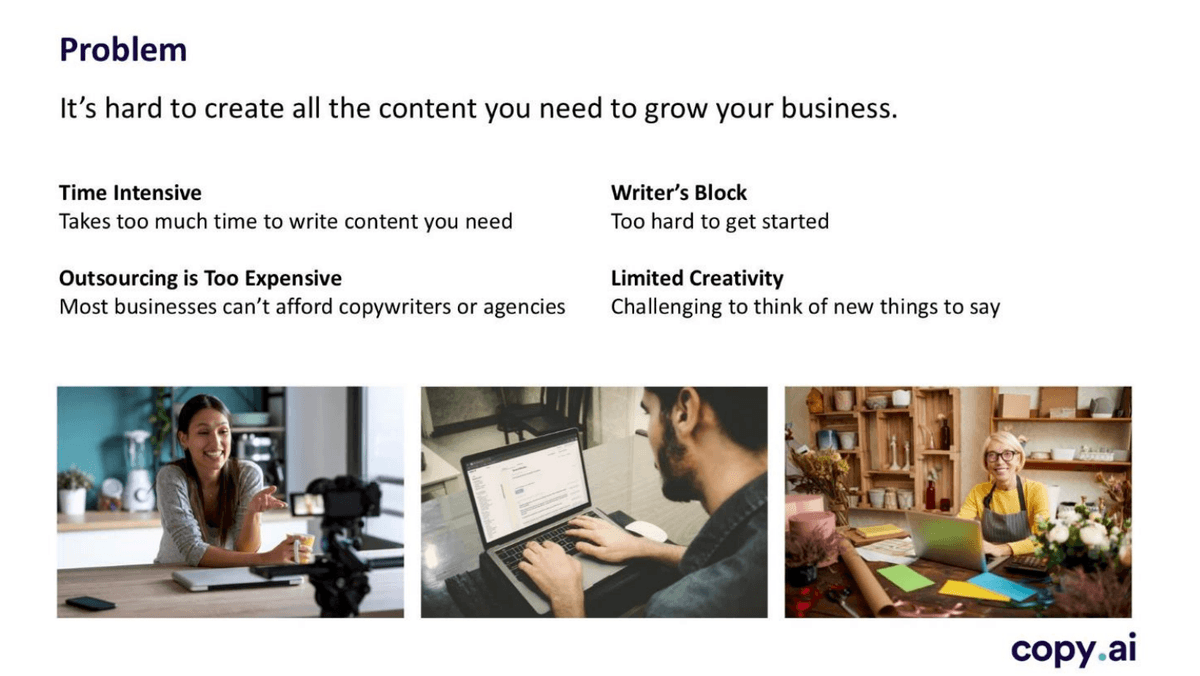

El pitch deck de Copy.ai destacó por articular un problema universal y luego demostrar que lo habían resuelto con métricas de tracción excepcionales. Su diapositiva de "Problema" desglosó magistralmente el desafío general—"Es difícil crear todo el contenido que necesitas para hacer crecer tu negocio"—en cuatro puntos de dolor altamente identificables que resonaron con su mercado objetivo.

La diapositiva categorizó el problema en cuatro áreas distintas: Intensivo en Tiempo (lleva demasiado tiempo), Subcontratar es Demasiado Caro (la mayoría de los negocios no pueden permitirse redactores o agencias), Bloqueo del Escritor (demasiado difícil empezar), y Creatividad Limitada (difícil pensar en cosas nuevas que decir).

Esta estructura hizo que el problema fuera completo pero digerible, mostrando una profunda comprensión del mercado. La diapositiva también utilizó narrativa visual con tres imágenes diversas de creadores de contenido—un vlogger, un escritor y un propietario de pequeño negocio—demostrando amplia aplicabilidad en diferentes segmentos de usuarios.

Lo más impresionante fue que Copy.ai comenzó con métricas de tracción explosivas que validaron inmediatamente su solución. Su diapositiva de "Tracción inicial" mostró un gráfico de crecimiento dramático: de $0 a $1.2 millones de tasa de ejecución de ARR en solo 7 meses.

El gráfico lineal visual mostraba el Ingreso Mensual Recurrente (MRR) acelerándose desde octubre hasta abril, con marcadores claros que mostraban el punto de lanzamiento y el logro de $1.2M ARR. Esta prueba visual de crecimiento rápido y consistente fue mucho más convincente que simplemente indicar números—los inversores podían ver la pronunciada trayectoria ascendente y calcular la escalabilidad por sí mismos.

Su diapositiva de oportunidad de mercado demostró eficazmente la amplitud de su mercado direccionable al desglosar casos de uso (Descripciones de Productos, Blogs, Anuncios en Redes Sociales, Sitios Web) y segmentos de clientes (Comercio Electrónico, Especialistas en Marketing, Agencias, PyMEs). Esta categorización mostró a los inversores que Copy.ai no solo estaba resolviendo un problema de nicho sino abordando una oportunidad de mercado masiva y multi-segmentada.

Lecciones clave para otras presentaciones:

- Desglosar los problemas en 4-5 puntos distintos y relacionables que demuestren una comprensión integral del mercado

- Utilizar narrativa visual con imágenes diversas para ilustrar la amplia aplicabilidad en el mercado

- Comenzar con métricas de tracción cuando tengas resultados iniciales sólidos—hazlos visuales y prominentes

- Mostrar la trayectoria de crecimiento con gráficos claros (gráficos de MRR/ARR) en lugar de solo indicar números

- Traducir el MRR a la tasa de ejecución de ARR para mostrar escala y potencial futuro

- Categorizar casos de uso y segmentos de clientes para demostrar la amplitud del mercado

Financiación de Copy.ai

⭐ Recaudado: $11 millones Serie A 📅 Año: 2021 🎯 Ronda: Serie A 💰 Liderado por: Wing Venture Capital

Su rápido crecimiento de ingresos y clara ruta de expansión hicieron que la recaudación de fondos Serie A fuera altamente competitiva. La transparencia de la presentación sobre las métricas generó confianza en los inversores sobre las capacidades de ejecución del equipo.

3. Chattermill

Sitio web: chattermill.com

Chattermill es una plataforma de análisis de experiencia del cliente que utiliza IA para analizar comentarios de múltiples fuentes, incluyendo encuestas, reseñas, tickets de soporte y redes sociales. Fundada en 2015, la empresa ayuda a las marcas a entender el sentimiento de los clientes a escala, identificando problemas y oportunidades que serían imposibles de detectar manualmente. Su IA transforma los comentarios no estructurados de los clientes en información empresarial procesable.

Características de Chattermill en su presentación

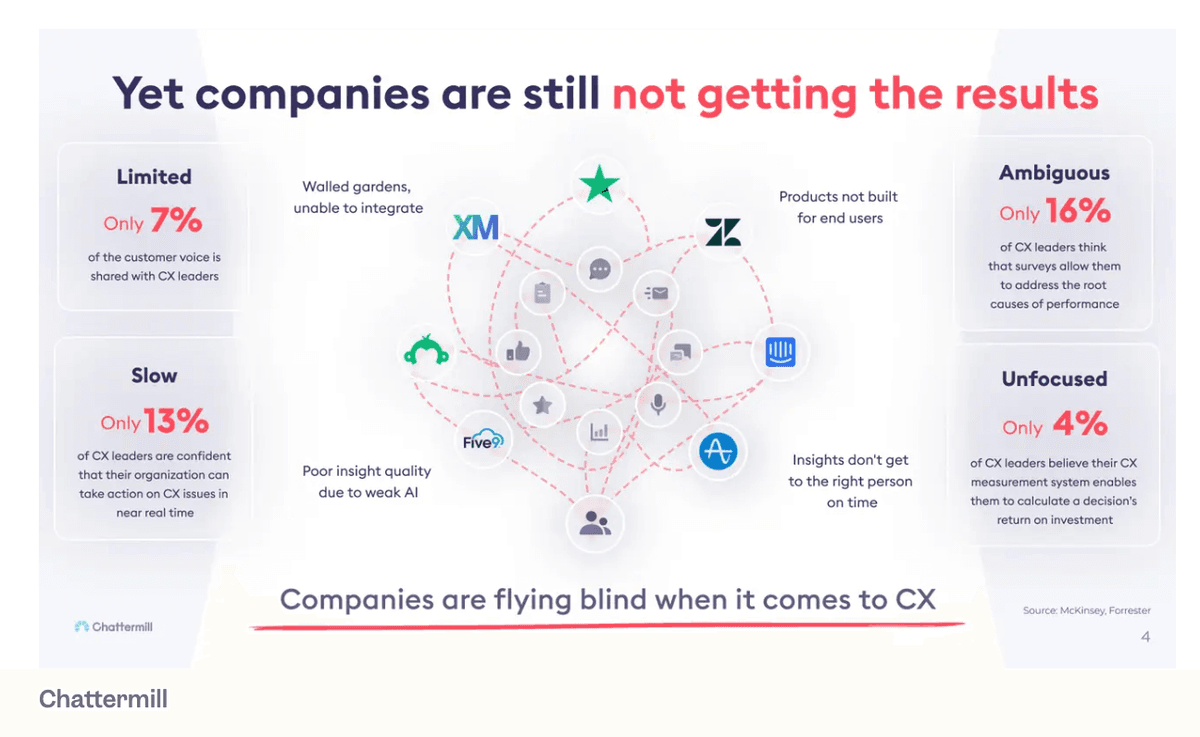

La presentación de Chattermill cuantificó poderosamente el enorme problema en la gestión de experiencia del cliente utilizando investigación creíble de terceros. Su diapositiva de problema titulada "Sin embargo, las empresas siguen sin obtener resultados" presentó cuatro puntos críticos con porcentajes sorprendentemente bajos que captaron inmediatamente la atención de los inversores. Solo el 7% de la voz del cliente llega a los líderes de CX, solo el 13% puede actuar sobre problemas en tiempo casi real, solo el 16% cree que las encuestas abordan las causas fundamentales, y solo el 4% puede calcular el ROI de sus sistemas de CX. Estas estadísticas, procedentes de McKinsey y Forrester, establecieron credibilidad e hicieron innegable la necesidad del mercado.

