Los 5 mejores portales de capital de riesgo en 2026

Los portales de capital de riesgo son los centros de comando donde los fondos gestionan las comunicaciones con LP, comparten salas de datos, rastrean compromisos y optimizan el flujo de operaciones. Los portales modernos combinan informes para inversores, intercambio seguro de documentos y análisis para que socios, LP y empresas del portafolio puedan trabajar desde una única fuente de verdad. Comprender qué es el capital de riesgo y cómo operan los fondos de capital de riesgo ayuda a contextualizar por qué estos portales son herramientas esenciales para el ecosistema de capital de riesgo. Esta guía destaca los portales líderes y lo que fundadores, GP y LP realmente hacen en ellos día a día.

Resumen rápido de portales de capital de riesgo

- Papermark: Portal de inversores y sala de datos de código abierto con intercambio seguro, análisis y marcas de agua

- Juniper Square: Portal de LP de nivel institucional para llamadas de capital, estados de cuenta e informes de fondos

- Carta: Portal de capital e inversores para tablas de capitalización, SPV y flujos de trabajo de administración de fondos

- AngelList: Portal de sindicatos y fondos para distribución de operaciones y actualizaciones de LP

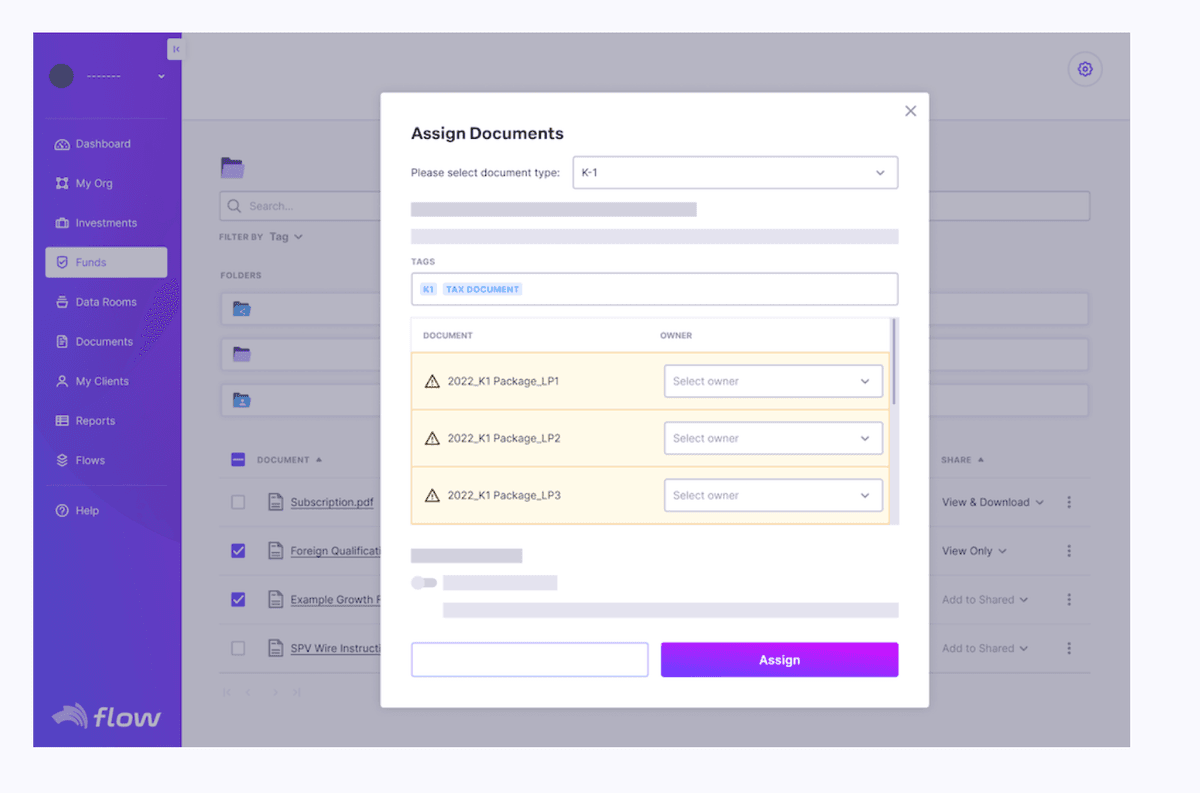

- Flow (Flowinc): Flujos de trabajo de incorporación de inversores y suscripciones para fondos de VC

