These are 7 Data Rooms I will recommend for investors in 2026

I'm Marc, founder of Papermark. I previously worked in a Fund of Funds and was constantly frustrated with existing data room providers—they were either too expensive, too complicated, or lacked the features investors actually needed. That frustration led us to build our own solution for fundraising and m&a, and we've been listening to feedback from startups around the world and investors ever since.

These are the 7 data rooms I recommend to investors based on real-world experience:

Quick recap of data rooms for investors

- Papermark: A secure data room and document infrastructure with page-by-page analytics and insights (built by us, open source first)

- Notion: A flexible workspace that can be adapted as a data room for document organization and collaboration

- Carta: A platform that specializes in equity management, offering solutions for managing company ownership, valuations, and compliance

- DocSend: A document sharing platform that provides real-time, page-by-page analytics

- Ideals: A virtual data room provider with a focus on M&A, real estate, and corporate communication

- FirmRoom: A virtual data room service with speed and simplicity in managing sensitive documents for financial transactions and M&A

- Digify: A platform offering document protection and tracking

What is data room for investors?

A Data Room for Investors is a secure, digital platform where companies provide essential information required by investors to evaluate investment opportunities. It is particularly useful during financial transactions like mergers, acquisitions, and fundraising efforts. The data room hosts critical documents including financial records, strategic plans, compliance certificates, and legal agreements.

Who Needs a Data Room for Investors?

For Startups

Startups raising capital need a data room to present their business professionally to potential investors. It serves as a centralized hub where founders can organize all company documents, from financial statements to product roadmaps, making it easy for investors to conduct due diligence. This organized approach demonstrates professionalism and helps build trust with potential investors.

Common use cases for startups include seed funding rounds, Series A/B/C fundraising, pre-IPO preparations, and M&A transactions. The data room allows founders to control access, track investor engagement, and understand which documents generate the most interest. This intelligence helps startups refine their pitch and focus on what matters most to investors.

For Investors and Venture Funds

Investors use data rooms to efficiently evaluate multiple investment opportunities simultaneously. The structured format allows them to quickly assess a company's financial health, legal standing, and growth potential without drowning in email attachments or scattered documents. Having all information in one secure location streamlines their decision-making process.

Key use cases for investors include conducting due diligence on potential investments, comparing multiple deal opportunities side-by-side, collaborating with co-investors during syndicate formations, and managing portfolio company reporting. A well-organized data room saves investors valuable time and reduces the risk of missing critical information during their evaluation process.

Benefits and usage of a data room for investors

Investors rely on a data room for multiple purposes:

- Streamlined Due Diligence: Investors can access a comprehensive collection of documents in one place, which simplifies the analysis of a company's financial health, operational strategy, and legal standings.

- Real-Time Updates and Notifications: Data rooms are equipped with features that alert investors to new document uploads or changes, ensuring they are always informed of the latest data.

- Secure Communication: Many data rooms provide secure communication channels that enable direct dialogue with company management, facilitating better understanding and transparency.

- Efficient Comparison: The structured environment of a data room allows investors to easily compare information across different investment opportunities, aiding in better decision-making.

Using a Data Room for Investors not only enhances the efficiency of the investment process but also ensures that all data exchanged remains confidential and well-protected.

Criteria for selecting a data room for investors

When choosing a data room for investors, it is essential to consider several key factors to ensure it meets the needs of both the company and the investors. Below are the primary criteria to evaluate:

1. Security Features

Look for a data room with robust security measures, including advanced encryption, two-factor authentication, and dynamic watermarks. These features are crucial for protecting sensitive information against unauthorized access.

2. User Accessibility and Interface

The data room should be accessible and easy to use, with a user-friendly interface that allows people of all technical skill levels to navigate efficiently. Multi-language support and cross-platform compatibility are important for accommodating international investors.

3. Document Management Tools

Effective document management capabilities are vital. Opt for a data room that supports bulk uploads, easy document indexing, and quick retrieval. Real-time updates and version control are also important for maintaining document integrity.

4. Collaboration Tools

Ensure the data room includes tools that facilitate collaboration, such as Q&A modules, note-taking capabilities, and secure communication channels. These features help streamline the due diligence process and enhance communication clarity.

5. Compliance and Auditing Features

The data room should comply with relevant international regulations (e.g., GDPR, HIPAA) and offer comprehensive auditing tools. These are necessary for tracking access and activity within the room, crucial for regulatory compliance and security.