La diapositiva representaba visualmente el problema de fragmentación a través de un diagrama de red que mostraba fuentes de datos y herramientas desconectadas, con etiquetas específicas que señalaban las causas principales: "Jardines amurallados, imposibles de integrar", "Productos no diseñados para usuarios finales", "Baja calidad de insights debido a IA débil" y "Los insights no llegan a la persona adecuada a tiempo". Esta narración visual hizo tangible la complejidad y preparó el terreno para su solución unificada.

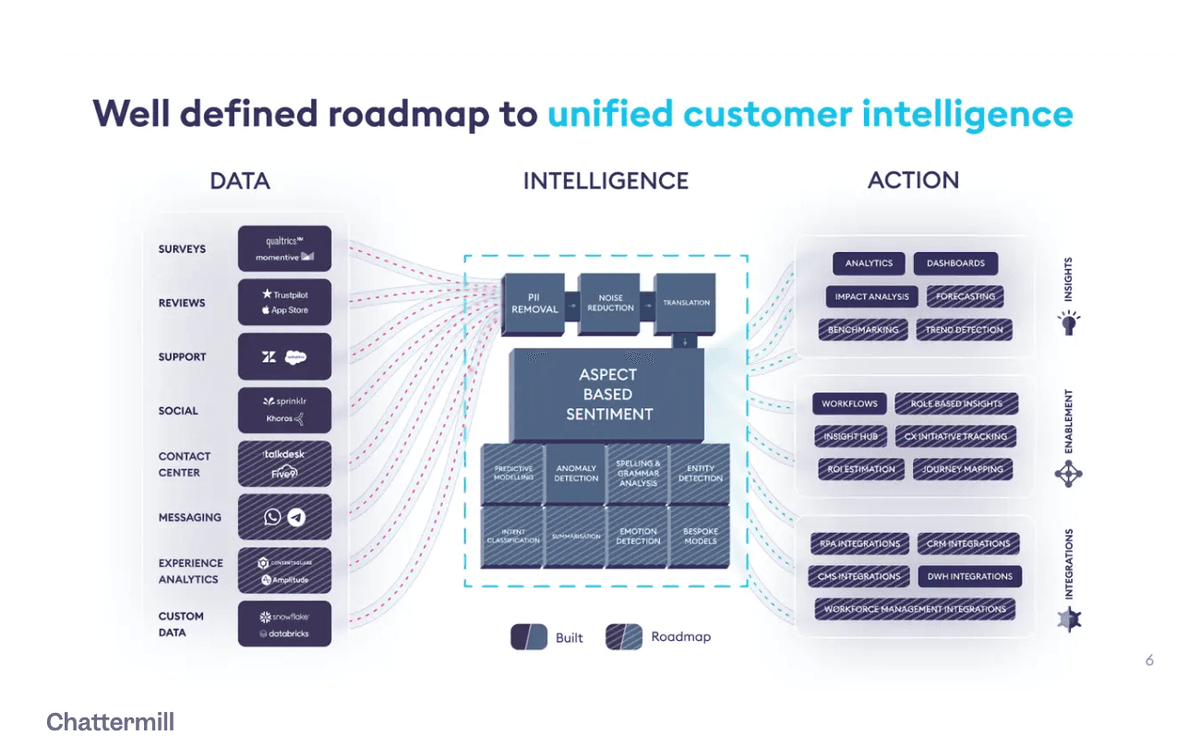

Su diapositiva de solución mostraba una hoja de ruta integral de tres etapas: DATOS (ingesta desde encuestas, reseñas, soporte, redes sociales, centros de contacto), INTELIGENCIA (con características implementadas como análisis de sentimiento basado en aspectos, modelado predictivo y detección de anomalías, además de elementos futuros como detección de emociones), y ACCIÓN (entrega de insights, habilitación e integraciones). Este claro flujo DATOS → INTELIGENCIA → ACCIÓN demostraba tanto las capacidades actuales como la visión futura, mostrando a los inversores exactamente cómo su plataforma de IA unificaba la retroalimentación fragmentada de los clientes.

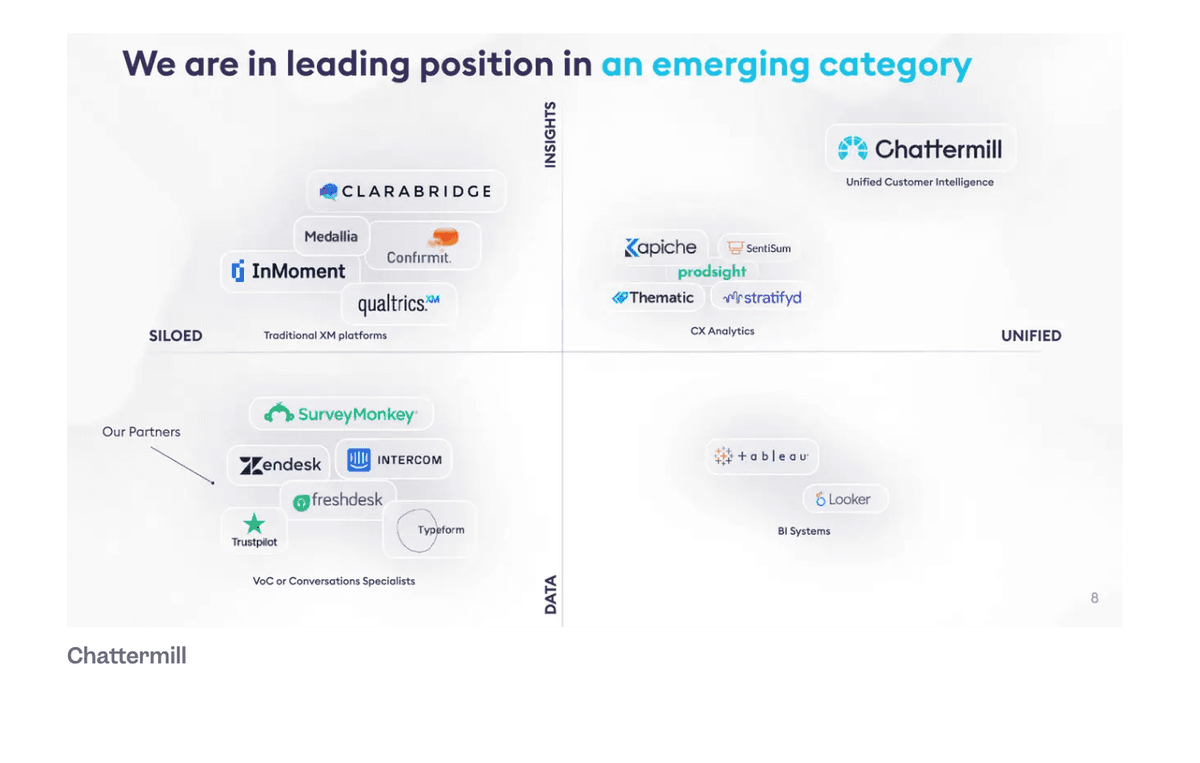

Lo más impresionante fue que su diapositiva de posicionamiento competitivo utilizaba una matriz 2x2 que los posicionaba como líderes en "Inteligencia Unificada del Cliente"—una nueva categoría emergente en el cuadrante superior derecho (UNIFICADO + INSIGHTS). Este posicionamiento estratégico los diferenció de las plataformas tradicionales de XM (aisladas), especialistas en VoC (enfocados en datos) y sistemas básicos de BI, estableciendo a Chattermill como creador y líder de una nueva categoría en lugar de competir en una existente.

