5 KI-Fundraising-Software für dein KI-Startup in 2026

KI-Startups, die 2026 Kapital aufnehmen, brauchen mehr als nur ein großartiges Produkt – sie brauchen einen strategischen Fundraising-Stack. Die richtige Kombination von Tools hilft dir, qualifizierte Investoren zu identifizieren, Beziehungen zu verwalten, Pitch Decks sicher zu teilen und Engagement in jeder Phase zu tracken. Dieser Leitfaden deckt das komplette Fundraising-Software-Ökosystem ab, von KI-gestütztem Investor-Matching bis hin zu traditionellen CRMs und Pitch-Deck-Plattformen.

Modernes Fundraising erfordert datengestützte Entscheidungsfindung. Verfolgen Sie, welche Investoren mit Ihrem Deck interagieren, automatisieren Sie personalisierte Kontaktaufnahmen im großen Maßstab und pflegen Sie eine einzige Informationsquelle für Ihre Pipeline. Die folgenden Tools repräsentieren die aktuell besten Lösungen in den Bereichen Investorensuche, Beziehungsmanagement, Dokumentenaustausch und Deal-Abwicklung.

Schneller Überblick über KI-gestützte Fundraising-Software für KI-Startups

- Papermark: KI-Datenraum-Erstellung und KI-Pitch-Deck-Sharing-Copilot mit seitenweiser Analyse

- Evalyze: KI-gestütztes Investor-Matching und Pitch-Deck-Optimierung

- Leopard AI: KI-Copilot für Research, Sourcing und Outreach

- Fundra: KI-gestützte Investor-Discovery mit Warm-Intro-Pfaden

- Cherub: KI-Fundraising-Copilot mit Datenräumen und Investor-Matching

- Easy VC: KI-gestützte Investor-Matching- und Fundraising-Automatisierungsplattform

Vergleichstabelle: KI-gestützte Fundraising-Software für KI-Startups

Den Fundraising-Stack für KI-Startups verstehen

Der moderne Fundraising-Stack besteht aus vier Kernkomponenten, die zusammenarbeiten. Erstens helfen Investoren-Discovery-Tools beim Aufbau gezielter Listen relevanter VCs und Business Angels. Zweitens verwalten CRM-Plattformen Beziehungen und verfolgen alle Interaktionen. Drittens ermöglicht Dokumenten-Sharing-Software die sichere Verteilung von Pitch Decks mit Engagement-Analysen. Viertens skaliert Outreach-Automatisierung die personalisierte Kommunikation.

KI-Startups profitieren von spezialisierten Tools, die Technologiesektoren verstehen, KI-spezifische Kennzahlen verfolgen und mit Investoren verbinden, die aktiv KI-Unternehmen finanzieren. Generische Fundraising-Software fehlt oft der Kontext zur Erklärung komplexer KI-Modelle, Trainingsdatenanforderungen oder technischer Wettbewerbsvorteile.

Die nachfolgenden Tools sind nach Kategorien organisiert, um dir beim Aufbau deines vollständigen KI-gestützten Fundraising-Stacks zu helfen. Die meisten erfolgreichen KI-Startups kombinieren 3-4 KI-gestützte Tools: eine KI-Investoren-Matching-Plattform für die Suche, eine KI-Pitch-Deck-Plattform für Sharing und Analysen sowie KI-gestützte Outreach-Automatisierung zur Skalierung der Kommunikation.

