What is a data room in private equity? (2026 guide)

What is a private equity data room?

A private equity data room (also called a virtual data room, or VDR) is a secure workspace used to share sensitive documents with investors, lenders, advisors, and buyers during diligence and portfolio management. Unlike email or generic cloud folders, a VDR provides link permissions, access controls, audit logs, NDAs and analytics so you can run a disciplined fundraising or M&A process.

Why private equity teams use a VDR

- Centralizes all diligence files and versions in one place

- Adds permissioning and document-level controls (password, expiry, email verification)

- Tracks investor engagement page by page to prioritize serious buyers

- Simplifies portfolio oversight with board packs and monthly reporting

- Creates buyer-specific rooms without duplicating work

What to include in a PE data room

Use this simple structure to get started. You can expand or rename folders later.

- Company overview: corporate structure, cap table, board minutes

- Financials: historical statements (3–5 years), projections, KPIs

- Commercial: customer and supplier lists, contracts, pipeline, pricing

- Legal and HR: contracts, policies, employment agreements, IP

- Product and tech: architecture, roadmap, security & compliance

- Operations: vendors, tooling, processes, SLAs

How to create a private equity VDR with Papermark (step by step)

Follow these steps to launch a professional VDR in minutes.

-

Create your Papermark account

Visit the app and sign in. You can start free and upgrade when you need advanced features.

-

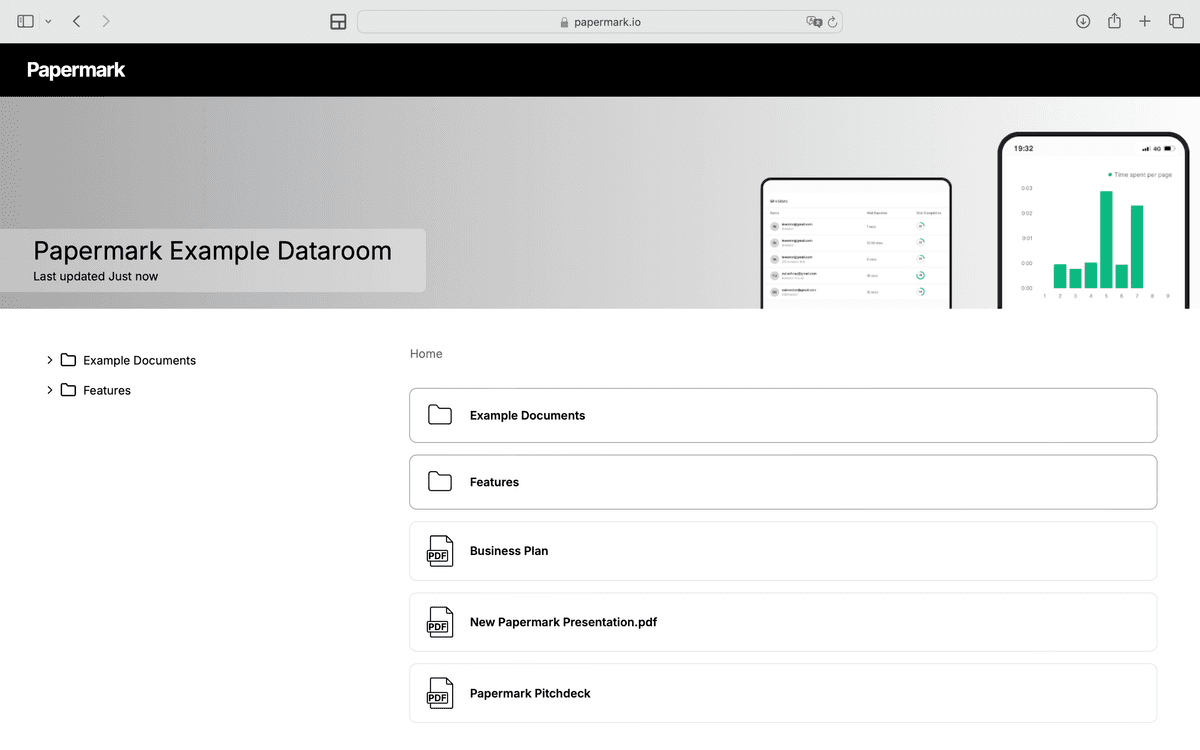

Create a new data room

Click “New data room”, give it a name (for example “Series B – PE Diligence”), and invite teammates who will upload documents.