Lecciones clave para otras presentaciones:

- Cuantificar problemas con porcentajes bajos e impactantes de fuentes creíbles (McKinsey, Forrester)

- Usar diagramas visuales para ilustrar la fragmentación o complejidad del sistema

- Identificar claramente las causas fundamentales de los fallos de soluciones existentes

- Mostrar una arquitectura de solución integral con etapas claras (DATOS → INTELIGENCIA → ACCIÓN)

- Posicionarse como creador de una nueva categoría en lugar de competir en las existentes

- Distinguir entre características implementadas y hoja de ruta para mostrar tanto capacidades actuales como visión

Financiación de Chattermill

⭐ Recaudado: $26 millones Serie B 📅 Año: 2021 🎯 Ronda: Serie B 💰 Liderado por: Index Ventures

La sustancial Serie B reflejó una fuerte confianza de los inversores en su tracción empresarial y potencial de expansión. El enfoque del pitch deck en resultados cuantificables para los clientes, en lugar de solo características, resonó con los inversores de etapa de crecimiento.

4. TensorWave

Sitio web: tensorwave.com

TensorWave es una empresa de infraestructura en la nube especializada en hardware y software optimizados para el entrenamiento e inferencia de modelos de IA. Fundada por veteranos de infraestructura de IA, la empresa aborda la escasez crítica de recursos de cómputo GPU necesarios para modelos de lenguaje grandes y otras cargas de trabajo de IA exigentes. Ofrecen alternativas rentables a los proveedores de nube a hiperescala con rendimiento optimizado específicamente para aplicaciones de IA.

Características de TensorWave en el pitch deck

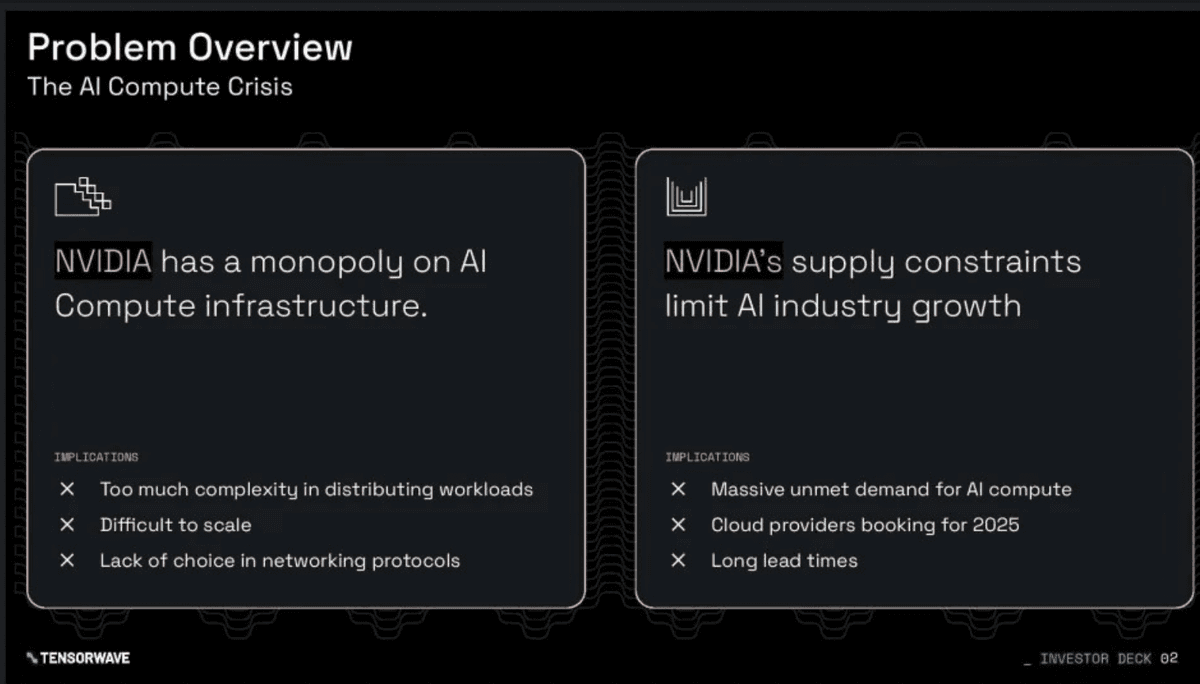

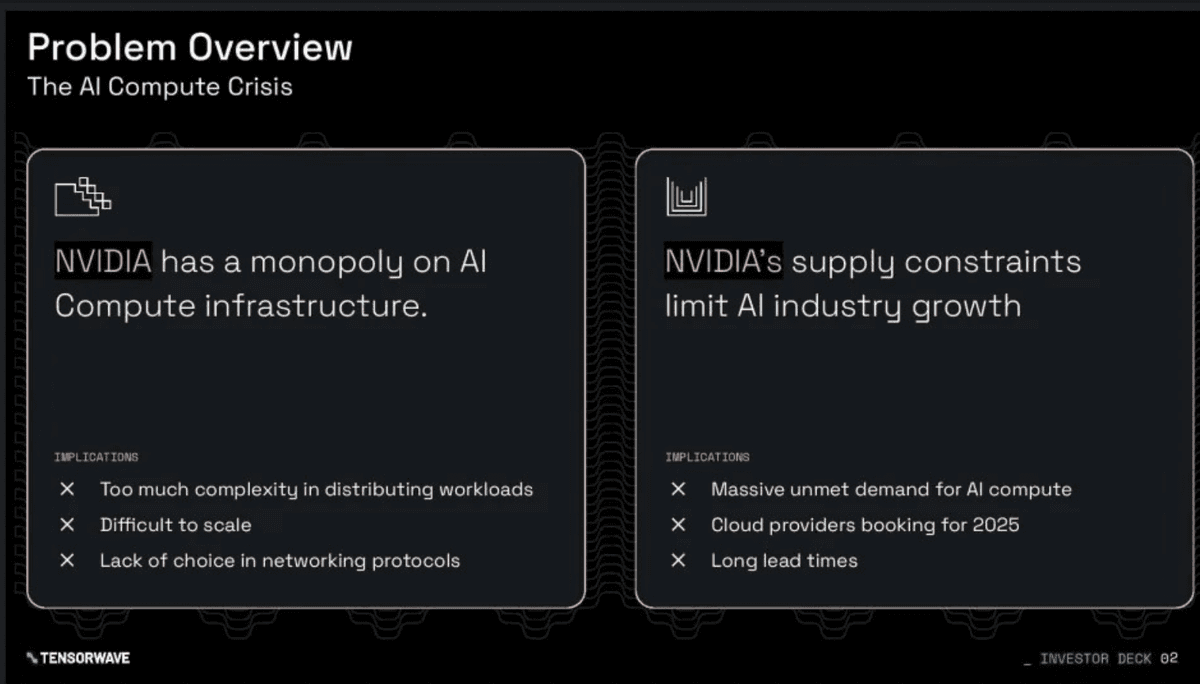

El pitch deck de TensorWave enmarcó poderosamente la crisis de computación de IA como un problema de dos vertientes que creó una oportunidad de mercado urgente. Su diapositiva de "Descripción del problema" titulada "La crisis de computación de IA" presentó dos cuestiones críticas lado a lado: el monopolio de NVIDIA en la infraestructura de computación de IA (con implicaciones de complejidad, dificultades de escalado y falta de elección de protocolo de red) y las restricciones de suministro de NVIDIA que limitan el crecimiento de la industria (mostrando una demanda masiva insatisfecha, proveedores de nube reservando para 2026 y largos plazos de entrega). Esta estructura de doble problema estableció inmediatamente tanto la necesidad del mercado como la urgencia.