KI-gestütztes Pitch-Deck-Sharing und Datenräume

1. Papermark

Website: papermark.com

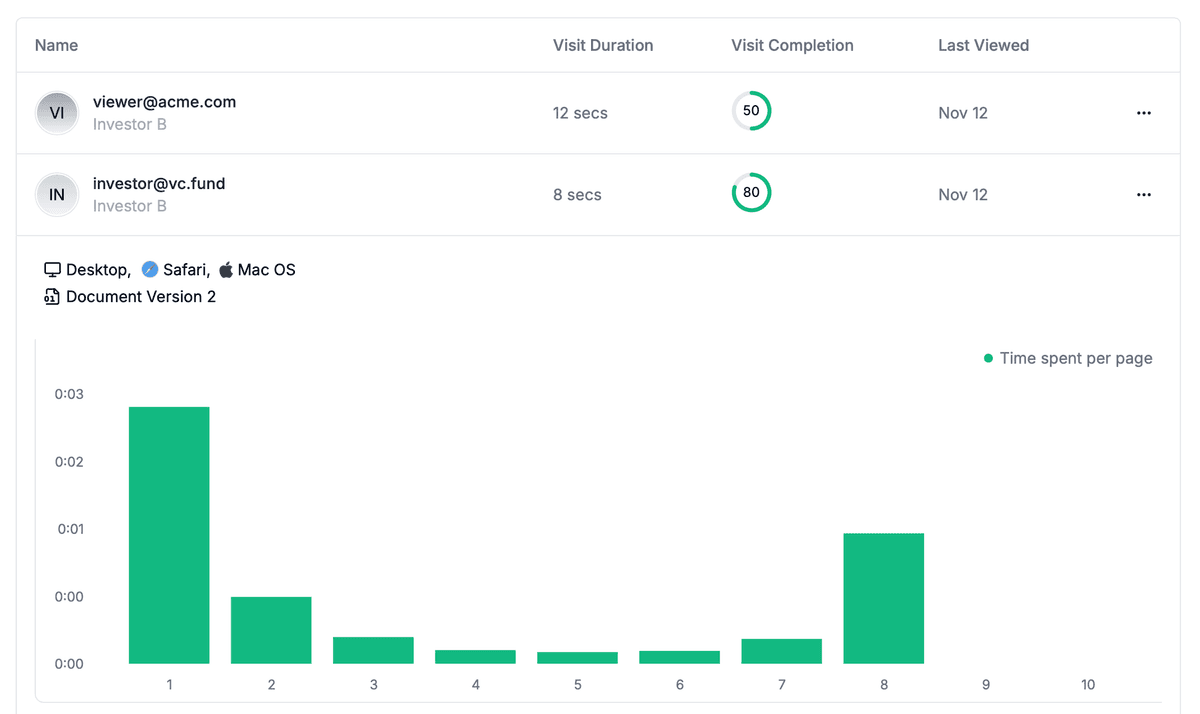

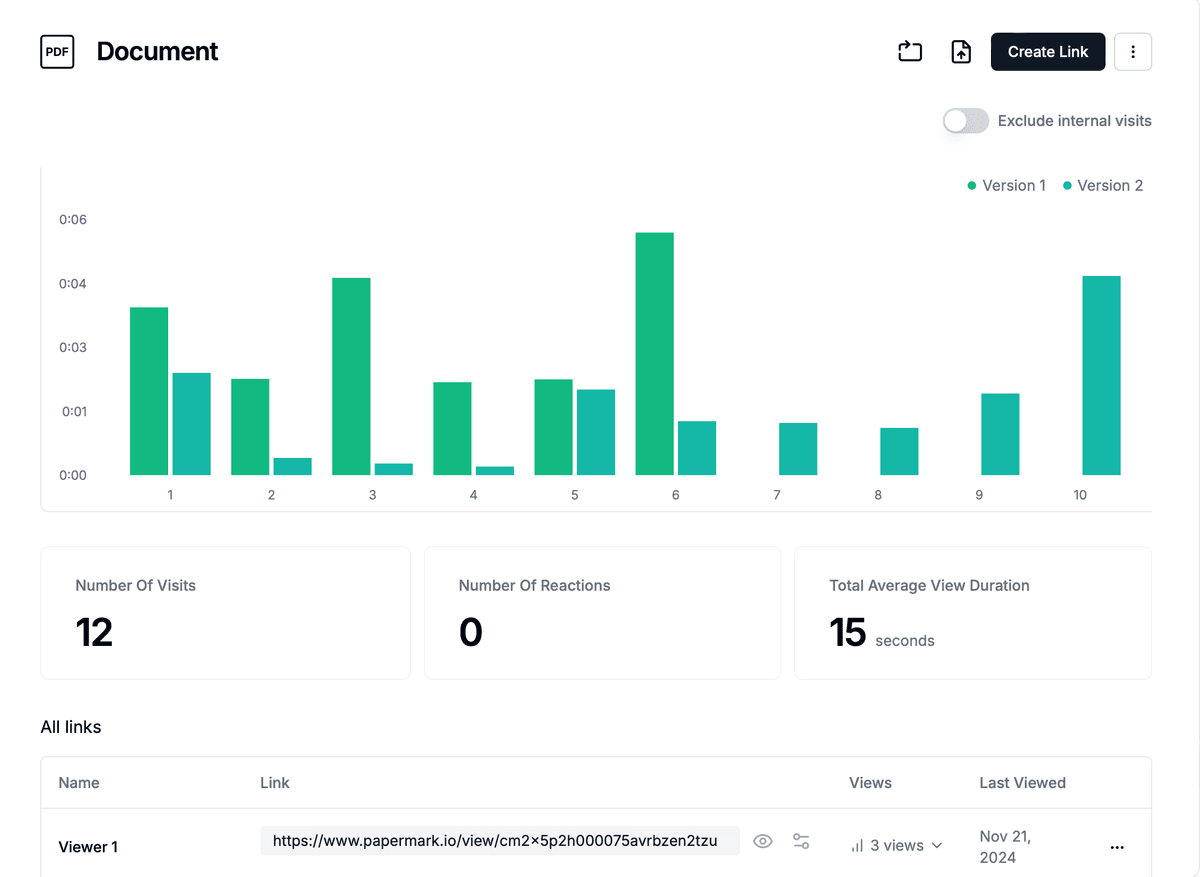

Papermark bietet KI-Datenraum-Erstellung und KI-Pitch-Deck-Sharing-Copilot-Funktionen und verwandelt PDF-Pitch-Decks in sichere, verfolgbare Links mit seitenweisen Analysen, die genau zeigen, wie Investoren mit deiner Präsentation interagieren. Die KI-gestützte Plattform hilft KI-Startups zu verstehen, welche technischen Erklärungen ankommen, welche Finanzprognosen Aufmerksamkeit erregen und welche Team-Qualifikationen durch intelligente Analysen und automatisierte Insights Interesse wecken.

Die Plattform bietet Echtzeit-Benachrichtigungen, wenn Investoren dein Deck ansehen, E-Mail-Erfassung vor dem Zugriff und dynamisches Wasserzeichen zum Schutz proprietärer KI-Technologiedetails. Screenshot-Schutz verhindert unbefugtes Kopieren deiner Algorithmen, Modellarchitekturen oder Kundendaten.

Die Datenraum-Funktionen von Papermark ermöglichen einen nahtlosen Übergang vom Pitch zur Due Diligence. Wenn Investoren zusätzliche Materialien anfordern – Finanzmodelle, technische Dokumentation, Kundenreferenzen – teilen Sie alles über eine sichere Ordnerstruktur mit granularen Zugriffskontrollen.

Papermark ermöglicht KI-gestützte Analysen Ihrer Pitch Decks und Datenräume und erleichtert es Investoren, Ihre Materialien anzusehen und zu analysieren. Wenn Sie KI für Ihr Pitch Deck oder Ihren Datenraum aktivieren, können Investoren KI nutzen, um Ihr Geschäftsmodell schnell zu verstehen, Finanzprognosen zu analysieren, technische Dokumentation zu prüfen und sofortige Antworten auf Fragen zu Ihrem Startup zu erhalten. Diese KI-Funktion optimiert den Prüfprozess für Investoren und ermöglicht es ihnen, mehrere Startups effizient zu bewerten und ihre Zeit auf die vielversprechendsten Möglichkeiten zu konzentrieren. Der KI-Assistent kann wichtige Punkte zusammenfassen, wichtige Kennzahlen extrahieren und Erkenntnisse liefern, die Investoren helfen, schnellere und fundiertere Entscheidungen zu treffen.