6. Customer Support and Service

Select a data room provider that offers excellent customer support and training resources. Support should be available 24/7 to assist with any issues that arise, helping users effectively navigate and utilize the platform.

7. Pricing Structure

Consider the pricing structure of the data room. It should be clear and scalable, tailored to your specific needs such as user numbers, storage size, or usage duration. Ensure there are no hidden fees and that the pricing model is straightforward.

By assessing these criteria, you can choose a data room that not only secures sensitive information but also facilitates a smoother and more efficient investment process.

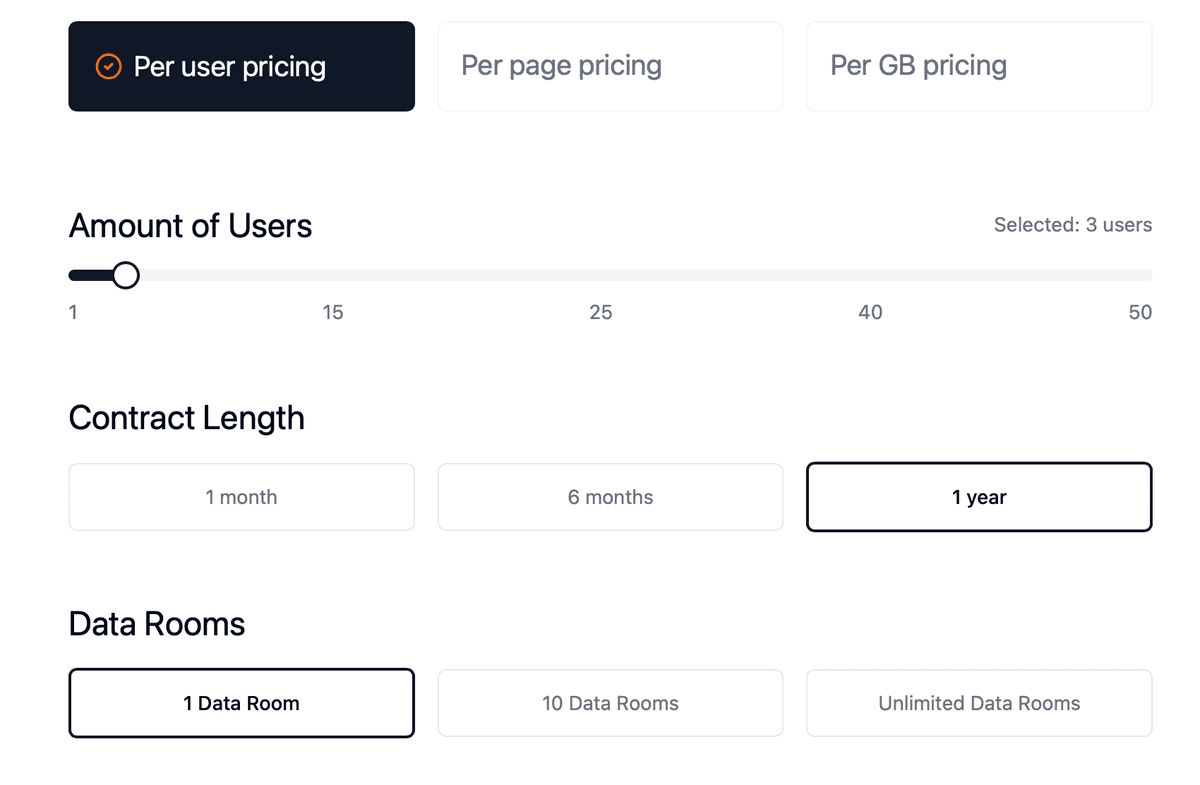

Virtual data room price comparison

When choosing a virtual data room for investor communications, it's crucial to consider both cost and functionality. Our data room price comparison tool helps you evaluate different providers based on:

- Number of Users (3-50 users)

- Contract Length (1 month to 1 year)

- Number of Data Rooms (1, 10, or unlimited)

Current market comparison shows:

- Papermark VDR: €59/month (billed yearly)

- Average VDR providers: €750/month (billed yearly)

This comparison tool helps you make an informed decision based on your specific needs and budget constraints. Remember to consider factors such as:

- Pricing model (per user, per page, per GB, or flat rate)

- Contract flexibility

- Number of required data rooms

- Storage requirements

- User access needs

Papermark - Data Rooms for Investors

Website: papermark.com

Papermark is an open-source data room and document sharing platform for investors and venture funds that offers built in page to page analytics.

