What is venture capital? A complete guide for 2026

Venture capital has become essential for startups and high-growth companies seeking funding to scale their operations, develop products, and enter new markets. As the startup ecosystem continues to evolve, understanding what venture capital is and how it works is crucial for entrepreneurs, investors, and anyone interested in the innovation economy.

Understanding what venture capital is and how it functions can help entrepreneurs make informed decisions about fundraising and help investors understand the venture capital landscape. This comprehensive guide explores the fundamentals of venture capital, its key characteristics, stages, benefits, and how modern venture capital firms operate in 2026.

What is venture capital?

Venture capital (VC) is a form of private equity financing provided by firms or funds to startups, early-stage, and emerging companies that have high growth potential. Venture capitalists invest in these companies in exchange for equity, or an ownership stake, with the expectation of generating a return through events such as an initial public offering (IPO) or acquisition.

Unlike traditional bank loans or public market financing, venture capital targets companies that are too risky for standard capital markets or bank loans. These investments are inherently high-risk but offer the potential for high returns. Venture capital firms typically invest in technology companies, innovative startups, and businesses with scalable business models that can achieve rapid growth.

Modern venture capital goes beyond just providing capital. Venture capitalists often bring industry expertise, business acumen, mentorship, and access to extensive networks of potential customers, partners, and future investors. This combination of capital and strategic support helps startups navigate challenges, make informed decisions, and scale their operations effectively.

Key characteristics of venture capital

Venture capital investments have distinct characteristics that differentiate them from other forms of financing. Understanding these characteristics helps entrepreneurs and investors navigate the venture capital landscape effectively.

1. High risk, high reward

Venture capital investments are inherently risky because they target companies with unproven business models, early-stage products, or emerging markets. Many venture-backed startups fail, but successful investments can yield substantial returns—often 10x, 20x, or more on the initial investment. This risk-reward profile attracts investors seeking significant returns and entrepreneurs who need capital to pursue ambitious growth strategies.

2. Equity-based financing

Venture capitalists receive an ownership stake in the company in exchange for their investment. This equity stake aligns the interests of investors and entrepreneurs, as both parties benefit from the company's success. The percentage of equity varies based on the company's valuation, the amount invested, and the stage of the company. Early-stage investments typically result in larger equity stakes for investors compared to later-stage rounds.

3. Active involvement

Unlike passive investors, venture capitalists often take an active role in the companies they invest in. This involvement can include serving on the board of directors, providing strategic guidance, helping with hiring, making introductions to customers and partners, and assisting with future fundraising. The level of involvement varies by firm and investment, but most venture capitalists bring more than just capital to the table.

4. Long-term investment horizon

Venture capital investments typically have a long-term horizon, often 5-10 years or more before an exit event occurs. This extended timeline allows companies to focus on growth rather than short-term profitability. Investors understand that building a successful company takes time, and they're willing to wait for the right exit opportunity, whether through an IPO, acquisition, or other liquidity event.

5. Focus on high-growth potential

Venture capitalists specifically target companies with the potential for rapid, scalable growth. These companies often operate in large addressable markets, have innovative products or services, and can achieve significant market share. The focus on growth potential differentiates venture capital from other forms of financing that might prioritize profitability or steady cash flow.

Stages of venture capital financing

Venture capital investments occur at different stages of a company's lifecycle, each with distinct characteristics, investment amounts, and expectations. Understanding these stages helps entrepreneurs identify the right time to raise venture capital and helps investors understand where different opportunities fit in the funding lifecycle.

1. Pre-seed stage

Pre-seed funding is the earliest stage of venture capital, typically involving investments of $50,000 to $500,000. At this stage, companies are often just an idea, a prototype, or in very early development. Pre-seed investors include angel investors, accelerators, and early-stage venture capital firms. The capital is typically used for market research, product development, and building the founding team.

2. Seed stage

Seed funding represents the first significant round of venture capital, typically ranging from $500,000 to $2 million. Companies at this stage usually have a working prototype or early product, some initial traction, and a clear path to market. Seed investors include seed-stage venture capital firms, angel investors, and some early-stage funds. The capital is used to validate the product-market fit, build the initial team, and begin customer acquisition.

3. Series A

Series A funding typically ranges from $2 million to $15 million and represents the first major institutional venture capital round. Companies at this stage have proven product-market fit, demonstrated traction, and a clear business model. Series A investors are typically institutional venture capital firms that bring significant capital and strategic support. The capital is used to scale operations, expand the team, and accelerate growth.