Tabla comparativa: portales de capital de riesgo

| Característica | Papermark | Juniper Square | Carta | AngelList | Flow |

|---|---|---|---|---|---|

| Portal de inversor/LP | ✔ | ✔ | ✔ | ✔ | ✔ |

| Salas de datos seguras | ✔ (VDR + marcas de agua) | Limitado | Limitado | Limitado | Limitado |

| Seguimiento de flujo de operaciones | ✔ (documentos + análisis) | Limitado | Limitado | ✔ (sindicatos) | Limitado |

| Informes de LP y llamadas de capital | ✔ (compartir informes de forma segura) | ✔ (fortaleza principal) | ✔ | ✔ (actualizaciones de fondos) | ✔ (suscripciones) |

| Branding/marca blanca | ✔ (dominio personalizado, branding) | ✔ | Limitado | Limitado | Limitado |

| Análisis y engagement | ✔ (análisis a nivel de página) | ✔ (vistas de LP) | Limitado | Limitado | Limitado |

| Marca de agua y control de acceso | ✔ (dinámico) | Limitado | Limitado | Limitado | Limitado |

| Código abierto / auto-hospedaje | ✔ | ✘ | ✘ | ✘ | ✘ |

| Automatización de documentos | ✔ (API + flujos de trabajo) | Limitado | ✔ (documentos de capital) | Limitado | ✔ (incorporación) |

| Transparencia de precios | ✔ | Personalizado | Por niveles | Por operación/fondo | Personalizado |

Qué hacen las personas en los portales de capital de riesgo

- Comparten llamadas de capital, K-1 y reportes trimestrales con LPs de forma segura.

- Alojan salas de datos para recaudación de fondos y rastrean qué LPs vieron qué páginas. Para startups recaudando capital de riesgo, estas salas de datos son esenciales para la debida diligencia.

- Ejecutan documentos de suscripción y flujos de KYC/AML para nuevos LPs.

- Envían actualizaciones de portafolio y dashboards de KPI a inversores existentes.

- Coordinan distribución de deals, asignaciones y documentos de SPV.

Tipos de portales de capital de riesgo y casos de uso

- Portales de sala de datos y compartición con inversores: Enfocados en compartir documentos de forma segura, marcas de agua y analíticas detalladas de engagement para recaudación de fondos y reportes a LPs. Ideales para GPs que necesitan acceso trazable a documentos y cumplimiento normativo.

- Portales de reportes a LPs y administración de fondos: Diseñados para llamadas de capital, estados de cuenta y distribuciones con flujos de trabajo estructurados y registros de auditoría—mejores para relaciones institucionales con LPs.

- Portales de sindicatos y distribución de deals: Diseñados para comercializar deals, gestionar asignaciones y recopilar compromisos rápidamente para SPVs y fondos continuos.

- Portales de onboarding y suscripción: Agilizan el onboarding de inversores, verificaciones KYC/AML y documentos de suscripción para reducir la fricción durante la recaudación de fondos.

- Portales de actualizaciones de portafolio: Enfatizan actualizaciones recurrentes, compartición de métricas y reportes automatizados por email para mantener informados a los LPs.

