What is a venture capital fund? A complete guide for 2026

Venture capital funds are the investment vehicles that power the startup ecosystem, providing capital to high-growth companies in exchange for equity. Understanding what a venture capital fund is and how it operates is essential for entrepreneurs seeking funding, investors considering venture capital, and anyone interested in how innovation gets financed.

Understanding what venture capital funds are and how they function helps entrepreneurs navigate the fundraising landscape and helps potential investors understand how venture capital investing works. This comprehensive guide explores the fundamentals of venture capital funds, their structure, lifecycle, and how they operate in 2026.

What is a venture capital fund?

A venture capital fund is a pooled investment vehicle that primarily invests the financial capital of third-party investors in enterprises that are too risky for standard capital markets or bank loans. These funds are typically managed by venture capital firms, which employ individuals with technology backgrounds, business training, and deep industry experience to identify, evaluate, and support promising startups.

Venture capital funds are structured as limited partnerships where the venture capital firm acts as the general partner (GP) managing the fund, and investors are limited partners (LPs) who provide the capital. The fund pools money from multiple LPs—including pension funds, endowments, family offices, and high-net-worth individuals—and invests it in a portfolio of startups over a typical 10-year lifecycle.

Unlike mutual funds or other investment vehicles that invest in public companies, venture capital funds focus exclusively on private companies, particularly startups and early-stage businesses with high growth potential. These funds play a crucial role in the innovation economy by providing capital to companies that might not otherwise have access to funding through traditional channels.

Structure of venture capital funds

Venture capital funds have a specific structure that defines how they operate, how capital flows, and how returns are distributed. Understanding this structure helps entrepreneurs understand how funds make investment decisions and helps potential investors understand how venture capital investing works.

1. Limited partnership structure

Venture capital funds are typically structured as limited partnerships with two types of partners. General partners (GPs) are the venture capital firm's partners who manage the fund, make investment decisions, and provide support to portfolio companies. Limited partners (LPs) are the investors who provide capital to the fund but don't participate in day-to-day management or investment decisions.

This structure provides LPs with limited liability—they can only lose their investment, not be liable for fund obligations beyond their commitment. GPs have unlimited liability for fund obligations, which aligns their interests with fund success. The partnership agreement defines the fund's investment strategy, management fees, carried interest, and other key terms.

2. Fund lifecycle

Venture capital funds typically have a 10-year lifecycle divided into distinct phases. The investment period, usually the first 3-5 years, is when the fund actively makes new investments in startups. During this period, GPs source deals, conduct due diligence, and deploy capital into portfolio companies.

The holding period follows the investment period, during which the fund manages existing portfolio companies, provides support, and works toward exits. The final phase involves exiting investments through IPOs, acquisitions, or other liquidity events and distributing returns to LPs. Some funds may have extension periods if needed to complete exits.

3. Capital commitments and drawdowns

LPs commit to providing a certain amount of capital to the fund, but this capital isn't provided all at once. Instead, GPs make capital calls (drawdowns) as they identify investment opportunities and need capital to invest. This structure allows LPs to commit to larger amounts than they might have available immediately while giving GPs flexibility in when to deploy capital.

Capital calls typically happen over the investment period as the fund makes investments. LPs must honor their commitments when capital calls are made. This structure means LPs need to have capital available when called, not just at fund inception. The total committed capital is the fund size, which can range from a few million dollars for micro-VCs to billions for large funds.

How venture capital funds operate

Venture capital funds follow a structured process for raising capital, making investments, and managing portfolios. Understanding how funds operate helps entrepreneurs understand the investment process and helps potential investors understand what to expect when investing in venture capital funds.

1. Fundraising

Venture capital firms raise funds by pitching their investment strategy, track record, and team to potential LPs. The fundraising process involves creating a private placement memorandum, meeting with potential investors, and securing commitments. Fundraising typically takes 12-18 months and requires demonstrating a strong track record, clear investment thesis, and capable team. Many firms use venture capital portals to streamline LP updates, data rooms, and document distribution during and after the raise.

Once fundraising closes, the fund is established and GPs can begin making investments. Fund sizes vary widely—early-stage funds might raise $10-50 million, while large growth funds can raise $1 billion or more. The fund size determines the typical check size and number of investments the fund can make.