-

Upload documents by folder

Drag and drop your folders (Financials, Legal, Commercial, Product, HR). Papermark keeps structure and supports large files.

-

Configure link permissions

Set password, email verification, link expiry and viewer limits. Add an NDA gate if you want viewers to accept terms before access.

-

Brand the room

Add your logo, select colors, and connect a custom domain for a branded investor experience.

-

Share buyer‑specific rooms

Duplicate the room for each sponsor if needed. Use granular permissions and groups to show different files to different bidders.

-

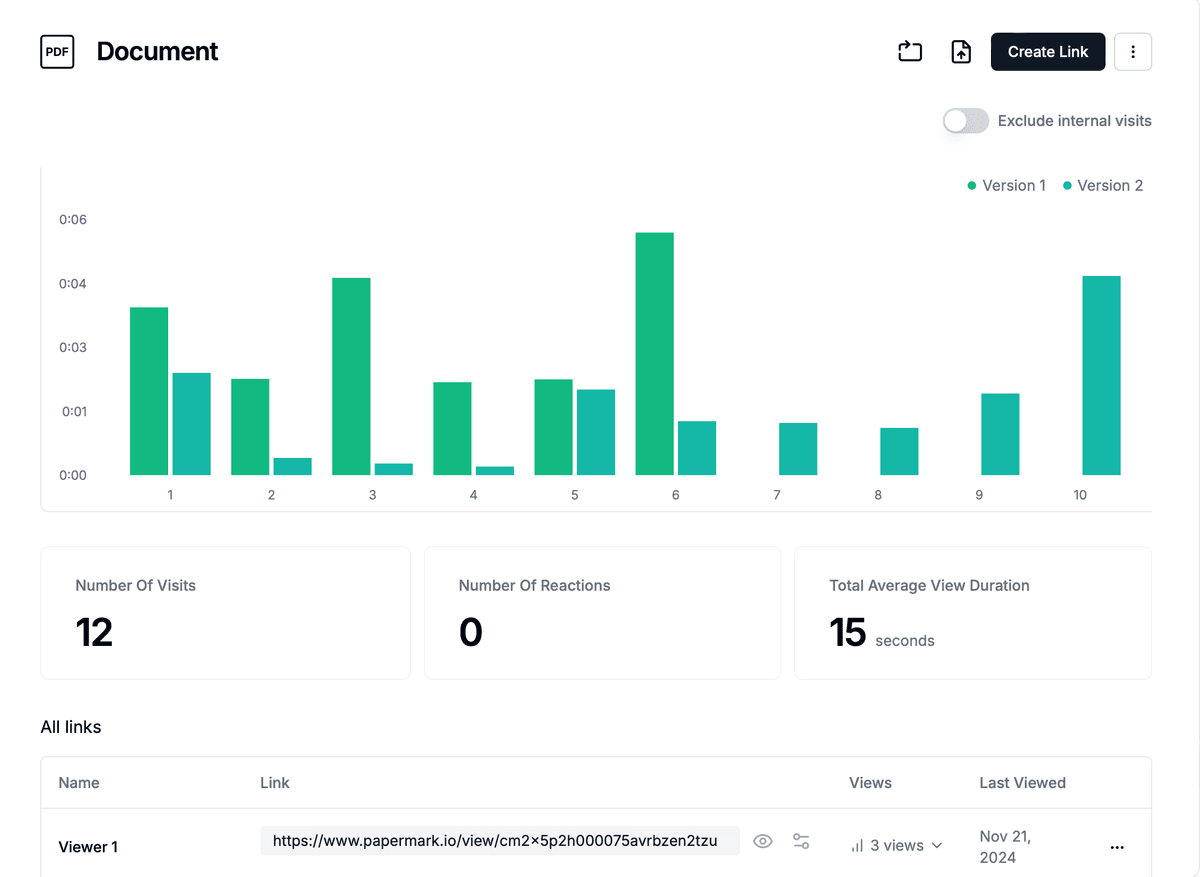

