Investor Outreach Plan in 8 einfachen Schritten

Die Entwicklung eines effektiven Investor-Outreach-Plans ist für Startup-Gründer auf der Suche nach Finanzierung entscheidend. Ein gut strukturierter Ansatz kann die Chancen auf Investitionen und den Aufbau bedeutsamer Beziehungen zu potenziellen Investoren deutlich erhöhen.

Kurzanleitung für Investor Outreach

- Zielliste erstellen: Recherchieren und identifizieren Sie geeignete Investoren mithilfe von Datenbanken und Netzwerken

- Materialien vorbereiten: Erstellen Sie ein überzeugendes Pitch Deck und unterstützende Dokumente

- Outreach-Strategie entwickeln: Planen Sie Zeitpunkt und Kanäle für den Investorenkontakt

- Tracking und Management: Richten Sie Systeme ein, um Outreach und Antworten zu überwachen

- Nachfassen: Pflegen Sie strategische Kommunikation mit interessierten Parteien

- Data Room aufbauen: Organisieren Sie umfassende Due-Diligence-Materialien

- Erfolg messen: Verfolgen Sie Antwortquoten und Engagement-Metriken

Schritt 1: Aufbau Ihrer Investoren-Zielliste

Nutzung von Investorendatenbanken

Papermark bietet eine umfangreiche offene Investorendatenbank mit über 8.000 Investoren weltweit. Sie können filtern nach:

- Investitionsphase

- Branchenfokus

- Geografischer Standort

- Investitionsgröße

- Frühere Investitionen

Qualifizierung von Investoren

Beim Aufbau Ihrer Zielliste sollten Sie folgendes beachten:

| Kriterien | Wichtige zu berücksichtigende Faktoren |

|---|---|

| Übereinstimmung der Investitionsthese | • Ihre Branche/Sektor • Ihre Entwicklungsphase • Ihre geografische Region |

| Aktuelle Investitionstätigkeit | • Suchen Sie nach aktiven Investoren • Prüfen Sie deren neueste Portfolio-Ergänzungen • Überprüfen Sie typische Investitionsgrößen |

| Strategischer Wert | • Branchenexpertise • Netzwerkzugang • Portfolio-Synergien |

Schritt 2: Vorbereitung Ihres Pitch Decks

Wesentliche Dokumente

-

Pitch Deck:

- Maximal 15-20 Folien Pitch Deck Sharing-Statistiken

- Klare Problem-/Lösungsdarstellung

- Marktchancen

- Traktionsmetriken

- Finanzprognosen

- Team-Hintergrund

-

Executive Summary:

- Einseitige Übersicht

- Wichtigste Highlights

- Investitionsanfrage

-

Finanzmodell:

- Detaillierte Prognosen

- Wichtige Annahmen

- Mittelverwendung

Schritt 3: Entwicklung Ihrer Kontaktstrategie

Timing Ihrer Kontaktaufnahme

-

Fundraising-Zeitfenster:

- Planen Sie 4-6 Monate ein

- Berücksichtigen Sie Ferienzeiten

- Beachten Sie Branchenveranstaltungen

-

Batch-Ansatz:

- Gruppieren Sie Investoren nach Priorität

- Beginnen Sie mit 20-30 Zielen

- Passen Sie basierend auf Feedback an

Kontaktkanäle

| Kanaltyp | Methoden |

|---|---|

| Warme Einführungen | • Netzwerken durch bestehende Kontakte • LinkedIn-Verbindungen nutzen • Accelerator-Netzwerke nutzen |

| Direkte Kontaktaufnahme | • Personalisierte E-Mails • LinkedIn-Nachrichten • Networking auf Konferenzen |

