7 best private equity fundraising software in 2025

Overview

Building a private equity fundraising stack? Start with a VDR for secure sharing and analytics, add a relationship‑aware CRM, and choose one research source. Below are the most commonly used tools.

Comparison table

| Tool | Category | Core use | Pricing (base) | Notes |

|---|---|---|---|---|

| Papermark | VDR | Data rooms & analytics | Free, paid from $59 | Custom domain, NDA gate, page analytics |

| DealCloud | Deal CRM | Pipeline & reporting | Contact sales (not public) | IC reports, Outlook integration |

| Affinity | Relationship CRM | Network mapping | Custom | Auto contact capture |

| 4Degrees | Deal CRM | Sourcing & reminders | Custom | Relationship intelligence |

| Satuit | IR/CRM | Investor relations | Custom | Emails, events, reporting |

| List Alpha | Investor discovery | Find funds/LPs | Custom | Thesis/geo filters |

| Fundwave | Fund admin | Capital accounts & reports | Custom | LP statements, portal |

1. Papermark — virtual data room (VDR)

Website: papermark.com

Papermark powers secure document sharing for PE fundraising and diligence with page‑by‑page analytics, NDAs, granular permissions, custom domains, and unlimited rooms. Self‑hosting available. Teams can track investor engagement in real‑time, set document expiration dates, and maintain complete control over sensitive financial documents. The platform integrates seamlessly with existing workflows while providing enterprise‑grade security for confidential deal materials.

Learn more about data rooms for secure folder storage and sharing in our overview: Papermark data room.

Features

- Unlimited data rooms and storage

- Page‑by‑page analytics (time per page, viewer details)

- NDA gate, password, email verification, link expiry

- Custom domains and full white‑labelling

- Groups, file‑level permissions, audit logs

- Self‑hosted deployment option

Use cases

- Run a competitive fundraising process with buyer‑specific rooms

- Buy‑side diligence across financial/legal/HR workstreams

- Portfolio company reporting and lender packs

Best for

- PE teams and founders who need modern VDR analytics and branding

Pricing

| Plan | Price | Team | Key features |

|---|---|---|---|

| Free | €0/month | 1 member | 50 links & 50 docs, unlimited visitors, page‑by‑page analytics, password, require email, 30‑day retention |

| Pro | €24/month | 1 member | Unlimited links, 100 docs, large uploads, custom branding, folders, video analytics, 1‑year retention |

| Business | €59/month | 3 members | Unlimited light data rooms, 1000 docs, unlimited folders, email verification, allow/block list, screenshot protection, custom domain (docs), webhooks, 2‑year retention |

| Data Rooms | €99/month | 3 members | Unlimited data rooms & docs, custom domain (data rooms), data room analytics, NDA agreements, dynamic watermark, file‑level permissions, groups, priority support, custom onboarding, 2‑year retention |

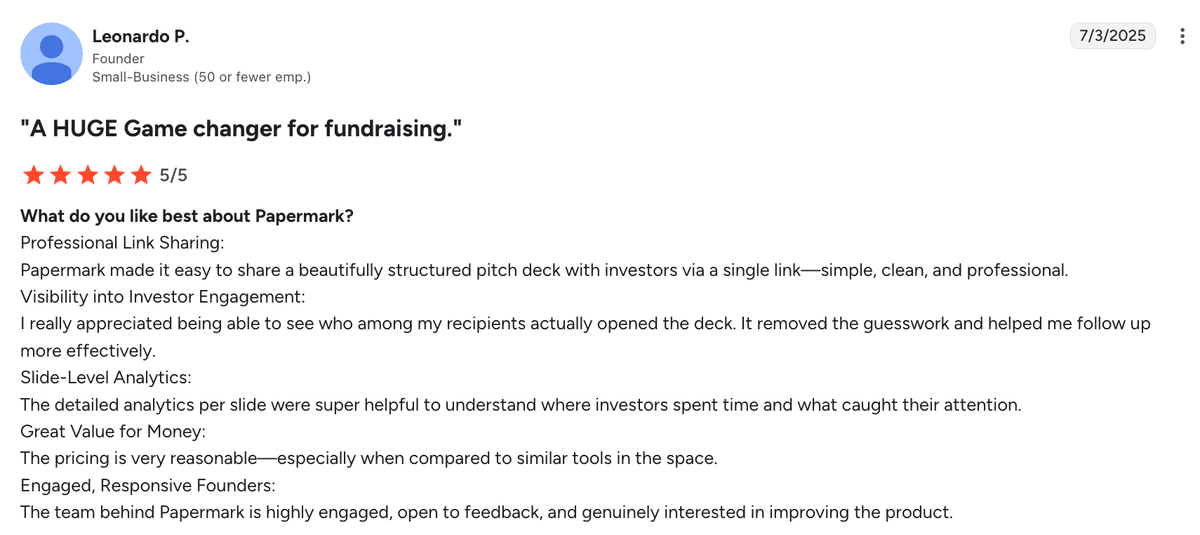

Reviews

- 4.5/5 (103 reviews) on G2

- Praised for speed, simple setup, and transparent pricing; appreciated by technical teams for open‑source option

