Top Venture Capital Software Solutions in 2026

Venture capital firms are constantly seeking ways to improve their operations and maximize returns. In 2026, the landscape of venture capital software has evolved significantly, offering innovative solutions to meet the complex needs of investors across various operational areas.

Portfolio management software for VCs

Portfolio management software helps venture capital firms track their investments, monitor performance metrics, and make data-driven decisions about their portfolio companies. A critical component of portfolio management is secure document sharing and data room functionality.

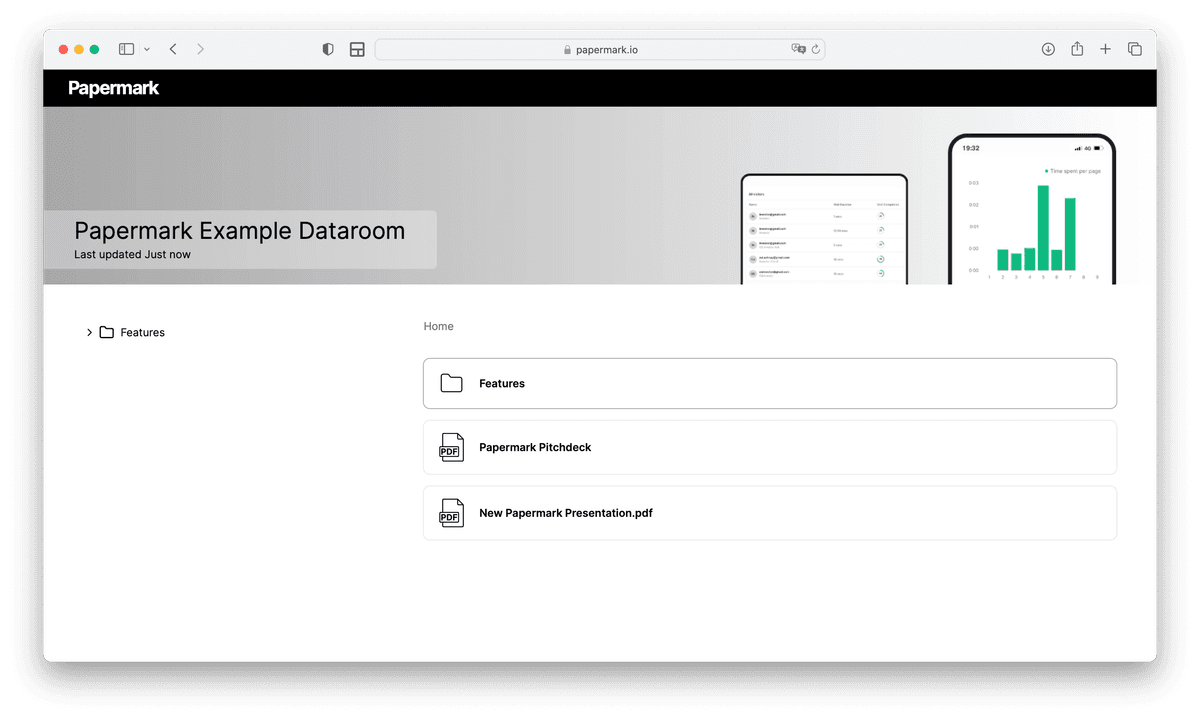

Papermark

Website: papermark.com

Papermark is an innovative, open-source document sharing and data room creation platform designed specifically for venture capital firms and startups.

It offers a secure and customizable solution for sharing sensitive documents, tracking engagement, and streamlining the fundraising process. As part of a comprehensive portfolio management approach, Papermark helps VCs maintain organized documentation for their investments while providing crucial security and analytics.

