Top 15 Venture Capital Funds in India in 2025

India's startup ecosystem is experiencing unprecedented growth in 2025, attracting global attention. From fintech to healthtech, venture capital firms are powering the country's next wave of innovation. In this guide, we highlight the top 15 VC firms in India that are actively investing in early to growth-stage startups.

Quick List of Top VC Funds in India

- Accel India: Early-stage investor behind Flipkart and Freshworks

- Peak XV Partners: Formerly Sequoia India, active across all growth stages

- Blume Ventures: India's leading homegrown seed-stage fund

- Kalaari Capital: Focused on disruptive consumer and enterprise startups

- Chiratae Ventures: Technology-first fund with SaaS and healthtech success

- Elevation Capital: Known for Paytm, ShareChat, and Meesho

- Matrix Partners India: Early-stage fund backing Ola and Razorpay

- Stellaris Venture Partners: B2B SaaS specialist with consumer bets

- Lightbox Ventures: Long-term investor with a consumer-first thesis

- 3one4 Capital: Focused on fintech, deep tech, and digital platforms

- India Quotient: Contrarian consumer internet and mobile investor

- Bessemer Venture Partners India: Global fund with India-specific strategy

- Kae Capital: Backers of 1mg, Porter, and early B2C models

- Antler India: Pre-seed/seed backers with global reach and structure

- 100X.VC: Pioneers of iSAFE in India with volume-driven model

How to get yes from venture capital funds in India?

Getting a "yes" from a venture capital fund in India isn't easy — the competition is high, and investors review hundreds of decks each month. The key is to capture interest quickly, show traction early, and stand out with clarity.

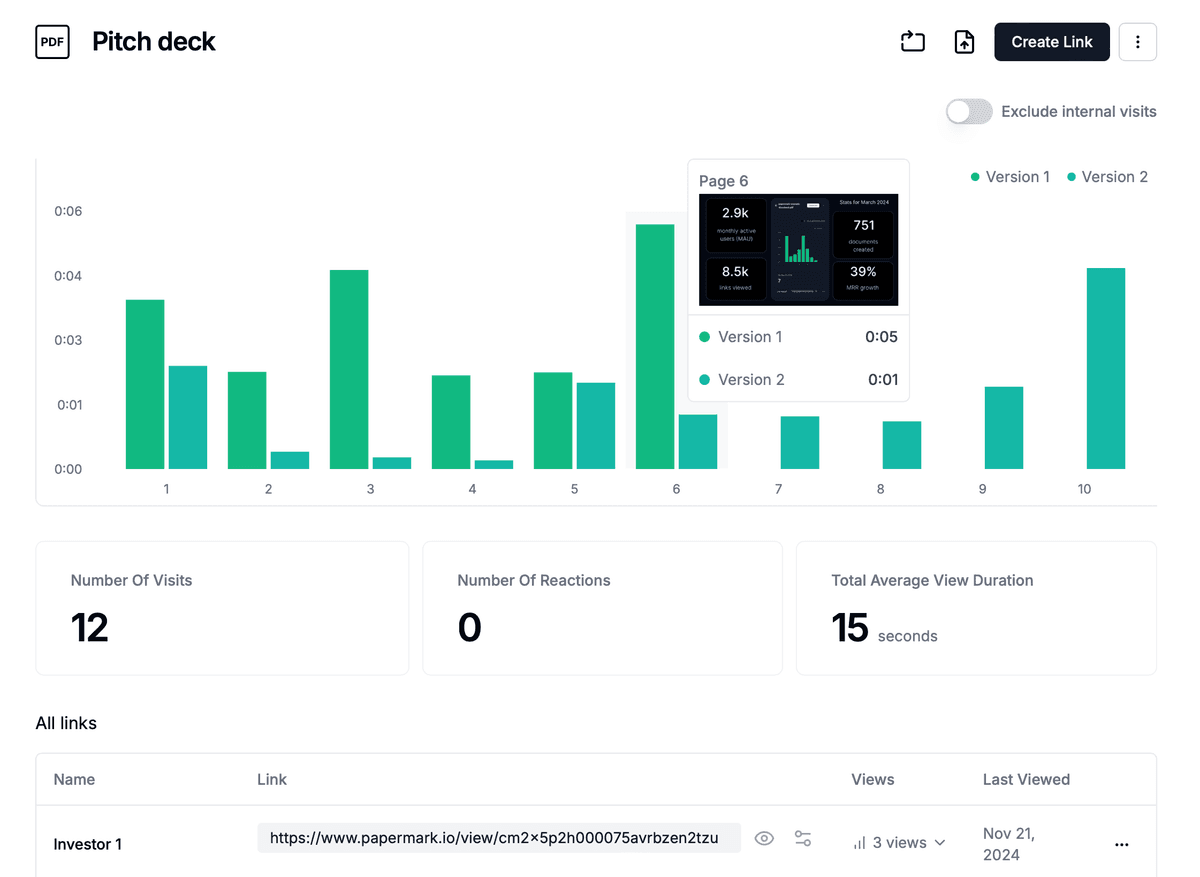

Instead of sending static attachments, use trackable links to know if your pitch is working.

