Getting venture capital funding is a critical milestone for many startups seeking to scale their operations, develop products, and enter new markets. The process involves preparing compelling materials, identifying the right investors, building relationships, and navigating due diligence. While challenging, understanding how to get venture capital and following a structured approach can significantly increase your chances of success.

This guide provides a comprehensive, step-by-step approach to securing venture capital funding. Whether you're raising your first seed round or a later-stage growth round, these strategies and best practices will help you navigate the fundraising process effectively and maximize your chances of closing a successful round.

Quick recap of steps

- Prepare your pitch deck: Create a compelling presentation that clearly communicates your business model, market opportunity, and growth potential

- Identify target investors: Research and identify venture capital firms that match your stage, sector, and geographic focus

- Build relationships: Network and build relationships with investors before you need funding

- Share your pitch deck: Send your pitch deck as a trackable link to gauge investor interest

- Schedule investor meetings: Set up meetings with interested investors to present your opportunity

- Navigate due diligence: Provide requested documents and information during the due diligence process

- Negotiate terms: Work with investors to agree on valuation, terms, and deal structure

- Close the round: Complete legal documentation and receive funding

1. Prepare your pitch deck

Your pitch deck is the foundation of your fundraising efforts. It needs to clearly communicate your business model, market opportunity, traction, and why investors should be excited about your company. A well-crafted pitch deck tells a compelling story that makes investors want to learn more.

Step-by-step guide for creating your pitch deck:

Start with a clear problem statement that demonstrates you understand the market pain point you're solving. Follow with your solution and how it addresses the problem uniquely. Include your business model showing how you'll generate revenue and achieve profitability. Present your market opportunity with data showing the total addressable market (TAM), serviceable addressable market (SAM), and serviceable obtainable market (SOM).

Include traction metrics that demonstrate progress—user growth, revenue, key partnerships, or product milestones. Showcase your team and why you're the right people to build this company. Present your go-to-market strategy explaining how you'll acquire customers and scale. Include financial projections showing realistic growth assumptions. End with your ask—how much you're raising and how you'll use the capital.

Keep your pitch deck concise—typically 10-15 slides. Focus on clarity over complexity. Use visuals, charts, and graphics to make key points memorable. Practice your presentation until you can deliver it naturally and confidently. Remember, your pitch deck should tell a story that makes investors excited about the opportunity.

2. Identify target investors

Not all venture capital firms are right for your company. Identifying investors that match your stage, sector, geographic focus, and investment thesis is crucial for efficient fundraising. Understanding what venture capital is and how different types of firms operate helps you identify the right investors. Researching investors helps you focus your efforts on firms most likely to be interested in your opportunity.

Step-by-step guide for identifying target investors:

Start by identifying your stage—are you raising pre-seed, seed, Series A, or later? Research firms that actively invest at your stage. Identify your sector and find firms with expertise and portfolio companies in your industry. Consider geographic focus—some firms invest globally while others focus on specific regions.

Review investor portfolios to see what types of companies they've backed. Check investment sizes to ensure they write checks in your target range. Look at recent investments to see if they're actively deploying capital. Use resources like Papermark's investor database to filter investors by stage, sector, and location.

Create a target list of 20-30 firms that match your criteria. Prioritize firms where you have warm introductions or connections. Research the partners at each firm to understand their investment focus and background. This research helps you personalize your outreach and increases your chances of getting meetings.

3. Build relationships

Building relationships with investors before you need funding is one of the most effective fundraising strategies. Investors are more likely to invest in founders they know and trust. Start building these relationships early, even if you're not actively fundraising.

Step-by-step guide for building investor relationships:

Attend industry events, conferences, and networking gatherings where investors are present. Participate in startup accelerators and incubators that provide access to investor networks. Engage with investors on social media and through content they share. Ask for advice rather than investment—investors are more likely to help when you're not asking for money.

Leverage your network to get warm introductions to investors. Ask advisors, mentors, and other founders for introductions. Warm introductions significantly increase your chances of getting meetings compared to cold outreach. When you do get meetings, focus on building relationships rather than immediately pitching.

Keep investors updated on your progress through periodic updates, even when you're not fundraising. Share milestones, traction, and company news. This keeps you top-of-mind when you're ready to raise. Building these relationships takes time, but it pays off when you're ready to fundraise.

4. Share your pitch deck

How you share your pitch deck matters. Sending it as an email attachment is less effective than sharing it as a trackable link. Using pitch deck sharing software like Papermark allows you to see which investors are interested and prioritize follow-ups.

