10 Best M&A Due Diligence Software in 2026

In today's dynamic M&A landscape, executing efficient due diligence isn't just beneficial—it's absolutely critical for ensuring deal success. With global M&A activity reaching impressive figures like $3.2 trillion in 2024 (PwC Global M&A Industry Trends), leveraging the right M&A due diligence software can be the deciding factor in a deal's outcome. Whether you're navigating a smaller acquisition or orchestrating a complex multi-billion dollar merger, the appropriate software solution significantly streamlines processes, bolsters security, and sharpens decision-making. Notably, a significant 78% of successful M&A deals in 2024 utilized specialized due diligence software (Deloitte M&A Trends Report), highlighting its importance in the modern merger and acquisition process.

Looking for M&A due diligence software that can handle complex deal requirements? We've analyzed and compared the top 10 solutions for 2026. From virtual data rooms to AI-powered analysis tools, we'll help you find the perfect platform to manage your M&A process efficiently and securely.

Quick recap of M&A due diligence software

1. Papermark: Comprehensive document sharing platform with advanced due diligence features

2. Ideals: Enterprise-grade virtual data room solution

3. Firmex: Secure document sharing and collaboration platform

4. Merrill DatasiteOne: AI-powered due diligence platform

5. Intralinks: Global virtual data room provider

6. Ansarada: AI-driven deal management platform

7. ShareVault: Secure document sharing for M&A

8. Box: Enterprise content management with M&A features

9. DealRoom: End-to-end M&A project management

10. SecureDocs: Simple virtual data room solution

How to choose M&A due diligence software?

Selecting the most suitable M&A due diligence software is akin to assembling the ideal team for your deal—it holds the potential to significantly influence the final outcome. In an environment where a substantial 60% of M&A deals don't meet their initial objectives (Harvard Business Review), employing the correct tools moves beyond convenience—it becomes essential for maximizing the chances of deal success.

Here's a breakdown of why considering specialized M&A due diligence software is crucial:

- Enhanced security: Protect sensitive deal documents with enterprise-grade encryption

- Improved efficiency: Streamline document review and analysis processes

- Better collaboration: Enable seamless communication between deal teams

- Compliance assurance: Meet regulatory requirements with audit trails

- Data analytics: Gain insights from document access patterns and review times

The good news? Today's M&A due diligence software market offers sophisticated features, many of which were once exclusive to large enterprises. From AI-driven document analysis capabilities to real-time collaborative tools, these platforms are designed to cater to deals of varying sizes and complexities, enhancing the overall merger and acquisition process.

Let's delve into the top 10 M&A due diligence software solutions poised to transform your M&A workflow:

Types of M&A due diligence software

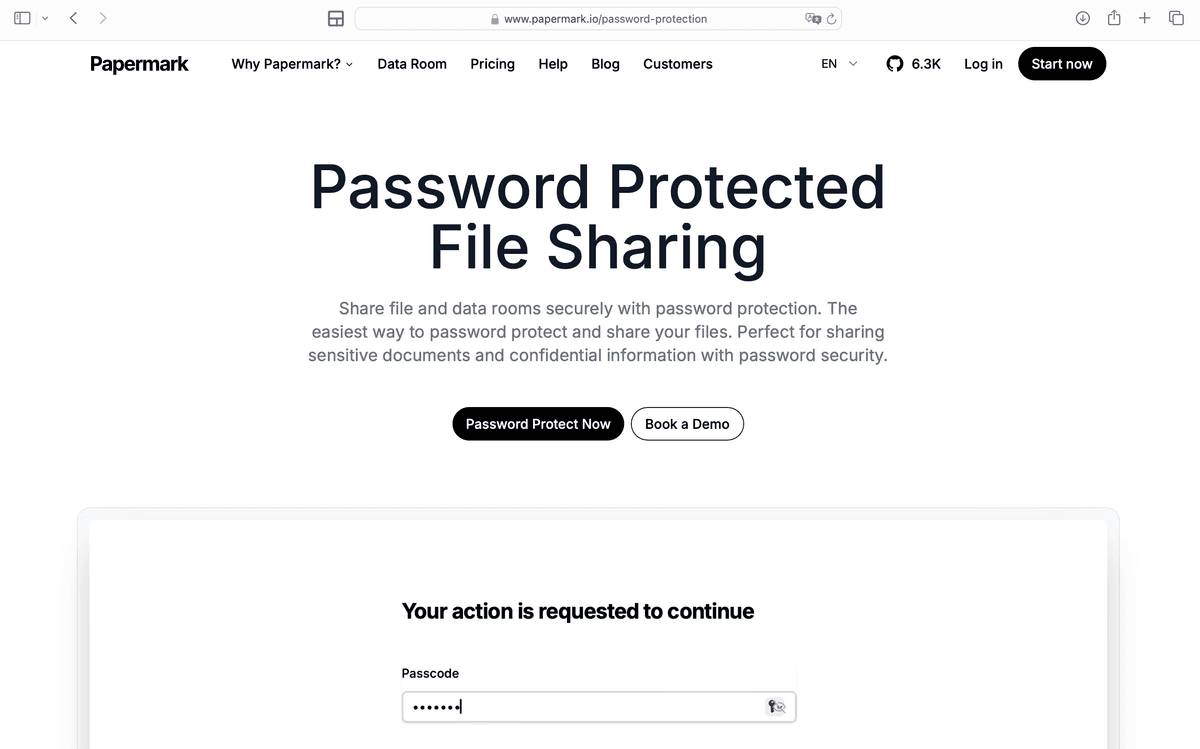

Papermark

Website: papermark.com

Papermark offers a comprehensive document sharing platform with specialized features for M&A due diligence. It combines security with analytics, making it ideal for deal teams needing to share sensitive documents while tracking engagement.

Papermark features

- Secure document sharing

- Advanced analytics

- Custom access controls

- Watermarking

- Link expiration

- View tracking

- Self-hosting option

- API access

Papermark pricing

- Free plan available

- Pro: $29/month

- Business: $59/month

- Data Rooms: Learn more about Papermark Data Rooms

Papermark on GitHub

⭐️ 6000+ stars 🧑💻 60+ contributors 🔗 800+ forks

Ideals

Website: idealsvdr.com

Ideals is a leading virtual data room provider known for its robust security features and user-friendly interface. It's particularly popular among investment banks and large corporations for complex M&A transactions.

Ideals features

- Advanced security controls

- AI-powered document analysis

- Q&A workflow management

- Bulk document upload

- Custom branding

- Mobile access

- Multi-language support

- API integration

Ideals limitations

- Higher price point

- Complex setup process

- Steeper learning curve

- Limited customization in basic plans

Ideals pricing

- Custom pricing based on deal size

- Enterprise plans available

- Free trial available

Firmex

Website: firmex.com

Firmex provides a secure document sharing platform specifically designed for M&A transactions. It offers a balance of security and usability, making it suitable for mid-sized deals.

Firmex features

- Secure document sharing

- Activity tracking

- Custom permissions

- Bulk upload

- Document watermarking

- Mobile access

- Audit trails

- Email notifications

Firmex limitations

- Limited AI features

- Basic analytics

- Standard templates only

- No self-hosting option

Firmex pricing

- Pay-per-deal pricing

- Monthly subscriptions available

- Custom enterprise plans

Merrill DatasiteOne

Website: merrillcorp.com

Merrill DatasiteOne combines AI-powered document analysis with traditional virtual data room features. It's particularly strong in large-scale M&A transactions and complex due diligence processes.

Merrill DatasiteOne features

- AI document analysis

- Advanced search capabilities

- Automated indexing

- Real-time collaboration

- Custom workflows

- Mobile access

- Multi-language support

- API integration

Merrill DatasiteOne limitations

- Premium pricing

- Complex setup

- Requires training

- Limited customization

Merrill DatasiteOne pricing

- Custom pricing

- Enterprise plans

- Volume discounts available

Intralinks

Website: intralinks.com

Intralinks is a global leader in virtual data rooms, offering comprehensive solutions for M&A due diligence. It's known for its robust security features and global presence.

Intralinks features

- Global infrastructure

- Advanced security

- Document analytics

- Workflow automation

- Mobile access

- Multi-language support

- API integration

- Custom branding

Intralinks limitations

- Higher cost

- Complex interface

- Limited customization

- Steep learning curve

Intralinks pricing

- Custom pricing

- Enterprise plans

- Global support included

Ansarada

Website: ansarada.com

Ansarada offers an AI-driven deal management platform that combines virtual data room capabilities with deal analytics and workflow automation.