Key features

- Secure document storage and sharing

- Built-in page analytics and engagement tracking

- Custom domains and white-labeling

- Granular access controls and permissions

- Document version control

- Activity tracking and audit trails

- Watermarking and document expiration settings

- Modern team collaboration

- Portfolio company document organization

- Fundraising process optimization

Pricing

- Free: €0

- Starter: €25/month

- Business: €59/month (Data Room plan)

- Data Rooms: €99/month (Unlimited Data Rooms plan)

- Enterprise & Self-hosted: Custom

Full white labelling and self hosting is available on demand

Ratings and reviews

Highly rated and supported by over 15,000 companies.

![]()

Carta

Website: carta.com

![]()

Carta is a leading equity management platform that has become indispensable for venture capital firms. It offers a comprehensive suite of tools for managing cap tables, valuations, and investor reporting. With Carta, VCs can easily track their portfolio companies' equity, perform scenario modeling, and generate detailed reports for limited partners.

Key features

- Digital cap table management

- 409A valuations

- Portfolio performance analytics

- Investor reporting tools

- Equity plan administration

- Fund administration services

Pricing

- Custom pricing based on firm size and needs

- Contact Carta sales for detailed quotes

eFront

Website: efront.com

eFront offers a robust suite of solutions for alternative investments, including venture capital. Its platform covers the entire investment lifecycle, from fundraising to portfolio monitoring and reporting. eFront's advanced analytics help VCs make data-driven decisions and optimize their portfolio performance.

Key features

- Portfolio monitoring and analytics

- Fund accounting and administration

- Investor relationship management

- Risk management tools

- Customizable reporting

Pricing

- Enterprise-level pricing

- Contact eFront for tailored solutions and quotes

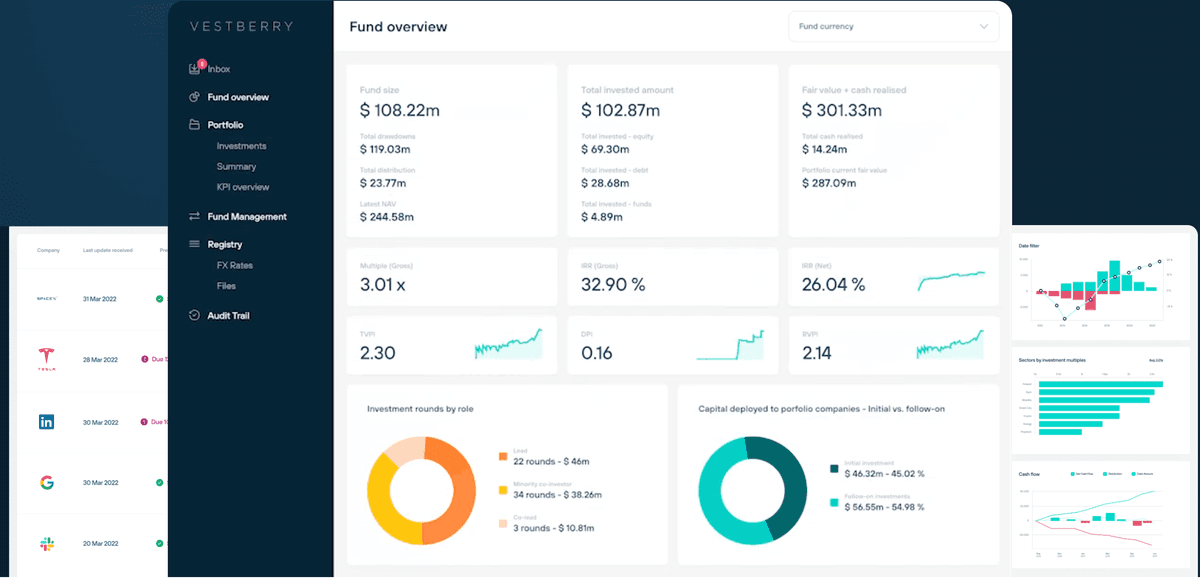

Alternative portfolio management solutions

- Vestberry: Specializes in portfolio monitoring with strong visual analytics

- Dynamo Software: Enterprise-level portfolio and investment management

- Cobalt LP: Institutional-grade portfolio monitoring and benchmarking

Customer Story: Fintech Startup Fundraising Success

See how Two used venture capital software and data rooms to secure €13M in Series A funding:

Deal flow management software for VCs

Deal flow management software helps venture capital firms source, evaluate, and track potential investment opportunities throughout the pipeline.