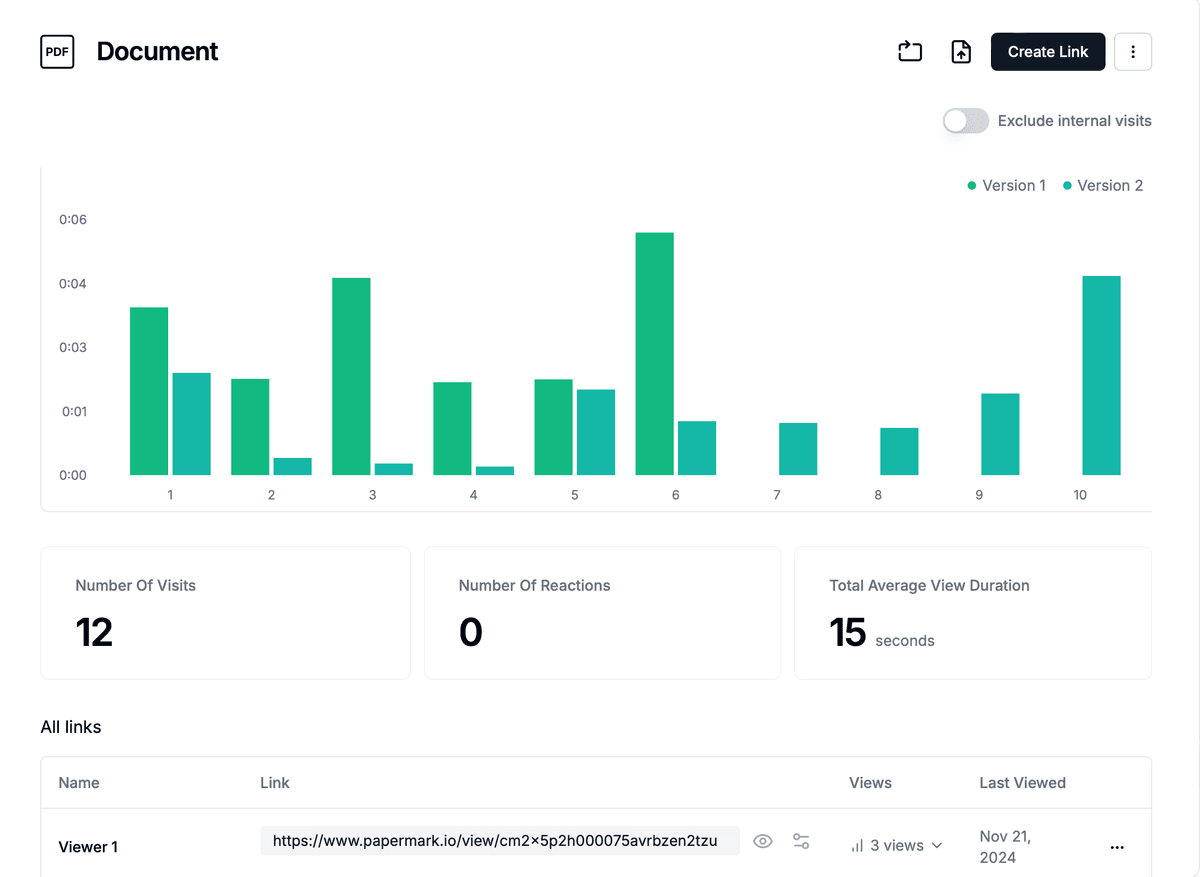

Track engagement and prioritize

Use page‑by‑page analytics to see which documents and slides buyers read most. Focus follow‑ups on highly engaged investors.

Case Study: VC Firm Raising Fund with Data Rooms

See how Icebreaker.vc, a leading early-stage VC firm, used data rooms to successfully raise their Fund III:

Best practices

- Keep filenames clear and versioned (e.g., FY2024-12 P&L v2.xlsx)

- Gate sensitive folders (customer contracts, payroll) behind additional permissions

- Use buyer‑specific Q&A and keep answers in writing

- Log changes in a short “Room updates” note so everyone stays aligned