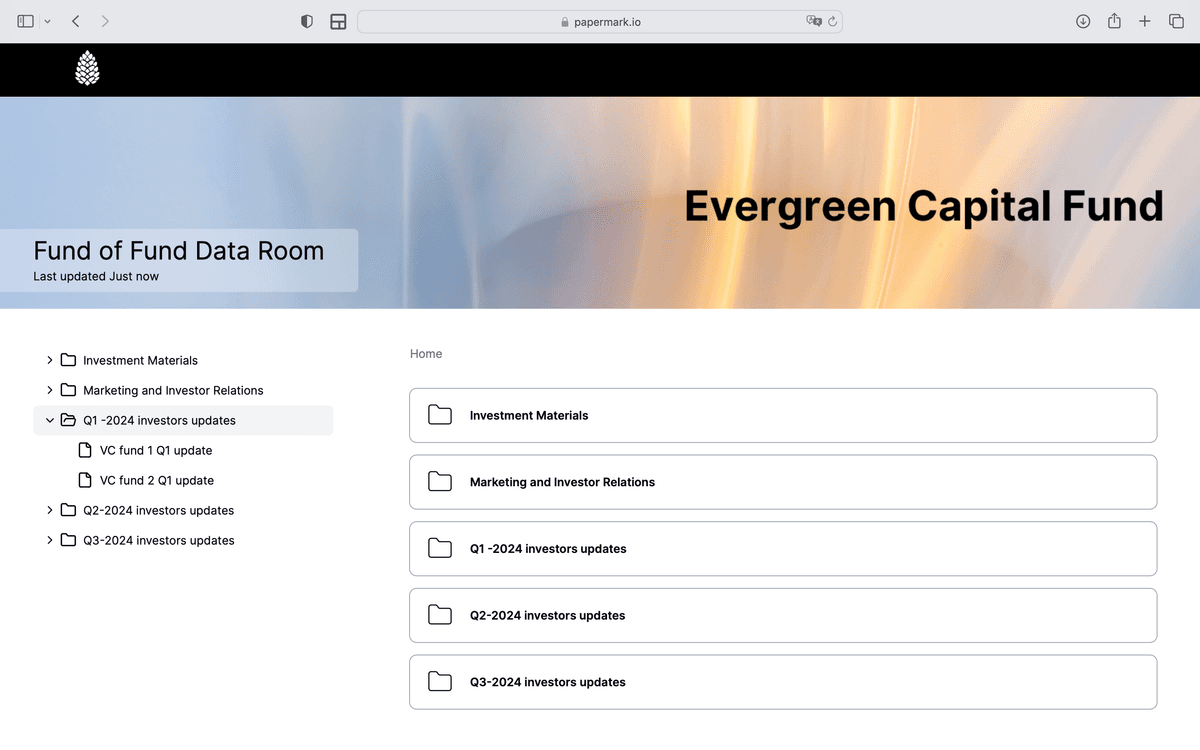

1. Papermark

Sitio web: papermark.com

Papermark es un portal de código abierto para equipos de capital de riesgo que necesitan salas de datos seguras, reportes a LPs y analíticas granulares de engagement. Los GPs lo usan para compartir llamadas de capital, K-1 y actualizaciones trimestrales con marcas de agua, mientras rastrean el engagement a nivel de página para ver qué LPs están más interesados.

Características de Papermark

Papermark proporciona salas de datos virtuales con marcas de agua dinámicas, analíticas de documentos y controles de compartición segura de archivos (verificación de email, expiración de enlaces, bloqueo de descargas). Las analíticas página por página muestran quién vio cada sección, ayudando a los GPs a priorizar seguimientos.

Los dominios personalizados y el branding mantienen la experiencia del LP alineada con la marca, y una API permite la distribución automatizada de informes y la segmentación de inversores. El sistema de permisos granulares de la plataforma permite a los GPs controlar el acceso a nivel de carpeta y documento, asegurando que los LPs solo vean lo que están autorizados a ver.