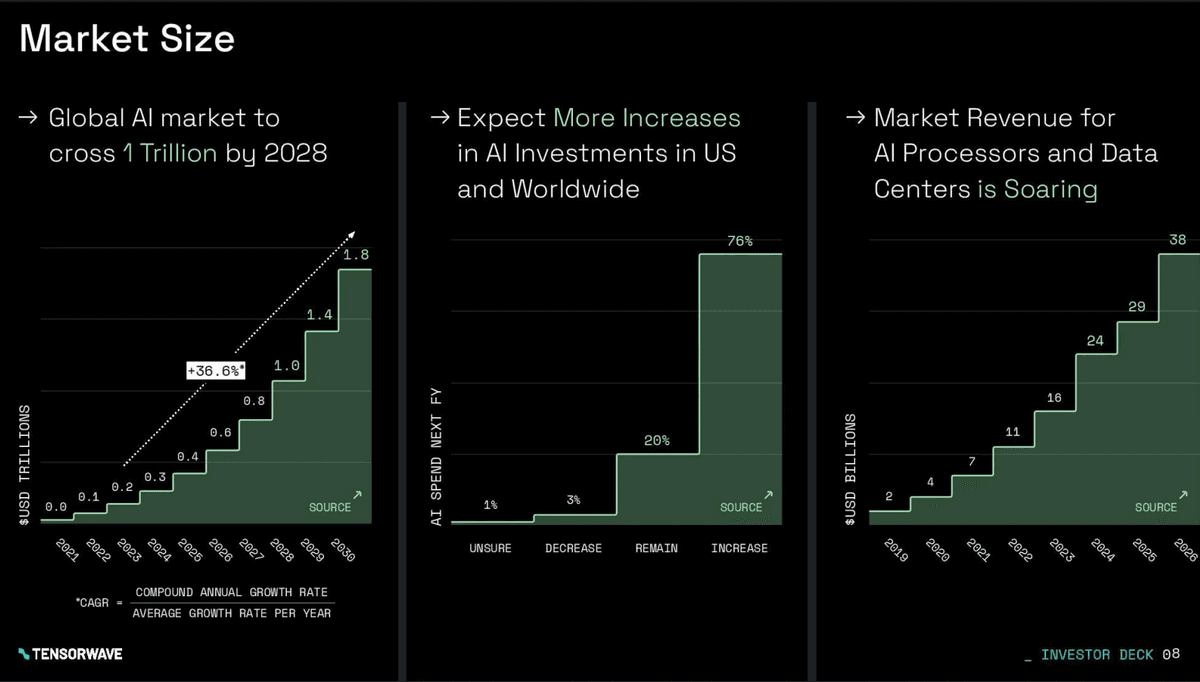

Su diapositiva de tamaño de mercado demostró una visualización de datos excepcional con tres gráficos convincentes. El primero mostró el crecimiento del mercado global de IA de $0.1 billones en 2022 a $1.8 billones para 2030, con un CAGR destacado de 36.6% hasta 2028. El segundo gráfico reveló que el 76% de los encuestados esperaban aumentos en las inversiones en IA, con solo un 3% esperando disminuciones. El tercer gráfico mostró que los ingresos de procesadores de IA y centros de datos se dispararon de $2 mil millones en 2019 a $38 mil millones para 2026. Este enfoque de triple gráfico proporcionó múltiples puntos de datos que validaban la enorme oportunidad de mercado desde diferentes ángulos.

Su diapositiva "TensorWave de un vistazo" posicionó eficazmente su solución destacando asociaciones estratégicas y diferenciación técnica. Enfatizaron ser un Socio de Lanzamiento de AMD MI300X completamente respaldado por AMD, construyendo la disruptiva Nube GPU de AMD, y logrando superioridad en inferencia con motores de inferencia exclusivos. La diapositiva también abordó directamente la necesidad del mercado: "La escasez de Aceleradores GPU ha privado a los hiperescaladores y empresas de Capacidad de Cómputo GPU" con la expectativa de que la escasez continúe. Esta combinación de asociaciones estratégicas, ventajas técnicas y clara necesidad del mercado creó una tesis de inversión convincente.

Lecciones clave para otros pitch decks:

- Plantear los problemas como cuestiones duales o multifacéticas para mostrar una comprensión integral del mercado

- Utilizar múltiples gráficos desde diferentes ángulos para validar el tamaño del mercado (proyecciones de crecimiento, tendencias de inversión, previsiones de ingresos)

- Destacar asociaciones estratégicas con actores importantes (AMD, Edgecore) para generar credibilidad

- Cuantificar el ahorro de costos con porcentajes específicos (30-50% vs AWS/Google Cloud)

- Mostrar claramente tanto el problema (monopolio/escasez de NVIDIA) como la solución (alternativa AMD)

- Utilizar presentación visual de problemas lado a lado para hacer digeribles los temas complejos

Financiación de TensorWave

⭐ Recaudado: $43 millones 📅 Año: 2024 🎯 Ronda: Serie A 💰 Inversores: Nexus Venture Partners

La sustancial Serie A reflejó la creencia de los inversores en la infraestructura de IA como una capa habilitadora crítica para la revolución de la IA. El claro posicionamiento del pitch deck frente a los incumbentes de hiperescala y la fuerte tracción inicial lo hicieron convincente para las firmas de capital de riesgo enfocadas en infraestructura.

5. Oii.ai

Sitio web: oii.ai

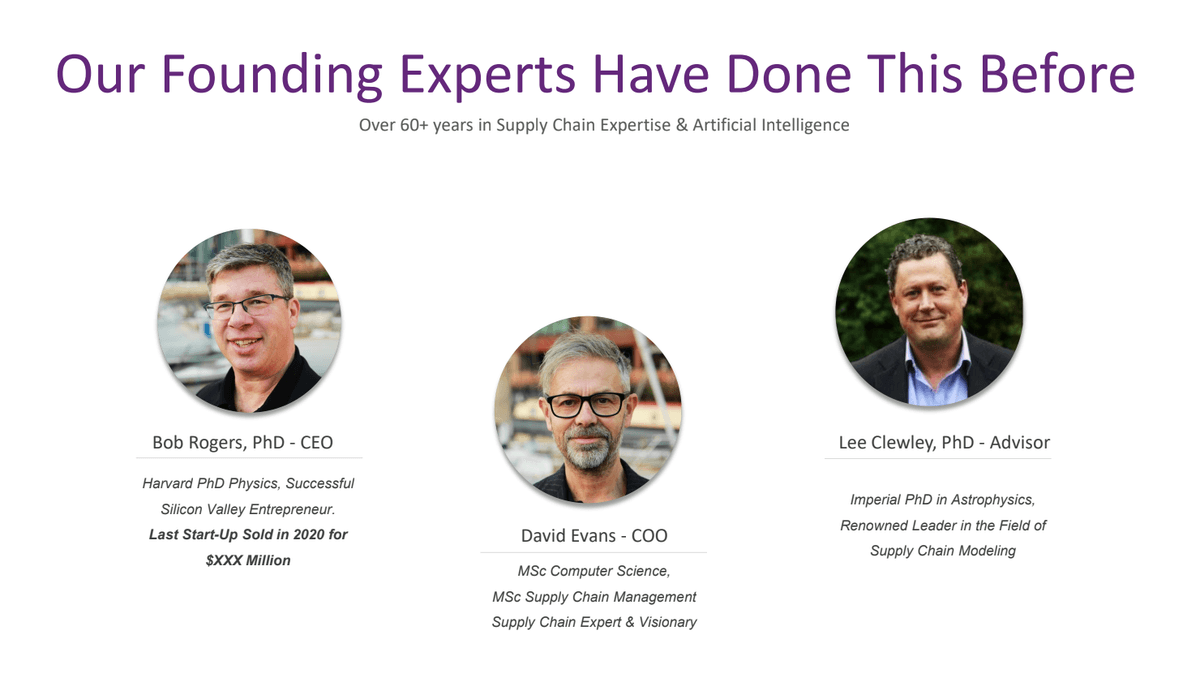

Oii.ai es una plataforma de optimización de cadena de suministro impulsada por IA que ayuda a fabricantes y distribuidores a mejorar la eficiencia operativa mediante automatización inteligente. La empresa utiliza aprendizaje automático para predecir la demanda, optimizar los niveles de inventario y agilizar los procesos de adquisición. Fundada por expertos en cadena de suministro e IA, Oii.ai aborda la complejidad e ineficiencia que afecta a la gestión tradicional de la cadena de suministro.

