Investment banking for startups: how the big players move capital

You've probably heard the term "investment banking" thrown around in startup circles, especially when companies reach growth stages or consider exits. But what exactly do these financial powerhouses do, and when should your startup care about them?

Investment banks are the architects of major capital movements. They help companies raise serious money, navigate acquisitions, and execute complex financial strategies that can make or break a business trajectory. For startups scaling beyond seed rounds or eyeing strategic exits, understanding investment banking isn't just helpful—it's essential.

What is investment banking?

Investment banking is a specialized segment of financial services that helps corporations, governments, and institutions raise capital and execute complex financial transactions. Unlike commercial banks that focus on deposits and loans, investment banks provide advisory services, underwriting, and facilitate strategic deals like mergers, acquisitions, and IPOs.

For startups, investment banks become relevant when you're ready for Series B and beyond, planning an IPO, or considering acquisition opportunities. They bring expertise, networks, and credibility that can transform your fundraising outcomes.

Key services investment banks provide

Investment banks offer several core services that become crucial as your startup matures. Capital raising is perhaps most relevant for growth-stage companies—investment banks help you issue stocks and bonds through their underwriting services, bringing institutional credibility to your offerings.

M&A advisory comes into play when you're considering strategic acquisitions or positioning your company for sale. Banks provide valuation expertise, identify potential buyers or targets, and negotiate terms that maximize value. Their sales and trading desks facilitate the buying and selling of securities and financial instruments, though this matters more for public companies.

Research capabilities provide market analysis and investment recommendations that can influence how institutional investors view your company. Finally, asset management services help manage investment portfolios for institutional and individual clients, including the pension funds and family offices that might invest in your later rounds.

Types of investment banks

Not all investment banks are created equal, and choosing the right one depends on your startup's stage and deal size. Bulge bracket banks like Goldman Sachs, JPMorgan Chase, and Morgan Stanley are the household names that offer full-service capabilities across all regions and deal sizes. They're ideal for large IPOs and billion-dollar acquisitions, but their fees reflect their prestige.

Middle market banks such as Jefferies and Houlihan Lokey focus on mid-sized deals, typically under $1 billion in transaction value. These firms often provide better attention to growing startups that don't yet command the largest deals. They balance expertise with accessibility.

Boutique banks like Lazard and Evercore concentrate on specific industries or transaction types, often providing specialized M&A advisory services. For tech startups, boutiques with sector expertise can deliver more relevant market intelligence and buyer networks than generalist banks.

How investment banking works

Investment banks earn revenue through fees rather than interest on loans. They charge clients for services like underwriting (typically 1-7% of deal value), M&A advisory (1-3% of transaction value), and ongoing relationship management. For a $100 million transaction, you're looking at $1-7 million in fees—substantial, but potentially worth it for complex deals.

The typical deal process starts with pitch and engagement, where multiple banks compete for your business through presentations and proposals. Once engaged, they conduct due diligence—a comprehensive analysis of your business, financials, and market position. This is where having organized documentation in a secure data room becomes crucial.

Next comes documentation, where banks create offering memorandums, financial models, and legal documents that tell your story to potential investors or buyers. The marketing phase involves presenting these materials to qualified prospects. Finally, execution means managing the transaction through closing and settlement, coordinating all parties until money changes hands.

Why investment banks use data rooms

Investment banks rely heavily on secure data rooms to manage complex transactions. When you're dealing with multiple parties—buyers, sellers, advisors, lawyers—you need a centralized system that keeps everyone organized while maintaining strict security. Learn more about what is a data room in investment banking and how to set one up.

