Virtual data rooms (VDRs) like Intralinks VDR remain a staple for M&A, fundraising, and other VDR due diligence workflows. But in 2026, new entrants—including Papermark—promise faster setup, modern UX, and powerful analytics at a fraction of the cost.

In this guide we will:

- Walk through how to set up an Intralinks VDR for due diligence

- Explore Intralinks' latest features and capabilities

- Compare Intralinks to Papermark feature-by-feature

- Show why thousands of founders, bankers, and legal teams are switching to Papermark for critical transactions

Intralinks VDR features overview

Simple

- Frictionless setup - Use Advanced Deal Prep to organize deal documents before going live, with no contract or upfront costs

- Optimized processes - Enhanced drag-and-drop capability lets you rename and upload files and folders in bulk

- Intuitive UI - Switch between data rooms, manage users, access reports simply and smoothly

- Streamlined access - Add users to your data room quickly and easily

Smart

- Integrated AI redaction - Leverage artificial intelligence to easily redact PII and other sensitive content from documents inside the data room, saving time and reducing risk

- Detailed reporting - Share key VDR metrics with deal team members to keep everyone informed and aligned

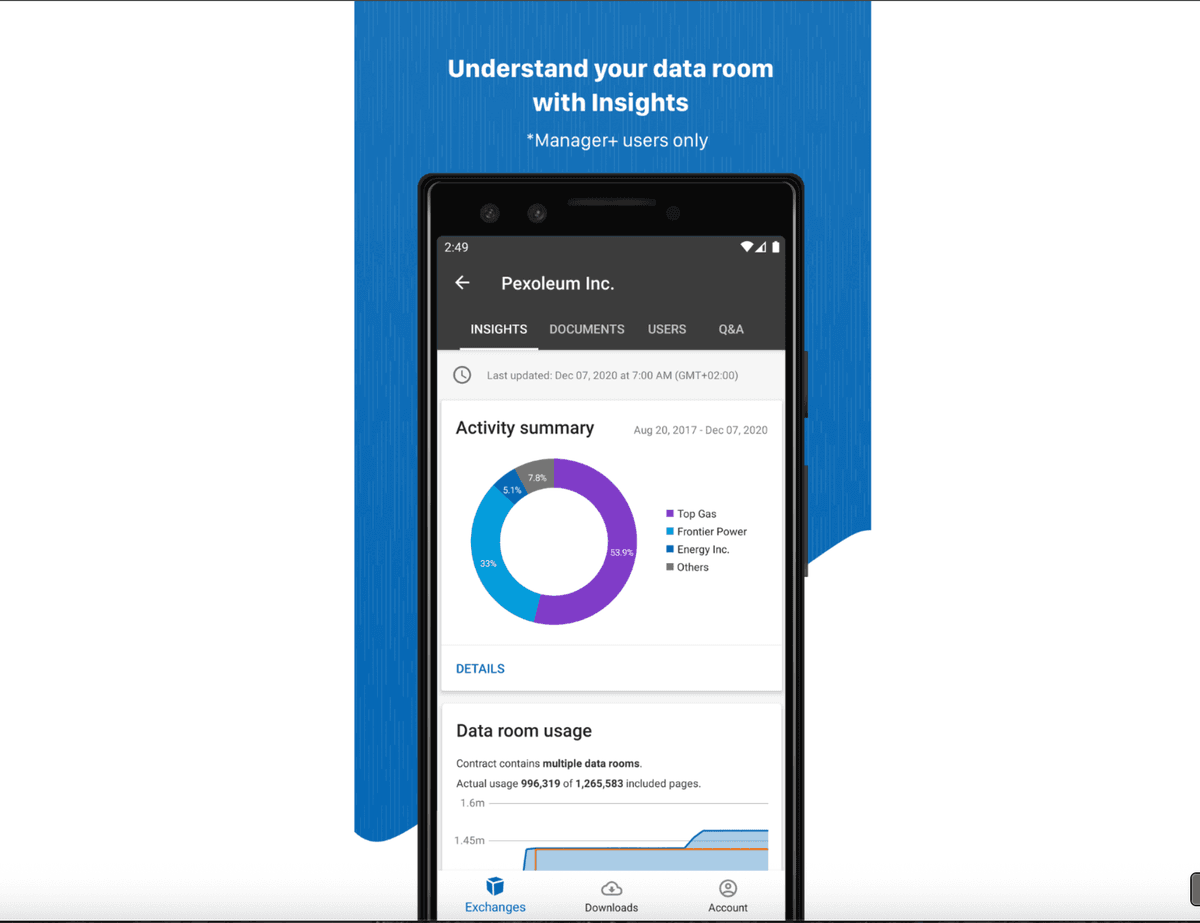

- Real-time insights - Easily track and share group, user and document level activity in your VDR through a customizable dashboard to help measure engagement