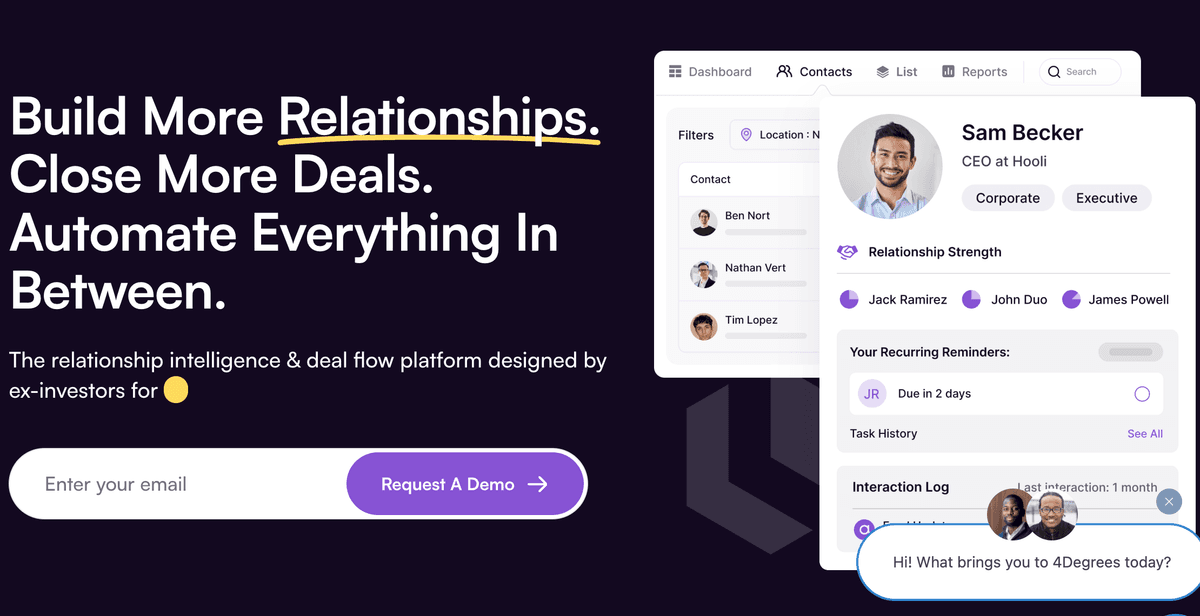

4Degrees

Website: 4degrees.ai

4Degrees leverages artificial intelligence to enhance relationship management and deal flow for venture capital firms. Its intelligent platform helps VCs identify promising opportunities and nurture key relationships within their network.