Papermark Funktionen

- KI-Datenraum-Erstellung mit intelligenter Dokumentenorganisation

- KI-Pitch-Deck-Sharing-Copilot mit automatisierten Insights

- KI auf Pitch Decks und Datenräumen für Investorenanalysen aktivieren

- KI-gestützter Dokumentenassistent für Investoren zur Analyse von Decks und Datenräumen

- Seitenweise Analysen mit Verweildauer auf jeder Folie

- Echtzeit-Betrachterbenachrichtigungen für perfektes Follow-up-Timing

- E-Mail-Erfassung und -Verifizierung vor Deck-Zugriff

- Dynamisches Wasserzeichen mit Betrachterinformationen

- Screenshot-Schutz für sensible technische Details

- Custom-Domain-Sharing von Ihrer eigenen gebrandeten URL

- Sichere Datenräume mit Ordnern und Berechtigungen

- Link-Ablauf, Passwortschutz und Download-Kontrollen

- NDA-Vereinbarungen vor Dokumentenzugriff

- White-Labeling und individuelles Branding

Papermark Preise

- Kostenlos: 50 Links, 50 Dokumente, unbegrenzte Besucher, grundlegende Analysen

- Pro (24 €/Monat): Unbegrenzte Links, 100 Dokumente, individuelles Branding, Video-Analysen

- Business (59 €/Monat): 3 Benutzerkonten, 1000 Dokumente, E-Mail-Verifizierung, Schutz vor Screenshots

- Datenräume (99 €/Monat): Unbegrenzte Datenräume, NDA-Vereinbarungen, dynamische Wasserzeichen, bevorzugter Support

Papermark Bewertungen

- 4,8/5 auf Product Hunt (über 500 Bewertungen)

- 4,9/5 auf G2 (über 100 Bewertungen)