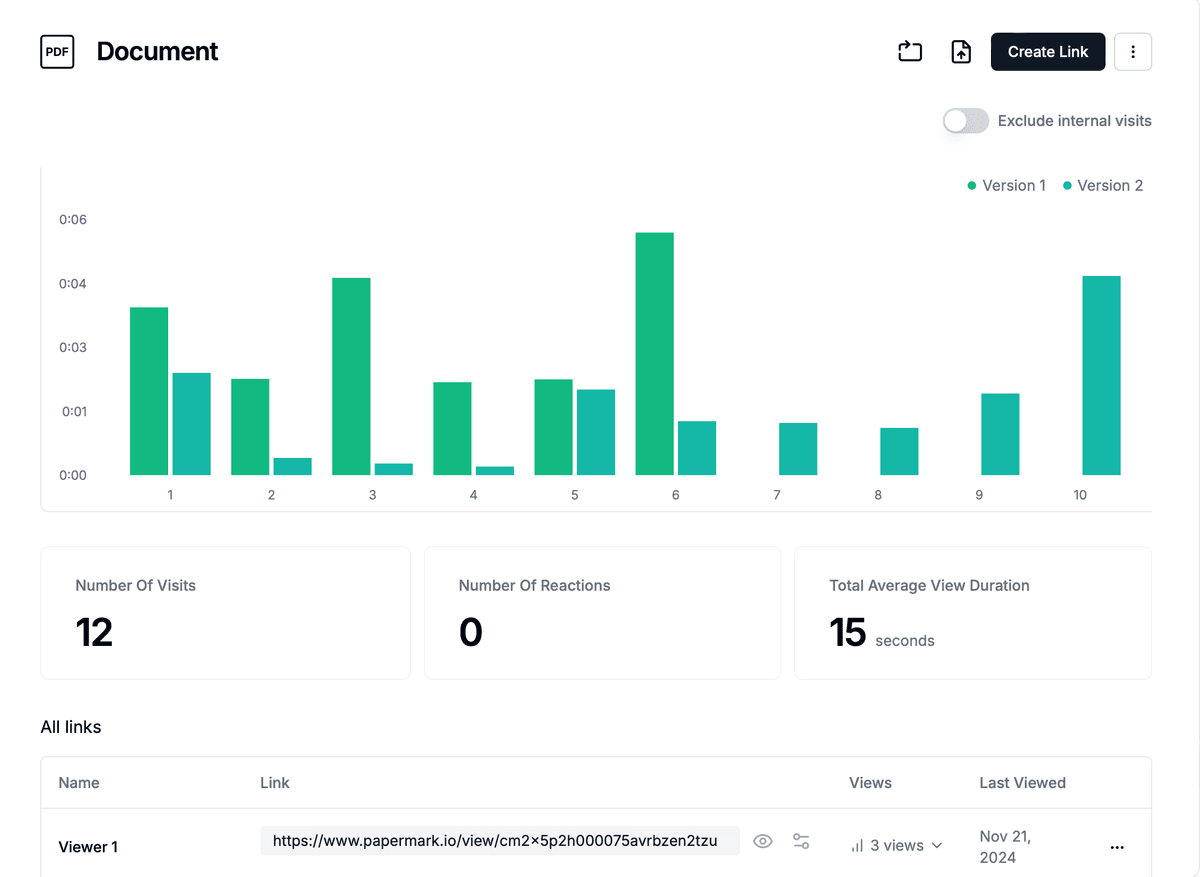

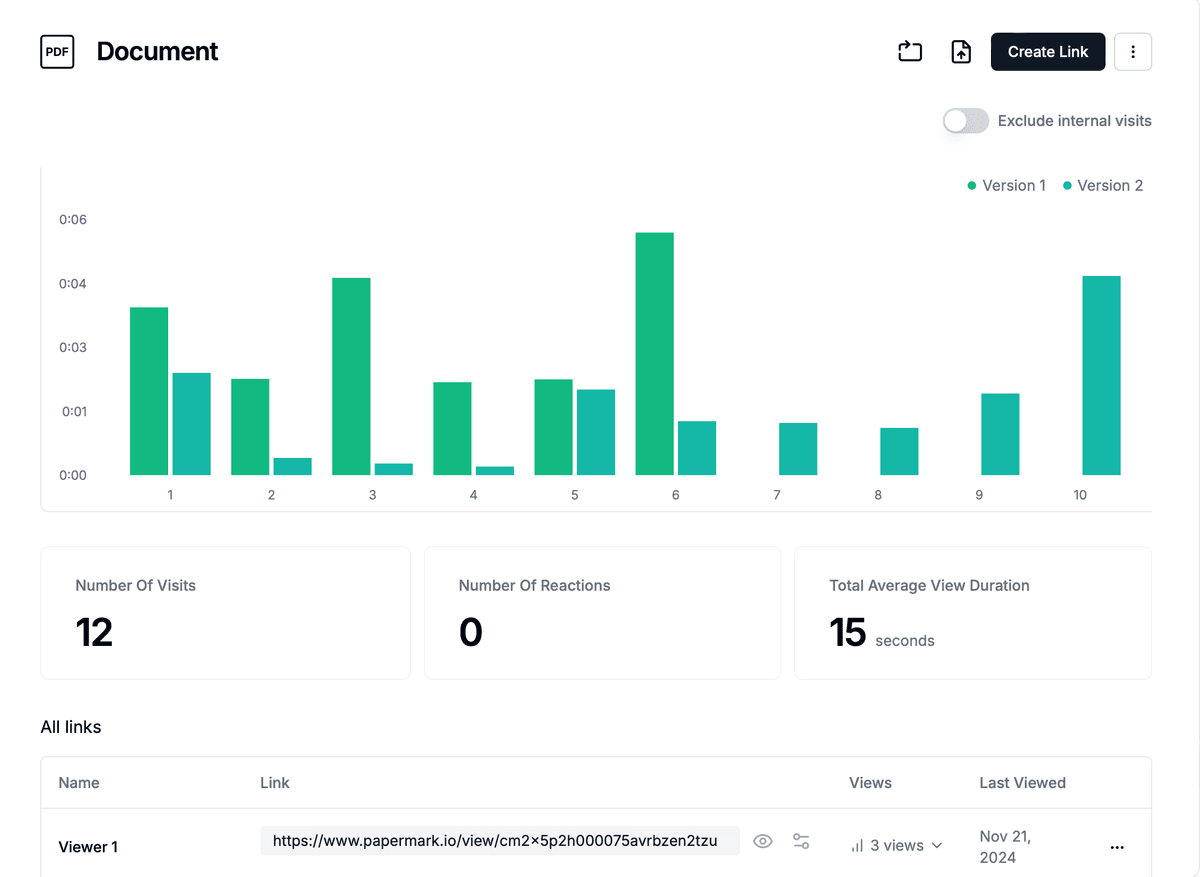

Data rooms let banks control access permissions with surgical precision, ensuring confidential information only reaches authorized eyes during due diligence. The ability to track engagement is invaluable—seeing which parties spend the most time reviewing materials helps prioritize follow-ups and gauge genuine interest versus tire-kickers.

Maintaining audit trails isn't just good practice, it's often required for regulatory compliance and deal documentation. Every download, view, and document access gets logged. Data rooms also facilitate Q&A processes between buyers and sellers, creating a structured dialogue that prevents information from getting lost in email threads.