2. DealCloud — deal & pipeline management

Website: dealcloud.com

DealCloud (by Intapp) centralizes firm and market intelligence with AI‑assisted relationship and deal management. It's more than a CRM: teams use it to source, evaluate, and execute opportunities with configurable dashboards, IC reporting, and deep Office/Microsoft 365 integrations. Preconfigured industry workflows help firms get up and running quickly while keeping a single source of truth across relationships, deals, and marketing.

Features

- Relationship & business intelligence with Applied AI

- Deal pipeline and IC reporting dashboards

- Outlook/Microsoft 365 integration and calendar sync

- No‑code configuration for fields, workflows, and reports

- Data foundation and partner ecosystem integrations

Use cases

- Centralizing deal flow from bankers and sponsors

- IC materials and portfolio reporting

Best for

- Mid‑to‑large PE funds that need deep reporting

Pricing

- Contact sales (pricing not publicly disclosed)

Reviews

- 4.4/5 (17 reviews) on G2

- Praised by mid‑market and enterprise firms for reporting depth and configurability; implementation typically involves vendor or partner support

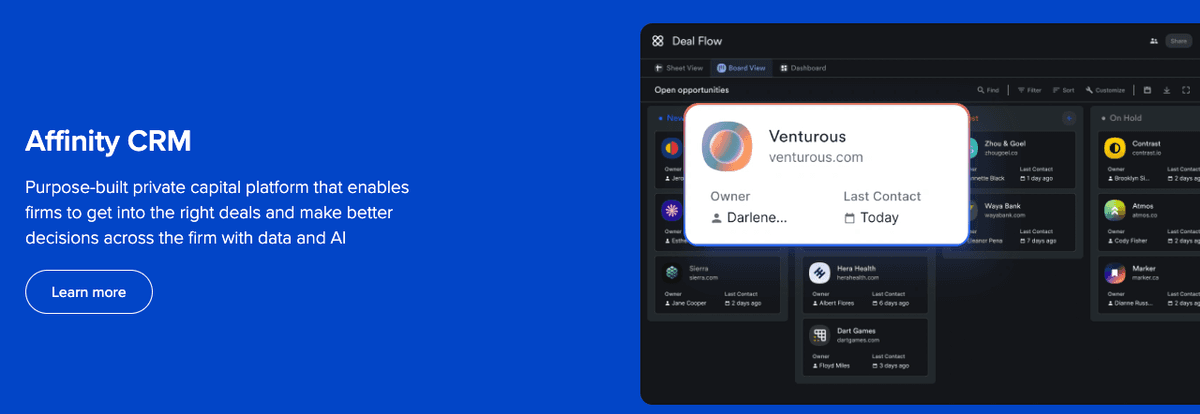

3. Affinity — relationship intelligence CRM

Website: affinity.co

AI‑powered relationship intelligence platform trusted by 50% of the top 300 venture firms globally. Auto‑captures relationships from email/calendar and maps warm introductions across your network. Powers over 1 million deals and $1 trillion in assets tracked through the platform, with proven results like 66% increase in deals reviewed annually.

Features

- Email/calendar ingestion to auto‑create contacts

- Relationship scores and warm‑intro graph

- Pipelines and reminders

- AI‑powered meeting intelligence and note‑taking

- 40+ premium data sources for enrichment

- Mobile app for relationship insights on‑the‑go

- Enterprise‑grade security (SOC2, ISO27001)

Use cases

- Mapping warm paths into sponsors and lenders

- Tracking outreach and meeting notes

- Deal sourcing and pipeline management

- Portfolio support and investor relations

Best for

- Teams that rely on network‑driven sourcing

- Firms needing automated data capture and enrichment

Pricing

- Essential: $2,000/user/year (~$167/user/month) — basic deal pipeline, relationship scoring

- Scale: $2,300/user/year (~$192/user/month) — deal sourcing extensions, mobile access

- Advanced: $2,700/user/year (~$225/user/month) — AI meeting intelligence, bulk email

- Enterprise: Contact sales — SSO, API access, custom governance

Reviews

- 4.4/5 (69 reviews) on G2

- Loved for automatic contact capture; data hygiene still matters

4. 4Degrees — deal & relationship intelligence

Website: 4degrees.ai

Relationship intelligence platform designed by ex‑investors for private markets teams. Trusted by hundreds of teams, it saves an average of 100 hours per week by streamlining operations and unlocking 4,000+ new signals for deal opportunities. Deal sourcing and relationship intelligence, with smart reminders and pipeline views.