Precios de Papermark

- Pro: $24/mes para compartir y analíticas básicas

- Business: $59/mes con branding, dominio personalizado y analíticas avanzadas

- Data rooms: $99/mes con carpetas ilimitadas, permisos y controles VDR

- Self-hosted: Disponible para equipos que necesitan control total y cumplimiento normativo

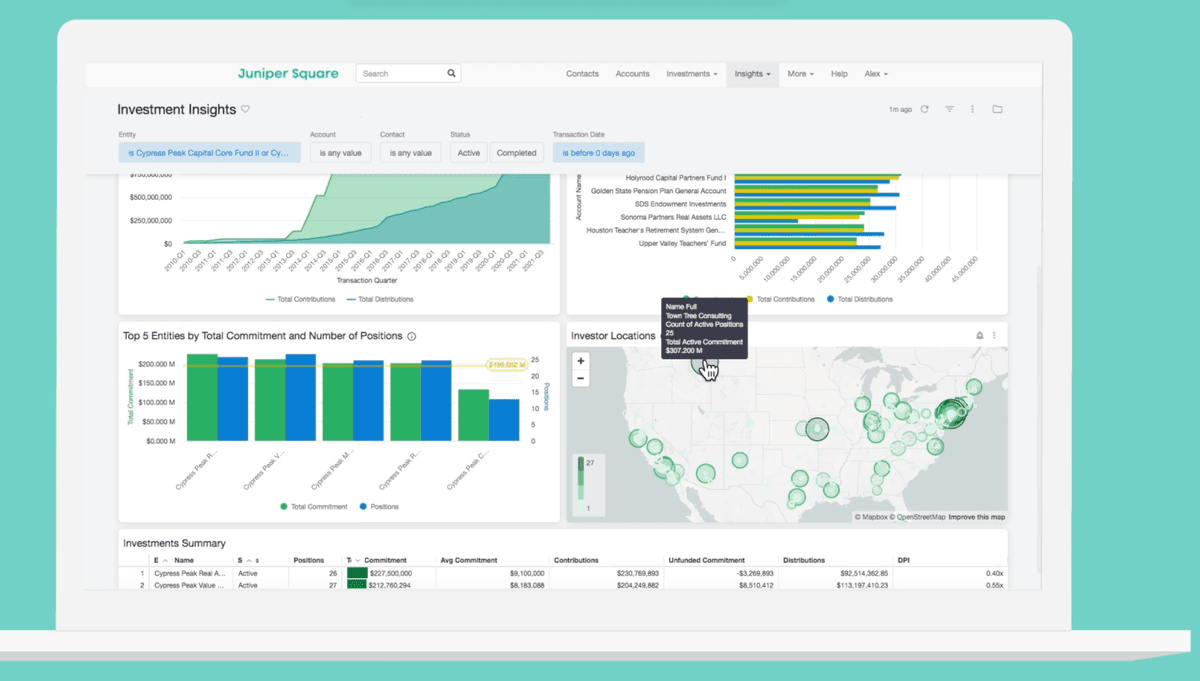

2. Juniper Square

Sitio web: junipersquare.com

Juniper Square es un portal LP de nivel institucional centrado en llamadas de capital, estados de cuenta e informes de fondos. Es utilizado por firmas de VC y PE para automatizar las comunicaciones con inversores y distribuciones, mientras proporciona a los LPs un panel único para documentos de fondos y rendimiento.

Características de Juniper Square

Juniper Square agiliza las llamadas de capital, estados de cuenta y avisos de distribución con flujos de trabajo predefinidos. Los LPs inician sesión para ver compromisos, rendimiento y documentos en un solo lugar. La plataforma admite registros de auditoría, acceso con permisos y perfiles de inversores para mantener el cumplimiento normativo y la coherencia en los informes de todos los fondos.

