This list focuses only on data rooms with meaningful AI capabilities because AI changes how diligence gets done: it cuts prep time, reduces missed risks, and speeds decisions. We highlight providers that go beyond storage and permissions to deliver practical AI that teams can use today across real deal workflows.

Common AI use cases in data rooms include auto‑indexing and OCR to structure messy uploads, natural‑language search to find clauses and facts instantly, automated redaction for PII and sensitive terms at scale, and AI summaries that condense long contracts or financials into actionable briefs. Advanced platforms add translation, anomaly/risk flagging, and Q&A assistance that link answers back to source documents.

Quick recap of AI data rooms

- Papermark: Modern VDR with AI co‑pilot; transparent pricing and self‑host option

- Datasite: Enterprise VDR; semantic search, summaries, redaction, in‑room translation

- Intralinks: DealCentre AI; assistant (Link), semantic discovery, prep/marketing/diligence tooling

- V7: AI‑native co‑pilot for buy‑side; agents, classification, no‑code automations

- iDeals: VDR with AI redaction, in‑room translation, intelligent search (privacy‑first)

- Ansarada: AI‑Sort/Translate/Redact + AI‑Predict for bidder signals; lifecycle workflows

- DealRoom: AI playbooks, deal‑level chat across contracts, bulk contract analysis with citations

- Box: Box AI for Q&A, summaries, extraction, classification; enterprise governance add‑ons

- ShareFile: AI workflow automation (templates, autofill, reminders) for client processes

| Feature | Papermark | Datasite | Intralinks | V7 | iDeals | Ansarada | DealRoom | Box | ShareFile |

|---|---|---|---|---|---|---|---|---|---|

| Data Room AI copilot | ✔️ | ✔️ | ✔️ | ✔️ | Limited | ✔️ | ✔️ | Limited | Limited |

| Open‑source / self‑hosted | ✔️ | — | — | — | — | — | — | — | — |

| Semantic search / NL Q&A | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ (deal‑level) | ✔️ | Limited |

| Summaries / insights | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | — | ✔️ | ✔️ | — |