Características de Oii.ai en el pitch deck

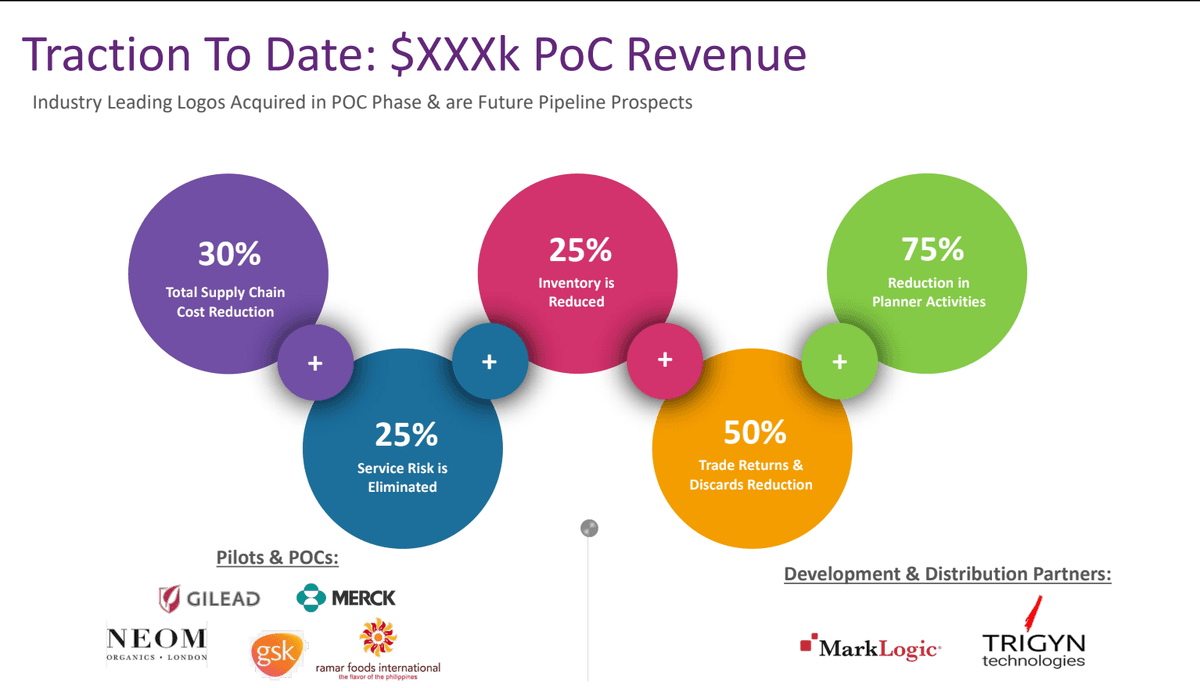

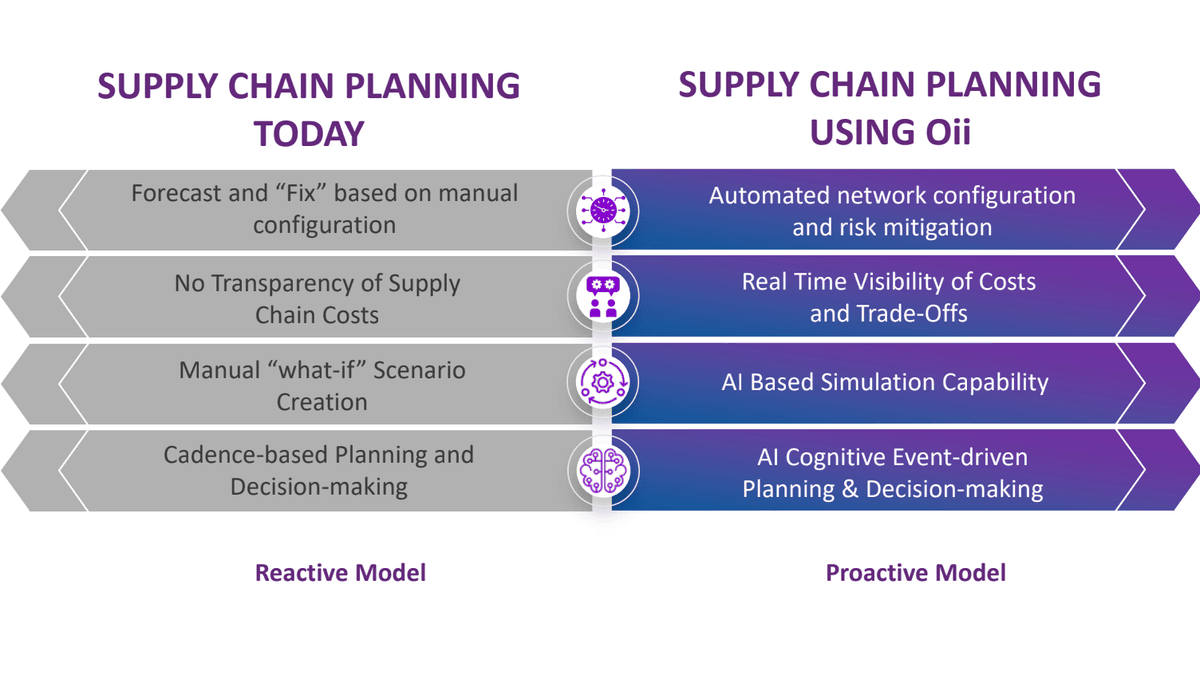

El pitch deck de financiación inicial de Oii.ai destacó por conectar la tecnología de IA con resultados operativos concretos que los profesionales de la cadena de suministro podían entender inmediatamente. Su diapositiva sobre el problema articulaba claramente puntos débiles específicos en la gestión tradicional de la cadena de suministro: exceso de inventario inmovilizando capital, roturas de stock causando pérdidas de ventas y procesos de adquisición ineficientes desperdiciando recursos. Este enfoque operativo resonó con inversores de cadena de suministro que entendían estos desafíos diarios.

Su diapositiva de solución demostraba cómo sus modelos de IA analizaban datos históricos, tendencias del mercado y factores externos para generar pronósticos de demanda precisos. El deck incluía estudios de caso cuantificados de clientes piloto que mostraban mejoras específicas como una reducción del 25% en los costos de mantenimiento de inventario. Esta demostración concreta de ROI resultó más convincente que las capacidades abstractas de IA—los inversores podían ver exactamente cómo la tecnología se traducía en mejoras en los resultados finales.

Su diapositiva de integración tecnológica abordaba una preocupación crítica sobre la complejidad de implementación explicando cómo se integraban con los sistemas ERP existentes. Esto mostró a los inversores que la adopción no requeriría cambios masivos en la infraestructura, reduciendo el riesgo percibido. El panorama competitivo los posicionó tanto frente al software tradicional de cadena de suministro como a los procesos de planificación manual, destacando claramente la ventaja de la IA mientras reconocían las alternativas existentes.

Lo más importante es que presentaron un perfil de cliente objetivo claro centrado en fabricantes de mercado medio en lugar de intentar abordar todos los segmentos del mercado. Este posicionamiento enfocado mostró pensamiento estratégico y planificación realista de entrada al mercado. La diapositiva del equipo combinaba profunda experiencia en el dominio de la cadena de suministro con capacidades de aprendizaje automático, una combinación rara y valiosa que demostraba que podían cerrar la brecha entre la tecnología de IA y las operaciones de la cadena de suministro.

Lecciones clave para otras presentaciones:

- Conectar las capacidades de IA con resultados operativos concretos (reducción de costos, aumento de eficiencia)

- Cuantificar las mejoras con porcentajes específicos de clientes piloto (reducción de costos del 25%)

- Abordar proactivamente las preocupaciones de implementación (integración con ERP, complejidad)

- Enfocarse en un segmento específico de clientes en lugar de intentar servir a todos

- Combinar experiencia en el dominio con capacidades técnicas en el equipo

- Posicionarse frente a software tradicional y procesos manuales para mostrar una ventaja integral

Financiación de Oii.ai

⭐ Recaudado: $1.85 millones 📅 Año: 2023 🎯 Ronda: Semilla 💰 Inversores: Ángeles enfocados en cadena de suministro e IA

La ronda semilla permitió el desarrollo del producto y los esfuerzos iniciales de comercialización. El éxito de la presentación provino de conectar claramente las capacidades de IA con mejoras operativas concretas que resonaron con los inversores de la cadena de suministro.

6. Alta

Sitio web: alta.ai

Alta es una empresa israelí de tecnología de ventas B2B que utiliza IA para analizar conversaciones de ventas y proporcionar coaching en tiempo real a los representantes de ventas. La plataforma escucha llamadas y reuniones, identifica patrones exitosos y sugiere respuestas y estrategias óptimas. Fundada en 2019, Alta aborda el desafío de mejorar consistentemente el rendimiento de ventas en equipos grandes.

Características de Alta en su presentación

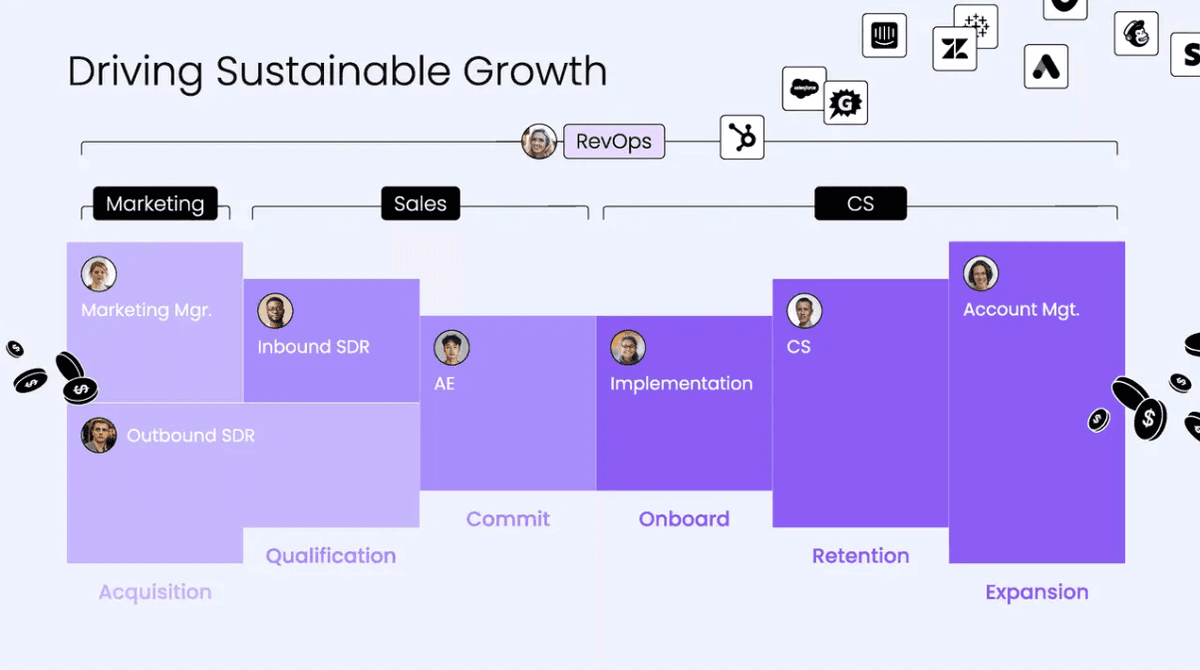

La presentación de Alta posicionó eficazmente su solución comenzando con la enorme oportunidad del mercado de software de ventas B2B y la importancia crítica de la efectividad de ventas para el crecimiento de ingresos. Este enfoque de dimensionamiento del mercado estableció inmediatamente la escala de la oportunidad, mostrando a los inversores que estaban abordando un mercado sustancial en lugar de un problema de nicho.