4. Series B and beyond

Series B, C, D, and later rounds involve increasingly larger investments, often ranging from $10 million to hundreds of millions of dollars. Companies at these stages have proven business models, significant revenue, and are scaling rapidly. Later-stage investors include growth equity firms, late-stage venture capital funds, and sometimes strategic investors. The capital is used for market expansion, product development, acquisitions, and preparing for potential exit events.

Benefits of venture capital

Venture capital provides numerous benefits that help startups grow, scale, and succeed in competitive markets. Understanding these benefits helps entrepreneurs evaluate whether venture capital is the right financing option for their company.

| Benefit | Description |

|---|---|

| Access to significant capital | Venture capital provides substantial funding that startups often can't obtain through traditional methods like bank loans or personal savings. This capital allows companies to invest in product development, hire talent, expand operations, and pursue aggressive growth strategies without the constraints of limited resources. The ability to raise significant capital quickly enables startups to move fast and capture market opportunities. |

| Industry expertise and mentorship | Venture capital firms bring deep industry knowledge, business acumen, and strategic guidance that helps startups navigate challenges and make informed decisions. Many venture capitalists have experience building and scaling companies themselves, providing valuable mentorship to founders. This expertise can be invaluable for first-time entrepreneurs who are learning to build and scale a business. |

| Network access | Venture capitalists have extensive networks of potential customers, partners, suppliers, and future investors. These networks can help startups find early customers, establish strategic partnerships, recruit talent, and raise additional funding. Access to these networks often provides startups with opportunities they wouldn't have access to otherwise, accelerating growth and opening doors that might otherwise remain closed. |

| Credibility and validation | Raising venture capital from reputable firms provides credibility and validation that can help startups attract customers, partners, and talent. The due diligence process that venture capitalists conduct validates the company's business model, market opportunity, and team. This validation can be particularly valuable for early-stage companies that are still building their reputation in the market. |

| Long-term partnership | Venture capital investments typically involve long-term partnerships where investors support the company through multiple funding rounds and growth stages. This long-term commitment provides stability and continuity as the company scales. Venture capitalists often participate in follow-on rounds and help the company navigate challenges and opportunities over several years. |

| Flexible use of capital | Unlike debt financing, venture capital doesn't require regular interest payments or collateral. This flexibility allows startups to use capital where it's most needed—whether for product development, marketing, hiring, or expansion. Companies can focus on growth without the pressure of meeting debt obligations, which is particularly valuable for early-stage companies that may not have predictable cash flow. |

Types of venture capital firms

The venture capital landscape includes various types of firms, each with different investment strategies, focus areas, and approaches. Understanding these different types helps entrepreneurs identify the right investors for their company.

- Early-stage VCs: Focus on seed and Series A investments, typically investing $500K to $10M in early-stage startups

- Growth-stage VCs: Focus on Series B and later rounds, investing $10M+ in companies with proven business models

- Sector-specific VCs: Specialize in specific industries like healthcare, fintech, or enterprise software

- Geographic-focused VCs: Concentrate investments in specific regions or countries

- Corporate venture capital: Investment arms of large corporations seeking strategic investments and innovation

- Micro VCs: Smaller funds that focus on seed-stage investments with smaller check sizes

How venture capital firms operate

Venture capital firms raise capital from limited partners (LPs) such as pension funds, endowments, family offices, and high-net-worth individuals. This capital is pooled into venture capital funds that typically have a 10-year lifecycle. The firm's general partners (GPs) then invest this capital in startups, taking equity stakes in exchange.

Venture capital firms typically charge management fees (usually 2% of committed capital annually) and receive carried interest (typically 20% of profits) when investments are successful. The firm's success depends on identifying promising startups, helping them grow, and achieving successful exits through IPOs or acquisitions.

Modern venture capital firms use sophisticated processes for deal sourcing, due diligence, and portfolio management. They leverage technology platforms like venture capital portals, data analytics, and extensive networks to identify investment opportunities and support portfolio companies. Many firms also provide portfolio companies with access to resources like recruiting support, business development assistance, and fundraising guidance.

