Selling to private equity: yes or no? (2026 guide)

You've built your business from the ground up. Years of late nights, tough decisions, and countless sacrifices have brought you to this moment. Now, a private equity firm is knocking at your door with an offer that could change everything. But you're torn—should you take the money and run, or hold onto the company you've poured your heart into?

The decision to sell to private equity isn't just about numbers on a spreadsheet. It's about letting go of control, trusting new management, and potentially watching your life's work transform under someone else's vision. You might get a significant payout, but you'll also lose the autonomy you've fought so hard to maintain.

Selling to private equity means transferring ownership of your business to a PE firm in exchange for cash, stock, or a combination of both. Unlike strategic buyers who may integrate your company into their operations, PE firms typically acquire businesses to improve operations, combine with other companies, and sell later at a higher valuation.

Why private equity firms want to buy your business

Private equity firms target businesses that fit their investment thesis and can generate returns through operational improvements:

- Roll-up opportunities: Combining multiple similar businesses to create economies of scale

- Operational improvements: Implementing cost-cutting measures and efficiency gains

- Growth capital: Providing resources for expansion and market penetration

- Management expertise: Bringing experienced operators to drive performance

- Exit strategy: Planning to sell the improved business in 3-7 years for a higher multiple

Typical private equity deal structure

| Component | Details |

|---|---|

| Cash vs. Stock | Typically 60-80% cash upfront, 20-40% stock in new entity |

| Earnout Structure | 2-5 year period with performance-based milestones |

| Management Retention | 3-5 year employment agreements for key personnel |

| Holdbacks | 10-20% of purchase price held in escrow for 12-24 months |

| Debt Financing | PE firms often use leverage, increasing business debt load |

Pros and cons of selling to private equity

Pros of selling to private equity

Financial benefits:

- Higher valuation potential: PE firms may pay premium prices for strategic assets

- Earnout upside: Stock portion can significantly increase total sale value

- Tax advantages: Deferred tax burden through earnout structure

- Liquidity event: Immediate cash for business owners and shareholders

Operational benefits:

- Growth capital: Access to resources for expansion and acquisitions

- Operational expertise: Experienced management and industry specialists

- Strategic acquisitions: PE firms can acquire competitors and complementary businesses

- Professional systems: Implementation of best practices and technology

Strategic benefits:

- Market consolidation: Creating larger, more competitive entities

- Exit preparation: Building toward a larger sale or IPO

- Management development: Professional development for existing team

- Industry relationships: Access to broader network and partnerships

Cons of selling to private equity

Financial risks:

- Lower upfront cash: Less immediate liquidity compared to strategic buyers

- Earnout uncertainty: Stock value depends on PE firm's success

- Debt burden: Increased leverage may strain cash flow

- Fee structure: Management and monitoring fees charged to portfolio companies

Operational challenges:

- Loss of control: No longer calling the shots on business decisions

- Performance pressure: Aggressive growth targets and cost-cutting measures

- Cultural changes: Shift from entrepreneurial to corporate environment

- Management turnover: Potential replacement of existing leadership

Strategic risks:

- Integration challenges: Combining with other portfolio companies

- Market timing: PE firm's exit strategy may not align with market conditions

- Competition: PE firm may acquire competitors, creating conflicts

- Limited flexibility: Reduced ability to make independent strategic decisions

What to expect during the PE sale process

The private equity sale process typically unfolds over 4-6 months, divided into two main phases that will test your patience and organizational skills. Understanding what's coming can help you prepare mentally and practically for the journey ahead.

Due diligence phase (2-4 months)

The due diligence phase is where PE firms dig deep into every aspect of your business. Expect teams of analysts, accountants, and lawyers to request extensive documentation and conduct thorough reviews. This phase can feel invasive as they examine your financial history, market position, and operational efficiency.

Financial due diligence involves comprehensive analysis of your historical financial statements, projections, and working capital. They'll scrutinize your cash flow modeling, tax compliance records, and audit reviews. Your management reporting systems and financial controls will be evaluated to ensure they meet institutional standards.

