CRM for private equity: How to choose the right one (2025 guide)

You're sitting in your office, staring at a spreadsheet with 200+ potential investors, trying to remember which LP you met at that conference last month and whether they're interested in your new fund. Your deal pipeline is scattered across emails, Excel files, and sticky notes. Meanwhile, your team is asking for updates on the portfolio company you're trying to exit, but you can't find the latest financials.

Sound familiar? This is the reality for many private equity professionals who rely on outdated tools to manage complex relationships, deal flow, and investor communications. The right CRM can transform this chaos into a streamlined, professional operation that helps you close more deals and maintain stronger investor relationships.

How to choose a CRM for private equity

Selecting the right CRM for your PE firm requires careful consideration of your specific needs, team size, and investment focus. Here's a structured approach to making the right choice:

Define your primary use cases

| Use Case | Key Activities |

|---|---|

| Relationship management | • Track LP communications and meeting history • Manage portfolio company relationships • Monitor advisor and consultant networks • Track warm introductions and referrals |

| Deal flow management | • Source and evaluate investment opportunities • Coordinate due diligence across workstreams • Track deal pipeline and investment committee decisions • Manage deal documentation and communications |

| Fundraising support | • Organize investor materials and presentations • Track fundraising progress and commitments • Manage roadshow logistics and follow-ups • Generate investor reports and updates |

Evaluate key features

| Feature Category | Key Capabilities |

|---|---|

| Core functionality | • Contact and relationship management • Deal pipeline and opportunity tracking • Email integration and activity capture • Document management and sharing • Reporting and analytics dashboards |

| Advanced capabilities | • AI-powered relationship intelligence • Automated data capture from emails/calendar • Integration with existing tools (Outlook, Salesforce) • Mobile access for on-the-go management • Custom fields and workflow configuration |

Consider your firm's characteristics

| Characteristic | Firm Type | CRM Focus |

|---|---|---|

| Firm size and stage | Emerging managers | Focus on cost-effective solutions with strong relationship mapping |

| Firm size and stage | Mid-market firms | Look for comprehensive deal management and reporting |

| Firm size and stage | Large funds | Prioritize enterprise features, integrations, and scalability |

| Investment focus | Sector specialists | Choose tools with industry-specific data sources |

| Investment focus | Geographic focus | Ensure global contact database and multi-currency support |

| Investment focus | Deal size | Match complexity to your typical transaction requirements |

| Team structure | Small teams | Prioritize ease of use and quick setup |

| Team structure | Distributed teams | Ensure cloud access and mobile capabilities |

| Team structure | Large organizations | Look for role-based permissions and workflow automation |

Top 5 CRM tools for private equity

| Tool | Best for | Key strength | Pricing model |

|---|---|---|---|

| Affinity | Network-driven sourcing | AI relationship intelligence | Per-user annual |

| DealCloud | Comprehensive deal management | Enterprise reporting | Contact sales |

| 4Degrees | Lightweight relationship CRM | Automated data capture | Custom |

| Altvia | Investor relations focus | LP communications | Contact sales |

| eFront | Large-scale fund administration | End-to-end platform | Enterprise |

| Papermark Data room | Secure document sharing | VDR analytics and branding — Not a CRM | Freemium |

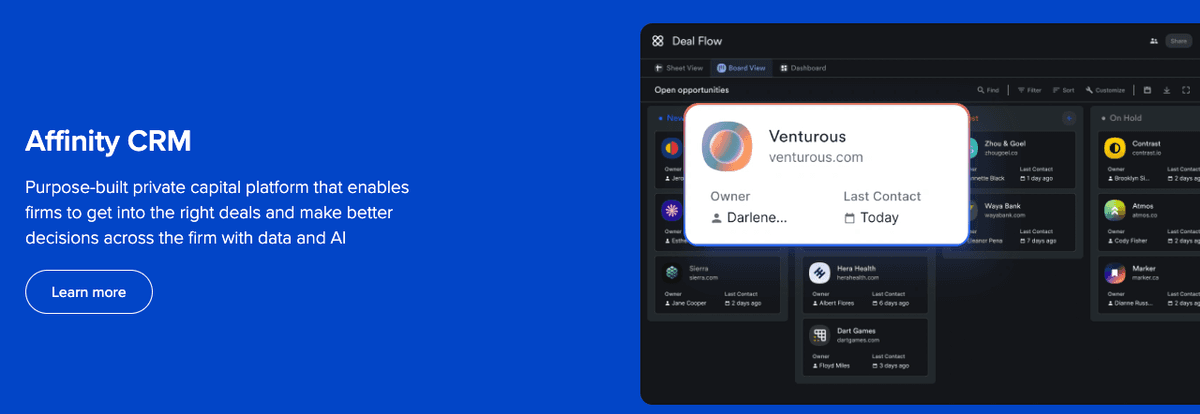

1. Affinity — relationship intelligence CRM

Website: affinity.co

AI-powered relationship intelligence platform trusted by 50% of the top 300 venture firms globally. Auto-captures relationships from email/calendar and maps warm introductions across your network. Powers over 1 million deals and $1 trillion in assets tracked through the platform, with proven results like 66% increase in deals reviewed annually.

Features:

- Email/calendar ingestion to auto-create contacts

- Relationship scores and warm-intro graph

- Pipelines and reminders

- AI-powered meeting intelligence and note-taking

- 40+ premium data sources for enrichment

- Mobile app for relationship insights on-the-go

- Enterprise-grade security (SOC2, ISO27001)

Use cases:

- Mapping warm paths into sponsors and lenders

- Tracking outreach and meeting notes

- Deal sourcing and pipeline management

- Portfolio support and investor relations

Best for: Teams that rely on network-driven sourcing and firms needing automated data capture and enrichment

Pricing:

- Essential: $2,000/user/year (~$167/user/month) — basic deal pipeline, relationship scoring

- Scale: $2,300/user/year (~$192/user/month) — deal sourcing extensions, mobile access

- Advanced: $2,700/user/year (~$225/user/month) — AI meeting intelligence, bulk email

- Enterprise: Contact sales — SSO, API access, custom governance

Reviews: 4.4/5 (69 reviews) on G2

2. DealCloud (Intapp) — deal & pipeline management

Website: dealcloud.com

DealCloud centralizes firm and market intelligence with AI-assisted relationship and deal management. It's more than a CRM: teams use it to source, evaluate, and execute opportunities with configurable dashboards, IC reporting, and deep Office/Microsoft 365 integrations. Preconfigured industry workflows help firms get up and running quickly while keeping a single source of truth across relationships, deals, and marketing.

Features:

- Relationship & business intelligence with Applied AI

- Deal pipeline and IC reporting dashboards

- Outlook/Microsoft 365 integration and calendar sync

- No-code configuration for fields, workflows, and reports

- Data foundation and partner ecosystem integrations

Use cases:

- Centralizing deal flow from bankers and sponsors

- IC materials and portfolio reporting

- Comprehensive deal management and execution

Best for: Mid-to-large PE funds that need deep reporting and enterprise-level functionality

Pricing: Contact sales (pricing not publicly disclosed)

Reviews: 4.4/5 (17 reviews) on G2

3. 4Degrees — deal & relationship intelligence

Website: 4degrees.ai

Relationship intelligence platform designed by ex-investors for private markets teams. Trusted by hundreds of teams, it saves an average of 100 hours per week by streamlining operations and unlocking 4,000+ new signals for deal opportunities. Deal sourcing and relationship intelligence, with smart reminders and pipeline views.

Features:

- Relationship intelligence across email/calendar

- Pipeline views and tasks

- Sourcing recommendations

- Chrome/LinkedIn/Gmail/Outlook extensions for data capture

- Salesforce integration for relationship intelligence

- Mobile app for deal management anywhere

- Real-time alerts for job transitions and news

Use cases:

- Prioritizing top relationships and active deals

- Finding warm introductions to target companies

- Automating data entry and contact management

- Portfolio support and LP relationship tracking

Best for: PE/VC teams wanting a lighter relationship-centric CRM and firms wanting to eliminate spreadsheet-based deal tracking

Pricing: Custom (contact sales)

Reviews: 4.5/5 (5 reviews) on G2

4. Altvia — investor relations & portfolio management

Website: altvia.com

Altvia provides comprehensive investor relations and portfolio management solutions specifically designed for private equity and venture capital firms. The platform streamlines LP communications, portfolio reporting, and deal management with a focus on compliance and investor transparency.

Features:

- Investor portal and LP communications

- Portfolio company performance tracking

- Deal flow management and pipeline analytics

- Document management and secure sharing

- Compliance reporting and audit trails

- Mobile access and integration capabilities

Use cases:

- Managing LP relationships and communications

- Portfolio company oversight and reporting

- Fundraising support and investor updates

- Compliance and regulatory reporting

Best for: PE firms emphasizing investor relations and portfolio management workflows

Pricing: Contact sales for custom pricing

Reviews: Strong reputation in the PE industry for investor relations focus

5. eFront — alternative investment management

Website: efront.com

eFront (now part of BlackRock) is a comprehensive alternative investment management platform that serves private equity, real estate, infrastructure, and private debt firms. The platform provides end-to-end solutions from fundraising to portfolio management and investor reporting.

Features:

- Fund administration and accounting

- Portfolio company management

- Investor relations and reporting

- Risk management and compliance

- Performance analytics and benchmarking

- Integration with external data sources

Use cases:

- Large-scale fund administration

- Complex portfolio management across multiple asset classes

- Institutional investor reporting

- Risk and compliance management

Best for: Large PE firms and multi-asset managers requiring comprehensive fund administration

Pricing: Enterprise-level pricing (contact sales)

Reviews: Industry leader for large-scale alternative investment management

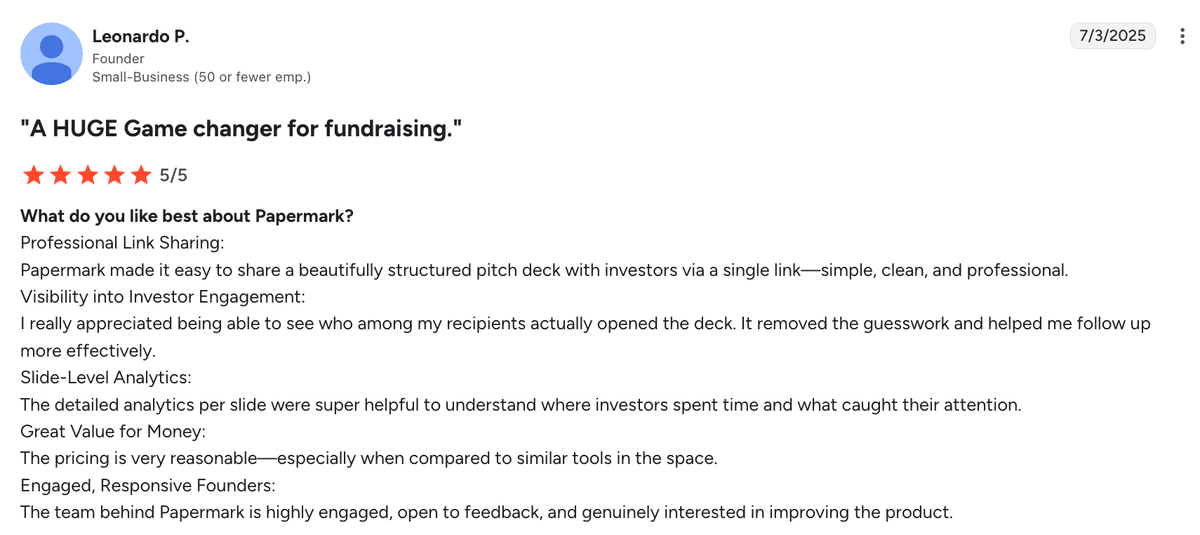

Secure document sharing in the deal sourcing process

While CRM systems manage relationships and pipelines, private equity firms need secure document sharing for deal sourcing and due diligence. Papermark complements your CRM with branded document sharing and detailed analytics.

Key benefits for PE firms

Deal sourcing:

- Share teaser materials with potential targets

- Track engagement and identify serious buyers

- Organize due diligence documents by workstream

Due diligence coordination:

- Create separate data rooms for different advisors

- Set document expiration dates and access permissions

- Monitor review progress and identify bottlenecks

Investor communications:

- Share fund materials and performance reports

- Create branded investor portals with custom domains

- Track LP engagement with quarterly updates

Security and compliance:

- NDA gating before document access

- Document watermarking and download restrictions

- Complete audit trails for compliance

- Page-by-page tracking of document views