Ansarada features

- AI-powered insights

- Deal analytics

- Workflow automation

- Document management

- Mobile access

- Custom branding

- API integration

- Audit trails

Ansarada limitations

- Premium pricing

- Complex setup

- Limited customization

- Requires training

Ansarada pricing

- Custom pricing

- Enterprise plans

- Free trial available

ShareVault

Website: sharevault.com

ShareVault provides secure document sharing specifically designed for M&A transactions, with a focus on mid-sized deals and professional services firms.

ShareVault features

- Secure document sharing

- Activity tracking

- Custom permissions

- Document watermarking

- Mobile access

- Audit trails

- Email notifications

- API integration

ShareVault limitations

- Basic analytics

- Limited AI features

- Standard templates

- No self-hosting

ShareVault pricing

- Monthly subscriptions

- Pay-per-deal options

- Custom enterprise plans

Box

Website: box.com

Box offers enterprise content management with specialized features for M&A due diligence, making it suitable for companies already using Box for document management.

Box features

- Enterprise content management

- Secure sharing

- Workflow automation

- Mobile access

- Custom branding

- API integration

- Audit trails

- Compliance tools

Box limitations

- Not M&A specific

- Limited deal analytics

- Basic due diligence features

- Requires customization

Box pricing

- Business: $15/user/month

- Enterprise: Custom pricing

- Free trial available

DealRoom

Website: dealroom.net

DealRoom provides an end-to-end M&A project management platform that combines virtual data room capabilities with deal management tools.

DealRoom features

- Project management

- Document sharing

- Task tracking

- Analytics dashboard

- Mobile access

- Custom workflows

- API integration

- Audit trails

DealRoom limitations

- Basic security features

- Limited AI capabilities

- Standard templates

- No self-hosting

DealRoom pricing

- Monthly subscriptions

- Custom pricing

- Free trial available

SecureDocs

Website: securedocs.com

SecureDocs offers a simple virtual data room solution that's particularly suitable for small to mid-sized M&A transactions.

SecureDocs features

- Simple interface

- Secure sharing

- Activity tracking

- Document management

- Mobile access

- Audit trails

- Email notifications

- Basic analytics

SecureDocs limitations

- Basic features

- Limited customization

- No AI capabilities

- Standard security

SecureDocs pricing

- Monthly subscriptions

- Pay-per-deal options

- Free trial available

Comparison of features

| Software | Security Level | AI Features | Mobile Access | API Integration | Pricing Model |

|---|---|---|---|---|---|

| Papermark | Advanced | Yes | Yes | Yes | Subscription |

| Ideals | Enterprise | Yes | Yes | Yes | Custom |

| Firmex | Advanced | No | Yes | Yes | Pay-per-deal |

| Merrill | Enterprise | Yes | Yes | Yes | Custom |

| Intralinks | Enterprise | Yes | Yes | Yes | Custom |

| Ansarada | Advanced | Yes | Yes | Yes | Custom |

| ShareVault | Advanced | No | Yes | Yes | Subscription |

| Box | Advanced | Yes | Yes | Yes | Subscription |

| DealRoom | Standard | No | Yes | Yes | Subscription |

| SecureDocs | Standard | No | Yes | No | Subscription |

Conclusion

The M&A due diligence software landscape in 2026 presents a diverse array of solutions tailored to different deal sizes, complexities, and specific requirements. From comprehensive, enterprise-grade platforms like Ideals and Merrill DatasiteOne to more streamlined and focused solutions such as Papermark and SecureDocs, organizations have ample choice to select a tool that aligns precisely with their specific M&A needs.

When evaluating and selecting M&A due diligence software, carefully consider factors such as:

- Deal size and complexity

- Security requirements

- Team size and location

- Integration needs

- Budget constraints

- Required features

Remember, the optimal M&A due diligence software choice fundamentally depends on your unique deal requirements, your team's capabilities, and stringent security needs. Consistent team training and meticulous setup are crucial steps to fully leverage the benefits and maximize the return on investment for any chosen M&A software solution.

Looking to further streamline your merger and acquisition process?