10 Best Virtual Data Room Tools for Due Diligence in 2026

Quick recap of the best virtual data rooms for due diligence

- Papermark: Open source virtual data room with unlimited document uploads and page-level analytics

- Intralinks: Enterprise-grade VDR known for M&A transactions with high-level encryption

- Ideals: Military-grade security VDR with 256-bit encryption, focused on M&A and legal industries

- Firmex: Enterprise VDR with dynamic watermarks and comprehensive project management tools

- Ansarada: AI-powered data rooms with real-time collaboration and comprehensive audit trails

- Datasite: Specialized in large-scale, complex deals with customizable solutions

- Box: Cloud content management platform with real-time collaboration

- ShareFile: Citrix's secure document sharing solution with SSL/TLS encryption

- Digify: Secure document sharing with file-level tracking and rights management

- DocSend: Document management platform with real-time tracking and detailed analytics

What is a Virtual Data Room for Due Diligence?

A virtual data room for due diligence is a secure online platform where companies can store, organize, and share critical documents related to their business operations, financials, and legal matters with potential investors, buyers, or partners during a transaction or evaluation process.

This centralized digital repository allows for efficient document management and controlled access, ensuring that all necessary information is easily accessible to authorized parties while maintaining confidentiality and security.

Why Use a Virtual Data Room for Due Diligence?

Using a VDR for due diligence is crucial for several reasons:

- Confidentiality: Protect sensitive business information with controlled access

- Efficiency: Streamline the due diligence process with organized, easily accessible documents

- Transparency: Provide a clear and comprehensive view of the company to stakeholders

- Global Accessibility: Enable secure access for parties across different locations and time zones

- Audit Trail: Track document views and interactions for better oversight

- Cost-Effective: Reduce expenses associated with physical data rooms and travel

Understanding Due Diligence Costs

Due diligence costs are a crucial consideration in any business transaction. These costs can vary significantly depending on the size and complexity of the deal, but they typically include:

- Virtual data room fees

- Legal and accounting services

- Technical assessments

- Environmental reviews

- Market research

- Management time and resources

The average cost of due diligence typically ranges from 0.1% to 0.5% of the transaction value, though this can vary based on the industry and deal complexity. For example:

- Small transactions ($10M): $10,000 - $50,000

- Mid-size transactions ($10M-$100M): $50,000 - $250,000

- Large transactions ($100M): $250,000+

Comparison of Virtual Data Room Providers

| Feature | Papermark | Intralinks | Ideals | Firmex | Ansarada |

|---|---|---|---|---|---|

| Document Analytics | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Custom Branding | ✔️ | ❌ | ✔️ | ❌ | ✔️ |

| Watermarking | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| NDA Requirements | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Access Controls | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Self-Hosted | ✔️ | ❌ | ❌ | ❌ | ❌ |