Commercial due diligence focuses on your market position and growth potential. PE firms will conduct detailed market analysis, review your competitive positioning, and examine customer concentration risks. They'll analyze your supplier relationships, dependencies, and identify growth opportunities for market expansion.

Legal and operational due diligence covers the structural and compliance aspects of your business. This includes verifying your corporate structure and ownership, reviewing intellectual property and technology assets, ensuring regulatory compliance, and examining human resources and employment matters.

Negotiation and documentation (1-2 months)

Once due diligence is complete, the negotiation phase begins. This is where the real deal-making happens, and you'll need to balance getting fair value with maintaining a working relationship with your new partners.

Key negotiation points include the purchase price and payment structure, earnout metrics and measurement periods, management retention and employment terms, representations, warranties, and indemnification clauses, plus post-closing covenants and restrictions that will govern your ongoing involvement.

Essential documents that will be drafted include the letter of intent and exclusivity agreements, comprehensive purchase agreements with related schedules, employment agreements and retention plans, transition services agreements, and escrow and holdback arrangements to protect both parties.

How to prepare for a private equity sale

| Category | Preparation Area | Key Actions |

|---|---|---|

| Financial | Clean up your books | • Complete audited financial statements for 2-3 years • Resolve any outstanding tax issues or disputes • Implement proper accounting systems and controls • Document all assets, liabilities, and contingent obligations |

| Financial | Optimize your business | • Maximize EBITDA through operational improvements • Resolve customer concentration issues • Strengthen management team and succession planning • Implement proper corporate governance |

| Operational | Document everything | • Standard operating procedures and policies • Customer contracts and supplier agreements • Intellectual property and technology documentation • Regulatory compliance and permits |

| Operational | Build your team | • Strengthen management depth and capabilities • Implement proper HR policies and procedures • Develop succession plans for key personnel • Create employee retention and incentive programs |

| Strategic | Market positioning | • Develop clear growth strategy and business plan • Identify acquisition opportunities and synergies • Build relationships with potential strategic partners • Prepare competitive analysis and market research |

| Strategic | Exit planning | • Understand your post-sale role and responsibilities • Plan for earnout achievement and measurement • Consider tax planning and wealth management • Prepare for life after the sale |