Features

- Relationship intelligence across email/calendar

- Pipeline views and tasks

- Sourcing recommendations

- Chrome/LinkedIn/Gmail/Outlook extensions for data capture

- Salesforce integration for relationship intelligence

- Mobile app for deal management anywhere

- Real‑time alerts for job transitions and news

Use cases

- Prioritizing top relationships and active deals

- Finding warm introductions to target companies

- Automating data entry and contact management

- Portfolio support and LP relationship tracking

Best for

- PE/VC teams wanting a lighter relationship‑centric CRM

- Firms wanting to eliminate spreadsheet‑based deal tracking

Pricing

- Custom (contact sales)

Reviews

- 4.5/5 (5 reviews) on G2

- Positive feedback for relationship insights and reminders

5. Satuit — investor relations & CRM

Website: satuit.com

Buy‑side CRM and investor portal for asset managers, PE/VC, hedge funds, and family offices. Focuses on LP relationship management, compliant communications, and secure document delivery with options for cloud or on‑prem deployment.

Features

- Contact/LP records, email campaigns, events

- Compliance‑friendly activity tracking and audit trails

- Secure Investor Portal (SatuitSIP) for statements, documents, and forms

- Document packaging/automated report compilation (SatuitCRA)

- Mobile access (Satuit2GO), SSO/SAML, DocuSign and API integrations

Use cases

- Managing LP communications during and after a raise

- Delivering statements and reports via a branded investor portal

- Coordinating roadshows/travel planning for fundraising

Best for

- PE firms emphasizing IR workflows and investor reporting

Pricing

- Essentials: $150/user/month; minimum 3 users; 1 GB/user storage

- Premium: starting at $200/user/month; minimum 5 users; 4 GB/user storage

- Enterprise: starting at $300/user/month; minimum 5 users; 10 GB/user storage

- API monthly transactions: up to 250K (Essentials), 500K (Premium); test site: $300/month

Reviews

- 4.3/5 (3 reviews) on G2

- Longtime IR tool; valued for compliance‑oriented workflows

6. List Alpha — investor discovery

Website: listalpha.com

Private equity CRM and deal platform built by investors. Acts as a single source of truth for advisers, contacts, and deals with AI‑powered search across people, deals, and documents. Outlook integration captures email/calendar activity; onboarding migrates data in ~3 weeks.

Features

- Single source of truth for advisers and contacts

- AI/neural search across people, deals, and documents

- Outlook email/calendar capture and automatic enrichment

- Deal flow tracking, analytics, and reporting

- Investor relations and deal origination modules

Use cases

- Expanding the sponsor/LP target list for a raise

- Running Monday deal flow meetings with clean analytics

- Migrating from spreadsheets/legacy CRM with structured onboarding

Best for

- Emerging managers or teams entering new regions/sectors

- PE teams wanting fast migration and modern search

Pricing

- Starter (up to 7 users): $135/user/month (min 5 users)

- Standard (7–20 users): $165/user/month; includes data migration/onboarding

- Professional (20+ users): Contact sales; SSO/SCIM, custom API, on‑demand integrations

Reviews

- Helpful for targeted list building; data depth varies by region

7. Fundwave — fund administration

Website: fundwave.com

All‑in‑one fund operations platform for VC/PE that unifies deal pipeline, portfolio KPIs, LP communication/reporting, investor portal, cap tables, capital calls, IRRs, exit modelling, and dashboards. Built for multiple fund types (VC, PE, FoF, Corporate VC, SPVs, Impact, Family Office) with templates and automation to reduce manual work.

Features

- Deal pipeline and portfolio management with real‑time analytics

- LP communication and reporting with in‑built templates

- Investor portal for secure document and data access

- Capital calls, portfolio IRRs, exit modelling

- Captables, KPI collection, tasks/notes/emails

Use cases

- Post‑close administration and recurring LP reporting

- Consolidated investor communications and statements

- Pipeline tracking across funds and SPVs

Best for

- Funds that want an integrated admin + reporting stack

Pricing

- Contact sales (no transparent pricing listed)

Reviews

- No G2 rating to report at this time

Conclusion

Pick a solid VDR and a relationship‑aware CRM, then add discovery/admin tools as needed. For most teams, Papermark + DealCloud or Affinity is enough to run a professional process.

FAQ

Do I need both DealCloud and Affinity?

No. Choose one CRM based on whether you prioritize pipeline reporting (DealCloud) or network mapping and relationship capture (Affinity/4Degrees).

Where should I host diligence files?

Use a VDR (Papermark) for security and analytics instead of generic cloud storage.

What about LP reporting and statements?

Fundwave covers capital accounts, statements, and LP portals; pair it with your VDR and CRM.