How to Invest in AI Startups as a Small Investor in 2026

Artificial intelligence is transforming industries at an unprecedented pace, creating exciting investment opportunities for individuals who want to participate in this technological revolution. As a small investor, you don't need millions of dollars to get started in AI startup investing. With the right knowledge and approach, you can build a diversified portfolio of AI investments that aligns with your financial goals and risk tolerance.

The AI market is projected to reach $1.8 trillion by 2030, driven by advancements in machine learning, natural language processing, and computer vision, according to Grand View Research. This growth presents unique opportunities for small investors to participate in early-stage companies that could become the next generation of tech giants. Whether you're interested in healthcare AI, fintech solutions, or autonomous systems, there are multiple pathways to invest in AI startups with relatively small amounts of capital.

Quick Recap of Steps

- Understand AI Investment Landscape: Learn about different AI sectors and market opportunities

- Choose Your Investment Platform: Select from crowdfunding, angel networks, or VC funds

- Research and Due Diligence: Evaluate startups based on team, technology, and market potential

- Start with Small Amounts: Begin with minimum investments to test your strategy

- Build a Diversified Portfolio: Spread investments across multiple AI startups and sectors

- Monitor and Track Progress: Use analytics tools to follow your investments' performance

Method 1: Equity Crowdfunding Platforms

Equity crowdfunding platforms have democratized startup investing, allowing individuals to invest as little as $100 in promising AI startups. These platforms provide detailed information about each company's business model, financial projections, and growth strategy.

Step-by-step guide for equity crowdfunding:

- Choose a reputable platform like SeedInvest, Republic, or StartEngine

- Create an account and complete the investor verification process

- Browse AI startup listings and filter by industry, funding goal, and investment minimum

- Review company profiles including pitch decks, financials, and team backgrounds

- Make your investment using the platform's secure payment system

- Track your investment through the platform's dashboard and updates

Platforms like Republic often feature AI startups in sectors such as healthcare, finance, and enterprise software. You can invest as little as $100 and receive equity shares in the company. The platform handles all legal documentation and provides regular updates on company progress.

Method 2: Angel Investing Networks

Angel investing networks connect individual investors with startup opportunities, often allowing you to co-invest with experienced angels. These networks provide access to vetted deals and offer educational resources for new investors.

Step-by-step guide for angel investing:

- Join an angel network like AngelList, Gust, or local angel groups

- Complete investor accreditation if required by your jurisdiction

- Attend pitch events and networking sessions to meet founders

- Review deal flow provided by the network's investment committee

- Conduct due diligence on companies that interest you

- Make investment decisions based on your research and risk tolerance

Angel networks often have minimum investment requirements ranging from $1,000 to $25,000, but some syndicates allow smaller amounts. You'll benefit from the network's due diligence process and gain access to deals that might not be available to individual investors.

Method 3: Venture Capital Funds with Low Minimums

Some venture capital funds offer opportunities for smaller investors to participate in diversified portfolios of startups, including AI companies. This approach reduces individual company risk while maintaining exposure to the AI sector.

Step-by-step guide for VC fund investing:

- Research VC funds that accept smaller investors (minimums $10,000-$50,000)

- Review fund performance and investment thesis

- Understand fee structures including management and carried interest fees

- Complete subscription documents and wire your investment

- Receive regular updates on portfolio company performance

- Monitor fund performance against your investment goals

Funds like MicroVentures and Fundrise allow smaller investors to participate in venture capital with minimum investments starting around $10,000. These funds typically invest in 20-50 companies, providing diversification across different AI applications and stages.

Method 4: Tokenized Startup Investments

Emerging platforms are using blockchain technology to offer fractional ownership in startups through digital tokens. This approach provides liquidity and lower entry barriers, though it's still a developing area with regulatory considerations.

Step-by-step guide for tokenized investments:

- Research tokenized investment platforms and their regulatory compliance

- Understand the token structure and your rights as a token holder

- Complete KYC/AML verification required by the platform

- Purchase tokens representing fractional ownership in AI startups

- Monitor token performance and any secondary market trading

- Understand tax implications of token-based investments

While this method offers potential liquidity advantages, it's important to thoroughly research the platform's regulatory compliance and understand the risks associated with tokenized securities.

Due Diligence: Step-by-Step Guide

Conducting thorough due diligence is critical before investing in any AI startup. This systematic process helps you evaluate the company's potential, identify red flags, and make informed investment decisions.

Step-by-step guide for due diligence:

-

Request and review the pitch deck: Ask for the company's pitch deck and analyze their business model, market opportunity, and growth strategy. Look for clear value propositions and realistic financial projections.