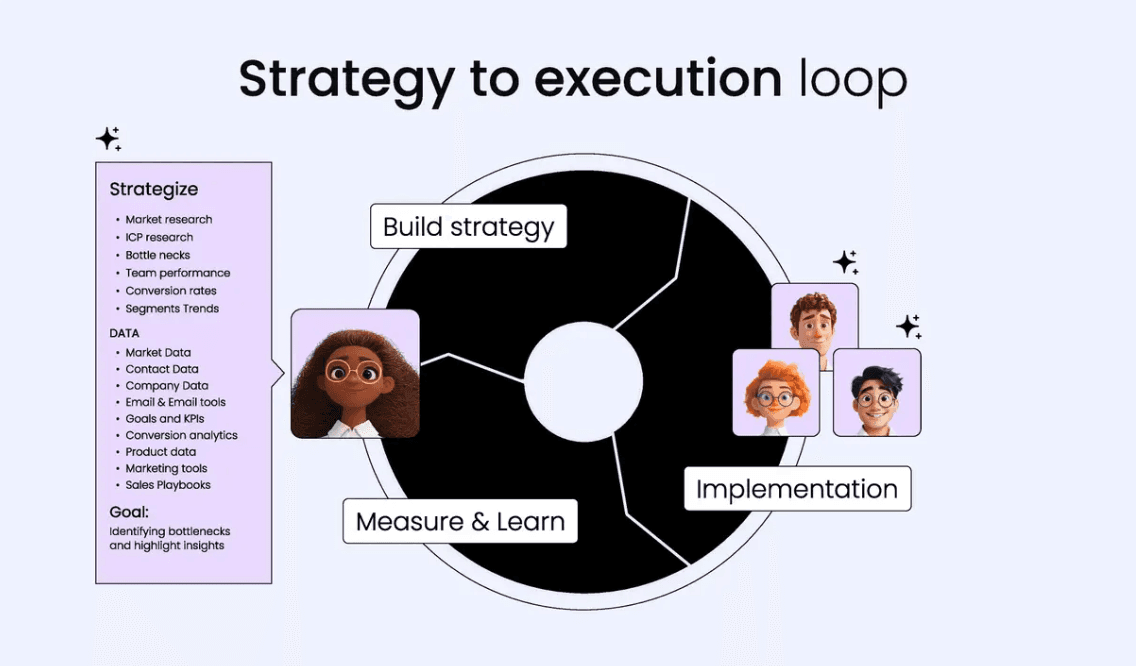

Su diapositiva de tecnología demostró cómo su IA analizaba miles de conversaciones de ventas exitosas para identificar patrones ganadores. La presentación incluyó métricas convincentes de antes y después de clientes piloto que mostraban una mejora del 15-30% en las tasas de cierre. Esta métrica de mejora cuantificada proporcionó una prueba concreta de que su coaching de IA se traducía directamente en impacto en los ingresos—los inversores podían calcular el ROI por sí mismos.

Lo más impresionante fue que mostraron sus capacidades de coaching en tiempo real que proporcionaban sugerencias durante las llamadas en vivo, no solo análisis posteriores como los competidores. Esta diferenciación fue crucial: no eran solo otra herramienta de grabación de llamadas, sino un sistema de coaching activo que mejoraba el rendimiento en tiempo real. El análisis competitivo los posicionó frente a herramientas básicas de grabación de llamadas y costosas consultorías de ventas, demostrando que ofrecían mejores resultados a menor costo.

Sus capacidades de integración con las principales plataformas CRM como Salesforce demostraron su preparación para empresas y abordaron una preocupación clave sobre la complejidad de adopción. La presentación enfatizó que sus modelos de aprendizaje automático mejoraban continuamente a medida que procesaban más conversaciones, creando una ventaja de foso de datos que se fortalecería con el tiempo. Esta narrativa de IA que se mejora a sí misma mostró a los inversores que su posición competitiva se fortalecería, no se debilitaría, a medida que escalaran.

Lecciones clave para otras presentaciones:

- Comenzar con el tamaño del mercado para establecer la escala de oportunidad antes de profundizar en la solución

- Cuantificar las mejoras con rangos porcentuales específicos (mejora del 15-30% en la tasa de cierre)

- Diferenciarse por las capacidades en tiempo real frente a competidores de análisis posterior

- Posicionarse frente a herramientas básicas y servicios premium para mostrar la propuesta de valor

- Destacar la IA que se mejora a sí misma/foso de datos para mostrar el fortalecimiento de la posición competitiva

- Demostrar la preparación empresarial mediante integraciones con CRM

Financiación de Alta

⭐ Recaudado: $7 millones 📅 Año: 2021 🎯 Ronda: Semilla 💰 Inversores: Capital de riesgo israelí y estadounidense

La financiación semilla permitió la expansión más allá del mercado israelí hacia Estados Unidos. La combinación de fuertes resultados piloto y un gran mercado direccionable hizo que la presentación fuera atractiva para los inversores de software empresarial.

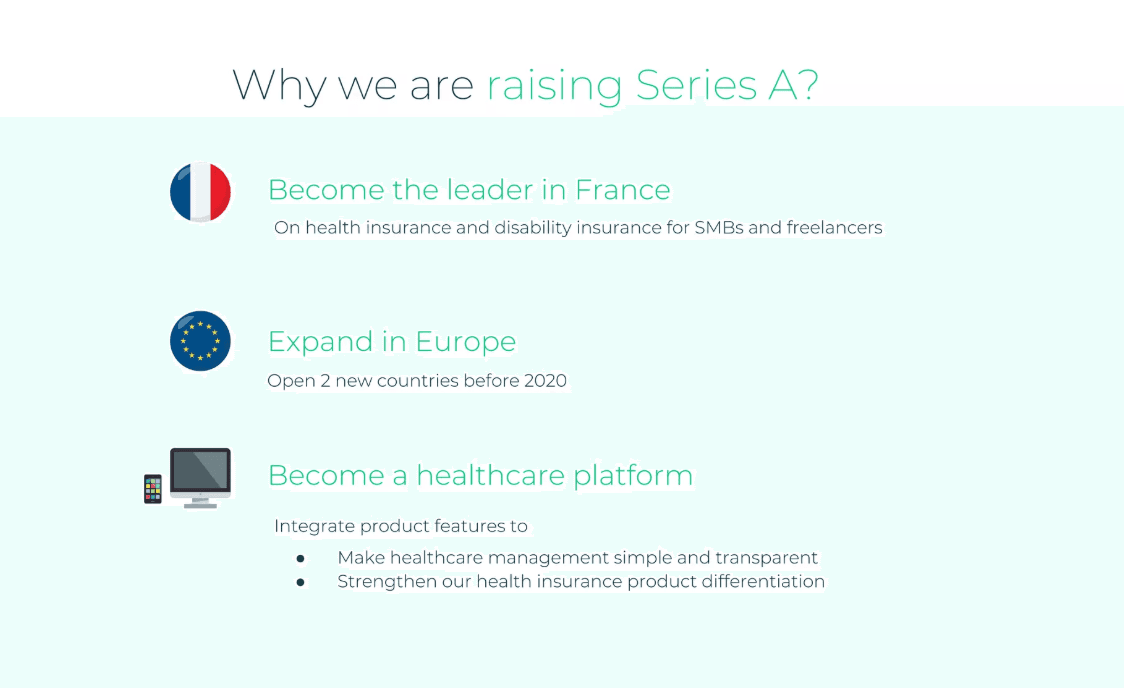

7. Alan

Sitio web: alan.com

Alan es una plataforma que utiliza tecnología para hacer que el seguro de salud sea más conveniente y asequible. Fundada en 2016, esta empresa insurtech francesa revolucionó el mercado tradicional de seguros de salud ofreciendo una experiencia digital simple, transparente y fácil de usar. Su modelo B2B atiende a empresas que buscan proporcionar mejores beneficios de seguro de salud a sus empleados mientras reducen la complejidad administrativa.

Características de Alan en su presentación

La presentación de Alan destacó por comunicar una propuesta de valor compleja con notable simplicidad. Su diapositiva de apertura presentaba un diseño limpio y minimalista con su distintivo logotipo verde y el potente eslogan francés "L'assurance santé simple" (Seguro de salud simple). Esta propuesta de valor de tres palabras transmitía inmediatamente toda su misión: hacer que el seguro de salud sea simple en un mercado conocido por su complejidad y opacidad.