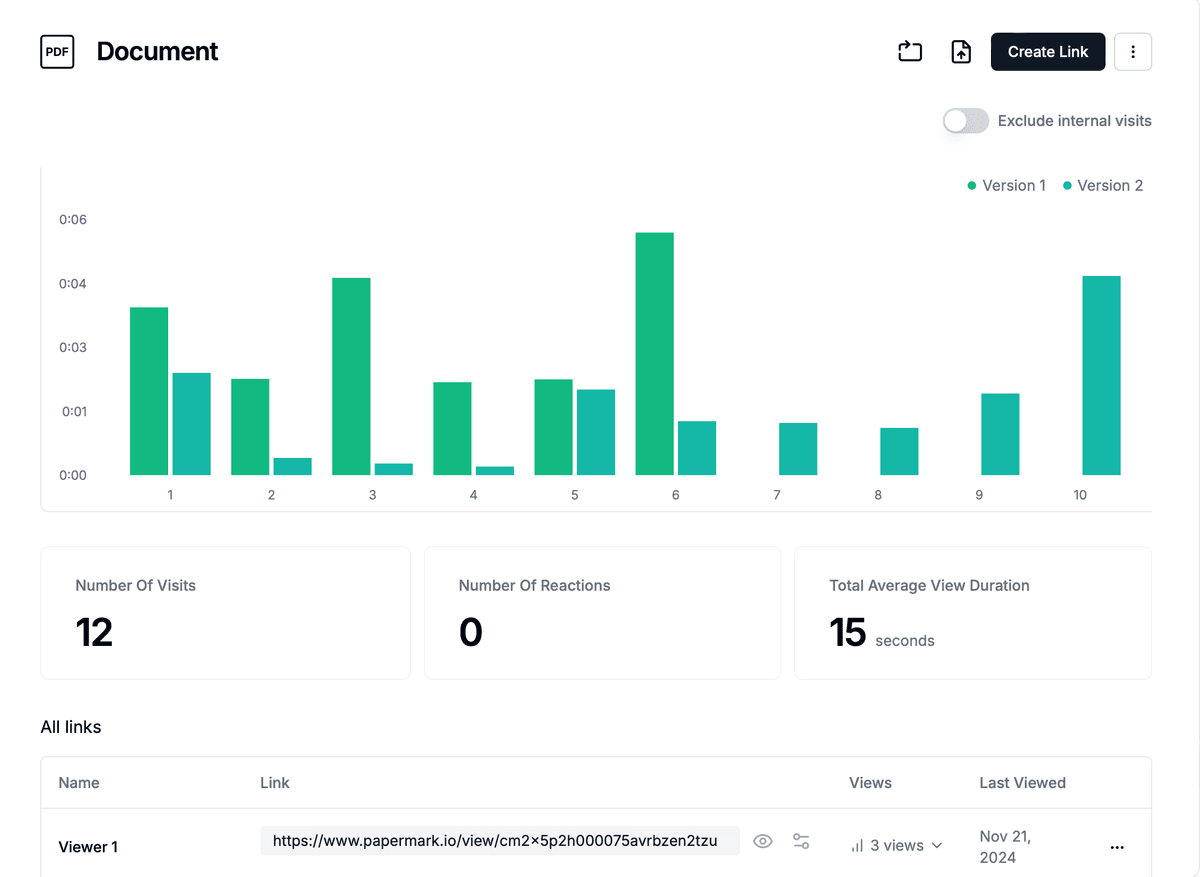

Data Room for private equity sales

When selling your business to private equity, you need a professional virtual data room (VDR) to manage the due diligence process effectively. Papermark is specifically designed for PE transactions, providing secure document sharing with detailed analytics to help you track buyer engagement and close deals faster.

Why Papermark is ideal for PE sales

Professional presentation:

- Custom branding with your company logo and colors

- Clean, organized interface that impresses PE buyers

- Multiple data rooms for different buyer groups

- Custom domains for a professional appearance

Advanced security:

- Granular permissions for different buyer teams

- NDA gating before document access

- Document watermarking and download restrictions

- Complete audit trails for compliance

Engagement analytics:

- Page-by-page tracking of document views

- Identify which buyers are most engaged

- Track review progress and completion rates

- Export reports for management updates

Key features for PE transactions

Document organization:

- Financial statements and audit reports

- Legal documents and corporate records

- Commercial contracts and customer agreements

- Operational procedures and policies

- Intellectual property and technology assets

Buyer management:

- Separate rooms for different PE firms

- Group-based access controls

- Document expiration and renewal

- Activity monitoring and reporting

Process optimization:

- Real-time notifications of document access

- Automated follow-up reminders

- Integration with CRM systems

- Mobile access for on-the-go management

Major 2025 private equity sales

Below are several headline transactions from 2025 that illustrate how sponsors structure large, complex sale processes and the kinds of buyers involved (strategics, sponsor‑backed platforms, and sovereign capital). Use these as reference points when planning positioning, diligence workstreams, and valuation narratives.

1. Constellation Energy Corp. acquiring Calpine Corp. (January)

- Buyer: Constellation Energy Corp. (strategic)

- Seller/backers: Calpine previously backed by Energy Capital Partners and CPP Investments

- Notes: Large U.S. independent power producer combining with a major integrated energy player; scale and fleet optimization were key rationale. Sponsors orchestrated a multi‑party process with significant regulatory and market structure considerations.