The platform is designed for modern venture teams looking to easily share documents with ability to self host and whitelabel it.

Papermark Features

- Real-time document analytics

- Virtual data rooms

- Secure document sharing

- Advanced link tracking

- Self-hosting

- Open Source

- Password protection

- Block and Allow list

- Custom domains

- Custom branding and design

- SOC 2 compliance

Papermark Pricing

- Free: €0

- Starter: €25/month

- Business: €59/month

- Data Rooms: from €99/month (Data Rooms plans)

- Enterprise & Self-hosted: Custom

Full white labelling and self hosting is availble, check pricing

Papermark Ratings and Reviews

⭐️⭐️⭐️⭐️⭐️ (5 out of 5 on G2)

Highly rated and supported by over 15000 customers and users.

![]()

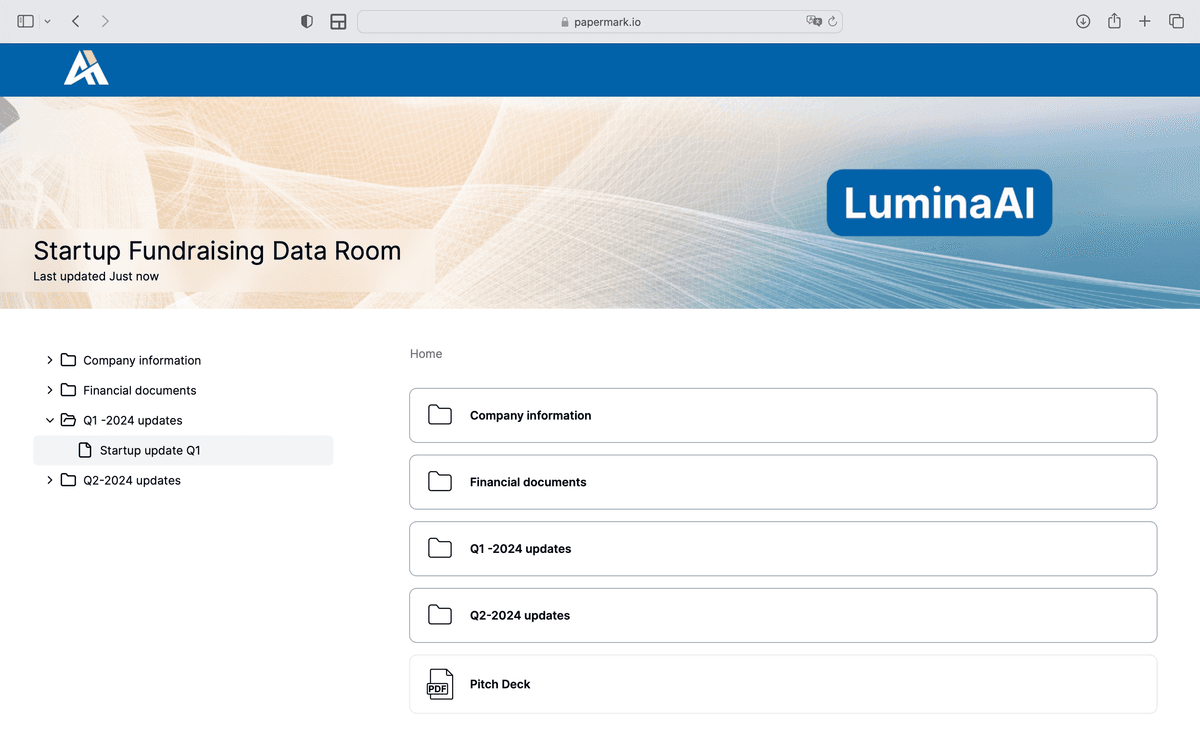

Notion as a Data Room

Website: notion.com

![]()

Notion is a flexible workspace platform that many startups adapt into a makeshift data room for investor communications. While not purpose-built for due diligence, its collaborative features and familiar interface make it a popular choice for early-stage companies with limited budgets.

Notion's template system allows teams to create organized document repositories with folder structures that investors can navigate. The platform's strength lies in its versatility—you can combine documents, databases, and notes in a single workspace.

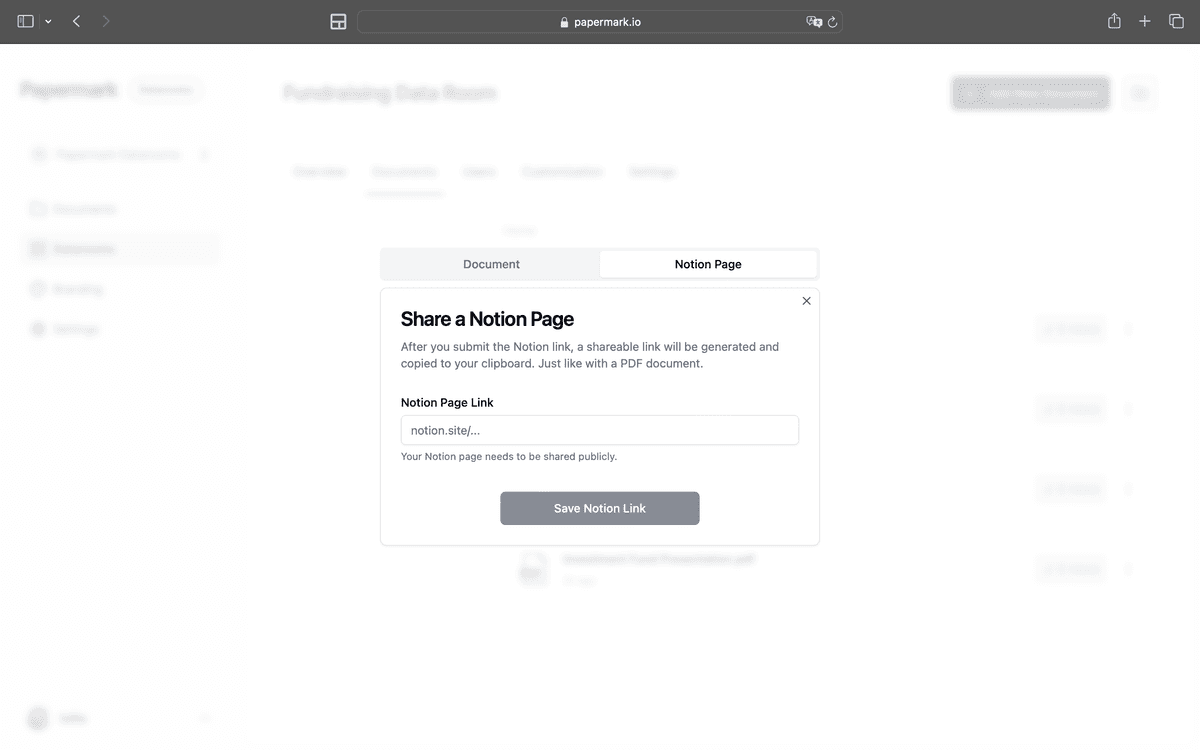

Enhancing Notion with Papermark: Many teams connect their Notion data rooms to Papermark to add security features and analytics tracking that Notion lacks natively. This integration allows you to maintain Notion's flexibility while gaining visitor tracking, page-by-page analytics, and password protection.

Once connected, you can track detailed analytics on how investors interact with your Notion data room, including time spent on each page and document views.

![]()

Learn more: How to Create a Notion Data Room and Share it with Custom Domain

Notion Features

- Customizable templates and layouts

- Real-time collaboration and comments

- Document embedding and linking

- Permission controls at page level

- Database views for organizing documents

- Cross-linking between pages

- Mobile and desktop apps

- Integration with other tools

Notion Limitations

- Not designed specifically for data rooms or due diligence

- Limited security features compared to dedicated VDR providers

- No detailed analytics on document views or engagement

- No watermarking or screenshot protection

- Permission management can become complex

- No email capture or visitor tracking

- Limited audit trail capabilities

Notion Pricing

- Free: $0 (limited features)

- Plus: $10/month per user

- Business: $15/month per user

- Enterprise: Custom pricing

Notion Ratings and Reviews

- G2: 4.7/5 (5000+ reviews)

- Capterra: 4.8/5 (2000+ reviews)

- Trustpilot: 3.5/5 (50+ reviews)

Carta

Website: carta.com

![]()

Carta offers equity management and venture capital support for businesses worldwide. The platform supports special purpose vehicles, fund admin services, and multi-geo/multi-currency share plans.

The company's software helps maintain ownership percentages, equity dilution, and investment round values. While primarily focused on cap table management, many investors use Carta to track their portfolio companies and access company information.