Key features

- AI-powered relationship mapping

- Deal flow management

- Automated data enrichment

- Email and calendar integration

- Customizable pipelines and workflows

Pricing

- Subscription-based model

- Pricing available upon request

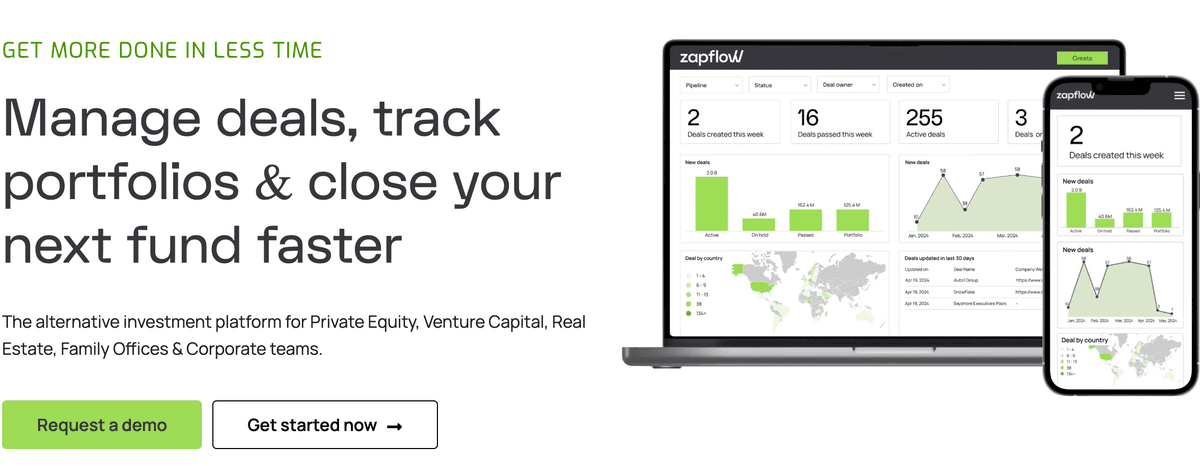

Zapflow

Website: zapflow.com

Zapflow offers a comprehensive solution for deal flow management and portfolio tracking. Its intuitive interface allows VCs to manage their entire investment process, from initial screening to exit.

Key features

- Deal pipeline management

- Portfolio company tracking

- Collaborative tools for investment teams

- Customizable deal stages and workflows

- Integration with CRM and other tools

Pricing

- Tiered pricing based on team size and features

- Free trial available

Market intelligence software for VCs

Market intelligence software provides venture capital firms with data-driven insights about industries, companies, and investment trends to inform their decision-making.

PitchBook

Website: pitchbook.com

PitchBook is a powerhouse of data and analytics for venture capital firms. It provides extensive information on private and public companies, investors, and deals. VCs use PitchBook to source deals, conduct due diligence, and track industry trends.

Key features

- Comprehensive private company data

- Deal and fundraising data

- Industry reports and analysis

- Customizable screening tools

- Benchmarking and comparables

Pricing

- Subscription-based model

- Pricing varies based on access level and user count

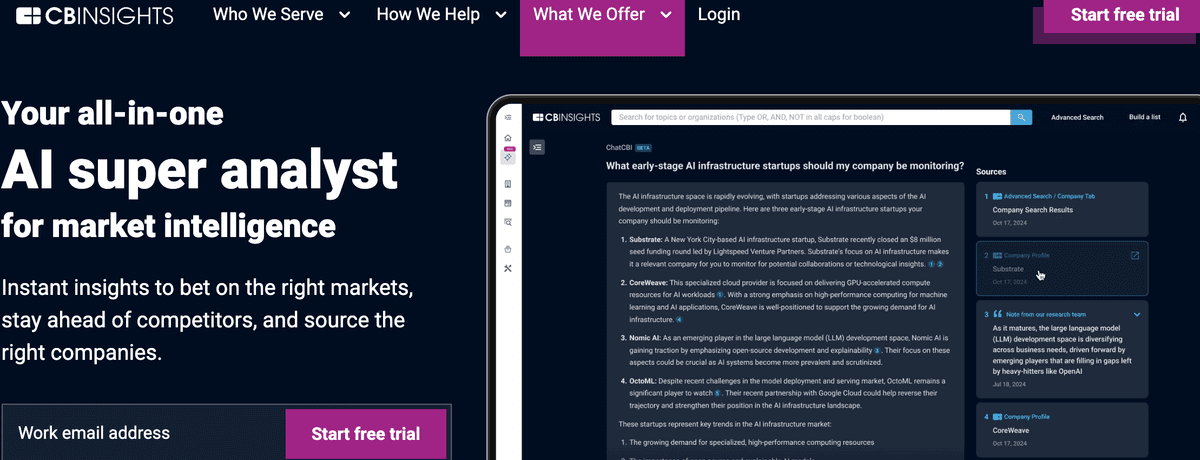

CB Insights

Website: cbinsights.com

CB Insights provides market intelligence and data analytics for the venture capital industry, helping firms identify emerging trends and promising startups across various sectors.