La presentación posicionó poderosamente a Alan frente a los puntos débiles de la industria tradicional de seguros de salud: papeleo complejo, falta de transparencia, procesamiento lento de reclamaciones y mala experiencia de usuario. Demostraron cómo su plataforma tecnológica eliminaba estas fricciones mediante un diseño digital, procesamiento de reclamaciones en tiempo real y precios transparentes. El enfoque problema-solución resonó fuertemente tanto con los empleadores que buscaban mejores beneficios como con los empleados frustrados con los seguros tradicionales.

Su diapositiva de oportunidad de mercado dimensionaba eficazmente el enorme mercado europeo de seguros de salud, destacando la baja penetración digital y las altas tasas de insatisfacción de los clientes. Esta combinación de gran tamaño de mercado y clara oportunidad de disrupción creó una convincente tesis de inversión. La presentación mostró cómo su modelo B2B les permitía adquirir clientes de manera eficiente a través de relaciones con empleadores en lugar de costosas campañas de marketing individual.

De manera más impresionante, la presentación de Alan mostró sólidas métricas de tracción, incluyendo crecimiento de clientes, tasas de retención y puntuaciones de promotor neto que demostraban un ajuste producto-mercado. Presentaron casos de estudio de clientes empresariales iniciales que mostraban una mayor satisfacción de los empleados y una reducción de la carga administrativa. El posicionamiento competitivo los diferenció claramente de las aseguradoras tradicionales a través de la tecnología, la experiencia de usuario y la transparencia, reconociendo al mismo tiempo las ventajas regulatorias de ser una aseguradora con licencia.

Lecciones clave para otras presentaciones:

- Utiliza eslóganes simples y memorables que capturen toda tu propuesta de valor en pocas palabras

- Posiciónate frente a los puntos débiles de la industria que resuenen universalmente (complejidad, falta de transparencia)

- Muestra cómo la tecnología elimina las fricciones tradicionales en lugar de solo añadir características

- Dimensiona la oportunidad de mercado destacando la baja penetración digital como una ventaja

- Demuestra el ajuste producto-mercado a través de métricas de retención y satisfacción, no solo de crecimiento

- Diferénciate a través de la experiencia de usuario y la transparencia en industrias conocidas por su opacidad

Financiación de Alan

⭐ Recaudado: $54 millones 📅 Año: 2020 🎯 Ronda: Serie C 💰 Inversores: VC

La financiación de Serie C reflejó una fuerte confianza de los inversores en la capacidad de Alan para revolucionar el mercado europeo de seguros de salud. La clara propuesta de valor de la presentación y la tracción demostrada en el mercado francés la hicieron atractiva para inversores que buscan respaldar la transformación digital en industrias tradicionales.

8. Anthropic

Sitio web: anthropic.com

Anthropic es una empresa de investigación en seguridad de IA enfocada en construir sistemas de IA confiables, interpretables y dirigibles. Fundada en 2021 por Dario y Daniela Amodei, ex ejecutivos de OpenAI, la empresa desarrolla modelos de lenguaje grandes con características de seguridad mejoradas. Su producto estrella Claude compite con GPT-4 y otros modelos de IA de vanguardia, mientras enfatiza la alineación con los valores humanos a través de su metodología de entrenamiento de IA Constitucional.

Características de Anthropic en el pitch deck

El pitch deck de Anthropic se diferenció poderosamente al hacer de la seguridad y alineación de la IA la tesis central de inversión en lugar de solo una característica. Su presentación comenzó con el problema crítico: a medida que los sistemas de IA se vuelven más potentes, garantizar que sigan siendo beneficiosos y alineados con los valores humanos se vuelve exponencialmente más importante. Este posicionamiento resonó profundamente con inversores preocupados por los riesgos regulatorios, las barreras de adopción empresarial y los desafíos de gobernanza de IA a largo plazo.

La presentación explicó magistralmente la IA Constitucional, su metodología de entrenamiento patentada que utiliza un conjunto de principios escritos para guiar el comportamiento de la IA. A diferencia del aprendizaje tradicional por refuerzo a partir de retroalimentación humana (RLHF) que requiere miles de evaluadores humanos, la IA Constitucional permite que los modelos evalúen y mejoren sus propios resultados basándose en principios explícitos. Esta diferenciación técnica no se trataba solo de mejores resultados, sino que abordaba las preocupaciones empresariales sobre seguridad, cumplimiento y previsibilidad de la IA en industrias reguladas como la salud, las finanzas y los servicios legales.

Su diapositiva de equipo mostraba una credibilidad excepcional con fundadores que lideraron el desarrollo de GPT-2 y GPT-3 en OpenAI, además de investigadores de Google Brain, DeepMind y destacadas instituciones académicas. Este historial de construcción de sistemas de IA exitosos antes de iniciar Anthropic dio a los inversores la confianza de que podrían ejecutar investigaciones de IA de vanguardia. La presentación posicionó a su equipo como únicamente calificado para resolver tanto los desafíos técnicos de construir modelos avanzados como los desafíos de seguridad para garantizar una implementación responsable.

De manera más impresionante, el pitch deck de Anthropic mostró asociaciones estratégicas que validaban tanto su tecnología como su modelo de negocio. Su asociación de $4 mil millones con Amazon Web Services y su asociación de $300 millones con Google Cloud demostraron que los principales proveedores de nube veían a Claude como una infraestructura esencial. Estas asociaciones proporcionaron más que capital: ofrecieron canales de distribución, recursos informáticos a escala y credibilidad empresarial que sería difícil de replicar para los competidores.

La diapositiva de estrategia comercial describía múltiples fuentes de ingresos: acceso API para desarrolladores, suscripciones a Claude Pro para usuarios individuales y contratos empresariales con infraestructura dedicada y tiempo de actividad garantizado. Demostraron una fuerte tracción con más de 200 clientes empresariales, incluyendo Salesforce, Notion y DuckDuckGo, con ingresos que alcanzaban aproximadamente $1 billón anualmente. Esta combinación de diferenciación técnica, enfoque en seguridad, alianzas estratégicas y tracción comercial comprobada creó un caso de inversión convincente para la ronda de financiación de IA más grande de la historia.

Lecciones clave para otras presentaciones:

- Hacer de la seguridad y la responsabilidad un diferenciador central, no solo una casilla de cumplimiento

- Explicar enfoques técnicos propietarios (IA Constitucional) en términos de valor comercial, no solo investigación

- Mostrar alianzas estratégicas que validen la tecnología y proporcionen distribución

- Destacar las credenciales del equipo de sistemas de IA exitosos para generar confianza en la ejecución

- Posicionarse proactivamente frente a preocupaciones regulatorias y empresariales en lugar de reactivamente

- Demostrar múltiples fuentes de ingresos (API, suscripciones, empresarial) para mostrar flexibilidad en el modelo de negocio

Financiación de Anthropic

⭐ Recaudado: $13 billones 📅 Año: 2025 🎯 Ronda: Serie F 💰 Inversores: Lightspeed Venture Partners, Fidelity Management, Salesforce Ventures, Google Ventures, Amazon Alexa Fund

La Serie F de $13 mil millones en septiembre de 2026 marcó la ronda de financiación de IA más grande de la historia, reflejando la confianza de los inversores en el enfoque de seguridad primero de Anthropic y su posicionamiento estratégico. El énfasis del pitch deck en la IA constitucional, las asociaciones estratégicas y la tracción empresarial comprobada atrajo tanto a VCs tradicionales como a inversores corporativos estratégicos que buscaban exposición al desarrollo responsable de IA.

9. Hugging Face

Sitio web: huggingface.co

Hugging Face es una plataforma de IA de código abierto que aloja modelos, conjuntos de datos y aplicaciones, sirviendo como un centro colaborativo para la comunidad de aprendizaje automático. Fundada en 2016 por Clément Delangue y Julien Chaumond, la empresa comenzó como una aplicación de chatbot antes de pivotar hacia la democratización del acceso a modelos de aprendizaje automático. Su biblioteca Transformers y Hugging Face Hub se han convertido en infraestructura esencial para ingenieros de ML, científicos de datos e investigadores en todo el mundo.

Características de Hugging Face en su presentación

La presentación de Hugging Face los posicionó poderosamente como "el GitHub del aprendizaje automático", una analogía simple pero convincente que comunicó inmediatamente su propuesta de valor a inversores familiarizados con el éxito de GitHub en el desarrollo de software. Este posicionamiento no era solo marketing—describía con precisión el papel de su plataforma como el repositorio central donde la comunidad de ML comparte, descubre y colabora en modelos y conjuntos de datos.