Step-by-step guide for sharing your pitch deck:

Upload your pitch deck to Papermark to create a secure, trackable link. Set up link permissions including email verification, password protection if needed, and download blocking to protect your intellectual property. Customize the link with your branding to maintain a professional appearance.

Share the link via email with a personalized message explaining why you're reaching out and why the investor might be interested. Track engagement to see which investors viewed your deck, how long they spent on each page, and when they accessed it. This data helps you identify the most interested investors and prioritize follow-ups.

Follow up with investors who viewed your deck but haven't responded. Reference specific slides they spent time on to show you're paying attention to their interest. Use the engagement data to tailor your follow-up messages and increase response rates.

5. Schedule investor meetings

Once investors express interest, schedule meetings to present your opportunity in person or via video call. These meetings are your chance to tell your story, answer questions, and build rapport with potential investors. Preparation and practice are key to making these meetings successful.

Step-by-step guide for investor meetings:

Prepare a presentation that expands on your pitch deck with more detail and storytelling. Practice your presentation multiple times until you can deliver it naturally. Anticipate questions investors might ask and prepare thoughtful answers. Research the investors you're meeting with to understand their background and investment focus.

During the meeting, tell your story compellingly and authentically. Be prepared to discuss your business model, market opportunity, competition, and financial projections in detail. Listen actively to investor feedback and questions—they often provide valuable insights even if they don't invest.

After the meeting, send a follow-up email thanking them for their time and addressing any questions or concerns raised. Include any additional information they requested. Keep the conversation going and continue building the relationship, even if they don't invest immediately.

6. Navigate due diligence

When investors are seriously interested, they'll conduct due diligence to verify your claims and assess risks. This process involves reviewing financials, legal documents, customer contracts, and other company materials. Being prepared and organized makes this process smoother.

Step-by-step guide for due diligence:

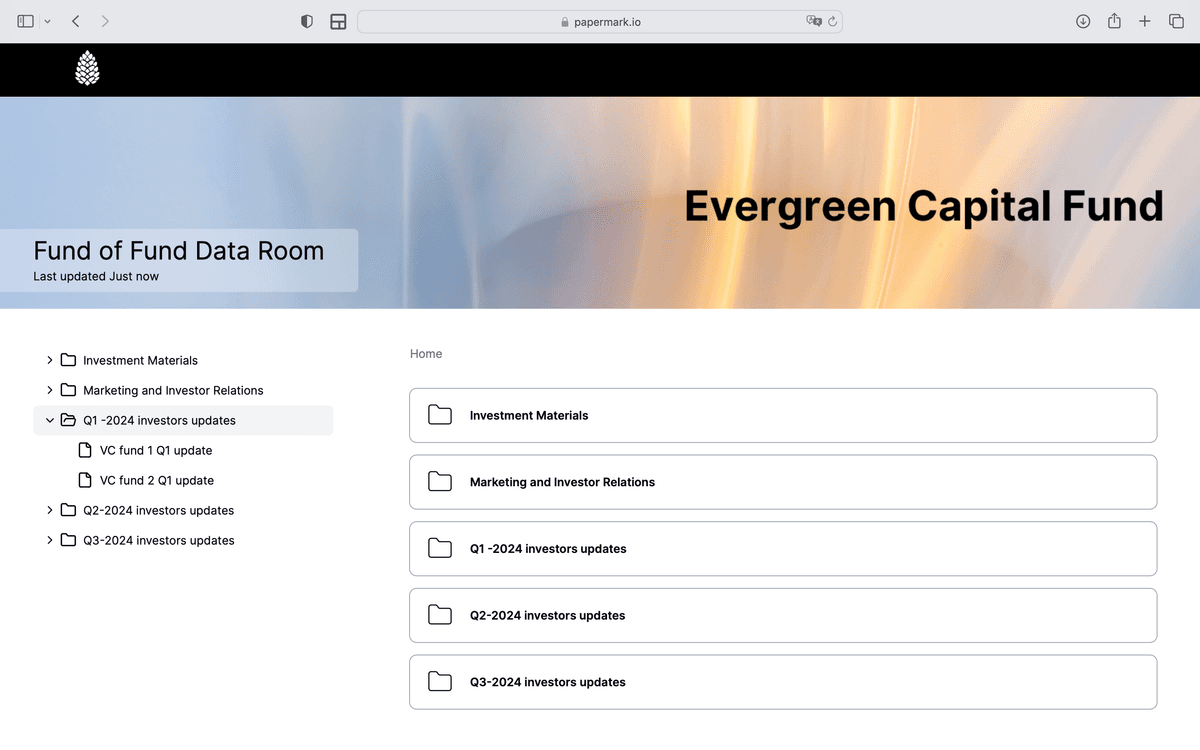

Organize your documents in a virtual data room to make it easy for investors to access what they need. Many venture capital firms use venture capital portals to manage their LP communications and portfolio company interactions. Include financial statements, cap table, customer contracts, legal documents, and any other materials investors might request. Use Papermark's data room feature to organize documents securely with granular permissions.

