Combien coûte la due diligence en 2026 ?

Coûts de la due diligence en 2026

Une acquisition SaaS de 75 M$ peut coûter 230 000 $ en due diligence. Un tour de table de série B de 25 M$ pourrait atteindre 75 000 $. Mais une transaction manufacturière de 450 M$ ? Cela représente 900 000 $, et ce, avant de prendre en compte les délais accélérés, la complexité transfrontalière ou les exigences spécifiques au secteur qui peuvent ajouter 30 à 50 % supplémentaires.

La différence entre un examen de phase d'amorçage à 10 000 $ et une enquête sur une méga-transaction à plus de 2 M$ ne concerne pas seulement la taille de la transaction. Il s'agit de comprendre quels coûts vous pouvez contrôler, lesquels vous ne pouvez pas, et comment optimiser votre budget sans compromettre la qualité. Nous détaillerons des exemples de transactions réelles, vous montrerons comment les cabinets du Big Four se comparent aux spécialistes boutique, et révélerons des stratégies qui peuvent réduire vos coûts de due diligence de 20 à 40 %, tout en maintenant la rigueur qu'exige votre transaction.

Récapitulatif rapide des coûts de due diligence

- Coûts de due diligence pour les fusions-acquisitions

- Coûts de due diligence d'investissement

- Coûts de due diligence juridique

- Coûts de due diligence financière

- Coûts de due diligence opérationnelle

- Coûts de due diligence informatique

- Coûts de due diligence environnementale

- Coûts de due diligence RH

Types de due diligence et leurs coûts

Les coûts de due diligence varient considérablement en fonction de la taille de la transaction, de sa complexité et du secteur. Voici ce que vous pouvez vous attendre à payer en 2026 :

1. Coûts de due diligence pour les fusions-acquisitions

Les transactions de fusions-acquisitions nécessitent la due diligence la plus complète, couvrant les aspects juridiques, financiers, opérationnels et stratégiques de l'entreprise cible. Les petites transactions de moins de 10 M$ coûtent généralement entre 25 000 $ et 50 000 $, tandis que les transactions de marché intermédiaire entre 10 M$ et 100 M$ varient de 50 000 $ à 150 000 $. Les grandes transactions de 100 M$ à 1 Md$ peuvent coûter de 150 000 $ à 500 000 $, et les méga-transactions de plus de 1 Md$ dépassent souvent 500 000 $, atteignant parfois 2 M$ ou plus.

Qu'est-ce qui détermine ces coûts ? La taille de la transaction et sa complexité jouent un rôle majeur, tout comme le nombre d'unités commerciales et de filiales impliquées. L'empreinte géographique compte également : les transactions transfrontalières coûtent nettement plus cher. Les réglementations sectorielles ajoutent de la complexité : les secteurs de la santé, de la finance et de l'énergie sont plus onéreux en raison des exigences de conformité. La qualité de la documentation de la cible impacte aussi les coûts, et la pression temporelle peut ajouter une prime de 20 à 40 % pour les transactions accélérées.

Vous souhaitez optimiser votre processus de due diligence ? Découvrez les salles de données virtuelles pour la due diligence

2. Coûts de la due diligence d'investissement

La due diligence d'investissement évalue les opportunités d'investissement potentielles, des startups en phase d'amorçage aux entreprises pré-IPO. Les startups en phase seed et série A coûtent généralement entre 10 000 $ et 25 000 $, tandis que les entreprises en croissance lors des tours de série B-C se situent entre 25 000 $ et 75 000 $. Les entreprises en phase avancée et pré-IPO peuvent coûter entre 75 000 $ et 200 000 $, et les investissements stratégiques se situent généralement entre 50 000 $ et 150 000 $.

Le stade et la maturité de l'entreprise influencent considérablement les coûts, tout comme la taille de l'investissement : des montants plus importants nécessitent un examen plus approfondi. La complexité du secteur fait également grimper les dépenses : les entreprises de deep tech et de biotechnologie coûtent plus cher en raison de l'expertise spécialisée requise. Le nombre d'investisseurs dans le tour de table et les exigences réglementaires impactent également la facture finale.