Key features

- Market maps and industry landscapes

- Startup and company tracking

- Investment trend analysis

- Predictive analytics for emerging technologies

- Customizable research reports

Pricing

- Enterprise pricing model

- Contact for custom quotes

Cap table management software for VCs

Cap table management software helps venture capital firms track equity ownership, valuations, and dilution scenarios for their portfolio companies.

EquityEffect

Website: equityeffect.com

EquityEffect focuses on cap table management and portfolio tracking for venture capital firms. Its specialized tools help VCs manage complex equity structures and track ownership across their portfolio.

Key features

- Cap table management

- Ownership tracking

- Waterfall analysis

- Scenario modeling

- Investor reporting

Pricing

- Custom pricing based on portfolio size

- Demo available upon request

Investor relations & reporting software for VCs

Investor relations software helps venture capital firms communicate effectively with limited partners, providing updates on portfolio performance and fund metrics.

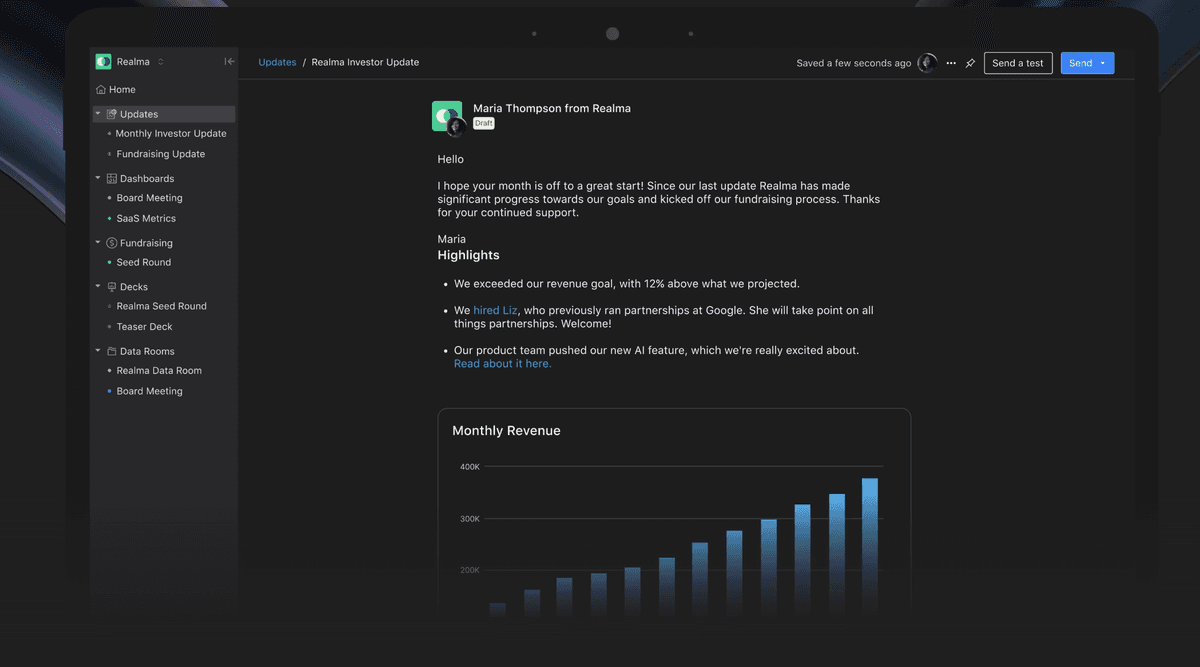

Visible

Website: visible.vc

Visible specializes in investor relations and communication for venture capital firms. Its platform helps VCs create compelling investor updates and maintain strong relationships with limited partners.