| Pricing | €59/mo | Custom | Custom | Custom | Custom |

| 24/7 Support | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

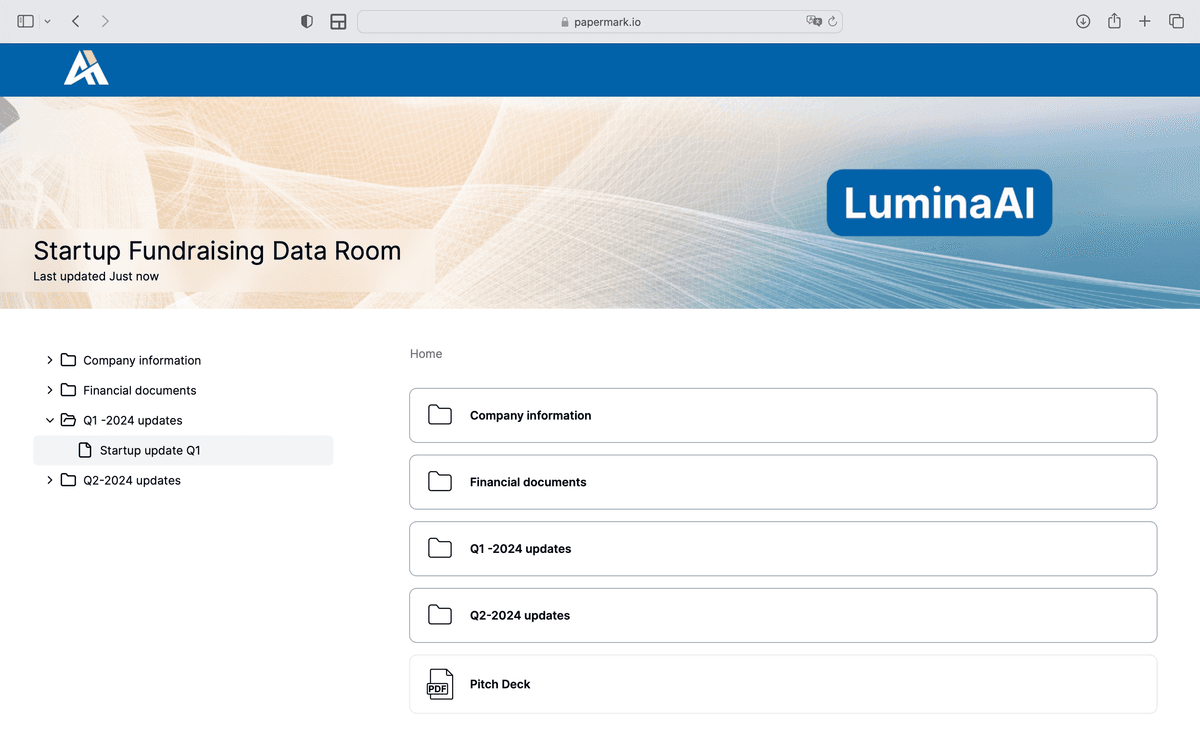

1. Papermark - Open Source Virtual Data Room

Website: papermark.com

![]()

Papermark Core Features

- Secure document sharing with access controls

- Unlimited Data Rooms

- Page-level analytics to track engagement

- Custom branded domains and URLs

- Full white-labeling

- Unlimited document uploads

- Folders

- Self-hosted version

Papermark Pricing

- Free: €0

- Starter: €25/month

- Business: €59/month (Data Room plan)

- Data Rooms: €99/month (Unlimited Data Rooms plan)

- Enterprise & Self-hosted: Custom

2. Intralinks - Enterprise Virtual Data Room

Website: intralinks.com

Intralinks Core Features

- High-level encryption and security protocols

- Detailed activity tracking and reporting

- Advanced permissions and secure document sharing

- Integration with major enterprise software

Intralinks Pricing

- Custom pricing based on transaction size and duration

3. Ideals - Military-Grade Security VDR

Website: idealsvdr.com

![]()

Ideals Core Features

- Military-grade security with 256-bit encryption

- Intuitive interface with no training required

- Comprehensive audit trails and detailed activity reports

- 24/7 customer support with dedicated project managers

Ideals Pricing

- Custom pricing based on client needs

4. Firmex - Enterprise Virtual Data Room

Website: firmex.com

Firmex Core Features

- High-security standards with dynamic watermarks

- Two-factor authentication and document control

- Comprehensive project management tools

- 24/7 customer support

- Detailed reporting and audit trails

Firmex Pricing

- Custom pricing based on usage and specific client needs

5. Ansarada - AI-Powered Virtual Data Room

Website: ansarada.com

![]()

Ansarada Core Features

- AI-powered document organization

- Real-time collaboration tools

- Comprehensive audit trails

- User-friendly interface with drag-and-drop functionality

Ansarada Pricing

- Starts at $339 per month (billed annually)

- Pricing type: Per GB

6. Datasite - Large-Scale Deal VDR

Website: datasite.com

![]()

Datasite Core Features

- Tailored storage options

- Advanced security features

- Dedicated project management support

- Customizable workflows and integrations

Datasite Pricing

- Custom pricing based on project needs

7. Box - Cloud Content Management

Website: box.com

![]()

Box Core Features

- Robust security and compliance measures

- Real-time collaboration tools

- Integration with popular apps like Office 365

- Advanced file management and sharing capabilities

Box Pricing

- Professional Plan 1: $9 per user/month, 2 TB of storage

8. ShareFile - Secure Document Sharing

Website: sharefile.com

ShareFile Core Features

- Secure file sharing with SSL/TLS encryption

- Customizable settings for document control

- Integration with Microsoft Office

- Detailed activity logs

ShareFile Pricing

- Starts at $50/month for basic services

9. Digify - Secure Document Sharing

Website: digify.com

![]()