| Deal‑level chat (all contracts) | ✔️ | — | — | — | — | — | ✔️ | — | — |

| Workflow automation | — | — | — | — | — | ✔️ (lifecycle) | — | ✔️ | ✔️ |

| AI redaction | — | ✔️ | ✔️ | ✔️ bulk | ✔️ | ✔️ | Limited | Add‑ons | — |

| Translation (in‑room) | — | ✔️ (17+) | — | — | ✔️ | ✔️ | — | Limited | — |

| Predictive signals | — | — | — | — | — | ✔️ (AI‑Predict) | — | — | — |

| Deal playbook builder | — | — | — | — | — | — | ✔️ | — | — |

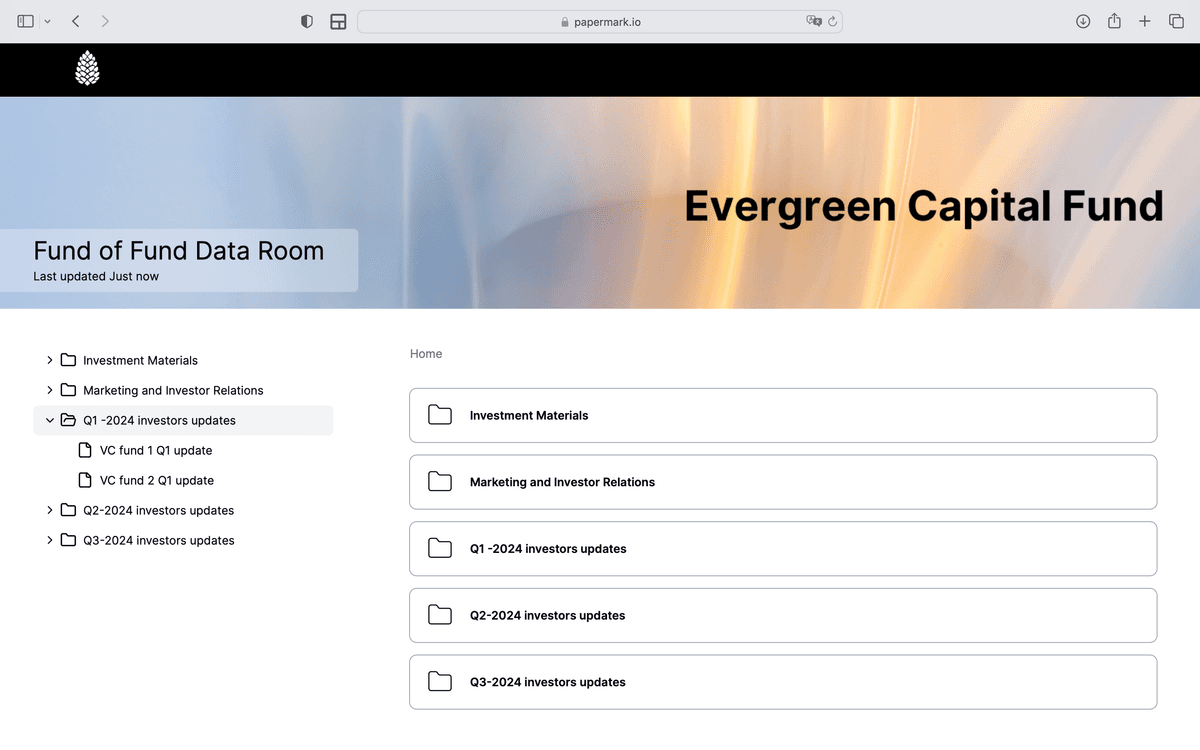

1. Papermark

Website: papermark.com

Our AI copilot lets you do anything with a group of documents in your data room — analyse, chat, summarise, search semantically, and extract insights. Papermark also includes page‑level analytics, granular permissions, watermarking, Q&A, custom domains, and optional self‑hosting.