- Open Source mit über 6000 GitHub-Stars

KI-gestützte Investorenvermittlung

2. Evalyze

Website: evalyze.ai

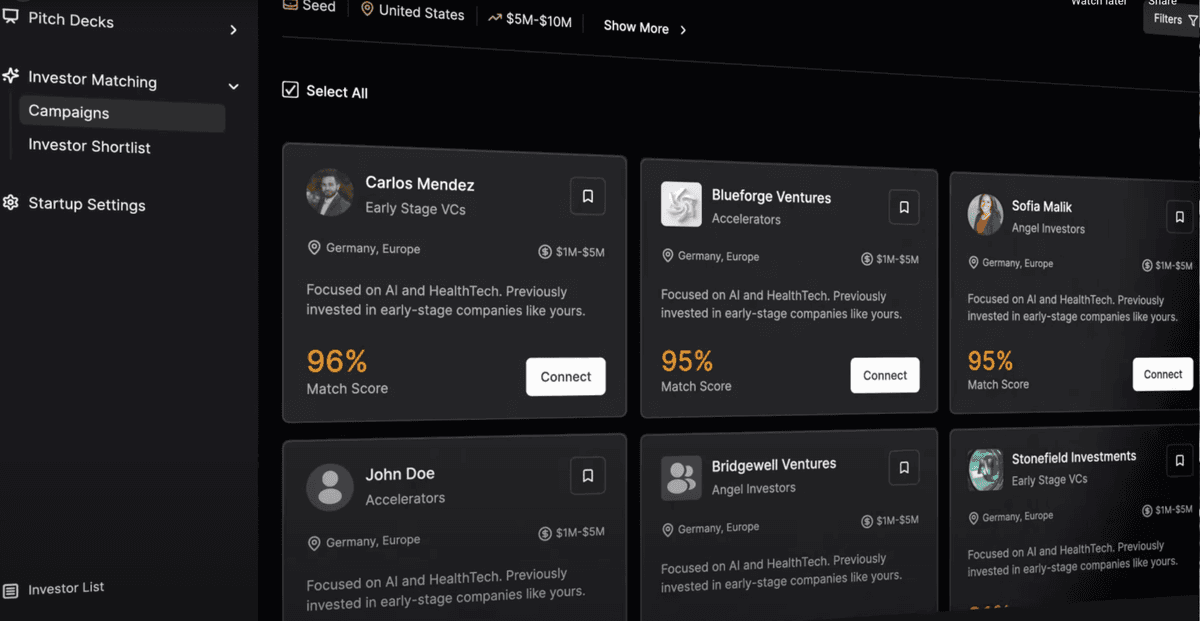

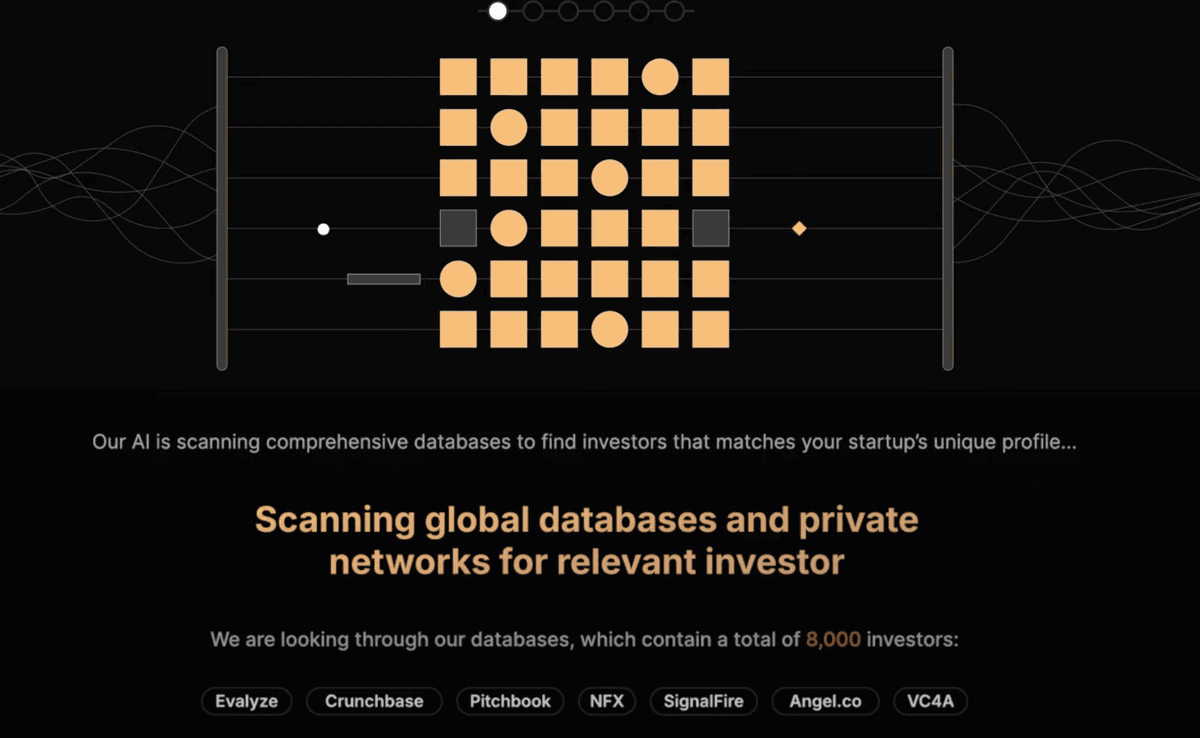

Evalyze nutzt künstliche Intelligenz, um KI-Startups mit passenden Investoren auf Basis von Branchenfokus, Präferenz für die Unternehmensphase, Investitionshöhe und Portfolio-Mustern zusammenzubringen. Die Plattform analysiert dein Pitch Deck, dein Unternehmensprofil und deine Fundraising-Ziele, um Investoren zu identifizieren, die am ehesten in deinen spezifischen KI-Anwendungsfall investieren würden.

Der Investor-Readiness-Score bewertet die Vollständigkeit deines Decks, die Stärke der Erzählung und die Datenpräsentation und liefert spezifische Empfehlungen zur Verbesserung. Erweiterte Suchfilter helfen dir, Investoren nach KI-Teilsektoren zu finden – egal ob du LLMs, Computer Vision, Robotik oder spezialisierte KI-Anwendungen entwickelst.

Die KI-gestützte Pitch-Optimierung von Evalyze schlägt Verbesserungen für deine Erzählstruktur, Finanzprognosen und Marktanalyse vor. Für technische Gründer, die mit dem Storytelling kämpfen, erweist sich diese Anleitung als unschätzbar wertvoll.

Evalyze Funktionen

- KI-gesteuerter Investor-Matching-Algorithmus

- Investor-Readiness-Score mit Empfehlungen

- Erweiterte Investorensuche nach KI-Sektor

- Pitch-Deck-Analyse und Verbesserungsvorschläge

- Investorendatenbank mit verifizierten Kontakten

- Engagement-Tracking und Erinnerungen für Nachfassaktionen

Evalyze Preise

- Starter (99 €/Monat): Basis-Matching, begrenzte Suchen

- Professional (299 €/Monat): Erweitertes Matching, unbegrenzte Suchen, priorisierter Support