E-Mail-Vorlagenstruktur

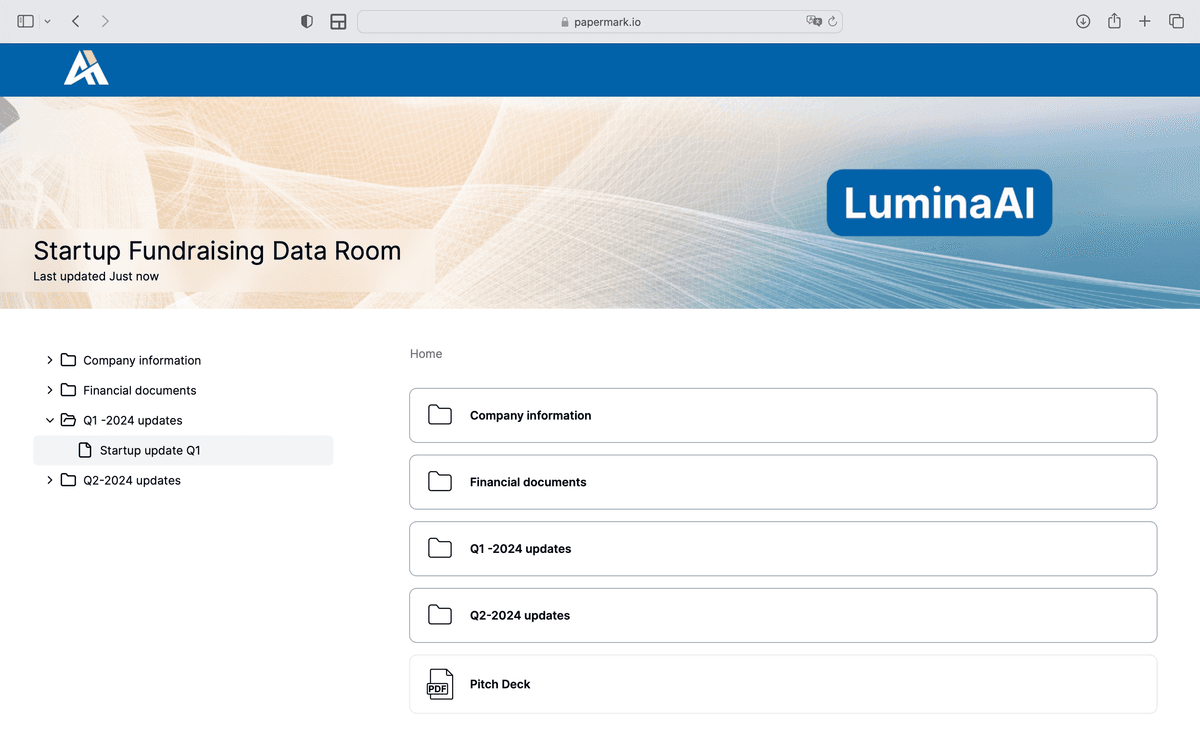

Schritt 4: Teilen Ihres Pitch Decks oder Datenraums

Teilen Sie Ihr Deck über einen Link und verfolgen Sie jede Seite, die Investoren angesehen haben.

Wenn Sie mehr als ein Dokument teilen möchten, erstellen Sie einen sicheren Datenraum zum Teilen.

Die Verwendung von Papermark für Ihre Investorenansprache bietet mehrere Vorteile:

-

Professionelle Präsentation:

- Gebrandete Betrachtungserfahrung

- Konsistente Formatierung auf allen Geräten

- Professionelle Landingpages

-

Sicherheitsfunktionen:

- Zugriffskontrollen

- E-Mail-Verifizierung

- Einstellungen für Linkablauf

-

Engagement-Tracking:

- Ansichtsanalysen

- Verbrachte Zeit pro Folie

- Betrachteridentifikation

Praxisbeispiel: Erfolgreiche Investorenansprache

Sehen Sie, wie Two, ein Fintech-Startup, ihre Investorenansprachestrategie umgesetzt hat, um 13 Mio. € zu sammeln:

Schritt 5: Verfolgung und Verwaltung der Kontaktaufnahme

![]()

Verwendung von Papermark für das Tracking

-

Dokumentenanalyse:

- Verfolgen Sie, wer Ihr Deck angesehen hat

- Überwachen Sie die Engagement-Zeit

- Sehen Sie, welche Folien Interesse wecken

-

Betrachter-Einblicke:

- Erfassung verifizierter E-Mails

- Verfolgung von Weiterleitungsaktivitäten

- Überwachung mehrfacher Aufrufe

CRM-Integration

Führen Sie eine Tabelle oder CRM mit:

- Investoren-Kontaktdaten

- Status der Kontaktaufnahme

- Meeting-Notizen

- Follow-up-Aufgaben

- Investitionsinteresse-Level

Schritt 6: Follow-up-Strategie

Timing

-

Erstes Follow-up:

- Warten Sie 3-5 Tage nach dem ersten Kontakt

- Beziehen Sie sich auf die Präsentations-Analysen

- Liefern Sie zusätzlichen Kontext

-

Nachfolgende Follow-ups:

- Im Abstand von 7-10 Tagen

- Teilen Sie neue Entwicklungen mit

- Bewahren Sie einen professionellen Ton

Nutzung von Analysen für Follow-ups

Nutzen Sie Papermarks Analysen, um:

-

Follow-ups zu priorisieren:

- Konzentrieren Sie sich auf engagierte Betrachter

- Beachten Sie spezifisches Interesse an bestimmten Folien

- Stimmen Sie Follow-ups mit der Betrachtungsaktivität ab

-

Nachrichten personalisieren:

- Beziehen Sie sich auf angesehene Inhalte

- Gehen Sie auf potenzielle Fragen ein

- Teilen Sie relevante Updates mit

Schritt 7: Erfolgsmessung

Verfolgen Sie wichtige Kennzahlen:

-

Antwortrate:

- Erste Antworten

- Meeting-Konversionen

- Investitionsinteresse

-

Engagement-Metriken:

- Dauer der Präsentationsbetrachtung

- Wiederholte Aufrufe

- Dokumentenfreigabe

-

Konversionsmetriken:

- Erfolgsquote bei Meetings

- Fortschritt bei der Due Diligence

- Abschlussrate bei Investitionen

Das sollten Sie nicht tun!

-

Massenhafte Kontaktaufnahme:

- Vermeiden Sie allgemeine Nachrichten

- Personalisieren Sie jeden Kontakt

- Recherchieren Sie vor der Kontaktaufnahme

-

Schlechtes Timing:

- Kontaktieren Sie nicht während der Feiertage

- Berücksichtigen Sie das Timing des Geschäftsjahres

- Respektieren Sie die Geschäftszeiten

-

Mangelnde Vorbereitung:

- Unvollständige Materialien

- Unklare Anfrage

- Fehlender Follow-up-Plan

Fazit

Ein erfolgreicher Investor-Outreach-Plan erfordert sorgfältige Vorbereitung, systematische Durchführung und gewissenhafte Nachverfolgung. Die Nutzung von Tools wie Papermarks Investorendatenbank und Dokumentenfreigabeplattform kann Ihren Prozess optimieren und wertvolle Einblicke in das Engagement der Investoren bieten. Denken Sie daran, Ihren Ansatz kontinuierlich auf Basis von Feedback und Ergebnissen zu verfeinern.