Key features

- Investor update creation and distribution

- Data visualization tools

- Metrics tracking

- Customizable templates

- Engagement analytics

Pricing

- Tiered pricing based on features and usage

- Free trial available

Vestberry

Website: vestberry.com

Vestberry specializes in portfolio monitoring and investor reporting for venture capital firms. Its user-friendly interface and powerful analytics make it easy for VCs to track their investments and communicate performance to stakeholders.

Key features

- Real-time portfolio monitoring

- Customizable dashboards and reports

- Data visualization tools

- Automated investor reporting

- Integration with other financial systems

Pricing

- Tiered pricing based on portfolio size and features

- Free trial available

Fund accounting software for VCs

Fund accounting software helps venture capital firms manage complex financial operations, including capital calls, distributions, and financial reporting.

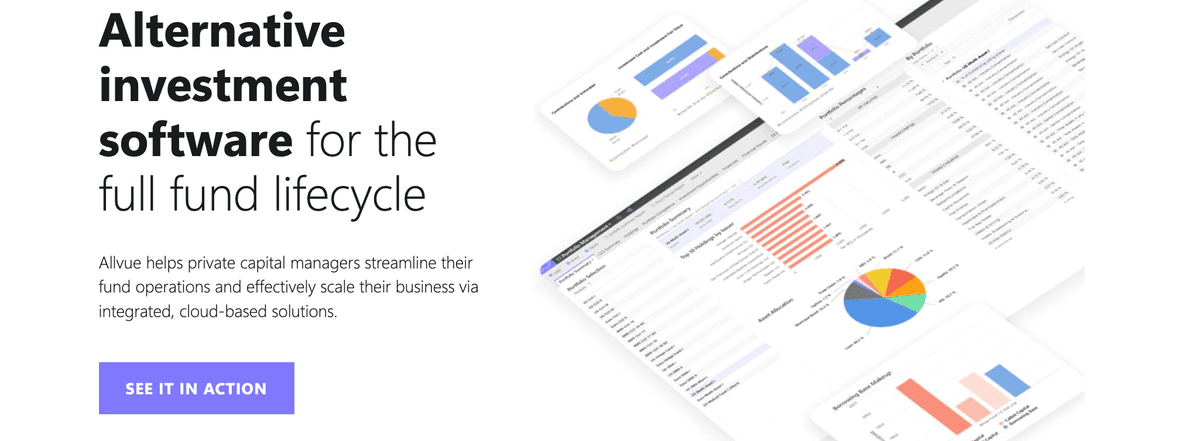

Allvue Systems

Website: allvuesystems.com

Allvue Systems provides comprehensive fund accounting and administration solutions for venture capital firms, helping them manage their financial operations efficiently.

Key features

- Fund accounting and general ledger

- Capital call and distribution management

- Financial statement generation

- Tax reporting and compliance

- Investor portal access

Pricing

- Enterprise pricing model

- Contact for custom quotes

CRM and relationship management for VCs

CRM systems designed for venture capital help firms manage their network of founders, investors, and industry connections.

Affinity

Website: affinity.co

Affinity is a relationship intelligence platform that helps venture capital firms manage their networks and identify valuable connections for deal sourcing and portfolio support.

Key features

- Automated relationship mapping

- Smart contact management

- Communication tracking

- Deal flow organization

- Relationship analytics

Pricing

- Custom pricing based on team size

- Contact for detailed quotes

Case Study: VC Firm Building Their Software Ecosystem

See how Icebreaker.vc, a leading early-stage VC firm, built their software ecosystem to raise Fund III:

Conclusion: Building an effective VC software ecosystem

Modern venture capital firms benefit from a comprehensive software approach that addresses multiple operational needs. By selecting the right tools for portfolio management (including document sharing and data rooms), deal flow, investor relations, and other key functions, VCs can optimize their workflows and focus on what matters most: finding great investments and creating value for their portfolio companies.

The ideal VC software stack combines specialized tools that excel in specific areas while integrating seamlessly with each other. Open-source solutions like Papermark for document sharing can be combined with commercial tools like Carta for cap table management, creating a powerful and cost-effective ecosystem tailored to your firm's unique requirements.