- Enterprise: Individuelle Preisgestaltung für größere Fundraising-Runden

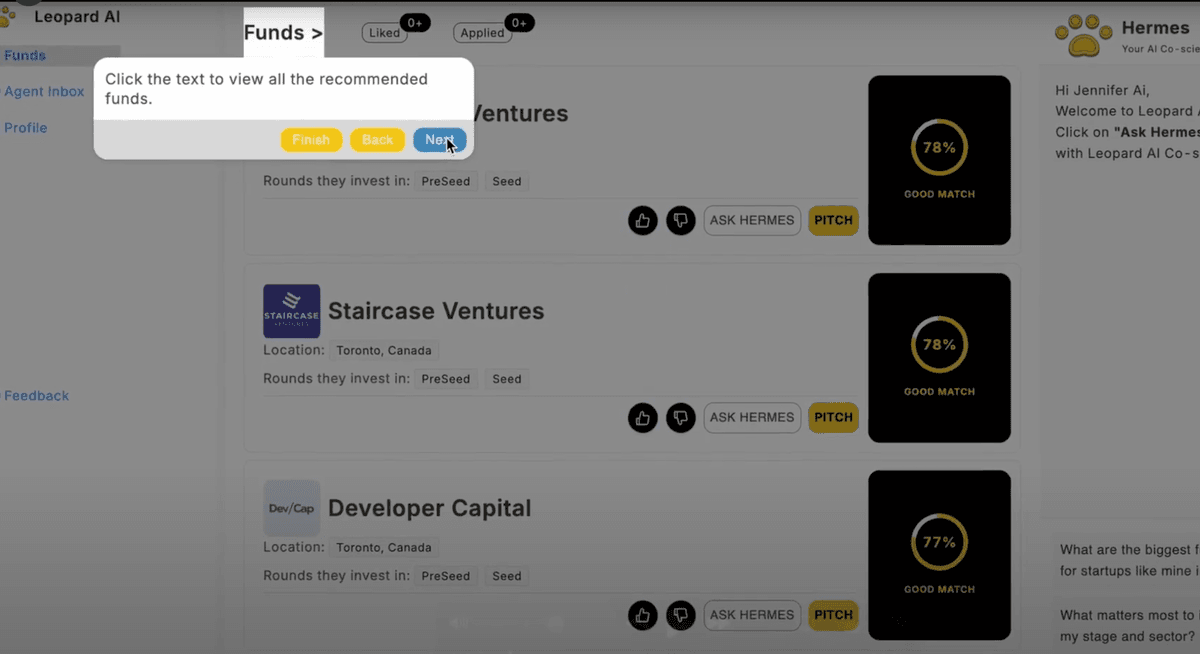

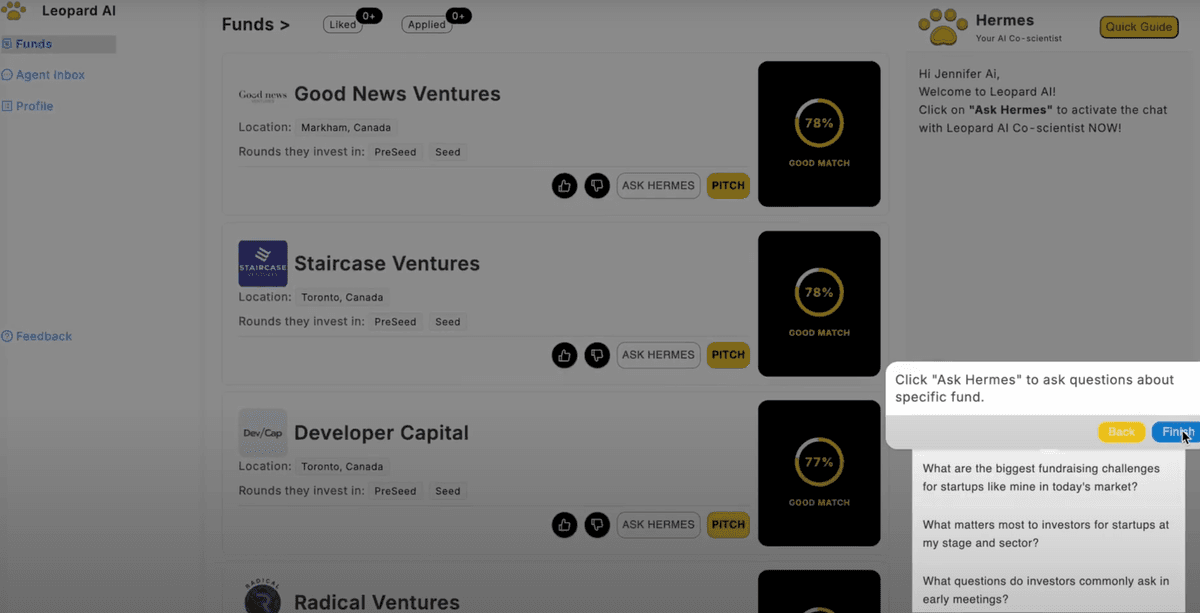

3. Leopard AI

Website: leopardai.app

Leopard AI fungiert als KI-Co-Pilot für deinen gesamten Fundraising-Prozess, von der ersten Recherche über die Investorenansprache bis hin zum Follow-up-Management. Die Plattform recherchiert Investoren, die aktiv KI-Startups finanzieren, analysiert deren Portfolio-Unternehmen und identifiziert Muster in ihrer Investitionsthese.

Die automatisierte Investorensuche nutzt maschinelles Lernen, um relevante Investoren basierend auf den spezifischen Merkmalen Ihres Startups zu finden. Die Plattform bewertet potenzielle Investoren nach Investitionswahrscheinlichkeit und hilft Ihnen, die Ansprache der vielversprechendsten Leads zu priorisieren.

Die personalisierte Outreach-Generierung erstellt individuelle E-Mails für jeden Investor, die auf dessen Portfoliounternehmen, aktuelle Investitionen und erklärte Schwerpunktbereiche Bezug nehmen. Für AI-Startups, die Hunderte von Investoren kontaktieren, erweist sich diese Personalisierung im großen Maßstab als unverzichtbar.

Leopard AI Funktionen

- KI-gestützte Investorenrecherche und -beschaffung

- Automatisierte Investorenbewertung und Priorisierung

- Personalisierte Outreach-E-Mail-Generierung

- Portfolio-Musteranalyse

- Echtzeit-Markteinblicke für den KI-Sektor

- Kampagnen-Tracking und Optimierung

- Follow-up-Automatisierung und Erinnerungen

Leopard AI Preisgestaltung

- Growth (199 $/Monat): Bis zu 500 Investorenkontakte, grundlegende Automatisierung

- Scale (499 $/Monat): Unbegrenzte Kontakte, erweiterte KI-Funktionen

- Enterprise: Individuelle Preisgestaltung mit dediziertem Success Manager

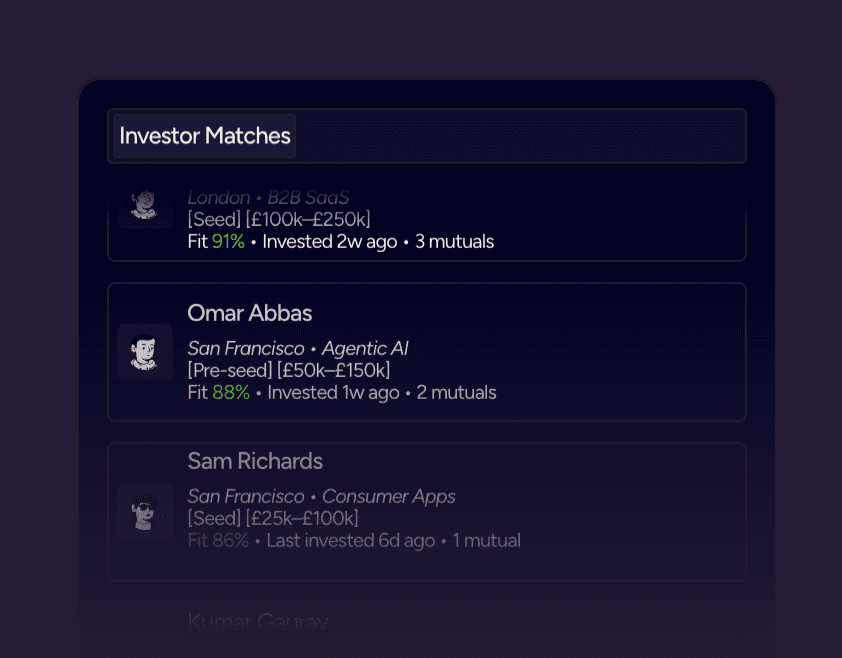

4. Fundra

Website: getfundra.io

Fundra bietet KI-gestützte Investorensuche mit Schwerpunkt auf der Identifizierung von Wegen für warme Vorstellungen. Die Plattform bildet Beziehungen zwischen Ihrem Netzwerk und potenziellen Investoren ab und identifiziert den kürzesten Weg zu Vorstellungen über gemeinsame Kontakte.

Aktivitätssignale verfolgen, wann Investoren aktiv neue Investitionen tätigen, Konferenzen besuchen oder über spezifische KI-Sektoren posten. Diese Timing-Intelligence hilft Ihnen, genau dann Kontakt aufzunehmen, wenn Investoren am empfänglichsten für neue Möglichkeiten sind.

Verifizierte E-Mail-Adressen beseitigen die Frustration zurückgewiesener Kontaktaufnahmen. Für AI-Startups mit knappen Zeitplänen stellt die Datenqualität von Fundra sicher, dass jede für Outreach aufgewendete Stunde zählt.

Fundra Funktionen

- KI-gestützte Investorensuche

- Mapping von Wegen für warme Vorstellungen

- Aktivitätssignal-Tracking

- Verifizierte Investoren-E-Mail-Adressen

- Automatisierte Outreach-Sequenzen

- Response-Tracking und Analytics

- Integration mit LinkedIn und E-Mail

Fundra Preise

- Starter (79 $/Monat): 500 Investorenprofile, Basisfunktionen

- Growth (199 $/Monat): 2.000 Profile, Warm-Intro-Pfade

- Pro (399 $/Monat): Unbegrenzte Profile, Priority-Support

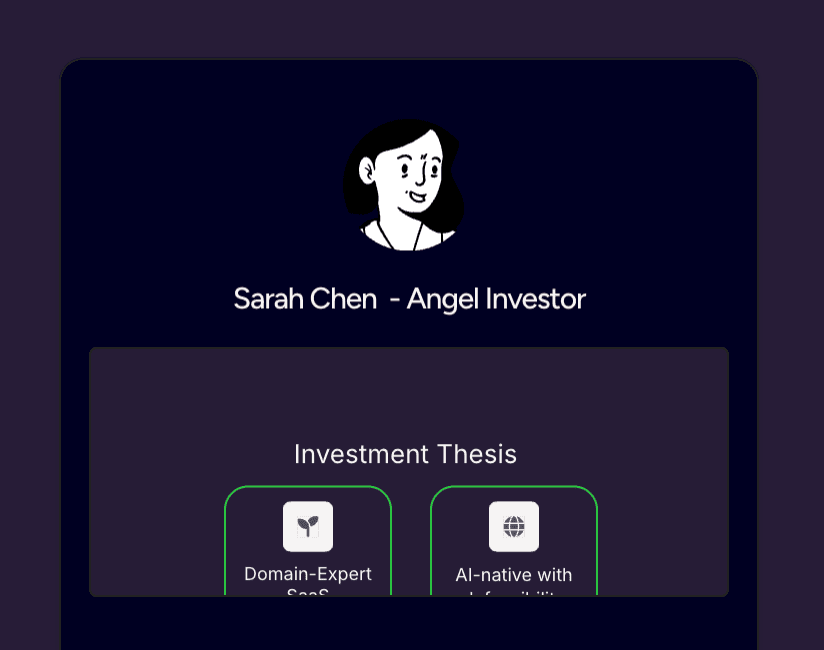

5. Cherub

Website: investwithcherub.com

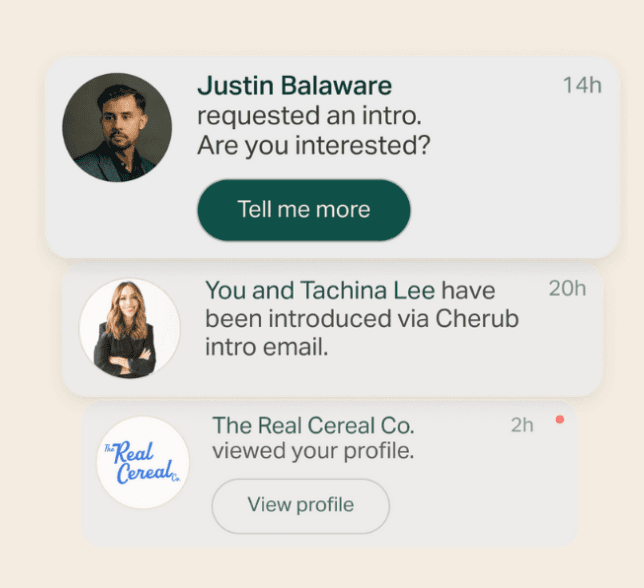

Cherub fungiert als KI-Fundraising-Co-Pilot für Gründer und Investoren. Die Plattform ermöglicht Startups, Datenräume zu erstellen, Einführungen zu verwalten und ihr Geschäft sicher zu präsentieren. Für Investoren bietet Cherub kuratierten Deal-Flow, Portfolio-Tracking und verifizierte Startup-Vermittlung.

Der beidseitige Marktplatz gewährleistet gegenseitige Verifizierung – Investoren bestätigen ihren Fondsstatus und ihre Investmentthese, während Startups ihre Kennzahlen und Traction verifizieren. Diese Qualitätskontrolle reduziert Zeitverschwendung auf beiden Seiten.

Der Datenraum-Builder von Cherub ermöglicht KI-Startups, Pitch Decks, Finanzmodelle, technische Dokumentation und Kundenreferenzen in einer professionellen Struktur zu organisieren. Wenn Investoren zusätzliche Materialien anfordern, teilen Sie alles über einen einzigen Link.

Cherub Funktionen

- KI-gestütztes Matching von Startups und Investoren

- Integrierter Datenraum-Builder

- Einführungs-Management-System

- Verifizierte Investoren- und Startup-Profile

- Portfolio-Tracking für Investoren

- Sicheres Dokumenten-Sharing

- Kommunikationstools für Gründer und Investoren

Cherub Preise

- Free: Basisprofil, begrenzte Matches

- Founder (99 $/Monat): Unbegrenzte Matches, Datenraum, Priority-Matching

- Investor: Individuelle Preise basierend auf Portfoliogröße

6. Easy VC

Website: easyvc.ai

Easy VC ist eine KI-gestützte Datenbank mit über 50.000 Venture-Capital- und Business-Angels. Jedes Profil enthält Investmentfokus, Ticketgröße, aktuelle Deals und verifizierte Partner-Kontakt-E-Mails. Easy VC hilft Ihnen, Investoren mit KI zu finden und Warm-Intro-Kampagnen zu erstellen, indem Sie Gründer aus deren Portfolio über LinkedIn ansprechen, sodass Sie Ihr Netzwerk für Ihre Finanzierungsrunde aufbauen können.

