Investment Due Diligence Checklist - A Comprehensive Guide for Investors

What is Investment Due Diligence?

Investment due diligence is a comprehensive process of evaluating a potential investment opportunity to verify facts, assess risks, and make informed decisions. It involves analyzing financial, legal, operational, and market aspects of the target company or asset.

This process is crucial for investors to understand the true value, risks, and potential of an investment before committing capital. A well-structured due diligence process can help identify red flags, validate assumptions, and ensure alignment with investment objectives.

Why is Investment Due Diligence Important?

Conducting thorough due diligence is essential for several reasons:

- Risk Mitigation: Identify potential risks and liabilities before making an investment.

- Value Verification: Confirm the accuracy of financial statements and business claims.

- Strategic Alignment: Ensure the investment aligns with your investment strategy and goals.

- Negotiation Leverage: Gain insights that can strengthen your position in negotiations.

- Future Planning: Understand the company's growth potential and future challenges.

- Compliance: Ensure the investment meets regulatory requirements and industry standards.

Types of Investment Due Diligence

Different types of investments require different due diligence approaches. Here are the main categories:

1. Financial Due Diligence

Focus: Analyzing financial statements, projections, and key financial metrics.

Key Areas:

- Historical financial performance

- Revenue and cost structure

- Working capital requirements

- Cash flow analysis

- Financial projections and assumptions

- Capital structure and debt obligations

2. Legal Due Diligence

Focus: Reviewing legal documents, contracts, and compliance matters.

Key Areas:

- Corporate structure and governance

- Contracts and agreements

- Intellectual property rights

- Litigation history

- Regulatory compliance

- Employment and labor matters

3. Operational Due Diligence

Focus: Evaluating business operations and processes.

Key Areas:

- Production and supply chain

- Technology infrastructure

- Quality control systems

- Operational efficiency

- Management team capabilities

- Business continuity plans

4. Market Due Diligence

Focus: Analyzing market position and competitive landscape.

Key Areas:

- Market size and growth potential

- Competitive analysis

- Customer base and concentration

- Market trends and dynamics

- Sales and marketing strategies

- Product/service differentiation

5. Environmental, Social, and Governance (ESG) Due Diligence

Focus: Assessing sustainability and corporate responsibility factors.

Key Areas:

- Environmental impact and compliance

- Social responsibility initiatives

- Corporate governance practices

- Ethical business conduct

- Sustainability reporting

- Stakeholder engagement

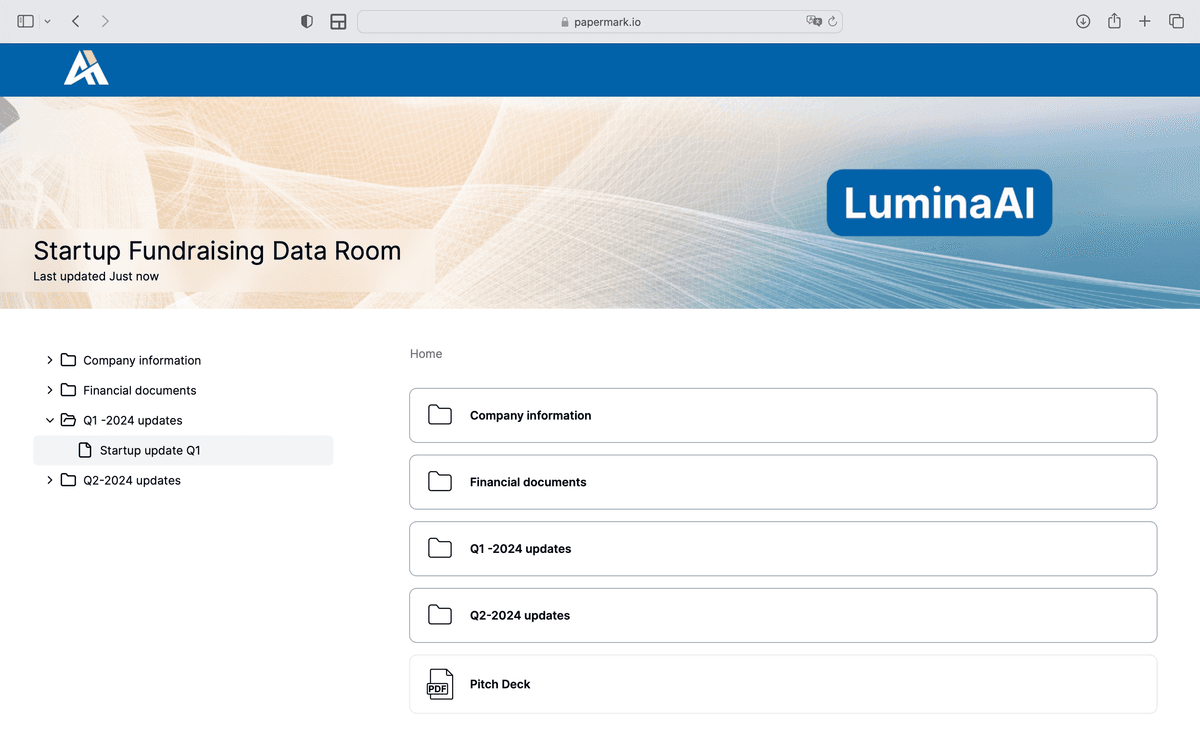

Real-World Example: How family offices running institutional investments use Papermark for due diligence

See how G.P. Loree & Co., a New York family office, uses Papermark for institutional investment due diligence:

Investment Due Diligence Checklist

Here's a comprehensive checklist of documents and information to review during the due diligence process:

| Document | Category | Essential | Nice to Have |

|---|---|---|---|

| Executive Summary | Overview | ✔️ | |

| Business Plan | Overview | ✔️ | |

| Financial Statements (3-5 years) | Financial | ✔️ | |

| Tax Returns (3-5 years) | Financial | ✔️ | |

| Financial Projections | Financial | ✔️ | |

| Cap Table | Financial | ✔️ | |

| Articles of Incorporation | Legal | ✔️ | |

| Bylaws and Amendments | Legal | ✔️ | |

| Shareholder Agreements | Legal | ✔️ | |

| Material Contracts | Legal | ✔️ | |

| Intellectual Property Portfolio | Legal | ✔️ | |

| Litigation History | Legal | ✔️ | |

| Market Analysis Reports | Market | ✔️ | |

| Customer Contracts | Market | ✔️ | |

| Competitive Analysis | Market | ✔️ | |

| Organizational Chart | Operations | ✔️ | |

| Key Personnel Resumes | Operations | ✔️ | |

| Technology Stack Overview | Operations | ✔️ | |

| Environmental Reports | ESG | ✔️ | |

| Sustainability Policies | ESG | ✔️ | |

| Corporate Governance Documents | ESG | ✔️ |

How to Conduct Investment Due Diligence

Follow these steps to ensure a thorough due diligence process:

1. Preparation Phase

- Define your investment criteria and objectives

- Create a due diligence timeline and checklist

- Set up a secure data room for document sharing

- Establish communication protocols with the target company

2. Information Gathering

- Request and review all essential documents

- Conduct interviews with key personnel

- Visit facilities and observe operations

- Analyze market data and industry reports

3. Analysis and Verification

- Verify financial statements and projections

- Assess legal compliance and risks

- Evaluate operational efficiency

- Analyze market position and competition

4. Risk Assessment

- Identify potential risks and liabilities

- Evaluate risk mitigation strategies

- Assess impact on investment returns

- Consider exit strategies

5. Documentation and Reporting

- Document findings and observations

- Prepare due diligence report

- Highlight key risks and opportunities

- Make investment recommendations

Best Practices for Investment Due Diligence

To ensure effective due diligence, follow these best practices:

- Use a Structured Approach: Follow a systematic process and checklist to ensure thoroughness.

- Leverage Technology: Utilize virtual data rooms for secure document sharing and tracking.

- Engage Experts: Consult with legal, financial, and industry experts when needed.

- Maintain Confidentiality: Ensure proper security measures and NDAs are in place.

- Document Everything: Keep detailed records of all findings and communications.

- Verify Information: Cross-check data from multiple sources to ensure accuracy.

- Consider Future Scenarios: Evaluate how the investment might perform under different conditions.

Common Due Diligence Pitfalls to Avoid

Be aware of these common mistakes during the due diligence process:

- Rushing the Process: Allocate sufficient time for thorough analysis.

- Overlooking Red Flags: Pay attention to warning signs and investigate thoroughly.

- Focusing Only on Financials: Consider all aspects of the business, not just financial performance.

- Ignoring Market Conditions: Evaluate how external factors might impact the investment.

- Neglecting Legal Compliance: Ensure all regulatory requirements are met.

- Underestimating Integration Challenges: Consider post-investment implementation issues.

Tools for Investment Due Diligence

Several tools can enhance your due diligence process:

- Virtual Data Rooms: Secure document sharing and tracking

- Financial Analysis Software: For detailed financial modeling and analysis

- Market Research Tools: For industry and competitive analysis

- Legal Research Platforms: For compliance and regulatory checks

- Project Management Tools: For organizing and tracking due diligence tasks

Conclusion

Thorough investment due diligence is essential for making informed investment decisions and mitigating risks. By following a structured approach, utilizing appropriate tools, and maintaining attention to detail, investors can significantly improve their chances of successful investments.

For a secure and efficient due diligence process, consider using Papermark's virtual data room solution, which offers robust security features, document tracking, and collaboration tools specifically designed for investment due diligence.