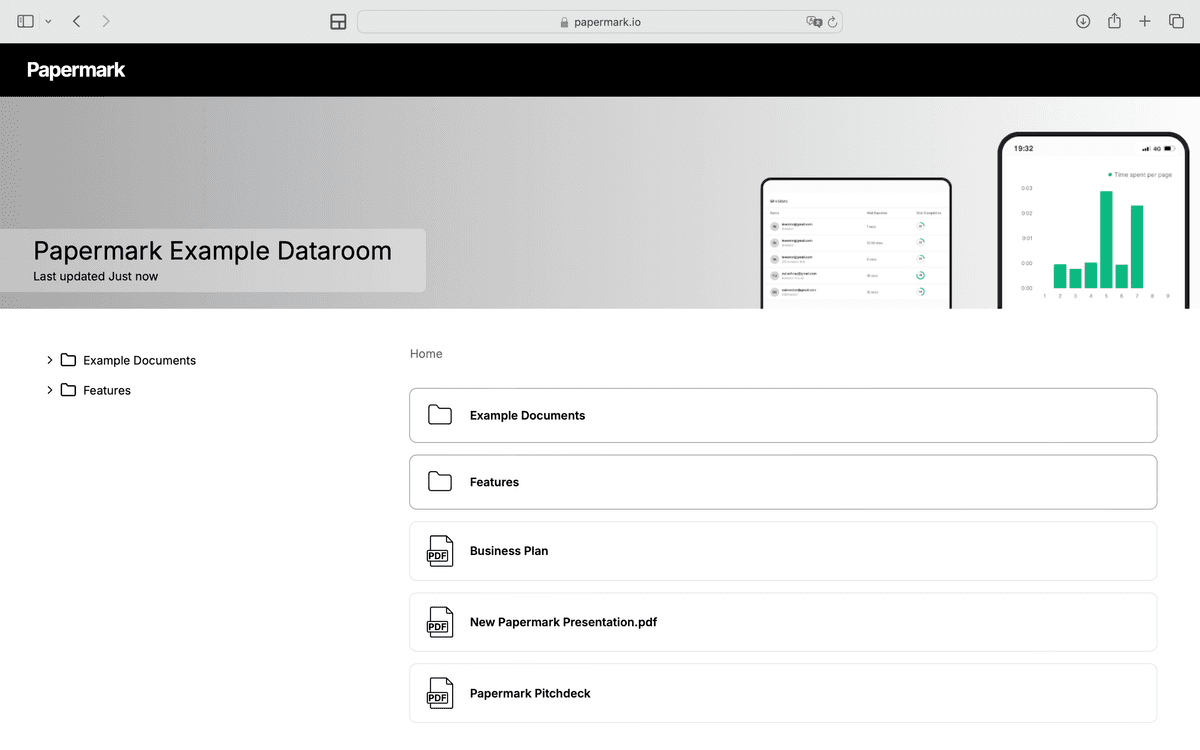

How to create an investment banking data room with Papermark

Follow these steps to set up a professional data room for your investment banking transactions.

-

Create your Papermark account

Visit the app and sign in. Start with the free plan and upgrade when you need advanced features for larger deals. -

Set up your deal room

Click "New data room", name it (e.g., "TechCorp M&A Process"), and invite team members who will manage documents and client access.

-

Organize deal documents

Upload folders for Financials, Legal, Commercial, Technical, and HR documents. Maintain clear folder structure for easy navigation by potential buyers.

-

Configure access controls

Set up password protection, email verification, link expiry dates, and viewer limits. Add NDA gates for sensitive information access.

-

Brand the data room

Add your bank's logo, select corporate colors, and connect a custom domain for a professional client experience.

-

Manage multiple bidders

Create separate rooms for different buyer groups or use granular permissions to show different documents to different parties.

-

Track deal progress

Monitor which documents buyers access most frequently and track time spent on key materials to prioritize follow-ups.

Best practices for investment banking data rooms

Organization makes or breaks a data room experience. Create separate folders for initial due diligence, final round materials, and closing documents—organizing by deal stage prevents confusion and shows professionalism. Use clear version control with naming conventions like "Financial_Model_v3.2.xlsx" so nobody wastes time reviewing outdated materials.

Implement tiered access levels for different buyer groups and advisors. Not everyone needs to see everything, and granular permissions protect sensitive information while maintaining transparency where needed. Keep all parties informed of new document uploads and room changes through automated notifications.

Finally, ensure all data handling meets regulatory requirements for financial services. For sensitive startup transactions, especially those involving due diligence processes, security compliance isn't optional—it's fundamental to maintaining trust and avoiding legal issues.