La presentación mostró impresionantes métricas de escala que demostraban efectos de red: más de 68,000 modelos pre-entrenados que cubren tareas de texto, audio e imagen, más de 9,100 conjuntos de datos accesibles con solo unas pocas líneas de código, y más de 6,500 modelos alojados en Spaces para demostraciones interactivas. Estos números no solo eran impresionantes—mostraban que Hugging Face se había convertido en la plataforma predeterminada donde los profesionales de ML acuden para encontrar, compartir e implementar modelos, creando una poderosa ventaja competitiva a través del compromiso de la comunidad.

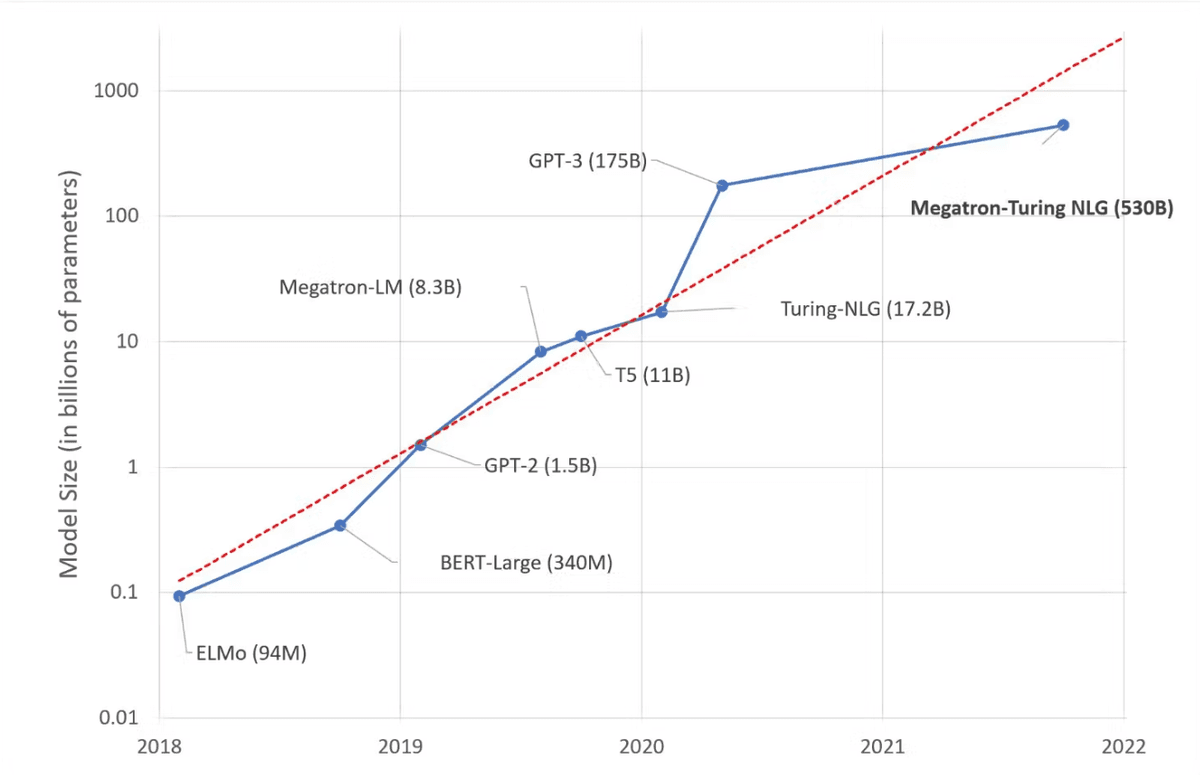

Su diapositiva sobre la biblioteca Transformers destacó cómo resolvieron un problema crítico de accesibilidad. Mientras empresas como Google, Facebook y OpenAI construían grandes modelos de transformers como BERT, GPT-2 y GPT-3, la mayoría de las empresas no podían desarrollarlos desde cero debido a costos que superaban los $1.6 millones por modelo. La biblioteca Transformers de código abierto de Hugging Face hizo que estos modelos avanzados fueran accesibles para todos, permitiendo a los desarrolladores ajustar modelos pre-entrenados para casos de uso específicos en lugar de construirlos desde cero.

La diapositiva del modelo de negocio explicó eficazmente su estrategia freemium: el uso de código abierto impulsó una adopción masiva por parte de la comunidad y el conocimiento, mientras que los clientes empresariales pagaban por inferencia gestionada, infraestructura de entrenamiento, soporte premium y alojamiento en la nube privada. Este modelo mostró a los inversores que Hugging Face podía monetizar su comunidad sin alienar a los usuarios de código abierto que creaban efectos de red. La presentación demostró una fuerte tracción empresarial con más de 1.000 clientes, incluyendo Intel, Qualcomm, Pfizer, Bloomberg y eBay.

Lo más impresionante fue que su diapositiva de posicionamiento competitivo mostró cómo las principales empresas tecnológicas, incluyendo Microsoft, Amazon y Google, utilizaban la infraestructura de Hugging Face para su propio desarrollo de IA. Esta validación por parte de los gigantes tecnológicos demostró que Hugging Face no era solo una plataforma comunitaria, sino una infraestructura esencial en la que incluso las mayores empresas de IA confiaban. La presentación posicionó su enfoque impulsado por la comunidad y los efectos de red como ventajas defendibles que serían extremadamente difíciles de replicar para los competidores.

Lecciones clave para otras presentaciones:

- Utilizar analogías simples y poderosas ("GitHub de X") que comuniquen inmediatamente tu posicionamiento

- Mostrar métricas de escala (modelos, conjuntos de datos, usuarios) que demuestren efectos de red

- Explicar cómo resuelves problemas de accesibilidad que impiden una adopción generalizada

- Demostrar que incluso los competidores utilizan tu plataforma, validando el estatus de infraestructura

- Mostrar un modelo freemium donde la comunidad impulsa el conocimiento y las empresas generan ingresos

- Posicionar los efectos de red y la participación de la comunidad como ventajas competitivas defendibles

Financiación de Hugging Face

⭐ Recaudado: $235 millones 📅 Año: 2023 🎯 Ronda: Serie D 💰 Valoración: $4.5 mil millones

La Serie D con una valoración de $4.5 mil millones reconoció la posición de Hugging Face como infraestructura crítica de IA. El enfoque de la presentación en las métricas de la comunidad, los efectos de red y la validación de las principales empresas tecnológicas atrajo a inversores que veían paralelismos con el éxito de GitHub en el desarrollo de software. Los inversores reconocieron que Hugging Face había creado una plataforma con fuertes efectos de red que sería difícil de replicar para los competidores.

10. Runway

Sitio web: runwayml.com

Runway es una plataforma creativa impulsada por IA enfocada en la generación y edición de videos. La empresa hace que las herramientas avanzadas de IA sean accesibles para creadores sin experiencia técnica, democratizando capacidades que anteriormente requerían conocimientos especializados. Su tecnología abarca generación de videos, conversión de imagen a video, seguimiento de movimiento y varias funciones de edición impulsadas por modelos de IA propietarios.

Características de Runway en su pitch deck

El pitch deck de Runway comenzó con la enorme economía de creadores y la explosión en la demanda de contenido de video en todas las plataformas. Mostraron la capacidad de su modelo Gen-2 para generar videos a partir de indicaciones de texto, demostrando capacidades que parecían ciencia ficción hace apenas unos años. El deck incluía impresionantes ejemplos de resultados que demostraban la calidad de su tecnología y su potencial creativo.

Presentaron métricas de crecimiento de usuarios que mostraban una rápida adopción por parte de creadores profesionales, estudios de producción y aficionados individuales. Los testimonios de clientes de cineastas premiados y grandes estudios validaron la calidad profesional. El panorama competitivo los posicionó frente a software de edición de video tradicional y otras herramientas de video con IA, destacando la calidad superior de su modelo y su interfaz intuitiva. Su hoja de ruta de producto mostró una clara trayectoria de innovación con mejor calidad, videos más largos y mejor control.

Financiación de Runway

⭐ Recaudado: $141 millones 📅 Año: 2023 🎯 Ronda: Serie C 💰 Valoración: $1.5 mil millones

La Serie C reflejó el entusiasmo de los inversores por las aplicaciones de IA generativa para creadores. Los impresionantes videos de demostración del pitch deck y las métricas de adopción por parte de creadores presentaron un caso convincente para que Runway se convirtiera en la plataforma estándar para la creación de videos impulsada por IA.

Mejores prácticas y errores comunes para pitch decks de IA

Conclusión: ejemplos de pitch deck de startups de IA en 2026

Los pitch decks de startups de IA más exitosos equilibran la innovación técnica con fundamentos empresariales claros, demostrando capacidades de manera tangible, probando la tracción del mercado a través de métricas convincentes y articulando modelos de negocio sostenibles. Estudia estos diez ejemplos excepcionales para entender qué resuena con los inversores, pero adapta las lecciones a tu historia única. Haz tu recaudación de fondos más efectiva rastreando el engagement de los inversores con herramientas como software para compartir pitch deck para ver qué diapositivas captan la atención e identificar inversores genuinamente interesados con los que vale la pena hacer seguimiento.