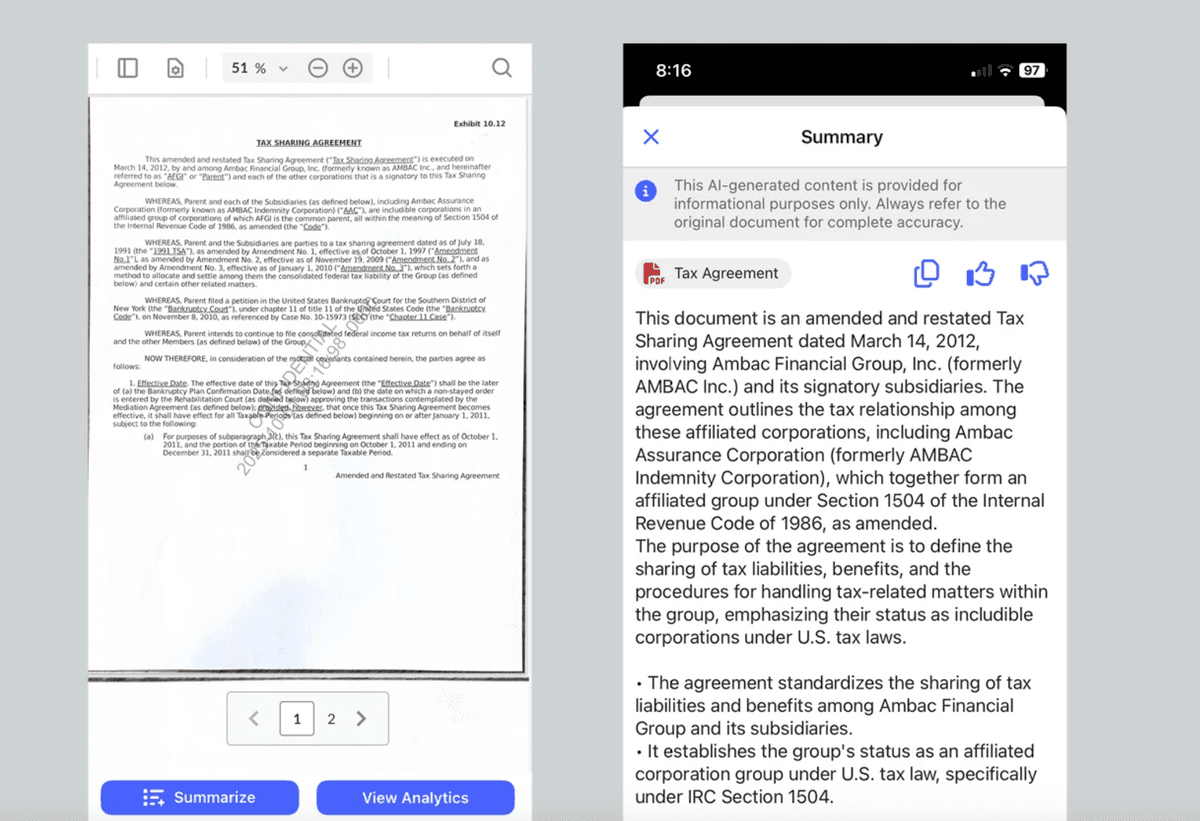

2. Datasite

Website: datasite.com

Datasite is an enterprise virtual data room widely used for M&A and due diligence, offering a robust, general‑purpose deal platform for complex, multi‑party transactions (see our Datasite VDR overview).

Pros include comprehensive permissions, detailed audit trails, and strong workflow modules such as Q&A and analytics that support enterprise governance. Potential cons are opaque pricing and a steeper learning curve compared to lighter VDRs. See our Datasite pricing review for a cost breakdown and alternatives.

AI features and use cases

Datasite’s AI capabilities focus on accelerating review quality and speed across large document sets:

- Semantic search to “find what matters,” going beyond keyword matches to intent‑level retrieval across the room.

- “Summarize and Explain This” to generate concise summaries and plain‑English explanations of complex documents, helping teams extract key insights faster.

- AI summaries available on mobile for PDFs, Word docs, and rich text, enabling on‑the‑go review and decision support.

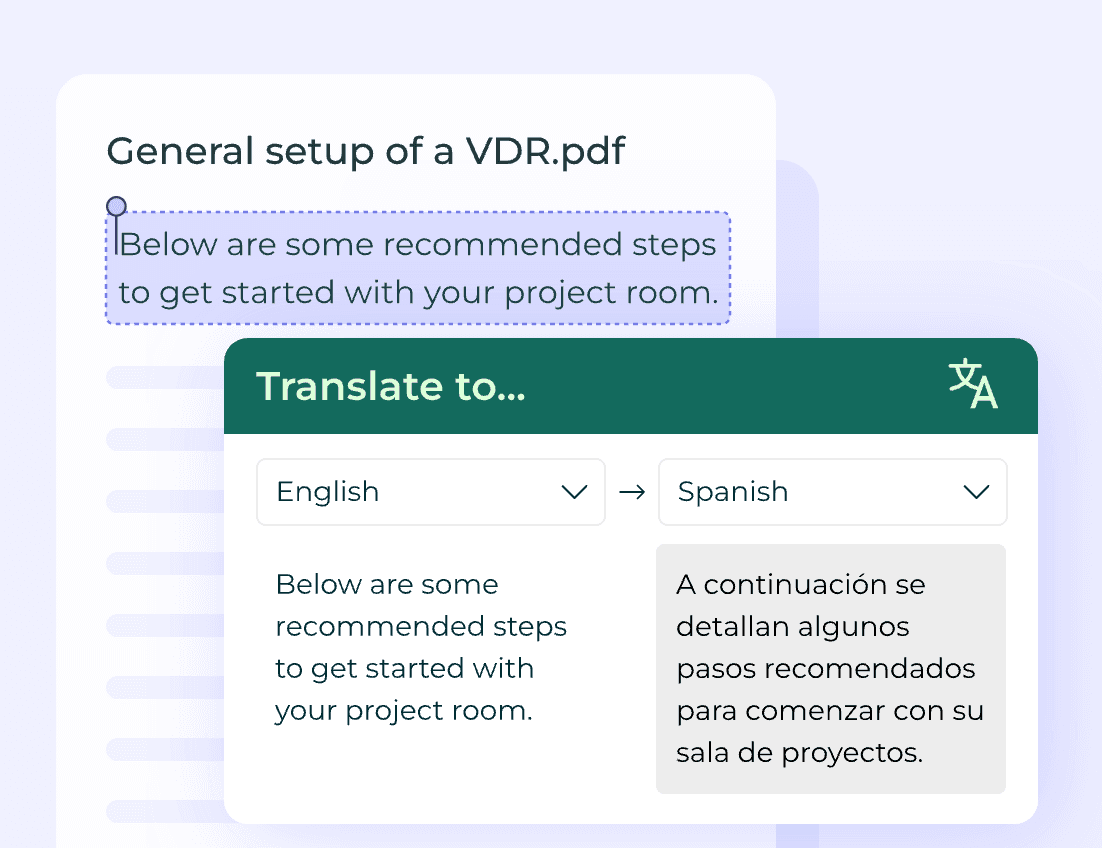

- Full‑document translation across 17+ languages directly in the viewer to streamline cross‑border diligence.