2. Deal sourcing and evaluation

GPs actively source investment opportunities through their networks, industry events, referrals, and direct outreach. They evaluate hundreds or thousands of opportunities to identify the most promising startups. The evaluation process involves reviewing pitch decks, meeting with founders, conducting due diligence, and assessing market opportunity, team, and business model.

Funds typically invest in 10-30 companies per fund, depending on fund size and strategy. This concentrated portfolio approach means each investment receives significant attention and support. GPs spend considerable time evaluating opportunities because each investment represents a significant portion of the fund's capital.

3. Portfolio management

After making investments, GPs actively manage their portfolio companies by serving on boards, providing strategic guidance, making introductions, and helping with future fundraising. This hands-on approach differentiates venture capital from other forms of investing. GPs work closely with portfolio companies to help them grow and succeed.

Portfolio management also involves monitoring company performance, identifying issues early, and providing support when companies face challenges. GPs track key metrics, review financials, and maintain regular communication with portfolio company leadership. This active management helps maximize the chances of successful exits.

4. Exit strategy

The ultimate goal of venture capital funds is to exit investments profitably through IPOs, acquisitions, or other liquidity events. Successful exits generate returns that are distributed to LPs after the fund takes its carried interest. Exits typically occur 5-10 years after the initial investment, though timing varies significantly.

Funds aim for a mix of exits—some may be successful IPOs or large acquisitions, while others may be smaller acquisitions or even failures. The fund's overall return depends on the portfolio's performance. Successful funds generate returns that significantly exceed the initial capital invested, with top funds achieving 3x-5x returns or more.

Key characteristics of venture capital funds

Venture capital funds have distinct characteristics that differentiate them from other investment vehicles. Understanding these characteristics helps entrepreneurs and investors navigate the venture capital landscape effectively.

1. High risk, high return profile

Venture capital funds invest in high-risk, high-reward opportunities. Many portfolio companies will fail, but successful investments can generate returns that compensate for failures and generate strong overall fund returns. This risk profile attracts investors seeking exposure to high-growth innovation but requires diversification and long-term perspective.

2. Illiquid investments

Venture capital fund investments are illiquid—LPs commit capital for the fund's entire lifecycle, typically 10 years. Unlike public market investments that can be sold quickly, venture capital investments can't be easily exited until portfolio companies have liquidity events. This illiquidity requires LPs to have long-term investment horizons.

3. Active management

Venture capital funds provide active management and support to portfolio companies, not just capital. GPs serve on boards, provide strategic guidance, make introductions, and help with hiring and fundraising. This active involvement differentiates venture capital from passive investment strategies and adds value beyond capital.

4. Diversified portfolio approach

Funds invest in multiple companies to diversify risk. While individual investments are high-risk, a diversified portfolio spreads risk across multiple opportunities. Successful funds typically have a few investments that generate most of the returns, while others may break even or fail. This portfolio approach helps manage the inherent risk of startup investing.

Types of venture capital funds

The venture capital fund landscape includes various types of funds, each with different strategies, focus areas, and investment approaches. Understanding these different types helps entrepreneurs identify the right funds for their company and helps investors understand fund options.

- Early-stage funds: Focus on seed and Series A investments, typically investing $500K to $10M in early-stage startups

- Growth-stage funds: Focus on Series B and later rounds, investing $10M+ in companies with proven business models

- Sector-specific funds: Specialize in specific industries like healthcare, fintech, or enterprise software

- Geographic-focused funds: Concentrate investments in specific regions or countries

- Micro-VC funds: Smaller funds ($10M-$50M) that focus on seed-stage investments with smaller check sizes

- Corporate venture capital funds: Investment arms of large corporations seeking strategic investments and innovation

Fund economics: management fees and carried interest

Venture capital funds generate revenue through two primary mechanisms. Management fees, typically 2% of committed capital annually, cover the fund's operating expenses including salaries, office space, and deal sourcing costs. These fees are paid throughout the fund's lifecycle, though they often decrease after the investment period ends.

Carried interest, typically 20% of profits, is the fund's share of investment returns. GPs only receive carried interest after LPs have received their invested capital back plus a preferred return (often 8% annually). This structure aligns GPs' interests with fund success—they only benefit significantly when the fund generates strong returns for LPs.

The "2 and 20" model (2% management fee, 20% carried interest) is standard in the industry, though terms can vary. Some funds may charge lower fees or have different carried interest structures. Understanding these economics helps entrepreneurs understand fund motivations and helps potential investors evaluate fund terms.

