Data Analytics in Private Equity (2026Guide)

Why data analytics matters in private equity

Modern private equity teams rely on data to make faster, higher‑confidence decisions from sourcing to exit. A robust analytics approach improves diligence quality, accelerates value‑creation, and sharpens exit timing. It also enables oversight at the portfolio level through standardized KPIs and timely reporting.

Leading firms build 360° views of portfolio performance, use embedded analytics to guide operators, and align people, process, and technology around a modern data strategy—translating analysis into actions that move EBITDA and multiples.

Where analytics drives outcomes in PE

- Diligence acceleration: normalize multi‑source data, run cohort and unit economics, validate forecasts, and quantify value‑creation levers.

- Value‑creation sprints: instrument funnels, pricing, churn, and ops KPIs; run A/B tests; set weekly KPI cadence and owner playbooks.

- Portfolio oversight: standardized KPI packs for boards, early warning signals, cross‑portfolio benchmarks, and capital allocation decisions.

- Exit readiness: KPI consistency, clean rooms, commercial metrics storytelling, and data‑supported equity stories.

Core PE KPIs to operationalize

- Revenue quality: recurring %, NRR/GRR, cohort retention, upsell/cross‑sell

- Unit economics: CAC payback, LTV/CAC, gross margin by product/segment

- Go‑to‑market: pipeline coverage, conversion by stage, sales velocity

- Product and customer: active users, feature adoption, NPS/CSAT, churn reasons

- Operations: on‑time delivery, SLA adherence, inventory turns, error rates

- Finance: cash conversion cycle, OPEX by function, working capital

A pragmatic modern data stack (PE‑friendly)

- Ingestion: Fivetran / Airbyte for SaaS and database connectors

- Warehouse: Snowflake / BigQuery for elastic scale and governance

- Transform: dbt to version models and standardize metrics

- BI: Looker / Power BI / Tableau for governed dashboards and self‑serve

- Reverse ETL: Census / Hightouch to operationalize insights in CRM/ERP/marketing

- Governance: data catalog, lineage, access controls, PII policies

Tip: standardize a baseline portfolio schema so every new platform integrates faster. Each company can extend with domain‑specific models without breaking comparability.

Implementation playbook (30–60–90 days)

Days 0–30: Foundation

- Define business questions and decision cadence at HoldCo and company levels.

- Select target KPI set and owners; map sources (CRM, ERP, billing, product, CS).

- Stand up warehouse, connectors, and first dbt models; publish versioned metrics.

- Ship v1 dashboards for the top 10 questions; start weekly KPI reviews.

Days 31–60: Scale and operationalize

- Add product/finance depth (cohorts, payback, margin waterfall, price/volume/mix).

- Enable reverse ETL to push segments and alerts into CRM/marketing tools.

- Instrument A/B testing or pricing experiments with readouts.

- Create portfolio benchmarks and board‑pack templates.

Days 61–90: Optimize and govern

- Harden governance: data catalog, lineage, access, PII policies, SLAs.

- Automate board decks; add narrative and comparisons to last quarter.

- Implement issue tracking for data defects and dashboard improvements.

- Prepare exit‑readiness package: clean rooms, KPI glossary, data story.

Running analytics in the VDR and board cadence

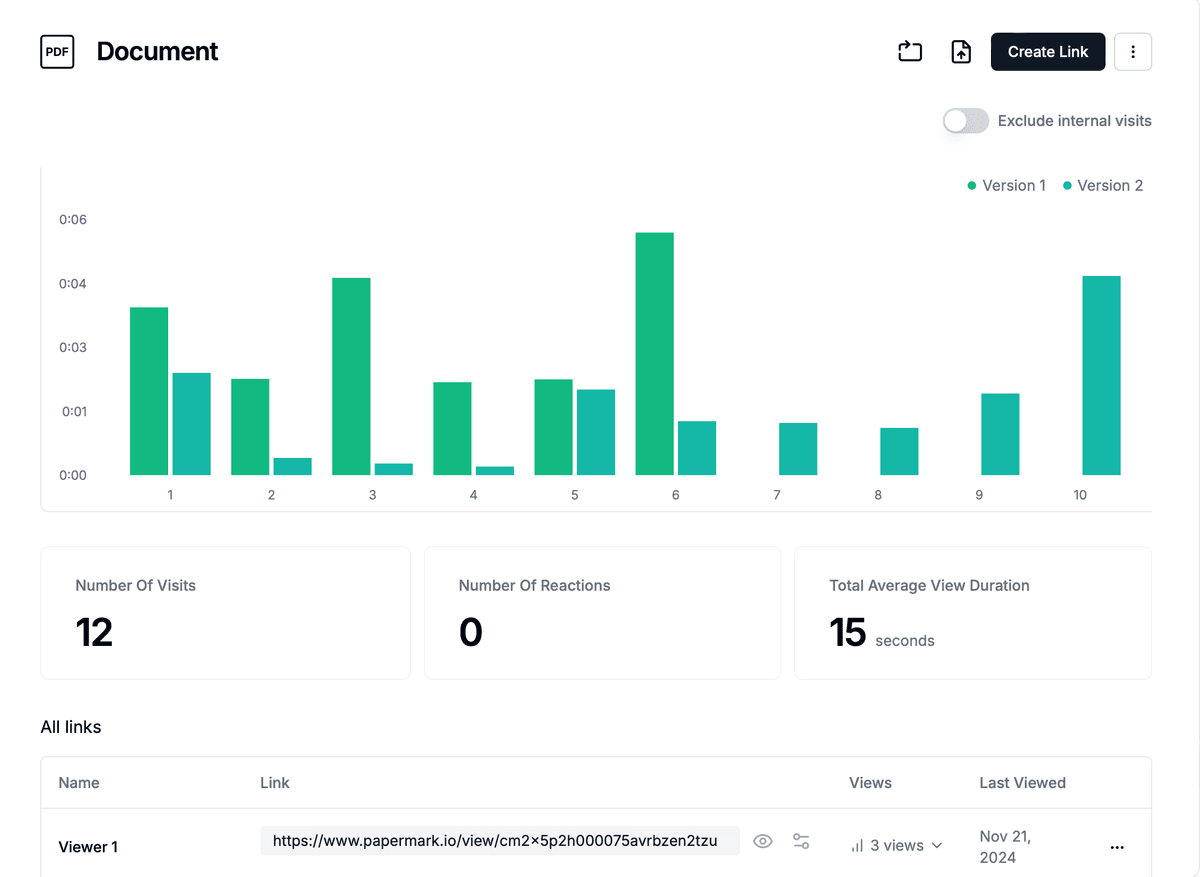

A virtual data room centralizes analytics during deals and post‑close:

- Store KPI packs, source extracts, and model documentation

- Share buyer‑specific rooms with tailored visibility

- Track what pages investors read to focus follow‑ups

- Maintain audit trails and NDA‑gated access for sensitive data

Best practices for PE analytics

- Start with decisions, not tools—define questions and cadences first

- Keep a shared KPI glossary and versioned metric definitions

- Make owners accountable; review weekly with clear actions

- Land and expand: prove value with one lever (pricing or churn), then scale

- Build once, reuse everywhere: portfolio schema + company extensions

- Govern early: access policies, PII handling, change management

Example: Weekly KPI pack structure

- Executive summary: what changed, why, actions

- Revenue quality and cohort retention

- Unit economics and CAC payback

- Pipeline, win rates, and sales velocity

- Product adoption and customer health

- Margin waterfall and working capital

- Risks, experiments, and next‑week commitments