Founders outgrow Visible VC when they need deeper analytics, tighter access control, or a data room that goes beyond monthly updates. Investor relations now spans secure deck sharing, granular engagement signals, and simple ways to move from interest to diligence. This guide covers seven alternatives—starting with Papermark—for different use cases: secure data rooms and deck tracking, investor discovery, and fundraising CRMs that keep pipelines organized.

Quick recap of Visible VC alternatives

- Papermark – Secure data rooms and trackable pitch deck links with page analytics

- OpenVC – Free, community-sourced investor database and direct submissions

- Foundersuite – Fundraising CRM plus investor database

- Affinity – Relationship intelligence CRM for warm intros

- Attio – Flexible, API-friendly CRM for early teams

- Folk – Lightweight relationship CRM with templates

- HubSpot CRM – Broad sales/marketing CRM with email automation

Comparison table for Visible VC alternatives

| Feature | Papermark | OpenVC | Foundersuite | Affinity | Attio | Folk | HubSpot CRM |

|---|---|---|---|---|---|---|---|

| Investor updates | ✓ Pages & files | — | ✓ Emails | — | — | ✓ | ✓ |

| Pitch deck analytics | ✓ Page-by-page | — | — | — | — | — | Limited |

| Data room | ✓ Secure VDR | — | Limited | — | — | — | — |

| Access control & watermark | ✓ Granular | — | — | — | — | — | — |

| Investor database | ✓ Links to deck | ✓ 10k profiles | ✓ 250k+ | — | — | — | — |

| CRM pipeline | Light | — | ✓ Kanban | ✓ Deals | ✓ Flexible | ✓ Templates | ✓ Full CRM |

| Email/send from tool | Share links | Submissions | ✓ Mail-merge | ✓ Gmail/Outlook | ✓ | ✓ | ✓ Sequences |

| Pricing (entry) | Free + VDR €349 | Free | $44/m | Custom | From $29/m | From $14/m | Free tier |

1. Papermark – Visible VC alternative for secure data rooms

Website: papermark.com

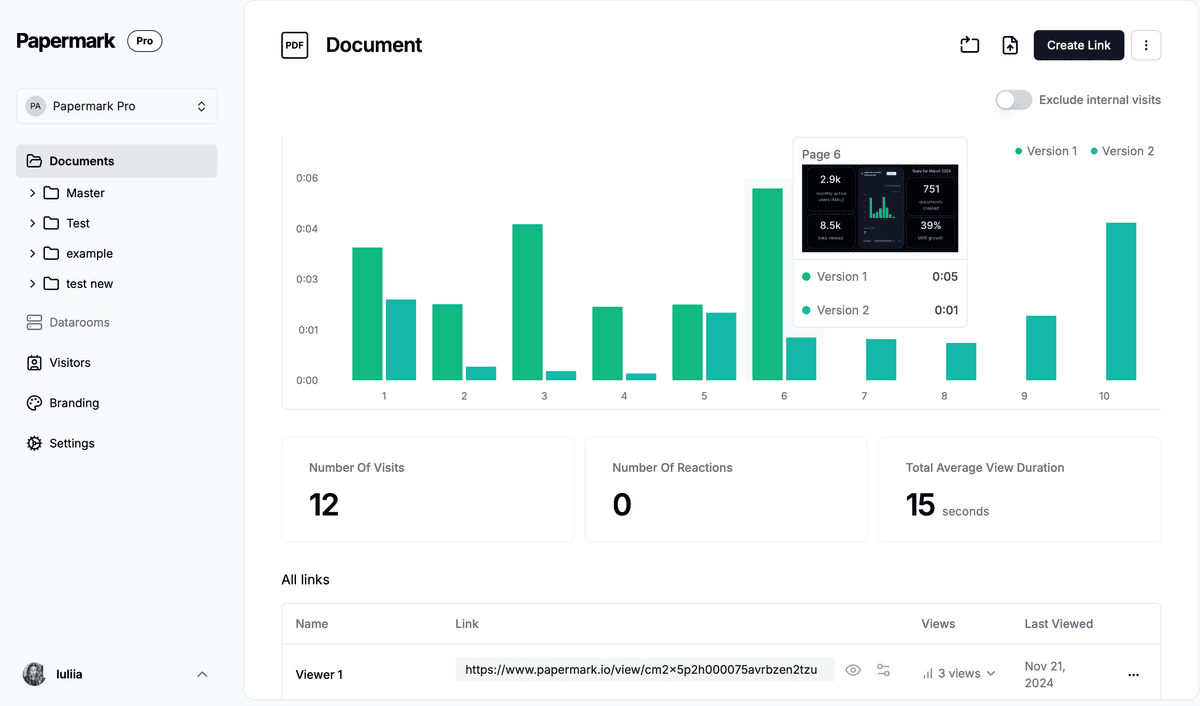

Papermark combines secure data rooms with shareable pitch deck links. You get page-by-page analytics, watermarking, and granular permissions—so you know exactly who viewed each slide and can move warm investors into diligence without leaving the platform.