3. Coûts de la due diligence juridique

Les équipes juridiques examinent les contrats, les cadres de conformité, les risques de litiges et les portefeuilles de propriété intellectuelle. Les petites entreprises coûtent généralement entre 15 000 $ et 30 000 $, les entreprises de taille moyenne se situent entre 30 000 $ et 75 000 $, et les grandes entreprises peuvent coûter entre 75 000 $ et 200 000 $.

Le volume de contrats compte : examiner des centaines plutôt que des milliers de documents impacte considérablement les coûts. La complexité réglementaire dans des secteurs comme la santé, la finance et l'énergie fait grimper les dépenses. Les litiges actifs ou les différends nécessitent un temps d'examen supplémentaire, et la taille et la qualité du portefeuille de propriété intellectuelle affectent l'étendue du travail. Les opérations internationales dans plusieurs juridictions ajoutent de la complexité et des coûts.

4. Coûts de due diligence financière

La due diligence financière valide les revenus, les dépenses, les actifs, les passifs et les projections financières. Les petites entreprises coûtent généralement entre 20 000 $ et 40 000 $, les entreprises de taille moyenne entre 40 000 $ et 100 000 $, et les grandes entreprises peuvent coûter entre 100 000 $ et 300 000 $.

La complexité financière détermine les coûts : les entreprises avec plusieurs sources de revenus et filiales nécessitent davantage d'analyses. La qualité comptable compte également : les normes GAAP versus non-GAAP et l'historique d'audit impactent le temps d'examen. Le nombre d'entités à consolider ajoute de la complexité, et les opérations internationales introduisent des complexités liées aux devises et à la fiscalité. La qualité des systèmes et des documents financiers affecte aussi le temps que les analystes doivent consacrer.

5. Coûts de due diligence opérationnelle

La due diligence opérationnelle évalue les processus métier, l'infrastructure technologique et l'efficacité opérationnelle. Les petites entreprises coûtent généralement entre 15 000 $ et 30 000 $, les entreprises de taille moyenne entre 30 000 $ et 75 000 $, et les grandes entreprises peuvent coûter entre 75 000 $ et 200 000 $.

La complexité opérationnelle détermine les coûts : les opérations de fabrication et de logistique nécessitent une analyse plus approfondie que les entreprises de services. L'empreinte géographique compte : les entreprises avec plusieurs sites nécessitent des visites sur place et des évaluations régionales. La profondeur de la chaîne d'approvisionnement et les dépendances ajoutent de la complexité, tout comme la pile technologique et l'infrastructure informatique. La taille et la répartition de la main-d'œuvre impactent également l'étendue de l'examen opérationnel.

Tableau comparatif des coûts de due diligence

Voici une répartition complète des coûts typiques de due diligence selon les différents types de transactions et tailles d'entreprises :

Comparaison des prix des prestataires de services de due diligence

Comparez les coûts entre différents types de prestataires de services et de plateformes VDR pour prendre des décisions budgétaires éclairées. Utilisez notre calculateur de coûts de due diligence pour obtenir une estimation personnalisée pour votre transaction spécifique.

Exemples concrets de due diligence

Comprendre les coûts réels de transactions concrètes aide à établir des attentes réalistes. Bien que les détails des coûts soient généralement confidentiels, voici des exemples basés sur des transactions publiquement divulguées avec des estimations de coûts standards du secteur :

1. Exemple de fusion-acquisition : l'acquisition de Slack par Salesforce (2020)

Montant de la transaction : 27,7 milliards de dollars

Cible : Slack Technologies

Secteur : plateforme de collaboration professionnelle

Employés : plus de 2 000 dans plusieurs pays

Répartition estimée de la due diligence :

- Revue juridique : 8 à 12 millions de dollars — plusieurs cabinets ont examiné des milliers de contrats, les portefeuilles de propriété intellectuelle et les cadres de conformité des opérations mondiales de Slack

- Analyse financière : 10 à 15 millions de dollars — les cabinets Big Four ont validé le modèle de revenus récurrents et les opérations multidevises de Slack

- Évaluation technique : 6 à 8 millions de dollars — revue du code et audits de sécurité de l'infrastructure de Slack

- Évaluation commerciale : 4 à 6 millions de dollars — analyse des contrats clients et du positionnement concurrentiel