Seamless

- Automated index - Dynamically organize your VDR without the need to constantly update the index

- Powerful Q&A - Simple, easy-to-use Q&A helps move your deal toward the finish line; bulk import of questions, priority level and access level are all easy to control

- Video support - Tell your story using video with Zoom Integration

- Mobile flexibility - Anytime, anywhere access to key data room capabilities and insights – even when you're on the go

- Fully integrated - VDRPro is a key component of DealCentre™, a powerful platform designed to speed and simplify every aspect of the deal lifecycle

Secure

- Platinum certification - The industry's first VDR to earn ISO 27701 certification – the standard in data privacy

- Easily share...and UNshare® - One-click to enable and one-click to retract a document with advanced information rights management

- Robust watermarking - Flexible and customizable, saving you time and effort

- Turnkey permissions - Granular and easy to control to ensure the right users have access to the right documents

- Holistic security - GDPR-compliant, encrypted archives, in-region data storage and processing

How to create an Intralinks VDR

Even though Intralinks is decades old, its security certs and extensive enterprise features mean it is still the default choice for many corporates and investment banks. If you must use it, here is the high-level process.

Step 1 – Request workspace activation

- Contact an Intralinks sales rep or partner

- Sign the order form and wait for provisioning (typically 24–48h)

- Receive admin credentials via email

Tip: If your deal timeline is tight, Papermark can spin up a secure room in minutes—no sales calls required.

Step 2 – Configure roles & permissions

- Navigate to Manage → Permissions

- Define roles (Admin, Manager, View-only, Q&A, etc.)

- Map each bidder or stakeholder group to a role

- Set up watermarks and view/download restrictions

Step 3 – Upload folders & index

- Use the desktop uploader or drag-and-drop web UI

- Follow Intralinks' naming convention (

01_Financials,02_Legal…) - Verify that inherited permissions are correct per folder

- Run the built-in index checker to validate numbering

Step 4 – Invite participants

- Bulk-import emails (.csv) or add manually

- Assign them to appropriate groups

- Enable two-factor authentication (recommended)

- Send invitation message and track access receipts

Step 5 – Monitor VDR due diligence activity

- Open Reports → User Activity

- Filter by group, document, or time period

- Export CSV for advisors or board updates

- Use the Q&A module to manage bidder questions

While Intralinks covers the basics, many users find the interface dated and the per-page pricing unpredictable. That is why growing teams increasingly choose Papermark.

Want to explore other VDR options? Check our comprehensive Intralinks alternatives for a side-by-side comparison of 10 competing solutions.