Papermark: Document management for venture capital funds

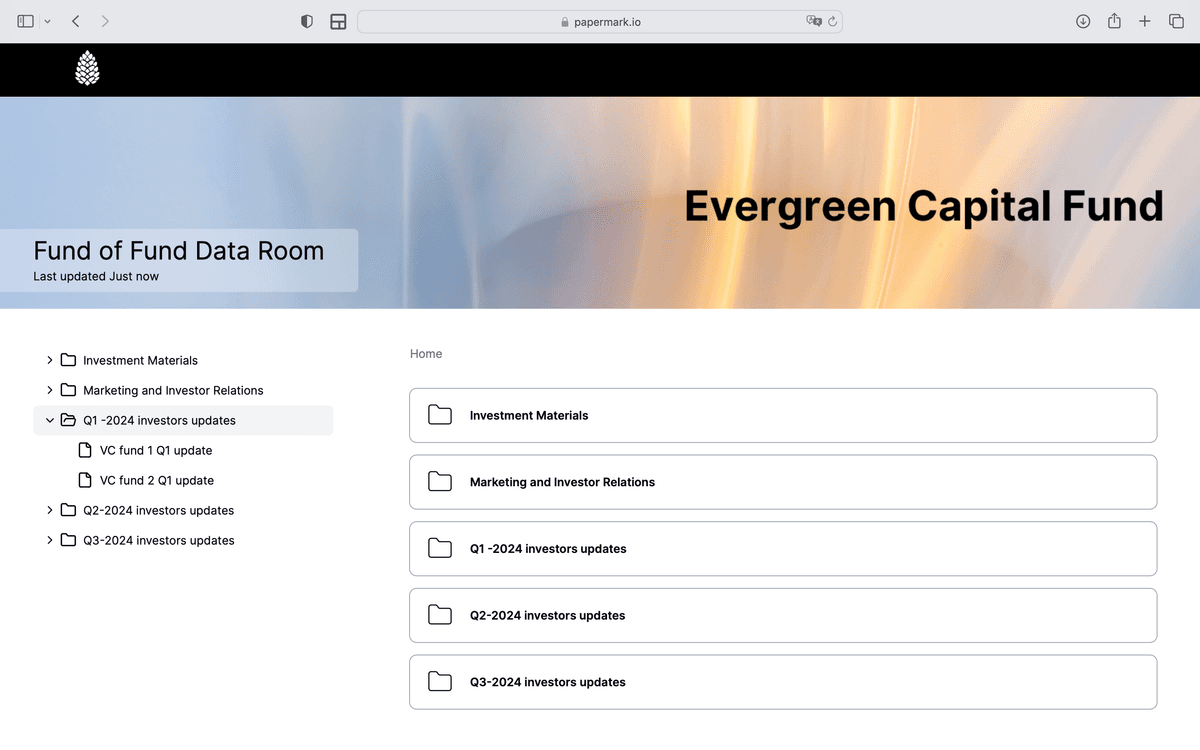

Papermark provides secure document sharing and analytics for venture capital funds managing LP communications, due diligence, and portfolio company interactions. The platform helps funds organize documents, track engagement, and maintain professional communication with LPs and portfolio companies.

For venture capital funds, Papermark's virtual data room feature provides secure document organization for LP reporting, capital calls, and fund administration. Funds can organize documents in folders, control access with granular permissions, and track which LPs viewed which documents. The platform includes dynamic watermarking to protect sensitive information and provides detailed analytics to track document engagement.

Papermark's analytics capabilities help funds understand LP engagement with reports and communications. Page-by-page analytics show which LPs are most engaged, helping funds prioritize follow-ups and improve communication. The platform's secure sharing features ensure sensitive fund information remains protected while remaining accessible to authorized parties.

Conclusion

Venture capital funds are essential components of the innovation economy, providing capital and support to high-growth startups. Understanding what venture capital funds are, how they're structured, and how they operate helps entrepreneurs navigate fundraising and helps potential investors understand venture capital investing.

The venture capital fund model has proven effective at identifying and supporting innovative companies that drive economic growth and technological advancement. As the startup ecosystem continues to evolve, venture capital funds will continue playing a crucial role in financing innovation.

For more information about venture capital, explore our guides on what venture capital is and how to get venture capital. For venture capital funds seeking better document management, Papermark provides secure sharing and analytics for LP communications and fund administration.