Data Room for IPO: The Complete Guide to Going Public

Taking your company public is a massive milestone. But before you ring that bell, you'll need to survive the IPO due diligence process.

An IPO data room is your command center for sharing sensitive documents with underwriters, auditors, and investors. Get it right, and you'll breeze through due diligence.

What Is a Data Room for IPO?

A data room for IPO is a secure virtual space where companies store and share confidential documents during the initial public offering process.

Think of it as a heavily secured digital filing cabinet. Everyone who needs access—underwriters, lawyers, accountants—can review documents without emailing PDFs back and forth.

Today's virtual data rooms offer:

- Granular access controls — decide who sees what

- Document tracking — know exactly who viewed which file

- Watermarking — protect against unauthorized sharing

- Audit trails — maintain compliance records

Why Do You Need a Data Room for Your IPO?

Going public without a proper data room is like showing up to a job interview without a resume.

Due Diligence Requirements

Underwriters are legally obligated to conduct thorough due diligence. They need to verify everything—financials, contracts, IP, litigation history.

Without a data room, you'd be drowning in email requests.

Speed to Market

IPO windows can close fast. Market conditions change quickly.

A well-organized data room accelerates due diligence. Messy document management causes delays—sometimes months.

Investor Confidence

Institutional investors want to see you run a tight ship. A professional data room signals operational maturity.

Regulatory Compliance

SEC regulations require extensive documentation. Your data room creates a clear audit trail showing what was disclosed, when, and to whom.

Essential Documents for an IPO Data Room

Your IPO data room needs to be comprehensive.

Corporate Documents

- Certificate of incorporation

- Bylaws and amendments

- Board meeting minutes

- Shareholder agreements

- Stock option plans and cap table

Financial Information

- Audited financial statements (3 years minimum)

- Quarterly financial reports

- Revenue breakdowns by segment

- Tax returns and financial projections

Legal Documents

- Material contracts

- Customer and supplier agreements

- Pending and settled litigation

- Regulatory correspondence

Intellectual Property

- Patent and trademark registrations

- License agreements

- Trade secret policies

Human Resources

- Executive employment agreements

- Compensation structures

- Organizational charts

How to Set Up a Data Room for IPO

Step 1: Choose the Right Platform

For IPOs, you need enterprise-grade security, granular permissions, document analytics, and bulk upload capabilities.

Papermark offers all these features with transparent pricing—no surprise bills.

Step 2: Create Your Folder Structure

Organization is everything. Number your folders for easy reference during Q&A:

Step 3: Upload and Organize Documents

Use consistent naming conventions. "Contract_CustomerName_Date.pdf" beats "scan001.pdf".

With Papermark, you can drag and drop entire folder structures.

Step 4: Set Up Access Permissions

Different parties need different access levels:

- Underwriters — full access

- Legal counsel — full access, excluding sensitive items

- Auditors — financial and tax documents only

- Investors — curated subset

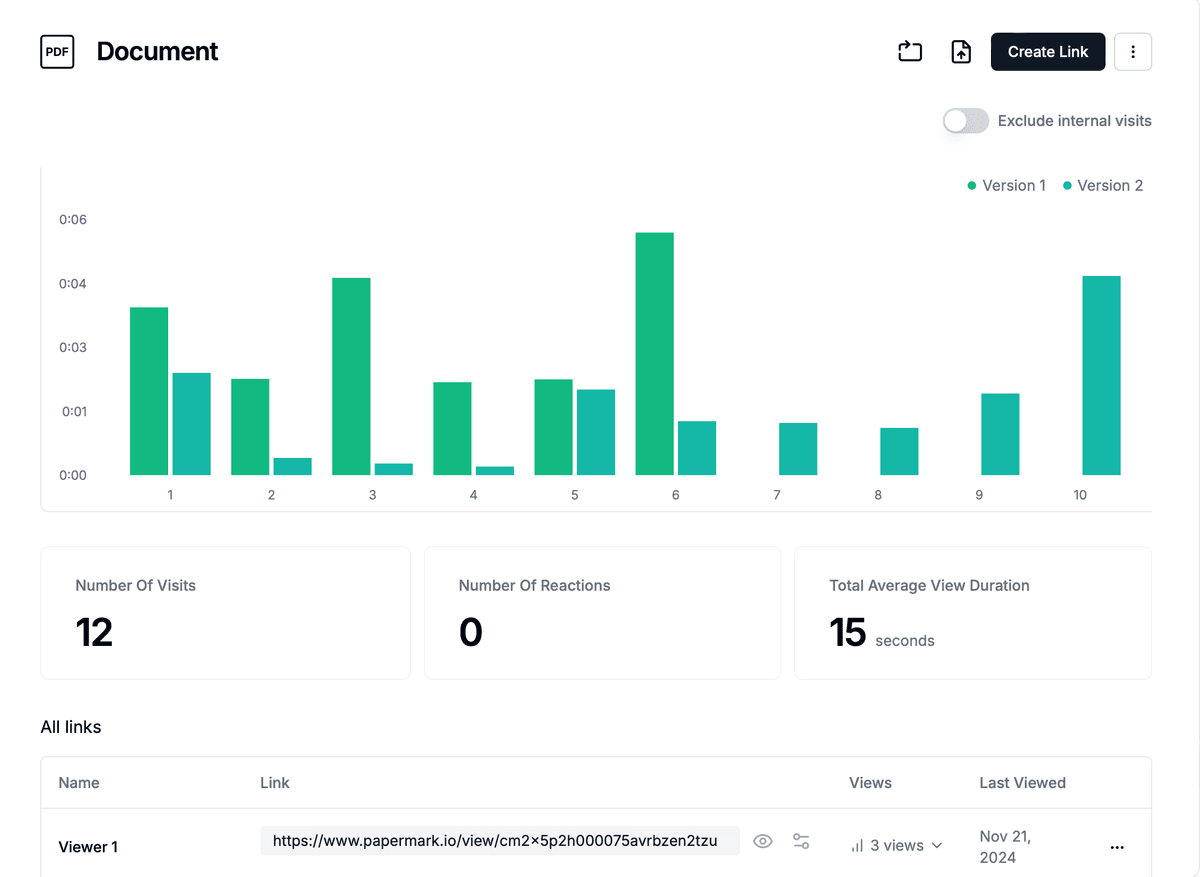

Step 5: Enable Tracking and Analytics

You need to know what's happening in your data room.

Track who opened which documents, how long they spent, and what they downloaded. If underwriters are spending lots of time on a particular contract, that signals questions coming.

Step 6: Manage Q&A

Questions will come. Set up a structured Q&A process with designated responders and response time expectations.

Best Practices for Managing Your IPO Data Room

Start Early

Start organizing documents 6-12 months before your planned IPO date.

Assign a Data Room Manager

Someone from legal or finance should own this process—maintaining organization, managing access, and coordinating Q&A.

Watermark Everything

Every document should have a watermark identifying the recipient.

Papermark's dynamic watermarking automatically adds recipient information to every page viewed.

Monitor Activity Closely

Pay attention to patterns. Which documents get the most attention? Who's logging in frequently?

Choosing the Right Data Room Provider

Traditional VDR providers charge per-page pricing—often hundreds of thousands for a large IPO.

Papermark offers transparent, predictable pricing:

| Feature | Papermark | Traditional VDRs |

|---|---|---|

| Pricing | €99/month | $25,000+/deal |

| Per-page fees | No | Yes |

| Unlimited documents | Yes | Often capped |

| Setup time | Minutes | Days |

Common IPO Data Room Mistakes

- Poor organization — dumping everything into one folder

- Incomplete documents — missing pages, unsigned contracts

- Overly restrictive access — creating unnecessary friction

- Ignoring analytics — not using the tracking data

- Waiting too long — starting setup two weeks before roadshow

Get Started with Papermark

Setting up a data room for your IPO doesn't have to be complicated or expensive.

Papermark gives you enterprise-grade security with an interface that makes sense. Transparent pricing means no surprise bills.

FAQ

Ready to prepare for your IPO?