Why Papermark is the modern alternative

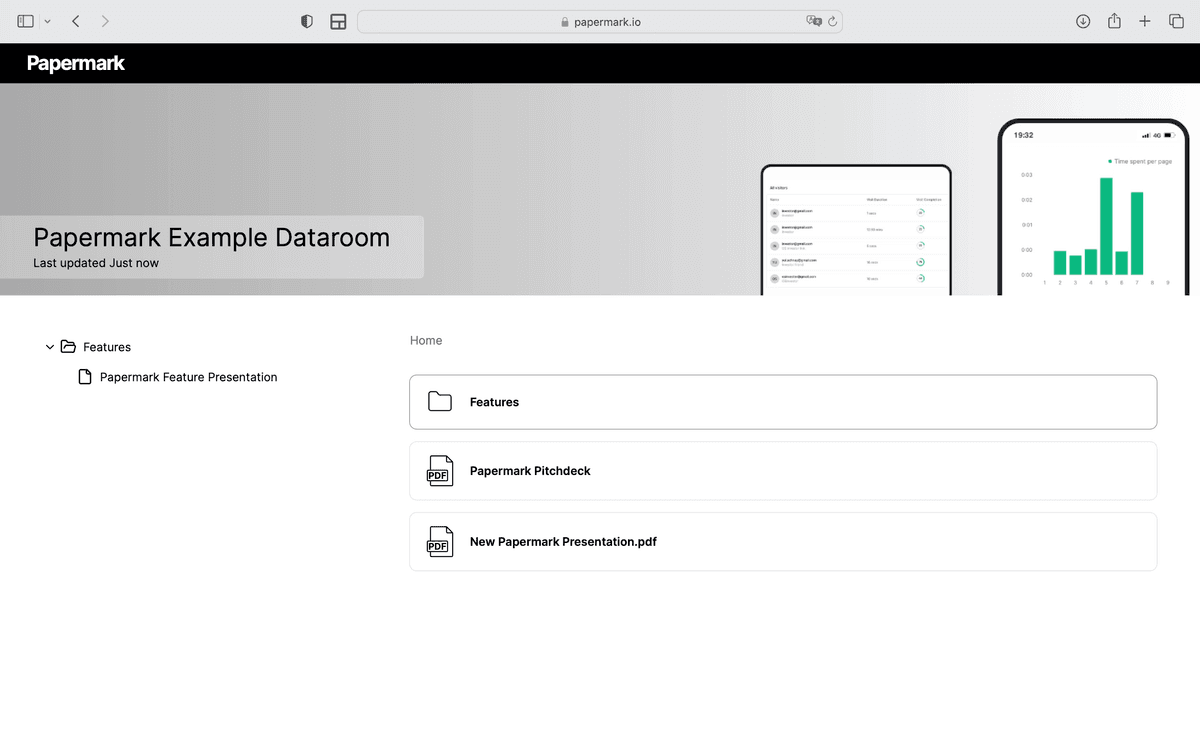

Papermark is a purpose-built data-room platform created in 2024. It provides enterprise-grade security without the enterprise price tag, helping you close deals faster.

- Instant self-serve setup—create a room in under 15 minutes

- Dynamic, non-invasive watermarking that follows every page

- Real-time heatmaps showing which pages investors care about

- Granular role-based access and email-gated links

- Q&A workflows, document versioning, and audit exports

- Simple, predictable subscription (no per-page or per-MB fees)

Data room solutions comparison

| Feature | Intralinks | Papermark |

|---|---|---|

| Setup time | 2–3 days (requires onboarding rep) | Less than 1 hour (self-serve) |

| Pricing | Request quote | €99/month (unlimited datarooms, 3 admins) |

| Dynamic watermarking | Yes | Yes (viewer info, timestamp) |

| User management | Complex permission layers | Intuitive role-based access |

| Activity tracking | Standard reports | Real-time heatmaps & page analytics |

| Q&A module | Yes (paid add-on) | Included |

| Custom branding | Limited | Full white-label |

Looking for detailed pricing information? See our full Intralinks pricing guide for a breakdown of all plans and hidden costs.

Papermark for fundraising & investor updates

If you are raising capital, Papermark's pitch deck tracking software lets you share a teaser or deck, then seamlessly upgrade to a full VDR when due diligence begins—keeping all analytics in one place.

Setting up a Papermark data room in 4 steps

Step 1 – Sign up & create room

- Sign up for Papermark

- Click New Room → Due Diligence

- Choose security defaults (view-only, watermark, NDA)

Step 2 – Upload & organise documents

- Drag-and-drop folders or connect Google Drive

- Auto-generate numeric index (

01_,02_…) - Apply metadata (stage, confidential, owner)

Step 3 – Manage access & watermarks

- Invite bidders via email or link

- Assign roles (Investor, Advisor, Legal, etc.)

- Turn on viewer watermark with name, email, and IP

Step 4 – Track engagement & export audit

- Open Analytics → Visitors to see dwell time and drop-off

- Filter by document to identify red-flag sections

- Export full audit trail (CSV/PDF) for the data room binder

Frequently asked questions

Conclusion

Legacy providers like Intralinks VDR still dominate high-stake transactions, but modern alternatives such as Papermark deliver the same security with superior usability, analytics, and pricing. Whether you are preparing for VDR due diligence or simply need a secure place to share confidential documents, Papermark lets you get started in minutes.

Ready to compare more options? Visit our guides on best virtual data rooms and Intralinks pricing to find the perfect fit for your team's needs.