Respond to investor requests promptly and transparently. Be honest about challenges and risks—investors appreciate transparency and will discover issues during due diligence anyway. Provide context for any concerns investors raise and explain how you're addressing them.

Use due diligence as an opportunity to demonstrate your professionalism and organization. Well-organized materials and prompt responses show investors you're serious and capable. This process also helps you identify any issues early that you'll need to address before closing.

7. Negotiate terms

Once investors are interested in investing, you'll negotiate the terms of the investment. This includes valuation, equity percentage, board seats, and other terms. Understanding term sheets and having advisors to help negotiate is important for getting fair terms.

Step-by-step guide for negotiating terms:

Understand the key terms in a term sheet including valuation, liquidation preferences, board composition, and investor rights. Work with experienced lawyers and advisors who understand venture capital terms. Don't optimize only for valuation—other terms like liquidation preferences and board control can be equally important.

Negotiate from a position of strength by having multiple interested investors. Competition among investors helps you get better terms. Be reasonable in your negotiations—overly aggressive terms can kill deals. Focus on terms that matter most for your company's long-term success.

Consider the investor's value beyond capital—their network, expertise, and ability to help your company grow. Sometimes accepting slightly less favorable terms from a more valuable investor partner makes sense. Remember, you're building a long-term partnership, not just raising capital.

8. Close the round

Closing a venture capital round involves completing legal documentation, coordinating with multiple investors, and receiving funding. This final step requires attention to detail and coordination with lawyers, investors, and your team.

Step-by-step guide for closing your round:

Work with experienced startup lawyers to draft and review legal documents including investment agreements, shareholder agreements, and board resolutions. Coordinate with all investors to ensure everyone signs documents and wires funds on schedule. Set clear deadlines and communicate regularly to keep the process moving.

Complete any closing conditions such as board approvals, regulatory filings, or other requirements. Ensure all legal and compliance requirements are met before closing. Once everything is complete, coordinate fund transfers and update your cap table.

After closing, thank all investors and keep them updated on company progress. Begin executing on your plan to use the capital effectively. Remember, closing the round is just the beginning—now you need to deliver on the promises you made during fundraising.

Best practices for getting venture capital

Following best practices throughout the fundraising process increases your chances of success and helps you build stronger investor relationships. Start fundraising when you have strong traction and momentum, not when you're running out of cash. Investors can sense desperation, and it weakens your negotiating position.

Be transparent and honest throughout the process. Investors will discover issues during due diligence, so it's better to address them proactively. Build genuine relationships with investors rather than treating them as transactional. These relationships can provide value beyond just capital.

Focus on investors who bring strategic value beyond capital—their network, expertise, and ability to help your company grow. Use data and analytics from tools like Papermark to track investor interest and prioritize your efforts. Follow up consistently but not aggressively—persistence pays off, but being pushy can backfire.

Key takeaways

Getting venture capital requires preparation, relationship building, and execution. Start by creating a compelling pitch deck that tells your story effectively. Identify investors who match your stage, sector, and needs. Build relationships with investors before you need funding. Share your pitch deck as a trackable link to gauge interest and prioritize follow-ups.

Navigate meetings and due diligence professionally and transparently. Negotiate terms that work for both you and your investors. Close the round efficiently with proper legal documentation. Remember, fundraising is a process that takes time—typically 3-6 months from start to finish. Stay focused, persistent, and professional throughout.

Conclusion

Getting venture capital funding is a challenging but achievable goal for startups with strong traction, compelling opportunities, and the right approach. By following a structured process, building relationships, and using the right tools, you can increase your chances of successfully raising venture capital.

The fundraising process requires preparation, persistence, and professionalism. Start early, build relationships, and use tools like Papermark to track investor interest and share documents securely. Remember that fundraising is a marathon, not a sprint—stay focused on building a great company while you raise capital.

For more information about venture capital, explore our guides on what venture capital is and what venture capital funds are. Start your fundraising journey today by sharing your pitch deck with investors using Papermark.