Easy VC stellt Startup-/Unternehmensdaten über die LinkedIn-Profile der Portfoliounternehmen der VCs bereit, wodurch die Investorenansprache persönlicher und effektiver wird. Der AI Investor Finder der Plattform hilft dir, Investoren nach Name, Phase, Ticketgröße und mehr zu finden und optimiert so den Rechercheprozess für KI-Startups.

Affinity Features

- Datenbank mit 50.000 Investoren mit verifizierten Kontakt-E-Mails

- Chrome-Erweiterung zur Automatisierung personalisierter LinkedIn-Kontaktanfragen

- AI Investor Finder zum Finden von Investoren nach Name, Phase, Ticketgröße und mehr

- Exklusive Fundraising-Ressourcen und Playbooks für Warm Intros mit Investoren

- LinkedIn-Profildaten von Portfoliounternehmen für personalisierte Ansprache

- Investitionsfokus, Ticketgröße und aktuelle Deals für jeden Investor

Easy VC Preise

- Kostenlose Testversion: 0 €

- Monatsplan: 119 €/Monat

- Jährlicher Pro-Plan: 89 €/Monat (jährliche Abrechnung)

Aufbau deines KI-Startup-Fundraising-Stacks

Die erfolgreichsten KI-Startups kombinieren KI-gestützte Tools strategisch, anstatt sich auf eine einzelne Plattform zu verlassen. Ein typischer Stack umfasst drei Kernkomponenten: KI-gestütztes Investor-Matching, KI-Pitch-Deck-Sharing mit Analytics und KI-gestützte Outreach-Automatisierung.

Beginne mit KI-gestützten Investor-Matching-Tools wie Evalyze, Fundra oder Easy VC, um deine Zielliste aufzubauen. Diese Plattformen nutzen KI, um nach KI-Sektor, Phase und Investitionsgröße zu filtern und 200-300 potenzielle Investoren zu identifizieren, die am wahrscheinlichsten in dein Startup investieren.

Teile dein Pitch Deck über Papermarks KI-Pitch-Deck-Sharing-Copilot, um das Engagement Seite für Seite zu verfolgen. Wenn Investoren dein Deck ansehen, erfährst du es sofort und kannst Follow-ups perfekt timen. Sobald Investoren zusätzliche Materialien anfordern, wechsle nahtlos zu Papermarks KI-Datenraum-Erstellung für die Due Diligence.

Automatisieren Sie die Kontaktaufnahme mit KI-gestützten Tools wie Leopard AI oder Easy VC. Diese Plattformen nutzen KI, um personalisierte Nachrichten in großem Umfang zu erstellen, die Sie dann basierend auf den Antwortraten verfeinern. Die KI lernt aus Engagement-Mustern, um Messaging und Timing zu optimieren.

Kostenoptimierung für KI-Startup-Fundraising

Die Kosten für KI-gestützte Fundraising-Software variieren, wobei umfassende Stacks potenziell 300–800 € monatlich kosten können. Budgetbewusste KI-Startups können mit kostenlosen Tarifen beginnen und strategisch upgraden, während das Fundraising voranschreitet.

Beginnen Sie mit dem kostenlosen Plan von Papermark für KI-Pitch-Deck-Tracking, dem kostenlosen Tarif von Cherub für KI-Investor-Matching und grundlegenden Tools für Pipeline-Management. Diese Grundlage bietet Kernfunktionalität mit KI-Unterstützung für Early-Stage-Runden bei minimalen Kosten.

Wenn Ihre Investorenliste wächst und sich Gespräche vervielfachen, upgraden Sie auf kostenpflichtige KI-gestützte Matching-Tools (Evalyze, Fundra oder Easy VC) und erwägen Sie Leopard AI für umfassende Automatisierung. Diese KI-Tools rechtfertigen ihre Kosten, indem sie das Fundraising beschleunigen und die Erfolgsraten durch intelligentes Matching und Automatisierung erhöhen.

Für Series A und darüber hinaus bieten Premium-KI-Plattformen fortschrittliche Matching-Algorithmen und Automatisierung, die die Investition wert sind. In dieser Phase kostet Ihre für Fundraising aufgewendete Zeit weitaus mehr als Software-Abonnements, was KI-gestützte Tools hochgradig ROI-positiv macht.

Viele Plattformen bieten Startup-Rabatte oder verlängerte Testversionen an. Wenden Sie sich an Vertriebsteams und erklären Sie, dass Sie aktiv Fundraising betreiben – die meisten Anbieter möchten Startups unterstützen und bieten flexible Vereinbarungen an.

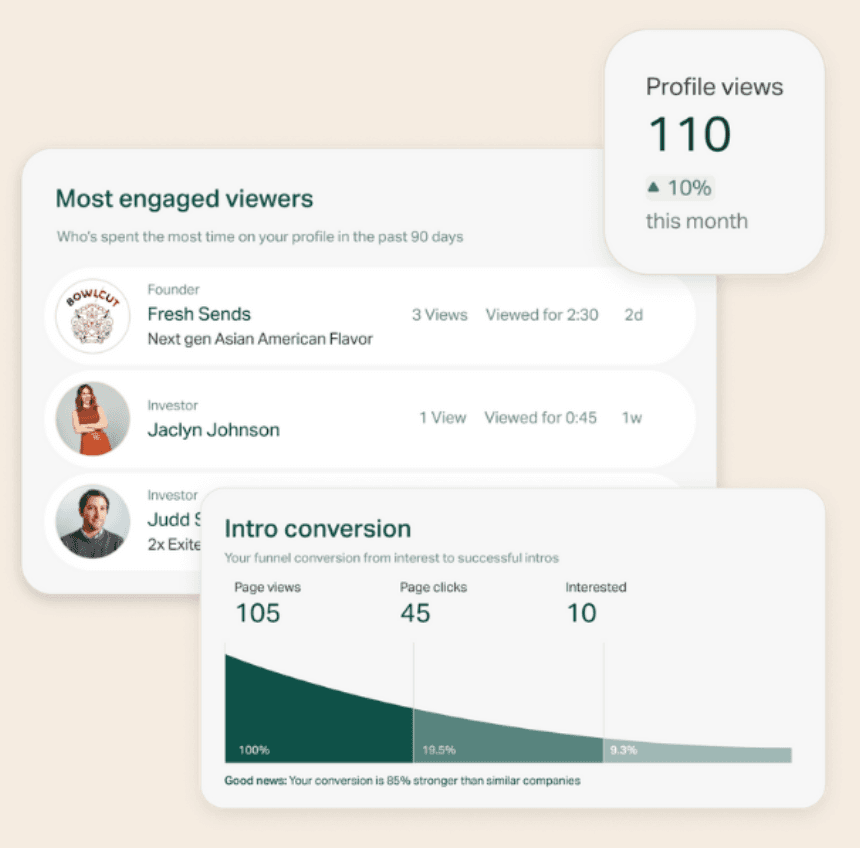

So tracken Sie Fundraising-Kennzahlen

Effektives Fundraising erfordert das Tracking wichtiger Kennzahlen, die die Pipeline-Gesundheit offenlegen und Engpässe identifizieren. Überwachen Sie diese Kernzahlen: Gesamtzahl kontaktierter Investoren, E-Mail-Öffnungsraten, Pitch-Deck-Aufrufe, geplante Meetings und Due-Diligence-Anfragen.

Conversion-Raten zwischen den Phasen zeigen, wo Sie an Schwung verlieren. Wenn 100 Investoren Ihr Deck ansehen, aber nur 5 Meetings vereinbaren, muss Ihr Pitch wahrscheinlich überarbeitet werden. Wenn 20 Investoren an Meetings teilnehmen, aber keiner in die Due Diligence eintritt, muss Ihre Nachverfolgung oder Qualifizierung verbessert werden.

Die Zeit in jeder Phase zeigt, wie lange Investoren für Entscheidungen benötigen. KI-Startups verbringen oft Wochen in der Due Diligence, während Investoren technische Behauptungen validieren. Das Verständnis typischer Zeitrahmen hilft, realistische Erwartungen zu setzen und mehrere Gespräche gleichzeitig zu führen.

Die Engagement-Tiefe unterscheidet wirklich interessierte Investoren von Reifenkickern. Die seitenweise Analyse von Papermark zeigt, welche Investoren sich intensiv mit Ihrem Deck beschäftigen und welche nur schnell durchblättern. Priorisieren Sie Follow-ups mit engagierten Betrachtern.

Die Deal-Geschwindigkeit misst die Tage vom Erstkontakt bis zum unterzeichneten Term Sheet. Erfolgreiche KI-Fundraising-Runden benötigen typischerweise 3–6 Monate, aber die Verfolgung Ihrer Geschwindigkeit hilft Ihnen, bei Bedarf anzupassen. Wenn Meetings nicht konvertieren, überdenken Sie Ihre Narrative oder Ihr Targeting.

Häufige Fehler bei Fundraising-Software

KI-Startups machen häufig mehrere Fehler beim Aufbau von Fundraising-Stacks. Vermeiden Sie es, sofort jedes Tool zu kaufen – starten Sie schlank und fügen Sie Funktionen hinzu, wenn Engpässe auftreten. Überinvestitionen in Software vor der Validierung Ihres Pitches verschwenden Ressourcen.

Ignorieren Sie nicht die Datensicherheit beim Teilen von Pitch Decks, die proprietäre KI-Technologie enthalten. Die Nutzung von Consumer-File-Sharing-Diensten wie Dropbox oder WeTransfer gefährdet sensible Informationen. Investieren Sie in Plattformen, die Wasserzeichen, Screenshot-Schutz und Zugriffskontrollen bieten.

Das Versäumnis, Engagement zu tracken, kostet Chancen. Wenn Investoren Ihr Deck ansehen, haben Sie ein enges Zeitfenster für Follow-ups. Ohne Analysen, die zeigen, wer engagiert ist, fliegen Sie blind und kontaktieren wahrscheinlich die falschen Personen.

Das Vermeiden von Personalisierung skaliert schlecht. Generische, vorlagenbasierte Ansprache erzeugt niedrige Antwortraten. KI-gestützte Tools können bei der Personalisierung im großen Maßstab helfen, aber überprüfen und passen Sie Nachrichten vor dem Versenden an.

Bestehende Investoren während der Fundraising-Phase zu vernachlässigen, frustriert deine Unterstützer. Sende regelmäßige Updates, die Fortschritte zeigen, auch wenn du dich auf neue Investoren konzentrierst. Plattformen wie Visible machen dies einfach.

Fazit

Fundraising-Software hat sich von einfacher Kontaktverwaltung zu KI-gestützten Plattformen entwickelt, die Startups mit Investoren zusammenbringen, personalisierte Kontaktaufnahme automatisieren und Echtzeit-Engagement-Analysen liefern. Für KI-Startups, die 2026 in einem wettbewerbsintensiven Umfeld Kapital aufnehmen, verbessert der Einsatz dieser Tools die Erfolgsquoten erheblich.

Der richtige KI-gestützte Fundraising-Stack hängt von deinen spezifischen Anforderungen, deinem Budget und deiner Fundraising-Phase ab. Beginne mit kostenlosen Versionen von Papermark für KI-Pitch-Deck-Tracking, nutze KI-gestützte Matching-Tools wie Evalyze oder Fundra für die Investorensuche und ergänze bei entsprechendem Budget umfassende KI-Automatisierung wie Leopard AI.

Am wichtigsten ist: Software ermöglicht großartiges Fundraising, ersetzt aber nicht die Grundlagen – überzeugende Story, starke Traktion, exzellentes Team und konsequente Umsetzung. Nutze diese Tools, um deine Stärken zu verstärken und deine Bemühungen zu skalieren, nicht um schwache Grundlagen zu kompensieren.