- Revue opérationnelle : 5 à 7 millions de dollars — processus et infrastructure dans plusieurs régions

- Fiscalité et réglementation : 3 à 5 millions de dollars — structures transfrontalières et conformité

- Data room et coordination : 2 à 3 millions de dollars — abonnement VDR de 6 mois et gestion de projet

Coût total estimé : 38 à 56 millions de dollars (0,14 à 0,20 % de la valeur de la transaction)

Calendrier : 6 mois avec plusieurs flux de travail et approbations réglementaires

2. Exemple de financement de startup : série H de Stripe (2023)

Montant du tour : 6,5 milliards de dollars série H

Entreprise : Stripe

Secteur : fintech

Employés : plus de 7 000

Répartition estimée de la due diligence :

- Revue juridique : 1,5 à 2,5 millions de dollars — plusieurs cabinets ont examiné la complexité de la table de capitalisation, les contrats et la conformité réglementaire des opérations fintech mondiales de Stripe

- Analyse financière : 2 à 3 millions de dollars — validation du modèle de revenus, de l'économie unitaire et des opérations internationales de Stripe

- Due diligence technique : 1,5 à 2 millions de dollars — évaluations de sécurité et revues de scalabilité de l'infrastructure de paiement

- Validation commerciale : 800 000 à 1,2 million de dollars — entretiens clients et analyse de marché

- Vérifications de références : 300 000 à 500 000 dollars — références des fondateurs, clients et partenaires

- Data room : 200 000 à 300 000 dollars — abonnement VDR de 3 mois

Coût total estimé : 6,3-9,5 millions $ (0,10-0,15 % de la taille du tour)

Calendrier : 3 mois avec plusieurs investisseurs (y compris les investisseurs existants) participant

3. Exemple de grande fusion-acquisition : l'acquisition de Nuance Communications par Microsoft (2021)

Taille de la transaction : 19,7 milliards $

Cible : Nuance Communications

Secteur : IA dans la santé

Employés : 7 100

Opérations : santé, services financiers et télécommunications

Répartition estimée de la due diligence :

- Examen juridique : 12-18 millions $ — Des milliers de contrats, des portefeuilles de propriété intellectuelle étendus et conformité réglementaire dans le secteur de la santé (HIPAA, FDA)

- Analyse financière : 15-22 millions $ — Les cabinets Big Four ont effectué une consolidation multi-entités et un audit des flux de revenus dans le secteur de la santé

- Examen opérationnel : 10-15 millions $ — Plusieurs unités commerciales, établissements de santé et chaînes d'approvisionnement

- Environnement et réglementation : 6-9 millions $ — Évaluations de conformité dans le secteur de la santé

- IT et cybersécurité : 8-12 millions $ — Examens de l'infrastructure de données de santé

- RH et avantages sociaux : 4-6 millions $ — Analyse de la main-d'œuvre sur 7 100 employés

- Fiscalité et structuration : 5-8 millions $ — Opérations transfrontalières et optimisation fiscale

- Data room et coordination : 3-5 millions $ — Abonnement VDR de 8 mois et gestion de projet

Coût total estimé : 63-95 millions $ (0,32-0,48 % de la valeur de la transaction)

Calendrier : 8 mois avec plusieurs flux de travail, approbations réglementaires et examens de conformité dans le secteur de la santé

Exemple concret : comment les family offices gèrent les coûts de due diligence

Découvrez comment G.P. Loree & Co., un family office basé à New York, utilise Papermark pour gérer efficacement la due diligence des investissements institutionnels tout en contrôlant les coûts :

Facteurs affectant les coûts de due diligence

La taille de la transaction établit la base de référence, mais la complexité détermine souvent les coûts plus que la valeur absolue. Une acquisition technologique de 50 millions $ peut coûter plus cher qu'une transaction immobilière de 100 millions $ en raison de la complexité du portefeuille de propriété intellectuelle. Le nombre d'unités commerciales, l'empreinte géographique (les transactions transfrontalières coûtent nettement plus cher) et les exigences réglementaires ajoutent tous des niveaux de complexité. La pression sur les délais impacte également les coûts : les calendriers standard de 4 à 8 semaines utilisent la tarification de base, mais les délais accélérés de 2 à 4 semaines ajoutent des primes de 20 à 40 %, et le travail le week-end ou en heures supplémentaires peut coûter 1,5 à 2 fois les taux horaires.