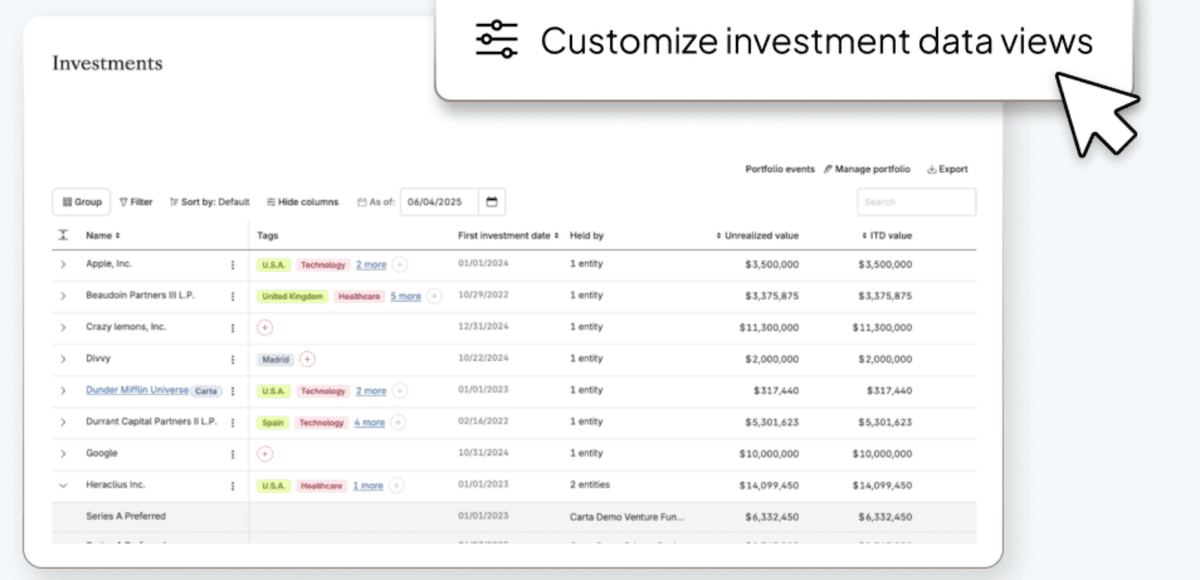

3. Carta

Sitio web: carta.com

Carta ofrece un portal de inversores vinculado a tablas de capitalización, SPVs y administración de fondos. Las firmas de VC lo utilizan para gestionar el capital, entregar estados de cuenta y proporcionar a los LPs una vista consolidada de asignaciones y documentos.

Características de Carta

Carta integra la administración de fondos, gestión de SPV y datos de tablas de capitalización para que los LPs vean asignaciones, propiedad e informes en un solo portal. Las llamadas de capital y estados de cuenta se pueden compartir junto con los datos principales de capital, reduciendo la reconciliación manual y manteniendo las comunicaciones con los LPs sincronizadas con los registros de propiedad en tiempo real.

4. AngelList

Sitio web: angellist.com

AngelList impulsa sindicatos y fondos, proporcionando a los GPs un portal para distribuir operaciones y actualizar a los LPs. Los inversores lo utilizan para evaluar operaciones y comprometerse con SPVs.

Características de AngelList

AngelList proporciona distribución de operaciones, gestión de asignaciones y flujos de trabajo de fondos/SPV. Los GPs comparten salas de datos y actualizaciones, mientras que los LPs se comprometen, firman documentos y reciben informes periódicos. Los sistemas de pago integrados y el soporte de cumplimiento ayudan a agilizar la ejecución de SPV y las operaciones de fondos continuos.