- Automated and intelligent redaction workflows, including key‑term redaction improvements and Excel watermark enhancements for sensitive data handling.

- AI‑powered categorization and indexing plus OCR to make scanned or unstructured documents searchable and organized for rapid diligence.

- Integrated Q&A workflow and refreshed analytics to connect questions with source materials and monitor engagement.

These features support common diligence use cases: quickly triaging large corpora, extracting decision‑ready summaries, running semantic searches for clauses and risk language, enforcing consistent redaction at scale, and supporting multilingual teams without leaving the secure room.

| Capability | What it does | Primary use cases | Value |

|---|---|---|---|

| Semantic search | Finds intent-relevant results beyond keywords | Locate clauses, risk language in seconds | Cuts review time; fewer misses |

| Summarize & Explain This | Creates concise summaries and explanations | Triage long contracts, CIMs, minutes | Faster decisions; better briefings |

| AI categorization & OCR | Auto-indexes uploads; scanned files searchable | Organize messy uploads; prep folders | Faster setup; smoother navigation |

| Intelligent redaction | Key-term detection and bulk redaction | Remove PII/sensitive terms at scale | Consistency; lower compliance risk |

| Full-document translation | Translate whole files in-room (17+ languages) | Cross-border diligence, multilingual review | No exports; one secure workflow |

| Mobile AI summaries | Summaries on iOS/Android for PDFs/Docs | On-the-go briefings, quick follow-ups | Always-available insights |

| Integrated viewer + inline translation | Preview, navigate, translate in one panel | Contextual review & collaboration | Less switching; higher throughput |

| Analytics & Q&A linkage | Tie engagement and Q&A to sources | Prioritize hotspots; resolve queries | Shorter timelines; clearer audit |

