Real Estate Due Diligence Checklist: A Comprehensive Guide for 2025

Conducting thorough due diligence is crucial when investing in real estate. It helps uncover potential risks, ensures informed decision-making, and safeguards your investment. This guide simplifies the due diligence process and introduces the simple checklist and data room page.

🏠 What Is Real Estate Due Diligence?

Real estate due diligence is the comprehensive evaluation of a property's legal, financial, physical, and environmental aspects before finalizing a transaction. This process aims to identify any issues that could affect the property's value or lead to future liabilities.

📋 Real Estate Due Diligence Checklist

Here's a comprehensive checklist to guide your due diligence process:

| Category | Documents | Priority |

|---|---|---|

| Legal Documentation | Title Deeds, Zoning Laws, Liens, Easements | High |

| Financial Assessment | Income Statements, Tax Records, Operating Expenses | High |

| Physical Inspection | Structural Reports, HVAC, Plumbing, Electrical Systems | High |

| Environmental Evaluation | Environmental Assessments, Compliance Reports | High |

| Tenant and Lease Review | Lease Agreements, Tenant Histories, Occupancy Rates | Medium |

| Regulatory Compliance | Building Codes, Permits, Licenses | High |

Detailed Breakdown of Each Category

1. Legal Documentation

Ensure all legal aspects of the property are in order:

- Title deeds and ownership verification

- Zoning laws and land use restrictions

- Liens, easements, or encumbrances

- Property tax records

- Survey reports

- Legal disputes or litigation history

2. Financial Assessment

Analyze the property's financial performance and potential:

- Income statements and rent rolls

- Property tax records

- Utility bills and operating expenses

- Maintenance costs

- Insurance policies

- Capital improvement plans

3. Physical Inspection

Conduct a thorough evaluation of the property's condition:

- Structural integrity report

- HVAC system assessment

- Plumbing and electrical systems

- Roof condition

- Foundation inspection

- Pest inspection report

4. Environmental Evaluation

Identify potential environmental risks and compliance:

- Phase I Environmental Site Assessment

- Asbestos and lead paint reports

- Soil contamination tests

- Flood zone determination

- Environmental compliance records

5. Tenant and Lease Review

Evaluate existing tenancies and lease agreements:

- Current lease agreements

- Tenant payment histories

- Occupancy rates

- Tenant improvement allowances

- Lease expiration schedules

- Tenant credit reports

6. Regulatory Compliance

Ensure the property meets all regulatory requirements:

- Building code compliance

- Fire safety certificates

- Accessibility compliance

- Zoning compliance

- Required permits and licenses

- Historical preservation requirements (if applicable)

💡 Best Practices for Real Estate Due Diligence

To get the most out of your real estate due diligence process, organization and consistency are key. Begin by setting up your documentation according to clear, logical categories—think legal, financial, physical, environmental, and tenant-related. Within each category, use a consistent naming convention and tag files with relevant metadata. This small step will significantly improve document discoverability and clarity for all stakeholders.

Next, focus on access control. Instead of giving blanket access to everyone involved, define user roles and permission levels based on each participant's responsibility. Regularly review and update these permissions, especially if your team or partner list changes. Monitoring access patterns not only adds a layer of security but also helps identify which documents are drawing attention and which might need follow-up.

Version control is another critical element. Keep a clean record of document updates, and always retain previous versions for reference. Notifying stakeholders of significant changes ensures everyone remains aligned, avoiding miscommunication and redundant work.

