How to start a private equity company (2026 guide)

What is a private equity company?

A private equity company is an investment firm that raises capital from institutional investors (limited partners) to acquire, improve, and sell companies for profit. Unlike public companies, PE firms are privately held and typically manage funds with 3-7 year investment horizons, focusing on operational improvements and strategic growth to generate returns for their investors.

Why start a private equity company?

Starting a PE firm offers several advantages for experienced investors and operators:

- High earning potential: Management fees (2% of AUM) plus carried interest (20% of profits)

- Operational control: Direct involvement in portfolio company management and strategy

- Long-term relationships: Deep partnerships with management teams and investors

- Market opportunity: $4.4 trillion in global PE assets under management

- Flexibility: Choose your investment focus, geography, and deal size

Key requirements to start a PE firm

Before launching your private equity company, ensure you meet these essential requirements:

| Category | Details |

|---|---|

| Capital and track record | Minimum fund size: $50M+ for first-time funds ($100M+ preferred); Proven track record: 3–5 years of relevant investment or operational experience; Skin in the game: 1–2% GP commitment; Institutional relationships: access to pension funds, endowments, family offices |

| Team and expertise | Investment professionals: 2–3 experienced dealmakers with complementary skills; Operational expertise: industry specialists or former executives; Support functions: CFO, compliance, investor relations; Advisory network: industry experts, former CEOs, board members |

| Legal and regulatory setup | Entity structure: LP with GP and management company; SEC registration: required if managing $150M+ AUM; State compliance: business registration and tax; Fund documentation: LPA, subscription agreements, side letters |

Step-by-step guide to starting a PE company

Follow this comprehensive roadmap to launch your private equity firm successfully.

Quick recap of steps

- Define your investment strategy (sector, geography, deal size, stage)

- Build the founding team (managing partner, investing, operating, CFO/COO)

- Establish legal structure and compliance (GP/LP entities, registrations)

- Develop core fund documentation (LPA, PPM, subscriptions, side letters)

- Raise your first fund (target LPs, terms, timeline to first/ final close)

- Set up operations and tooling (CRM, VDR like Papermark, accounting)

- Launch deal sourcing and execution (bankers, networks, outreach; run diligence)

1. Define your investment strategy

Choose your focus area:

- Sector specialization: Technology, healthcare, manufacturing, consumer

- Geographic focus: North America, Europe, Asia, or specific regions

- Deal size: Lower middle market ($10M-$100M), middle market ($100M-$1B)

- Investment stage: Growth equity, buyouts, distressed, special situations

Create your investment thesis:

- Market opportunity and trends

- Competitive advantages and differentiation

- Value creation playbook

- Target returns and risk profile

2. Build your founding team

Core team requirements:

- Managing Partner: Industry experience, investor relationships, leadership

- Investment Partner: Deal sourcing, due diligence, execution

- Operating Partner: Portfolio company management, value creation

- CFO/COO: Fund administration, compliance, operations

Compensation structure:

- Base salaries: $200K-$500K+ depending on experience

- Carried interest: 15-25% split among partners

- Management fees: Cover operating expenses and salaries

3. Establish legal structure and compliance

Entity formation:

- Form GP entity (LLC or corporation)

- Create fund LP structure

- Establish management company

- Set up portfolio company holding structure

Regulatory compliance:

- SEC registration (if required)

- State business licenses

- Tax elections and structuring

- Insurance coverage (E&O, D&O)

4. Develop fund documentation

Essential documents:

- Limited Partnership Agreement (LPA): Fund terms, economics, governance

- Private Placement Memorandum (PPM): Investment strategy, team, track record

- Subscription agreements: Investor commitments and representations

- Side letters: Custom terms for key investors

5. Raise your first fund

Fundraising process:

- Target investors: Pension funds, endowments, family offices, sovereign wealth funds

- Fund size: Start with $50M-$200M for first-time funds

- Fund terms: 2% management fee, 20% carried interest, 8% preferred return

- Timeline: 12-18 months from launch to first close

Investor materials:

- Pitch deck and PPM

- Track record documentation

- Financial projections and models

- References and case studies

6. Set up operations and infrastructure

Technology stack:

- CRM system: Track investor relationships and deal pipeline

- Data room software: Secure document sharing for due diligence

- Accounting system: Fund administration and portfolio tracking

- Analytics platform: Performance monitoring and reporting

Office and resources:

- Physical office or virtual setup

- Legal and accounting support

- Industry databases and research tools

- Professional networks and memberships

7. Launch deal sourcing and execution

Deal sourcing strategies:

- Industry networks: Leverage your professional relationships

- Investment bankers: Build relationships with sell-side advisors

- Portfolio company referrals: Network through existing investments

- Direct outreach: Target companies in your focus sectors

Due diligence process:

- Financial analysis: Historical performance, projections, valuation

- Commercial due diligence: Market analysis, competitive positioning

- Legal review: Contracts, compliance, litigation, IP

- Operational assessment: Management team, systems, processes

Examples: how managers raised their funds

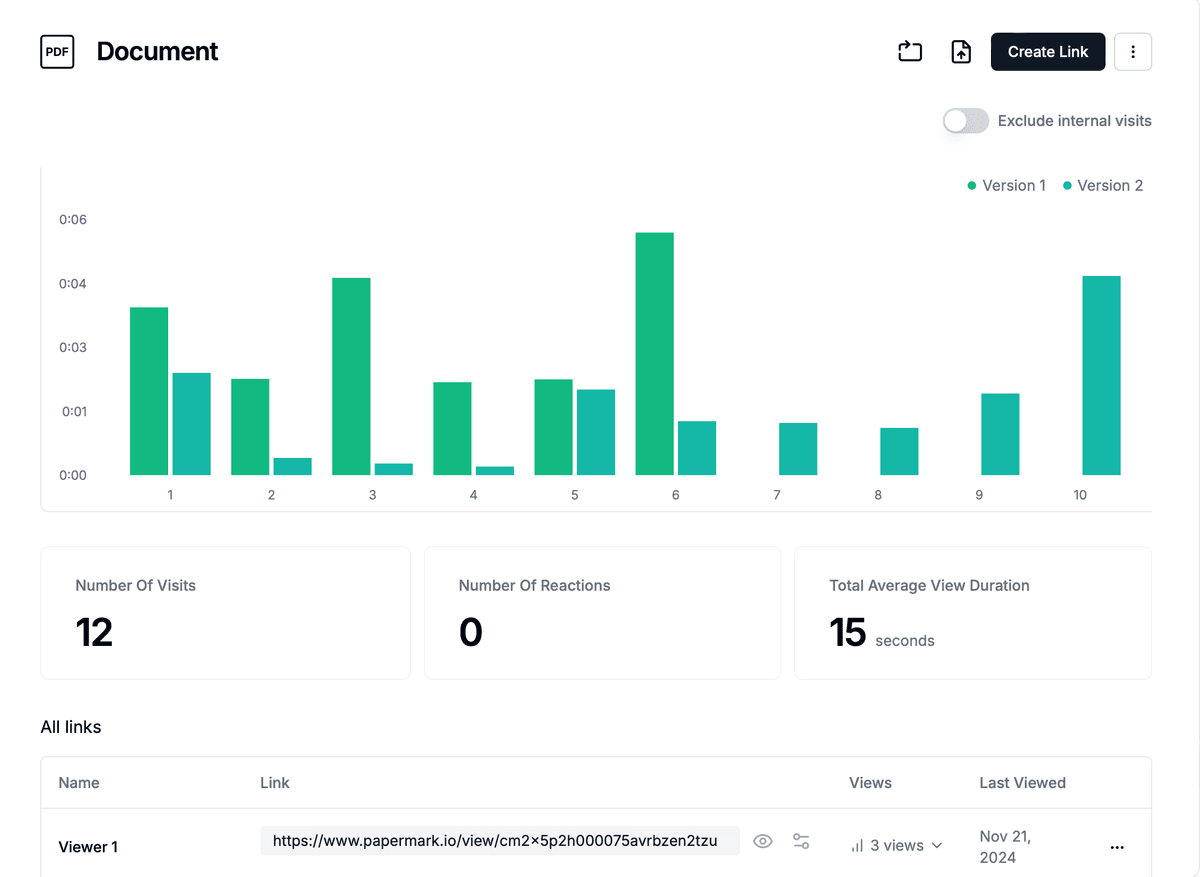

Using data rooms for PE fundraising and operations

A virtual data room (VDR) is essential for private equity firms throughout the investment lifecycle.

Fundraising applications

Investor due diligence:

- Share fund documentation securely with potential LPs

- Track which investors are most engaged with your materials

- Control access to sensitive information with permissions

- Maintain audit trails for compliance

LP reporting:

- Quarterly and annual fund performance reports

- Portfolio company updates and board materials

- Capital call and distribution notices

- ESG and impact reporting

Portfolio management

Buy-side due diligence:

- Organize target company documents by workstream

- Grant access to different team members and advisors

- Track review progress and identify bottlenecks

- Maintain version control and document security

Portfolio oversight:

- Board materials and monthly reporting

- Strategic planning documents and budgets

- Add-on acquisition opportunities

- Exit preparation and buyer due diligence

Best practices for PE data rooms

Organization:

- Create clear folder structures (Financial, Legal, Commercial, Operations)

- Use consistent naming conventions and version control

- Implement document retention policies

- Regular cleanup and archiving

Security:

- Password protection and two-factor authentication

- Granular permissions and access controls

- NDA requirements and acceptance tracking

- Audit logs and activity monitoring

Analytics:

- Track document views and engagement metrics

- Identify most active investors and advisors

- Monitor review progress and completion rates

- Export reports for management and compliance

Common challenges and solutions

Fundraising difficulties

Challenge: First-time fund managers struggle to attract institutional capital Solution:

- Start with smaller fund size ($25M-$50M)

- Focus on high-net-worth individuals and family offices

- Partner with established GPs or consider fund-of-funds

- Build strong track record through co-investments

Team building

Challenge: Attracting experienced professionals without established brand Solution:

- Offer competitive compensation and equity upside

- Emphasize growth opportunities and autonomy

- Leverage personal networks and industry relationships

- Consider part-time advisors and consultants initially

Deal sourcing

Challenge: Limited deal flow in competitive market Solution:

- Develop sector expertise and thought leadership

- Build relationships with investment bankers and advisors

- Focus on proprietary deal sources and direct outreach

- Consider smaller deals or emerging sectors

Operational complexity

Challenge: Managing multiple portfolio companies and investor relations Solution:

- Invest in technology and systems from day one

- Hire experienced operations professionals

- Outsource non-core functions (accounting, legal, compliance)

- Develop standardized processes and templates

Timeline and milestones

| Phase | Timeline | Key milestones |

|---|---|---|

| Planning and setup | Months 1–3 | Define investment strategy and team; establish legal structure and compliance; begin fundraising preparation |

| Fundraising | Months 4–9 | Launch fundraising process; meet with potential investors; refine materials based on feedback |

| Fund closing | Months 10–12 | Complete legal documentation; close first round of commitments; begin deal sourcing activities |

| Operations | Year 2+ | Execute first investments; build portfolio and track record; prepare for next fund raise |