Papermark features

Papermark offers self-serve data rooms, pitch deck sharing with page analytics, and secure document sharing using watermarking, screenshot protection, and link controls. White-label branding and custom domains keep your fundraise on-brand, while audit logs, Q&A, and visitor notifications give you a full trail for diligence.

Papermark pricing

- Free plan for basic sharing

- Data room plan: €349/month with 7-day free trial (5 seats, unlimited docs, custom domains, audit log, Q&A, notifications)

- See pricing

2. OpenVC – Visible VC alternative for investor discovery

Website: openvc.app

OpenVC is a free, community-sourced investor database with 10,000+ verified profiles. Founders can submit decks directly to investor inboxes, browse 400+ curated lists, and filter by industry, stage, and geography. It is ideal for top-of-funnel investor discovery before sending a tracked deck.

OpenVC features

- 10,000+ verified investor profiles

- Direct submission to investor inboxes

- Warm introduction finder

- 400+ pre-built investor lists

- Fundraising CRM

- Industry and phase filtering

- Geographic search functions

- Regular database updates

- Free access for all founders

- Mobile-friendly user interface

OpenVC limitations

- Outreach is still outbound

- Basic search functions

- Response rates can be low

OpenVC pricing

- Free for all founders

- Optional Premium upgrade

- No hidden fees or contracts

3. Foundersuite – Visible VC alternative for fundraising CRM

Website: foundersuite.com

Foundersuite blends a fundraising CRM with a 250k+ investor database and investor update emails. Use Kanban pipelines to track intros, meetings, and commits, then send updates to keep your round moving.

Foundersuite features

Pipeline boards for investor stages, mail-merge for outreach, templated investor updates, and a database filtered by stage, geography, and thesis. Light data room support helps share documents, though without deep analytics.

Foundersuite pricing

- Free tier (limited investors)

- Pro: $44/month

- Enterprise: Custom

4. Affinity – Visible VC alternative for warm-intro CRM

Website: affinity.co

Affinity is a relationship intelligence CRM used by funds for warm intros. It mines email and calendar data to surface relationship strength, making it easier to reach the right partner.

Affinity features

Relationship scoring, automatic contact enrichment, deal pipelines, and shared intelligence across teams. Integrations with Gmail/Outlook and LinkedIn help keep networks updated without manual data entry.

Affinity pricing

- Growth: Custom quote

- Enterprise: Custom

5. Attio – Visible VC alternative for flexible, API-first CRM

Website: attio.com

Attio is a flexible, API-forward CRM for early teams. You can model fundraising pipelines, sync data from product or billing tools, and trigger automations without heavy admin.

Attio features

Custom objects, bi-directional email sync, list views, workflows, and an API for enriching investor records. Good fit if you want CRM plus lightweight product data to prioritize outreach.

Attio pricing

- Starter: From $29/month per user

- Premium and Enterprise: Custom

6. Folk – Visible VC alternative for lightweight relationship CRM

Website: folk.app

Folk is a lightweight relationship CRM with templates for fundraising, partnerships, and recruiting. It is simple enough for small teams that want a clean UI and quick setup.

Folk features

Contact enrichment, email send and log, pipeline views, and collaborative notes. Templates help teams spin up a fundraising workspace fast without heavy configuration.

Folk pricing

- Basic: From $14/month per user

- Standard/Pro: Higher tiers

7. HubSpot CRM – Visible VC alternative for broad go-to-market CRM

Website: hubspot.com

HubSpot CRM offers broad sales and marketing features that some founders repurpose for investor relations. Sequences, deal stages, and reporting are strong, though it lacks native deck analytics.

HubSpot CRM features

Deal pipelines, email sequences, meeting links, reporting, and marketing automation. Integrations with calendars and inboxes make it easy to keep investor comms logged.

HubSpot CRM pricing

- Free tier for core CRM

- Starter/Growth bundles: Paid tiers by seat and hub

How to choose the right Visible VC alternative

Match tools to your stage and workflow. If you need secure sharing and analytics, start with Papermark for pitch deck tracking and data rooms. For sourcing, pair Papermark links with OpenVC lists. If pipeline rigor is the gap, Foundersuite or Affinity may suit; if you want flexible CRM with API hooks, Attio works well. Teams seeking simplicity can start with Folk, while revenue teams that already live in HubSpot can keep investor comms in one place.

Conclusion: investor updates and data rooms in one stack

Visible VC alternatives span sourcing, CRM, and secure sharing. Papermark covers the last mile with trackable links, watermarking, and full data rooms, while OpenVC and Foundersuite help you find and manage investors. Choose based on where your bottleneck sits—discovery, pipeline, or diligence—and integrate Papermark to see who is engaged before you spend more time.