-

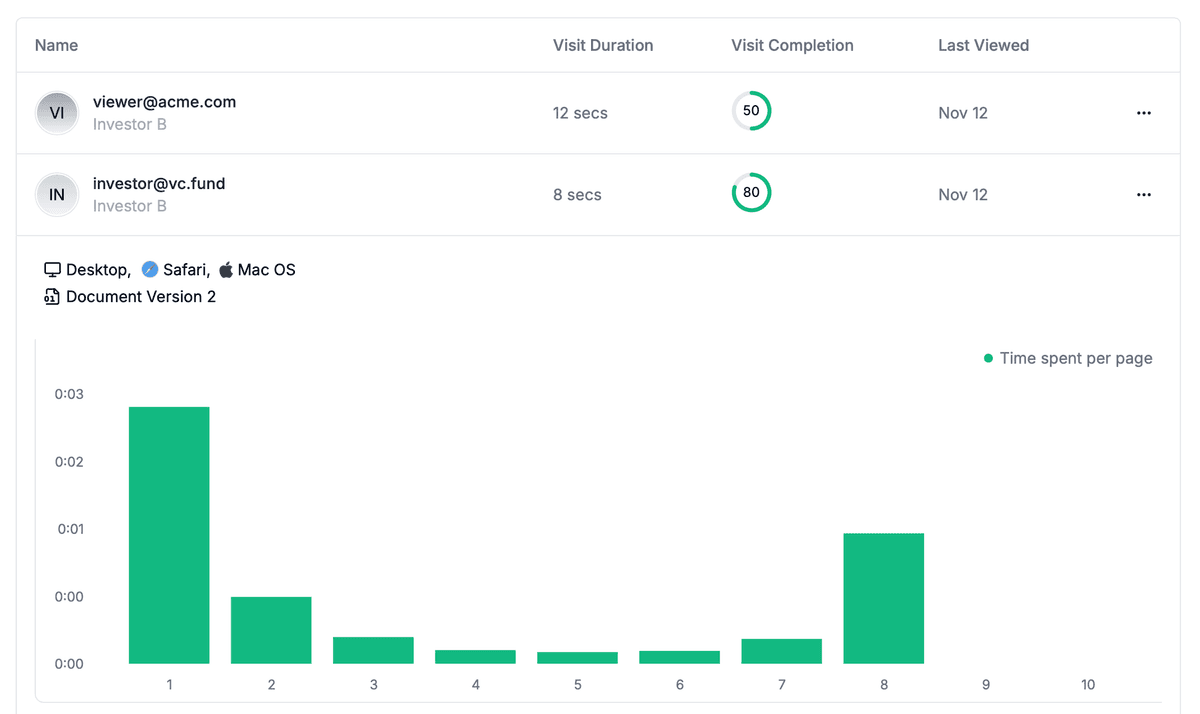

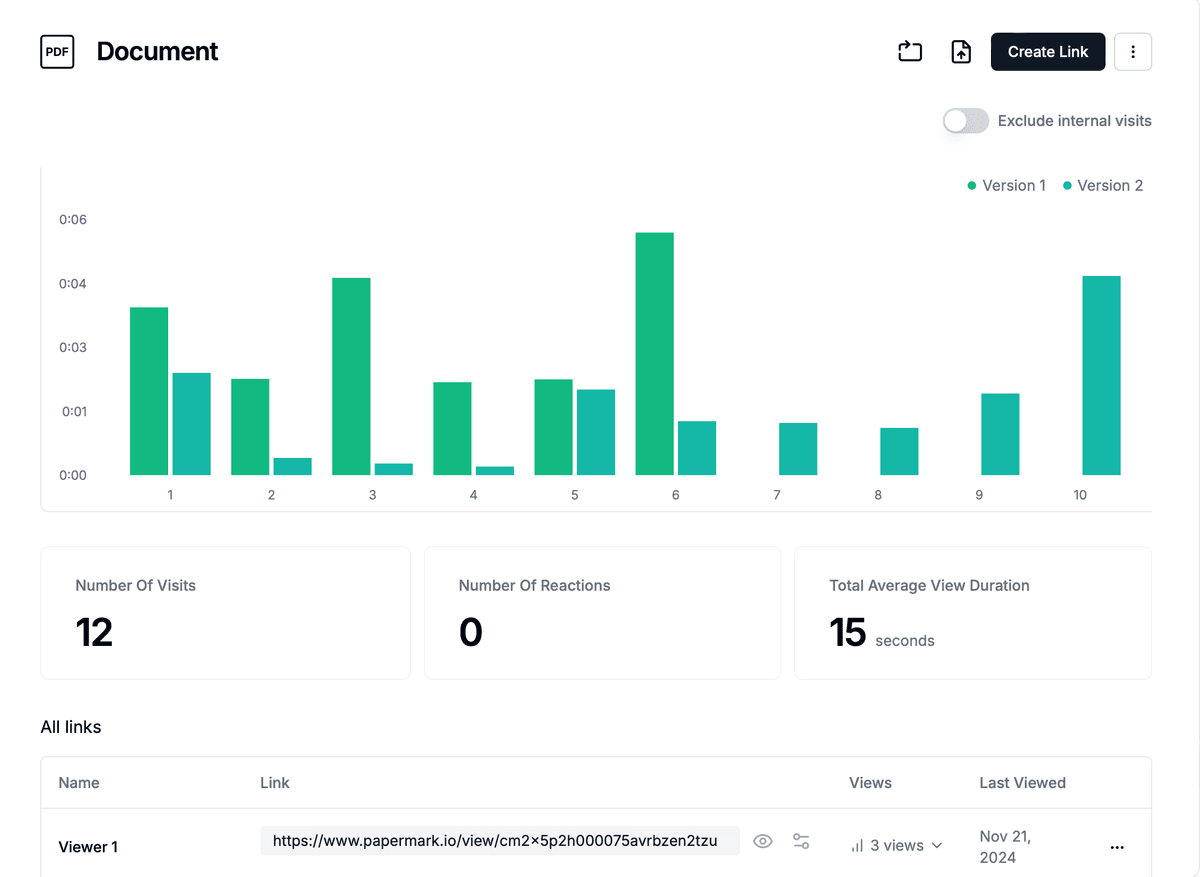

Use pitch deck analytics tools: Platforms like Papermark allow you to track how founders share their pitch decks and monitor engagement. When founders share their deck via Papermark, you can see which slides they emphasize, how long investors spend on each section, and identify patterns that indicate strong investor interest.

-

Evaluate the founding team: Research the founders' backgrounds, technical expertise, and previous experience. For AI startups, look for team members with relevant AI/ML experience, successful exits, or strong academic credentials in computer science or related fields.

-

Assess the technology: Understand the AI technology being developed, its technical feasibility, and competitive advantages. Review technical documentation, patents, or research papers if available. Consider whether the technology is defensible and difficult to replicate.

-

Analyze the market opportunity: Evaluate the size of the target market, growth potential, and competitive landscape. Look for startups addressing large, growing markets with clear customer pain points.

-

Review financials and traction: Examine revenue, user growth, customer acquisition costs, and burn rate. Early-stage companies may have limited financials, but look for signs of product-market fit and customer validation.

-

Check legal and regulatory compliance: Verify the company's legal structure, intellectual property ownership, and any regulatory requirements specific to their AI application (e.g., healthcare AI may need FDA approval).

-

Speak with the founders: Schedule a call or meeting to ask questions about their vision, challenges, and plans. This helps you assess their communication skills, transparency, and commitment.

-

Review investor updates: If the company uses tools like Papermark to share investor updates, review their progress over time. Consistent updates and milestone achievements indicate good communication and execution.

-

Compare with competitors: Research similar companies in the space to understand competitive positioning, pricing, and differentiation. This helps you assess whether the startup has a sustainable competitive advantage.

Using Papermark for due diligence

Papermark provides powerful tools for investors conducting due diligence on AI startups. When founders share their pitch decks through Papermark, you gain valuable insights:

- Page-by-page analytics: See which slides capture the most attention and identify areas of concern or interest

- Time spent analysis: Understand how long investors review each section, indicating thoroughness of evaluation

- Engagement tracking: Monitor when pitch decks are viewed and by whom, helping you gauge investor interest levels

- Secure document sharing: Access pitch decks, financials, and data room materials in a secure environment with watermarking and access controls