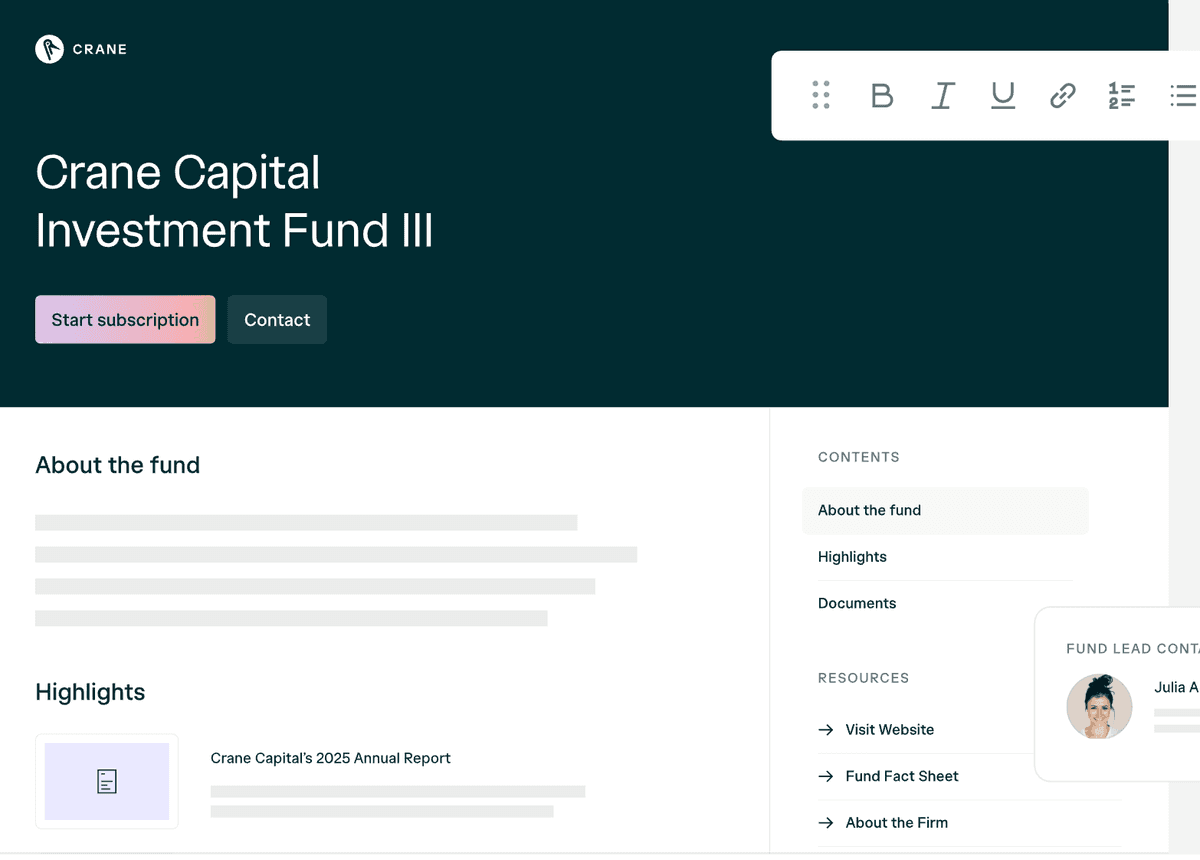

5. Flow (Flowinc)

Sitio web: flowinc.com/vc-portal

Flow se centra en la incorporación de inversores y flujos de trabajo de suscripción. Los equipos de VC lo utilizan para ejecutar KYC/AML, recopilar compromisos y automatizar acuerdos de suscripción durante las rondas de financiación.

Características de Flow

Flow ofrece documentos de suscripción digitales, verificación de identidad y cobro de pagos para acelerar la incorporación de LPs. Los recordatorios automatizados y el seguimiento de estado reducen el intercambio con los inversores, mientras que las pistas de auditoría capturan quién firmó y cuándo para el cumplimiento.

Conclusión: portales de capital de riesgo en 2026

Los portales de VC modernos reúnen informes para LPs, salas de datos, incorporación y distribución de operaciones en un solo lugar. Papermark destaca por sus salas de datos seguras y análisis de engagement; Juniper Square por informes institucionales para LPs; Carta por vistas de inversores conectadas a la tabla de capitalización; AngelList por sindicatos y actualizaciones de fondos; y Flow por incorporación. Elige según tus flujos de trabajo principales—informes para LPs, recaudación de fondos o distribución de operaciones—y el nivel de branding, cumplimiento y análisis que necesites.