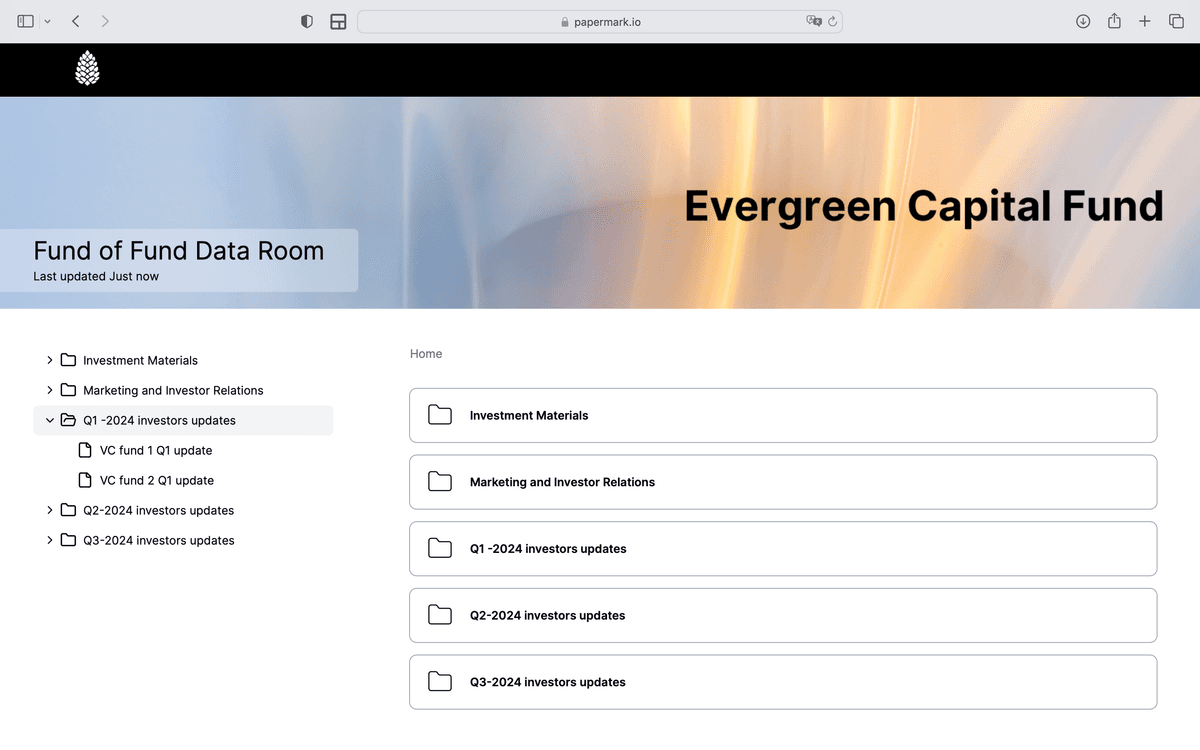

Papermark: Secure document sharing for venture capital

Papermark is an open-source platform that provides secure document sharing and analytics for venture capital firms and startups. During the fundraising process, Papermark helps companies share pitch decks, financial documents, and due diligence materials securely while tracking investor engagement.

For startups raising venture capital, Papermark provides pitch deck sharing software that enables companies to share their pitch decks as trackable links rather than email attachments. The platform provides detailed page-by-page analytics, showing which investors viewed the deck, how long they spent on each slide, and when they accessed it. This engagement data helps startups prioritize follow-ups and understand investor interest.

Papermark's virtual data room feature provides secure document sharing for due diligence processes. Companies can organize documents in folders, control access with granular permissions, and track which investors viewed which documents. The platform includes dynamic watermarking to protect sensitive information and provides detailed analytics to track document engagement throughout the fundraising process.

Conclusion

Venture capital plays a crucial role in the innovation economy by providing capital, expertise, and networks to high-growth startups. Understanding what venture capital is, how it works, and the benefits it provides helps entrepreneurs make informed decisions about fundraising and helps investors understand the venture capital landscape.

Whether you're an entrepreneur considering venture capital funding or an investor exploring venture capital opportunities, understanding the fundamentals of venture capital is essential. The venture capital ecosystem continues to evolve, with new firms, investment strategies, and technologies shaping how capital flows to innovative companies.

For startups raising venture capital, modern tools like Papermark provide secure document sharing and analytics that help streamline the fundraising process. For a comprehensive guide on the fundraising process, see our article on how to get venture capital.