By requesting that startups share their materials through Papermark, you can track your own due diligence process and compare your engagement patterns with other investors. This data helps you identify red flags early—for example, if a founder is sharing the deck with hundreds of investors but seeing low engagement, it may indicate issues with the pitch or business model.

Papermark's secure data room features allow you to access comprehensive due diligence materials including financial statements, legal documents, and technical documentation. The platform's watermarking and screenshot protection ensure sensitive information remains secure while you conduct your evaluation.

Best Practices for AI Startup Investing

Successful AI startup investing requires a systematic approach and thorough research. Start by understanding the different AI sectors and their growth potential. Focus on companies with strong technical teams, clear market opportunities, and defensible competitive advantages.

Diversification is crucial when investing in startups, as the failure rate is high. Consider spreading your investments across different AI applications, company stages, and geographic regions. Use tools like pitch deck analytics to track how founders present their companies and monitor investor interest.

Stay informed about AI trends and technological developments. Attend industry conferences, read technical papers, and follow AI research to better understand which technologies are gaining traction. This knowledge will help you identify promising investment opportunities and avoid companies with outdated approaches.

Key Takeaways

Investing in AI startups as a small investor is more accessible than ever, with multiple platforms offering low minimum investments. Success requires thorough due diligence, diversification across multiple companies, and a long-term perspective. Focus on companies with strong technical teams, clear market opportunities, and defensible competitive advantages.

The AI sector offers significant growth potential, but also carries high risk due to the competitive nature of the industry and rapid technological change. By using the right platforms and following best practices, small investors can participate in this exciting sector while managing risk appropriately.

Conclusion

Investing in AI startups as a small investor provides an opportunity to participate in one of the most transformative technological trends of our time. With platforms offering minimum investments as low as $100, you can start building a diversified portfolio of AI investments that aligns with your financial goals.

Remember that startup investing is inherently risky, with many companies failing to achieve their potential. However, by following best practices, conducting thorough due diligence, and maintaining a diversified portfolio, you can position yourself to benefit from the AI revolution while managing risk effectively.