2. Sycamore Partners acquiring Walgreens Boots Alliance (March)

- Buyer: Sycamore Partners (financial sponsor)

- Target: Walgreens Boots Alliance (WBA)

- Notes: Sponsor‑led acquisition of a global retail pharmacy chain emphasizing turnaround potential, portfolio reshaping, and footprint optimization; complex separation and carve‑out planning across regions.

3. Global Payments Inc. acquiring Worldpay Inc. (April)

- Buyer: Global Payments Inc. (strategic)

- Other parties: GTCR involved in the transaction

- Notes: Consolidation in payments infrastructure; thesis centered on scale economics, omnichannel capabilities, and cross‑border volumes. Illustrates combined sponsor/strategic dynamics in high‑throughput fintech.

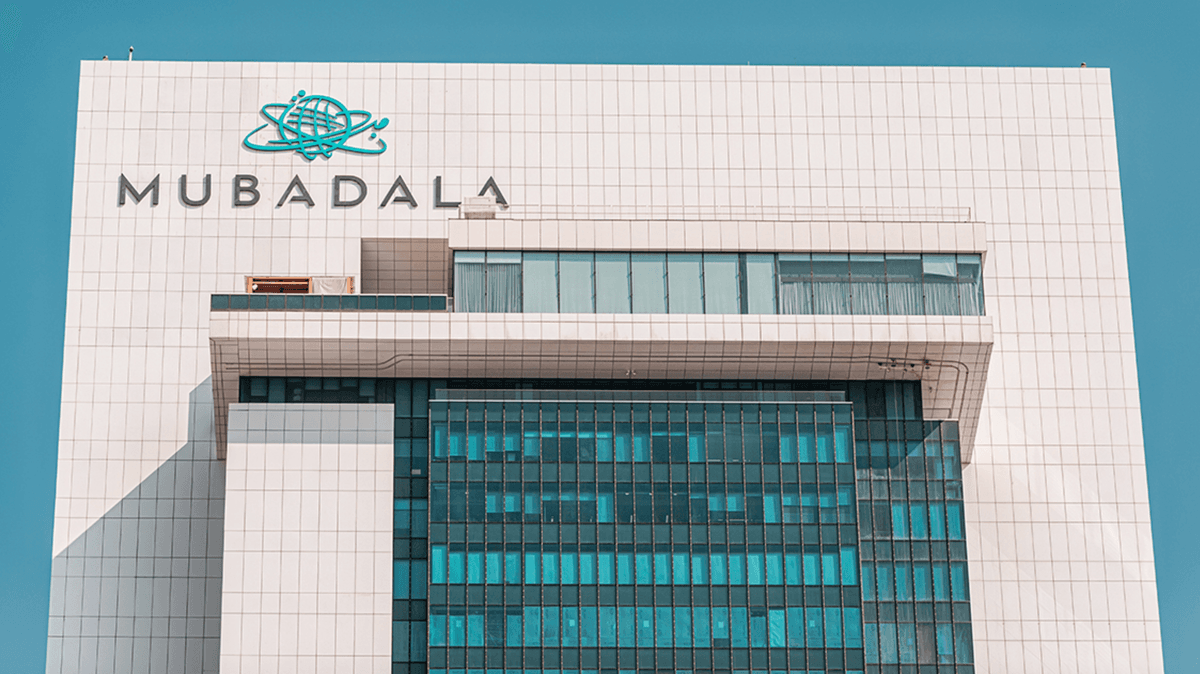

4. Mubadala Capital acquiring TWG Global (April)

- Buyer: Mubadala Capital (sovereign/sponsor)

- Target: TWG Global

- Notes: The deal underscores sovereign‑backed capital’s role in specialty and growth platforms; focus on international expansion and governance with long‑duration capital.

What these deals signal for sellers

- Expect hybrid buyer universes (strategic + sponsor + sovereign) even in single processes

- Prepare carve‑out plans early for multinational footprints and shared services

- Emphasize operating levers: scale benefits, mix shift, cross‑sell, and cash conversion

- Run a data‑driven process with clean KPIs and audit‑ready diligence materials