Les exigences spécifiques à chaque secteur créent des variations de coûts substantielles. Les secteurs réglementés comme la santé (conformité HIPAA, FDA) ajoutent 30 à 50 % aux coûts, tandis que les services financiers peuvent ajouter 40 à 60 %. Les transactions technologiques nécessitent des examens de portefeuilles de propriété intellectuelle et des audits de sécurité, ajoutant 20 à 40 %, tandis que les secteurs de la fabrication et de l'énergie nécessitent des évaluations environnementales qui ajoutent 25 à 50 %. La qualité de la documentation compte également : des salles de données virtuelles bien organisées maintiennent les coûts au niveau de base, mais des fichiers désorganisés ajoutent 15 à 30 % pour le tri et l'indexation, des documents manquants nécessitent 5 000 à 25 000 $ d'enquête supplémentaire, et des dossiers de mauvaise qualité ajoutent 20 à 40 % pour le travail de vérification.

Le choix des prestataires de services professionnels affecte considérablement votre facture finale. Les cabinets Big Four (PwC, Deloitte, EY, KPMG) pratiquent des tarifs premium de 400 à 800 $ par heure, tandis que les cabinets de taille intermédiaire facturent 250 à 500 $ par heure. Les spécialistes boutique offrent une expertise sectorielle spécifique à 300-600 $ par heure, et les équipes internes ont des coûts directs plus faibles mais comportent des coûts d'opportunité liés aux ressources internes. La bonne combinaison de prestataires — en adaptant l'expertise à la complexité — peut optimiser les coûts sans sacrifier la qualité.

Stratégies d'économie pour la due diligence

Une planification intelligente et les bons outils peuvent réduire les coûts de due diligence de 20 à 40 % sans sacrifier la qualité :

1. Utiliser des salles de données virtuelles

Les salles de données virtuelles éliminent les réunions physiques, réduisent les frais de déplacement et accélèrent l'accès aux documents. Les plateformes modernes comme Papermark offrent une organisation et des analyses basées sur l'IA.

Économies réalisées :

- Éliminer les frais de déplacement (5 000 à 50 000 $ économisés)

- Accès plus rapide aux documents (réduire le calendrier de 1 à 2 semaines)

- Suivi automatisé (réduire les frais administratifs)

- Meilleure organisation (réduire le temps d'examen de 15 à 25 %)

La solution de salle de données de Papermark commence à 149 € par mois pour les salles de données, nettement moins cher que les salles de données virtuelles d'entreprise qui facturent 5 000 à 15 000 $ par mois.

2. Prioriser les zones à haut risque

Concentrez le temps précieux des experts sur les points bloquants en priorité. Utilisez une approche basée sur les risques pour définir le périmètre des travaux.

Stratégie de priorisation :

- Semaine 1 : identifier les points bloquants (signaux d'alerte juridiques et financiers)

- Semaines 2-3 : analyse approfondie des zones à haut risque

- Semaine 4+ : valider les hypothèses restantes

- Résultat : détecter les problèmes tôt, éviter les efforts inutiles sur des transactions vouées à l'échec

3. Exploiter l'IA et l'automatisation

Les outils d'IA peuvent examiner les documents 10 fois plus rapidement que les humains, réduisant ainsi les coûts d'examen juridique et financier.

Avantages technologiques :

- Examen de documents par IA : gain de temps de 60 à 80 % sur l'analyse des contrats

- Vérifications de conformité automatisées : signalement instantané des problèmes réglementaires

- Flux de travail numériques : réduction des frais de coordination

- Tableaux de bord analytiques : visibilité en temps réel sur l'avancement

4. Dimensionner correctement votre équipe

Un sureffectif gaspille de l'argent. Un sous-effectif retarde les transactions. Trouvez le juste équilibre.

Optimisation de l'équipe :

- Utiliser les associés seniors uniquement pour les décisions stratégiques

- Faire appel aux collaborateurs pour l'examen de routine des documents

- Faire intervenir les spécialistes uniquement en cas de besoin (pas à temps plein)

- Une communication claire réduit les reprises et les retards

5. Standardiser et réutiliser

Les modèles et les listes de contrôle réduisent le temps de préparation et garantissent qu'il ne manque rien.