Carta Features

- Equity Management

- Venture Capital

- Digital cap table

- Company valuations

- EMI share plans

- Special purpose vehicles

- Portfolio management

- Investment tracking

Carta Limitations

- Lack of information about pricing

- Limited information on legal, financial, accounting, and tax advice

- Unclear if the platform is suitable for all types of businesses

- Not a traditional data room—focused more on equity management

Carta Pricing

- No pricing publicly available

- Custom pricing based on company needs

Carta Ratings and Reviews

- G2: 4.4/5 (191+ reviews)

- Capterra: 4.3/5 (58+ reviews)

DocSend

Website: docsend.com

Dropbox DocSend offers solution for businesses to track customer engagement and share documents. Investors use it as a virtual data room.

Using real-time document and video analytics, users can gain valuable insights into what resonates most with customers.

With it businesses can improve their pitches, engage customers more effectively, and ultimately achieve greater success in their endeavors.

DocSend Features

- Real-time document and video analytics

- Trackable links

- Proactive follow-up

- Control over shared documents

- Virtual data rooms, watermarking, and one-click NDAs

- PDF editing

- Set up admins and tiered admin roles

DocSend Limitations

- Potential over-reliance on data analytics may lead to overlooking other important factors in a pitch or negotiation

- Dependence on technology for document sharing and tracking may result in vulnerabilities to cyber threats or technical issues

- Features such as advanced security and compliance tracking may be unnecessary or not applicable for all users or industries

DocSend Pricing

- Personal: $15 (1 team member, no data room)

- Standard: $65 (1 user , basic multi file sharing,no data room,)

- Advanced: $250/month( limited to 3 members)

DocSend Ratings and Reviews

- G2: 4.6/5 (481+ reviews)

- Capterra: 4.6/5 (60+ reviews)

- Trustpilot: 3.7/5 (1+ reviews)

Ideals Virtual Data Rooms

Website: idealsvdr.com

![]()

Ideals specializes in Virtual Data Room solutions for M&A transactions and other business-critical tasks.

With a focus on effective document and user management, activity tracking, and team collaboration.

Ideals Virtual Data Rooms Features

- Share and collaborate on documents

- Easy uploads via Drag & Drop

- Redact text, image, or area of the document straight in the data room

- Copy and paste email addresses to invite users

- Intuitive document rights management

- Multiple data centers continuously mirror each other

Ideals Virtual Data Rooms Limitations

- May not meet all specific requirements for every user

- Limited customization options for data rooms

- Potential lack of pricing transparency and information

Ideals Virtual Data Rooms Pricing

- No pricing publicly available

- Prices for virtual data rooms can range from $500 per month for 1 GB of storage to as much as $100,000 annually for specific plans

Ideals Virtual Data Rooms Ratings and Reviews

- G2: 4.7/5 (306+ reviews)

- Capterra: 4.8/5 (249+ reviews)

- Trustpilot: 4.4/5 (13+ reviews)

FirmRoom

Website: firmroom.com

![]()

FirmRoom is virtual data room solutions for venture funds that offer sharing functionality.

FirmRoom users manage document disclosure, and gain valuable insights into data room activity.

FirmRoom Features

- Data room management

- Permissions controls

- Viewer tracking

- Analytics dashboard

- Document management

- Bulk document upload

- Q&A functionality

FirmRoom Limitations

- Limited analytics compared to modern alternatives

- Limited customization options

- High pricing points

- Lack of third-party integrations

FirmRoom Pricing

- Standard: $695/month (1 room)

- Pro: $1,295/month

- Enterprise: $2,995/month

- Custom quotes available

FirmRoom Ratings and Reviews

- Trustpilot: 4.1/5 (30+ reviews)

- G2: 4.6/5 (21+ reviews)

- Capterra: 4.6/5 (44+ reviews)

Digify

Website: digify.com

![]()

Digify is a document security service, providing protection for important documents.

Digify offers virtual data rooms for managing sensitive company information such as intellectual property, optimized for tasks like fundraising and investor updates, ultimately helping businesses close deals faster.

Digify Features

- Document Security

- Easily control access and distribution

- Virtual Data Rooms

- Track document access

- Automated watermarks

- Close deals faster with virtual data rooms

- Cloud-based document security service

Digify Limitations

- Potential risk of confidential documents spreading online

- Complexity of managing document security and digital rights management features

- Dependency on internet connection for cloud-based services

Digify Pricing

- Pro: $165/month (1 user)

- Team: $450 (3 users)

- Business: Custom

Digify Ratings and Reviews

- Trustpilot: 3.8/5 (2+ reviews)

- G2: 4.7/5 (55+ reviews)

- Capterra: 4.9/5 (166+ reviews)

Conclusion

Start from easy to use secure and modern Virtual Data data room software for investors and venture funds.