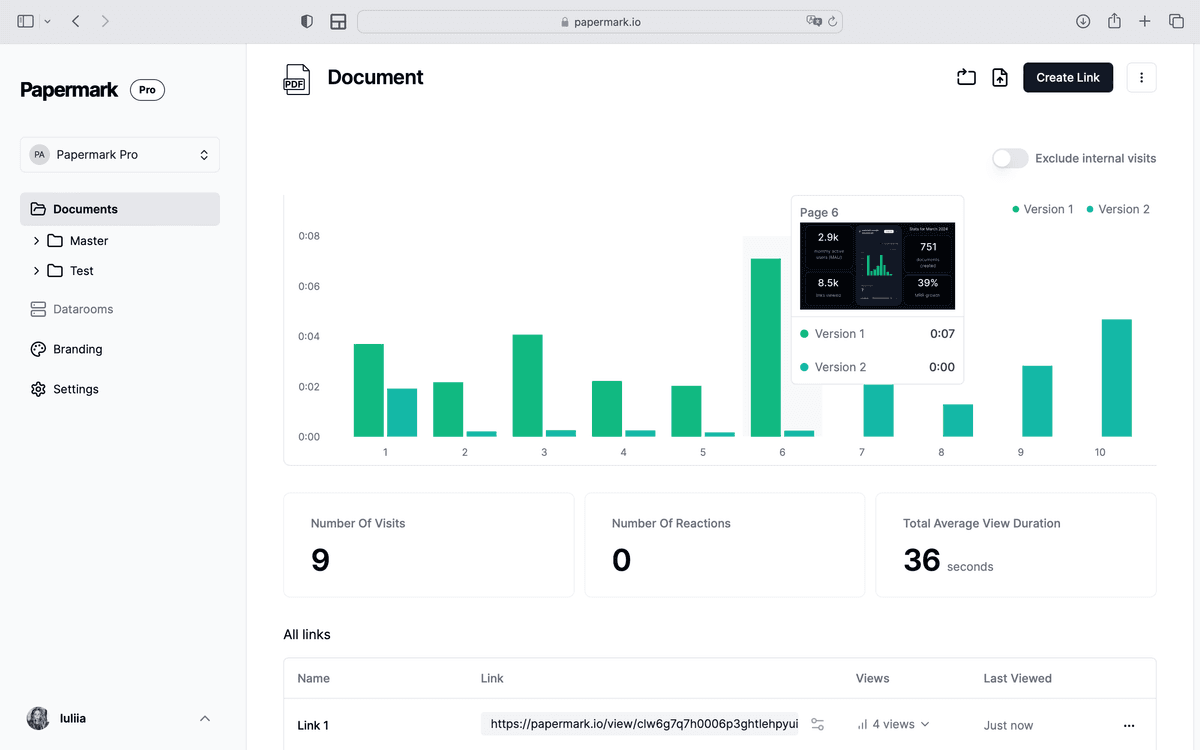

Lastly, make data insights work for you. The analytics tools built into platforms like Papermark let you see how documents are being accessed, how long they're viewed, and by whom. This information can uncover bottlenecks, highlight critical areas of interest, and help you keep the due diligence timeline on track.

🗄️ The Role of Virtual Data Rooms in Real Estate Due Diligence

Virtual data rooms (VDRs) have become essential tools in modern real estate due diligence. They provide a secure, centralized platform for managing and sharing sensitive property documents. Here's why they're crucial:

- Enhanced Security: Bank-level encryption and advanced access controls

- Efficient Collaboration: Multiple parties can review documents simultaneously

- Document Tracking: Real-time analytics on document engagement

- Audit Trail: Complete record of all document access and activities

- Cost Reduction: Eliminates physical document storage and courier costs

🔐 Security and Controls for Due Diligence Process

A robust virtual data room provides comprehensive security controls to protect sensitive real estate documents during the due diligence process:

- Granular Access Controls: Set specific permissions for different stakeholders (investors, lawyers, brokers)

- Document-Level Security: Control who can view, download, or print specific documents

- Time-Based Access: Set expiration dates for document access

- IP Restrictions: Limit access to specific geographic locations or networks

- Two-Factor Authentication: Add an extra layer of security for document access

- Screenshot Protection: Prevent unauthorized screenshots of sensitive documents

- Watermarking: Add dynamic watermarks with viewer information

- NDA Requirements: Require viewers to accept terms before accessing documents

These security features ensure that your real estate due diligence process remains confidential and controlled, while still allowing efficient collaboration between all parties involved.

🔍 Key Features of a Modern Real Estate Data Room for Due Diligence

A robust real estate data room doesn't just store files—it transforms how your team collaborates, secures information, and closes deals faster. With modern and secure data room solution, document organization becomes seamless. The platform supports hierarchical folder structures, intuitive drag-and-drop uploads, and auto-indexing that keeps files neatly categorized. Document version control and custom metadata fields ensure every update is tracked and easily searchable.

Security is built-in at every level. With two-factor authentication, watermarking, IP restrictions, and fine-grained download and screenshot controls, sensitive information stays protected. You can also set document expiration dates to automatically limit access when due diligence periods end. For comprehensive document security, explore our secure file sharing features.

Collaboration flows more naturally with features like Q&A conversations, task assignments, and real-time notifications. Papermark's Q&A tools and detailed user tracking ensure that nothing slips through the cracks. These features allow legal teams, brokers, and buyers to stay on the same page—literally.

Where Papermark really shines is in its reporting. Built-in analytics track which documents are viewed most often, how long users engage with them, and who's falling behind. Exportable audit trails and engagement logs bring full visibility to your deal process, helping you make smarter, faster decisions.

✅ Conclusion

Conducting thorough real estate due diligence is essential for making informed investment decisions. By following a structured checklist and leveraging software like Papermark for document management, you can streamline the process, mitigate risks, and ensure a successful transaction.

Remember, the key to successful real estate due diligence is organization, thoroughness, and secure document management. Papermark provides the tools you need to manage this complex process efficiently and securely.

Ready to streamline your real estate due diligence process? Create a due diligence data room today and experience the difference a professional data room can make.

❓ Frequently Asked Questions

📚 Related resources:

For more information about data rooms and due diligence, check out our related articles: