What is a data room in investment banking? (2026 guide)

What is a data room in investment banking?

A data room in investment banking (also called a virtual data room or VDR) is a secure digital workspace used to share confidential documents with potential buyers, investors, and advisors during M&A transactions, IPOs, and other complex deals.

Unlike email or basic cloud storage, investment banking data rooms provide advanced security, access controls, and engagement tracking to manage sensitive financial information professionally.

For more context on what is investment banking and how it works, see our comprehensive guide.

Why investment banks use data rooms

Investment banks rely on data rooms to manage complex transactions efficiently and securely. Here's how the process differs with and without data rooms:

Investment banks use data rooms to:

- Centralize deal documents in one secure location for all parties

- Control access permissions to protect sensitive information during due diligence

- Track buyer engagement to identify serious prospects and prioritize follow-ups

- Maintain audit trails for regulatory compliance and deal documentation

- Facilitate Q&A processes between buyers and sellers during transactions

- Manage multiple bidders with different access levels and document visibility

What to include in an investment banking data room

Organize your data room with these essential categories for comprehensive due diligence:

- Company overview: Corporate structure, cap table, board minutes, and organizational charts

- Financial information: Historical statements (3-5 years), projections, KPIs, and financial models

- Commercial data: Customer lists, supplier contracts, pipeline information, and pricing strategies

- Legal documentation: Contracts, agreements, litigation history, and regulatory compliance records

- Human resources: Employment agreements, policies, compensation structures, and organizational charts

- Technical assets: Intellectual property, patents, technology architecture, and security protocols

- Operations: Vendor relationships, processes, SLAs, and operational procedures

How to create an investment banking data room with Papermark

Follow these steps to set up a professional data room for your investment banking transactions.

-

Create your Papermark account

Visit the app and sign in. Start with the free plan and upgrade when you need advanced features for larger deals.

-

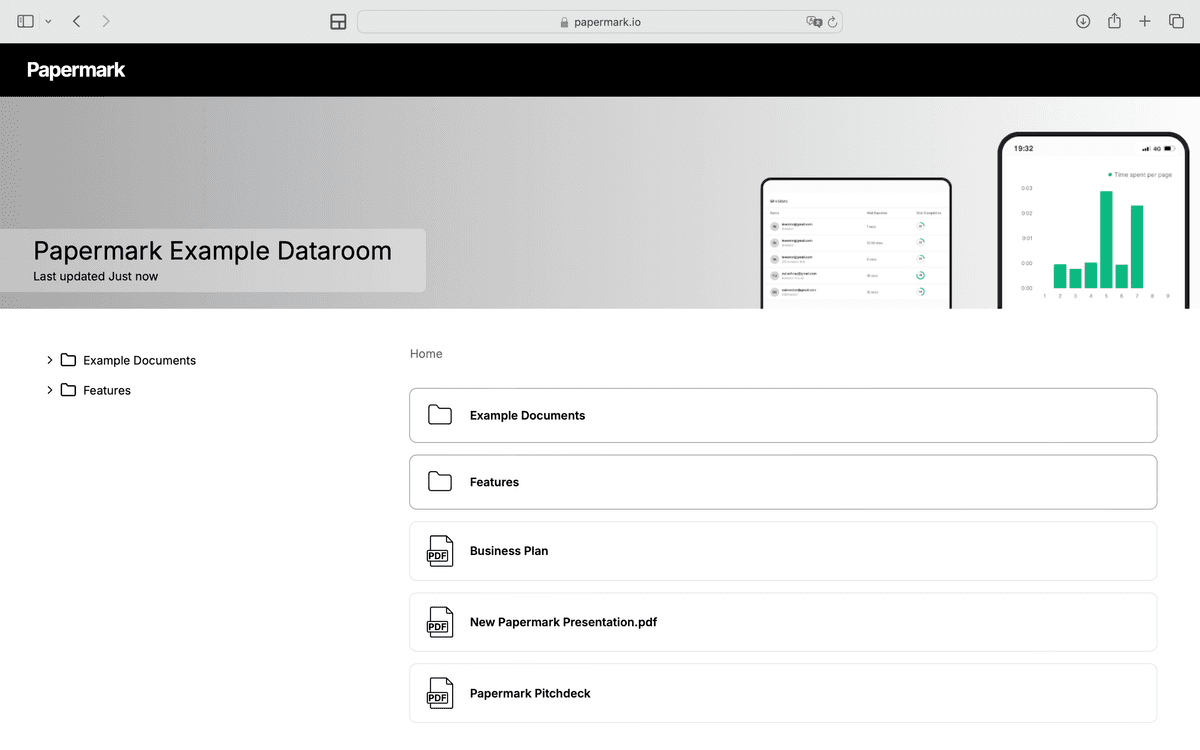

Set up your deal room

Click "New data room", name it (e.g., "TechCorp M&A Process"), and invite team members who will manage documents and client access.

-

Organize deal documents

Upload folders for Financials, Legal, Commercial, Technical, and HR documents. Maintain clear folder structure for easy navigation by potential buyers.

-

Configure access controls

Set up password protection, email verification, link expiry dates, and viewer limits. Add NDA gates for sensitive information access.

-

Brand the data room

Add your bank's logo, select corporate colors, and connect a custom domain for a professional client experience.

-

Manage multiple bidders

Create separate rooms for different buyer groups or use granular permissions to show different documents to different parties.

-

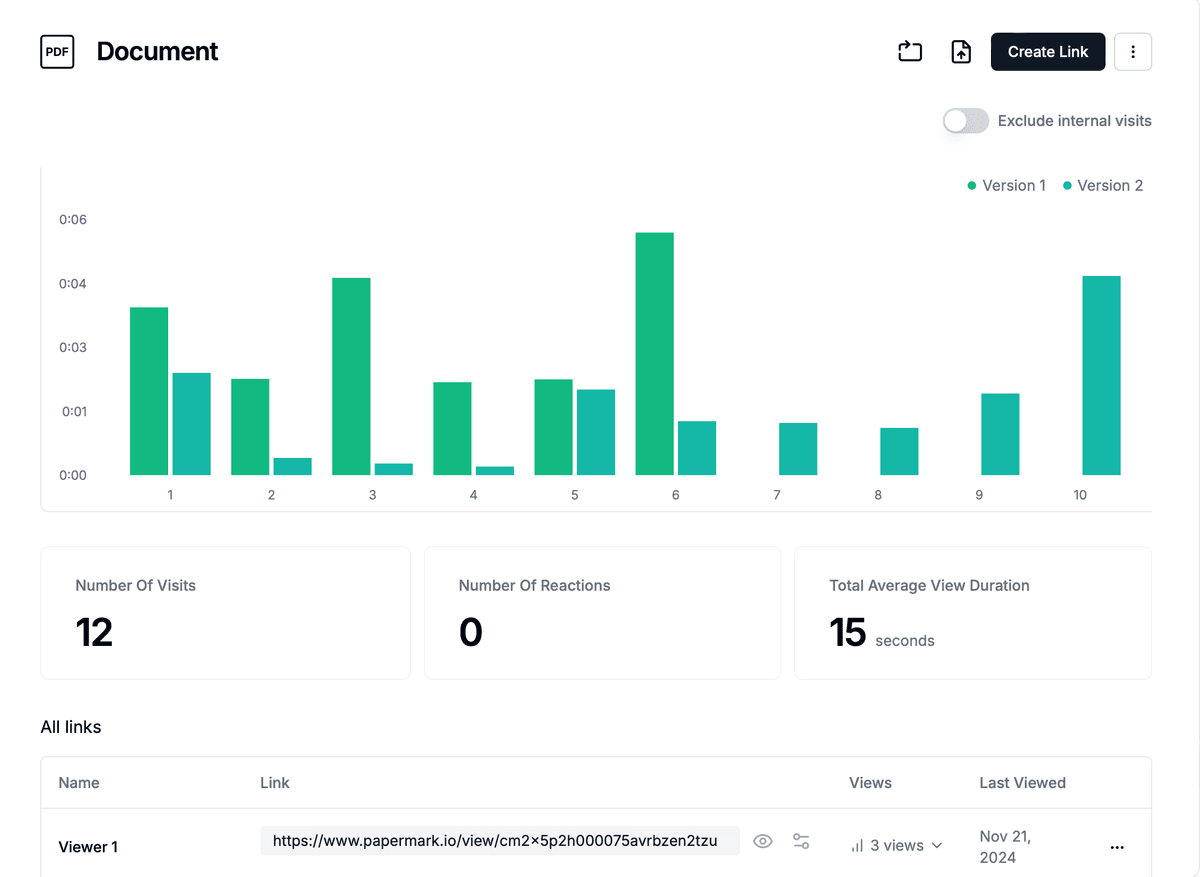

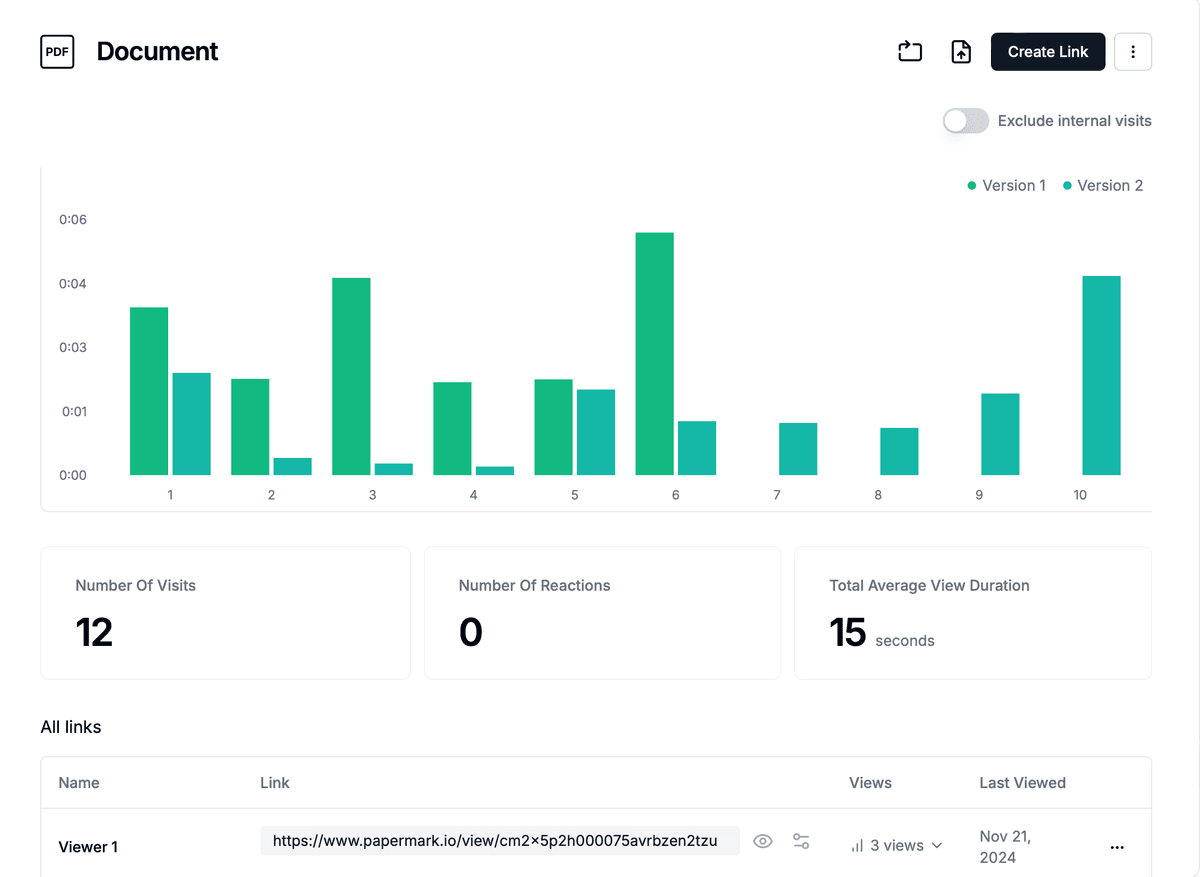

Track deal progress

Monitor which documents buyers access most frequently and track time spent on key materials to prioritize follow-ups.

Best practices for investment banking data rooms

- Organize by deal stage: Create separate folders for initial due diligence, final round materials, and closing documents

- Version control: Use clear naming conventions (e.g., "Financial_Model_v3.2.xlsx") and maintain document history

- Access management: Implement tiered access levels for different buyer groups and advisors

- Regular updates: Keep all parties informed of new document uploads and room changes

- Security compliance: Ensure all data handling meets regulatory requirements for financial services

- Document indexing: Use automatic file indexing to make documents searchable and easily accessible