How does private equity fundraising work? (2025 guide)

What is private equity fundraising?

Private equity fundraising is the process of raising committed capital from limited partners (LPs) to invest via a pooled fund managed by a general partner (GP). LPs commit capital up to a target fund size, and the GP deploys it over a 3–5 year investment period, seeking returns through operational improvements and exits.

Fundraising stages and timeline

| Stage | Timeline | What happens |

|---|---|---|

| Pre‑marketing | Months 0–3 | Define thesis, build materials (deck, PPM), soft‑circle anchor LPs, open a data room |

| First close | Months 6–9 | Secure anchor commitments, close initial LPs, begin fee clock, start deploying capital |

| Rolling closes | Months 9–18 | Add subsequent LPs, run ongoing diligence and reference calls, update data room |

| Final close | Months 12–18 | Reach target/hard cap, stop taking new commitments, finalize side letters |

Who invests in PE funds (LP types)

- Pension funds and sovereign wealth funds

- Endowments and foundations

- Funds of funds and insurer balance sheets

- Family offices and HNW investors

Core materials LPs expect

| Category | Documents |

|---|---|

| Strategy & team | Investment thesis, sector focus, sourcing model, team bios, governance |

| Track record | Gross/net returns, DPI/TVPI/IRR, case studies, attribution and consistency |

| Compliance | Policies, SEC/state registrations (as applicable), conflicts, ESG policy |

| Legal docs | PPM, LPA, subscription docs, template side letters |

| Operations | Fund model, fee waterfall, audit, administration, reporting cadence |

Fund economics at a glance

- Management fee: typically 2% on committed capital (steps down post‑investment period)

- Carried interest: typically 20% above an 8% preferred return (hurdle)

- GP commitment: 1–2% of fund size (signals alignment)

- Recycling and extensions: negotiated in LPA; clarify early with LPs

How the PE fundraising process works (step by step)

Step 1: craft a differentiated thesis and value‑creation playbook

- Define sector focus, deal size, geography, and sourcing advantages

- Articulate repeatable value‑creation levers (pricing, GTM, ops, M&A)

- Back claims with data: market maps, comps, case studies, and benchmarks

Step 2: assemble a complementary GP team and advisors

- Pair investing skill sets (sourcing, underwriting, execution) with operating expertise

- Line up advisors/referenceable executives for diligence calls

- Align incentives and carried interest splits early to avoid friction

Step 3: prepare LP materials and open your diligence data room

- Build deck, PPM, LPA term sheet, fee waterfall, attribution methodology

- Include track record schedules (gross/net, DPI/TVPI/IRR) and case studies

- Open a Papermark room with page‑level analytics, NDA gate, and branded domain

Step 4: soft‑circle anchors, collect IOIs, and schedule meetings

- Target a credible anchor (10–20% of fund) to catalyze momentum

- Run a tight pipeline: first meetings, follow‑ups, and diligence next steps

- Maintain a weekly update cadence; refresh the data room as materials evolve

Step 5: run diligence via the data room (references, compliance, cases)

- Pre‑wire references (CEOs, co‑investors) and prepare compliance policies

- Provide sample quarterly reports and valuation memos to reduce uncertainty

- Use analytics to prioritize LPs demonstrating deep engagement

Step 6: negotiate terms, side letters, and complete first close

- Confirm fee structure, carry, GP commit, recycling, key‑man, and governance

- Address LP‑specific side letters (reporting, ESG, information rights)

- Coordinate legal to execute subs docs and announce first close

Step 7: continue rolling closes and finalize the fund

- Maintain momentum with periodic updates (new pipeline, hires, closes)

- Add LPs on rolling basis until target/hard cap; keep room current

- Announce final close and transition to fully deploying capital

Using a data room for PE fundraising (Papermark)

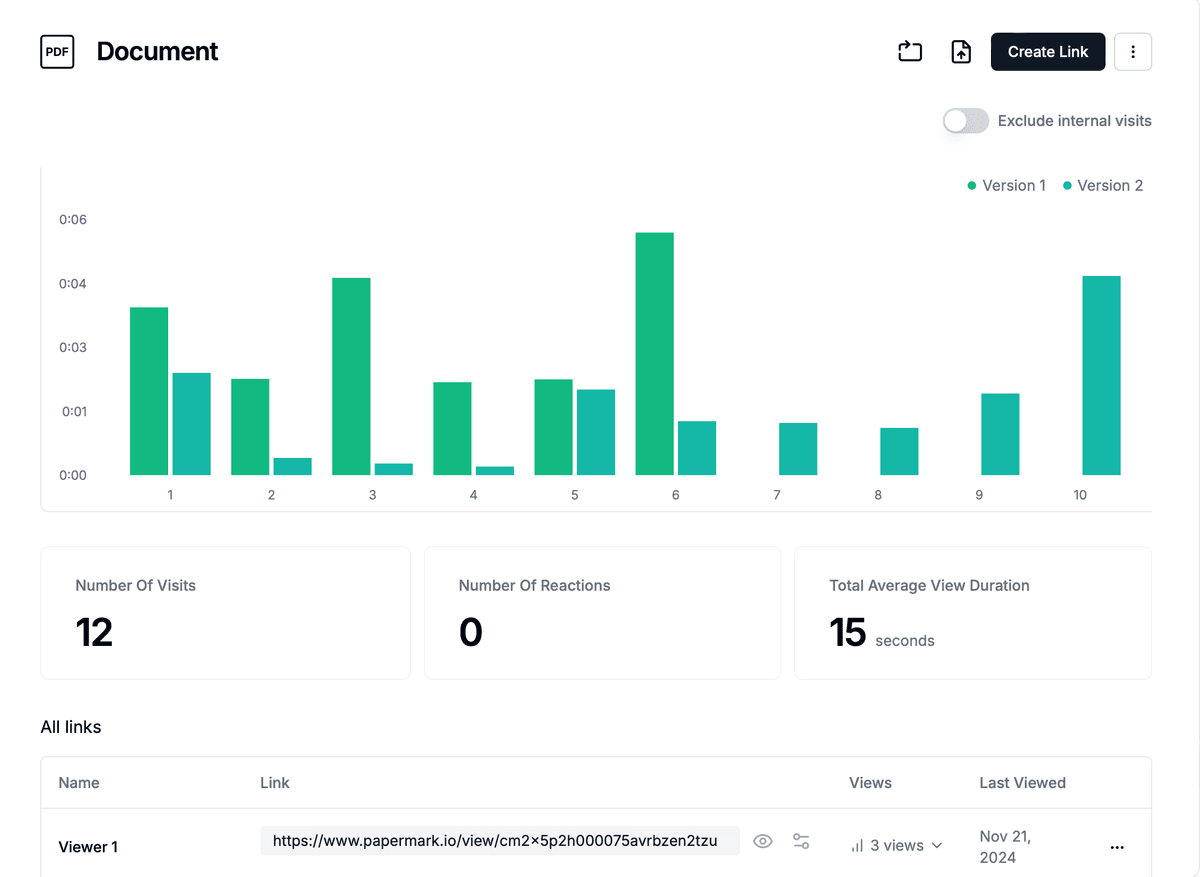

LP diligence happens entirely in your data room. Unlike email attachments or generic cloud folders, a professional VDR like Papermark centralizes all investor materials while providing granular access controls, audit trails, and engagement analytics. This lets you identify which LPs are genuinely interested versus just browsing, so you can prioritize your time on serious prospects who are actively reviewing your materials and likely to commit capital.

What to include in your LP data room

- Fund overview: deck, PPM, LPA, sub docs, fee waterfall

- Team: bios, org chart, compliance, Code of Ethics

- Track record: audited numbers, case studies, methodology

- Operations: auditor, admin, reporting samples, valuation policy

- ESG & risk: policy, framework, example reports

Key Papermark capabilities for LP diligence

- Page‑by‑page analytics to identify most engaged LPs

- Password, email‑verify, and expiration for shared links

- NDA gating before access; group‑based permissions

- Unlimited rooms with custom branding and custom domains

- Exportable audit logs for compliance

Best practices to get to first close

- Target realistic fund size; secure a credible anchor early

- Be transparent on attribution and lessons learned

- Keep the data room current; version your docs clearly

- Pre‑wire references and align on ops (auditor, admin) early

- Provide sample reporting and valuation memos