Digify Core Features

- File-level security with rights management

- Document tracking

- Integration with popular platforms

- Detailed reporting

Digify Pricing

- Free trial available

- Paid plans with advanced features

10. DocSend - Document Management

Website: docsend.com

DocSend Core Features

- Real-time document tracking and analytics

- Advanced document permissions

- Integration with email and communication tools

- Simple user interface

DocSend Pricing

- Basic plan with essential features

- Higher tiers with advanced analytics

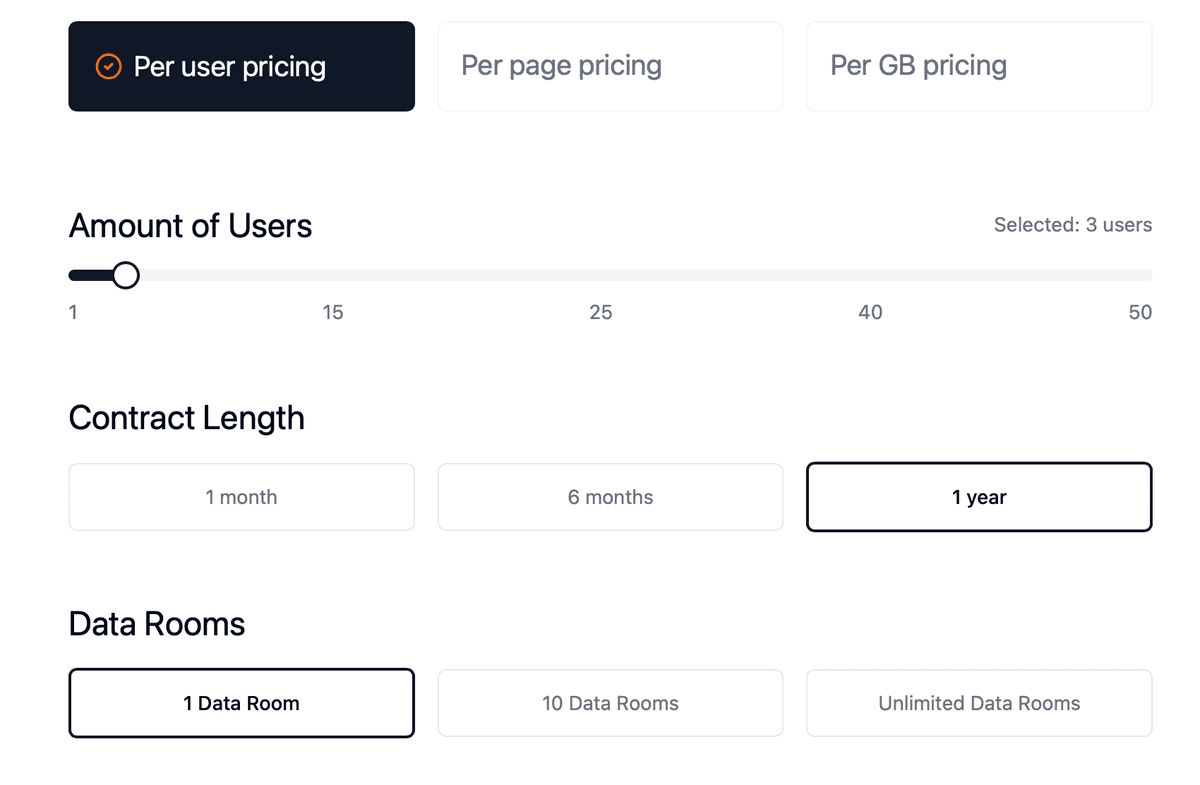

Virtual Data Room Costs for Due Diligence

When considering a virtual data room solution for due diligence, it's important to understand the associated costs. Here's a comparison of pricing:

- Papermark VDR: €59 per month (billed yearly)

- Average VDR providers: €750 per month (billed yearly)

Real-World Success Story: Family Office Due Diligence

See how G.P. Loree & Co., a New York-based family office, uses Papermark to streamline institutional investment due diligence and manage complex deal documentation:

Conclusion

Choosing the right virtual data room for due diligence is crucial for ensuring secure and efficient document sharing during business transactions. While there are many options available, Papermark stands out as a cost-effective, feature-rich solution that combines security, ease of use, and flexibility. Whether you're handling M&A transactions, fundraising, or other sensitive business processes, a reliable virtual data room can significantly streamline your due diligence process while maintaining the highest security standards.

For a comprehensive virtual data room solution tailored for due diligence, consider Papermark's offering and use their pricing calculator to compare costs.