Avantages de la standardisation :

- Listes de contrôle de due diligence réutilisables (économie de 10 à 20 heures de préparation)

- Formats de rapport cohérents (réduction du temps d'examen)

- Modèles de contrats et cadres d'analyse

- Meilleures pratiques issues des transactions précédentes

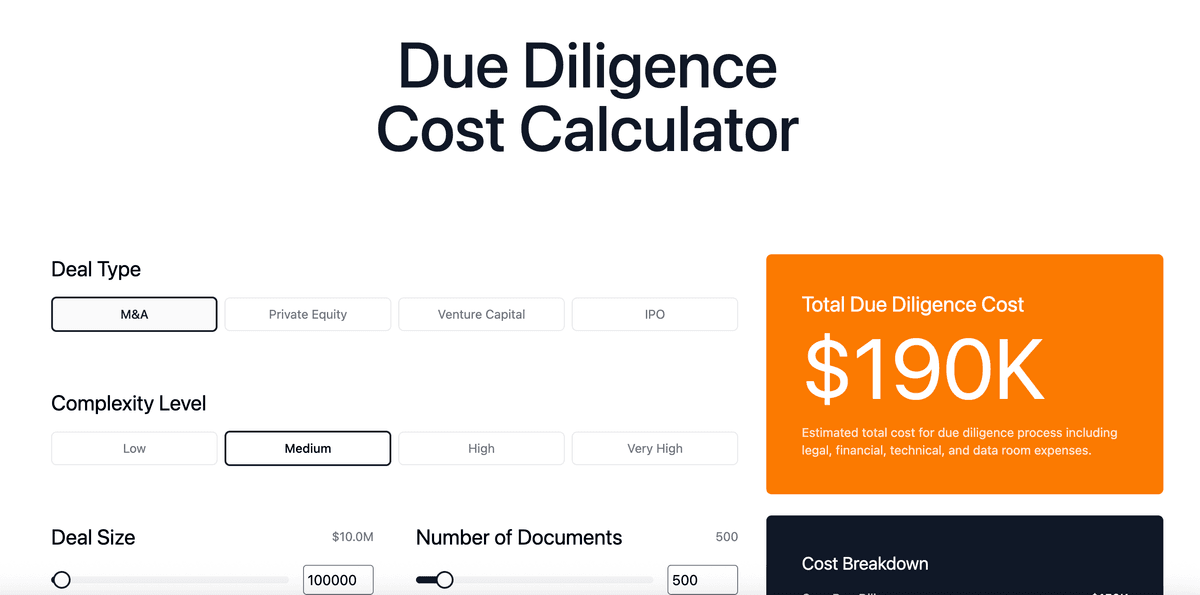

Calculateur de coûts de due diligence

Estimez vos coûts de due diligence en fonction de la taille de la transaction, du type, de la complexité et du calendrier. Notre calculateur utilise des multiplicateurs standards du secteur et des données de transactions réelles pour fournir des estimations précises.

Variables clés prises en compte par le calculateur :

- Taille de la transaction et type d'opération (M&A, PE, VC, IPO)

- Niveau de complexité (faible, moyen, élevé, très élevé)

- Nombre de documents à examiner

- Durée de la data room

- Périmètre géographique

- Exigences spécifiques au secteur

Conclusion

Les coûts de due diligence en 2026 peuvent varier considérablement en fonction de multiples facteurs, de la taille de la transaction aux exigences sectorielles. Bien que ces coûts soient nécessaires pour prendre des décisions commerciales éclairées, il existe des stratégies pour les optimiser et les gérer efficacement. En tirant parti de la technologie, notamment des salles de données virtuelles, et en mettant en œuvre des processus efficaces, les entreprises peuvent mener une due diligence approfondie tout en maîtrisant les coûts.

N'oubliez pas que si le coût est une considération importante, la qualité et l'exhaustivité de la due diligence ne doivent pas être compromises, car elles peuvent prévenir des erreurs coûteuses et garantir la réussite des transactions.