- Get notified when a VC opens your deck

- Track how long they spent on each slide

- Capture decision-maker emails automatically

- Protect your IP with watermarking and secure permissions

- Share a full data room with docs like traction metrics, roadmap, and team profiles

How to send your pitch deck to VC funds in India

To effectively engage with venture capital investors in India:

- Research and Shortlist: Use platforms like AngelList, Crunchbase, or Papermark to identify relevant VCs.

- Tailor the Deck: Highlight market opportunity in India, traction, and local relevance.

- Warm Introductions: Ask for intros via network, alumni, or advisors.

- Use Papermark Links: Create trackable links to monitor engagement and get alerts.

- Follow Up: Use engagement data (time/page views) to personalize your follow-up.

- Be Ready: Have a clear ask, clean cap table, and data room ready before outreach.

How to Find the Right Venture Capital Fund in India

With hundreds of VCs operating in India, finding the right partner can be overwhelming. Here's what to consider:

- Are they investing at your stage: seed, Series A, or later?

- Do they have portfolio companies in your vertical?

- Are their check sizes aligned with your expectations?

- Do their partners have relevant expertise?

Discover and filter VC funds by stage and sector using Papermark's investor database.

What Indian VCs Expect in a Deal Room

Before sending your deck to a VC, make sure your deal room includes:

- Short and full versions of your pitch deck

- Product overview or demo link

- Core traction metrics (revenue, MAU, LTV)

- Team bios and cap table

- Vision, GTM strategy, and fundraising ask

You can structure and control this in a Papermark Data Room.

1. Accel India

- Founded: 2005

- Focus: Early-stage technology and internet startups

- Notable Investments: Flipkart, Swiggy, Freshworks

- Website: Accel India

2. Peak XV Partners (ex-Sequoia Capital India)

- Founded: 2000

- Focus: Seed to growth-stage startups

- Notable Investments: Zomato, OYO, Byju's

- Website: Peak XV Partners

3. Blume Ventures

- Founded: 2010

- Focus: Early-stage tech startups

- Notable Investments: Unacademy, Purplle, Dunzo

- Website: Blume Ventures

4. Kalaari Capital

- Founded: 2006

- Focus: E-commerce, digital health, B2B tech

- Notable Investments: Cure.fit, Snapdeal

- Website: Kalaari Capital

5. Chiratae Ventures

- Founded: 2006

- Focus: SaaS, Healthtech, Fintech

- Notable Investments: Myntra, FirstCry, PolicyBazaar

- Website: Chiratae Ventures

6. Elevation Capital

- Founded: 2002

- Focus: Consumer tech, fintech, SaaS

- Notable Investments: Paytm, ShareChat, Meesho

- Website: Elevation Capital

7. Matrix Partners India

- Founded: 2006

- Focus: Consumer & enterprise tech

- Notable Investments: Ola, Practo

- Website: Matrix Partners India

8. Stellaris Venture Partners

- Founded: 2016

- Focus: B2B SaaS, consumer internet

- Notable Investments: Whatfix, Mamaearth

- Website: Stellaris Venture Partners

9. Lightbox Ventures

- Founded: 2014

- Focus: Consumer internet

- Notable Investments: Rebel Foods, Furlenco

- Website: Lightbox Ventures

10. 3one4 Capital

- Founded: 2016

- Focus: Fintech, SaaS, digital media

- Notable Investments: Licious, Darwinbox

- Website: 3one4 Capital

11. India Quotient

- Founded: 2012

- Focus: Early-stage consumer internet

- Notable Investments: Lendingkart, ShareChat

- Website: India Quotient

12. Bessemer Venture Partners India

- Founded: 2004

- Focus: SaaS, fintech, enterprise tech

- Notable Investments: BigBasket, Swiggy

- Website: Bessemer Venture Partners India

13. Kae Capital

- Founded: 2012

- Focus: Seed-stage across sectors

- Notable Investments: 1mg, Porter

- Website: Kae Capital

14. Antler India

- Founded: 2019

- Focus: Pre-seed and seed investments

- Notable Investments: BukuWarung, Volopay

- Website: Antler India

15. 100X.VC

- Founded: 2019

- Focus: Pre-seed deals using iSAFE notes

- Notable Investments: Over 130 early-stage Indian startups

- Website: 100X.VC

How Indian Startups Can Use Papermark to Raise Capital?

When raising funds from venture capital firms in India, you need more than just a pitch deck.

With Papermark, you can:

- Upload and organize investor documents in one secure space

- Share trackable links to your deck and metrics

- Add dynamic watermarks or set email-based access

- See exactly who viewed your documents and when

Build investor trust and streamline your fundraising with Papermark.

Didn't find the right investor?

Explore our open database of 7,000+ venture capital firms. Filter by:

- Stage

- Sector

- Geography

- Name

Final Thoughts

If you're a founder building the next unicorn in India, these VC firms are worth exploring. Most of them accept warm introductions and regularly scout for new opportunities. Stay prepared with a polished pitch and a clear business model.

Need to securely share pitch decks with VCs?

Sign up for Papermark to create secure, trackable links to share documents with investors.