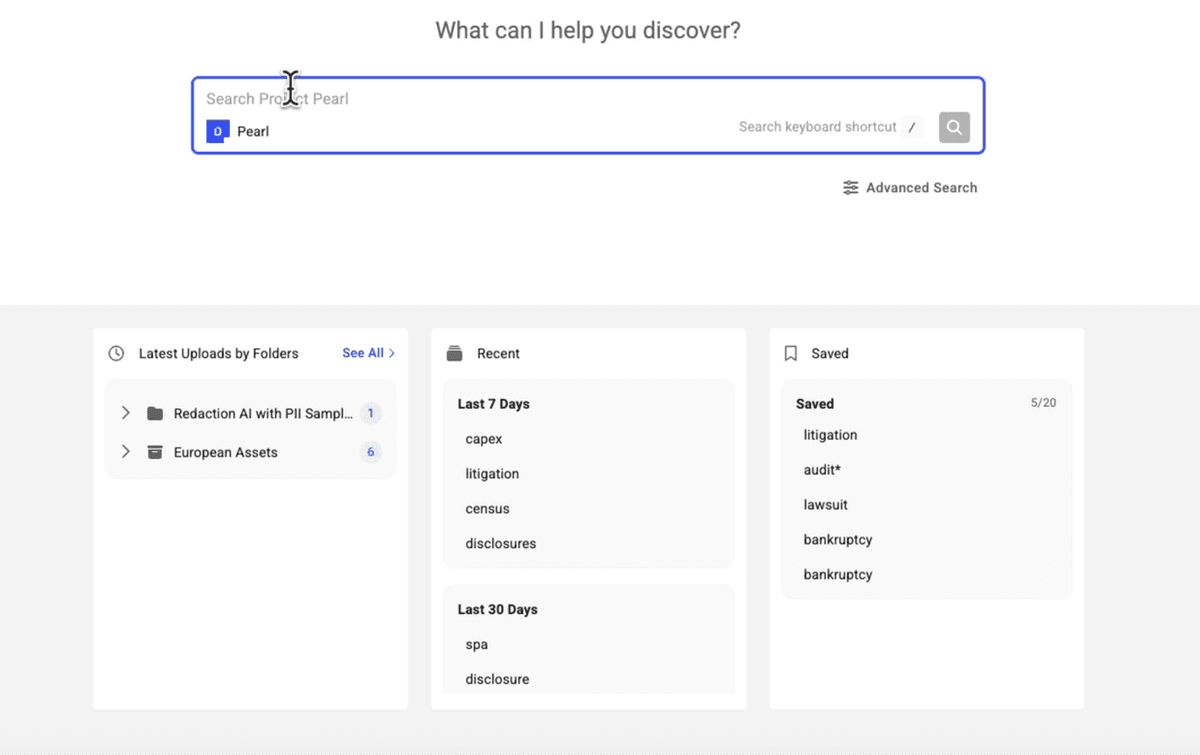

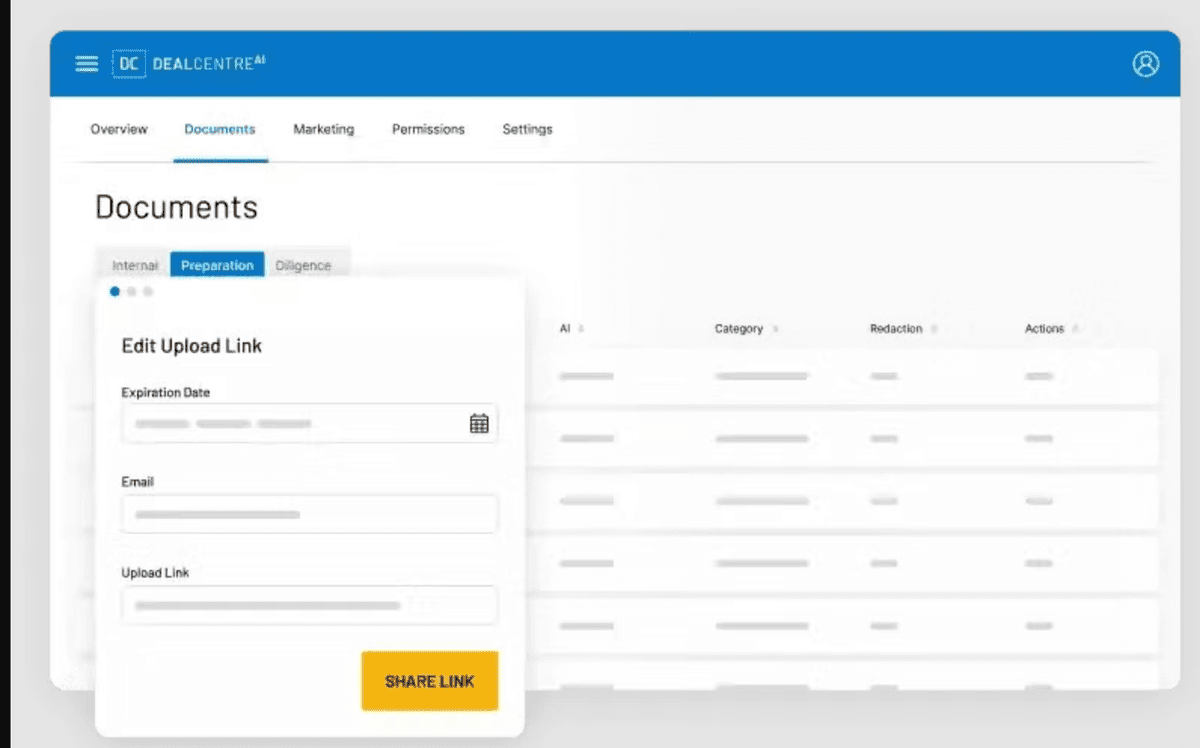

3. Intralinks

Website: intralinks.com

Intralinks is an enterprise data room and deal platform used across M&A phases. It’s built for complex, multi‑party processes where governance, scale, and dedicated services matter.

Pros include deep workflow coverage (prep, marketing, diligence, management), strong security posture, and global support. Potential cons are enterprise‑oriented onboarding, higher total cost, and complexity that can be heavy for small teams.

For a step‑by‑step walkthrough, see our Intralinks VDR guide.

AI features and use cases

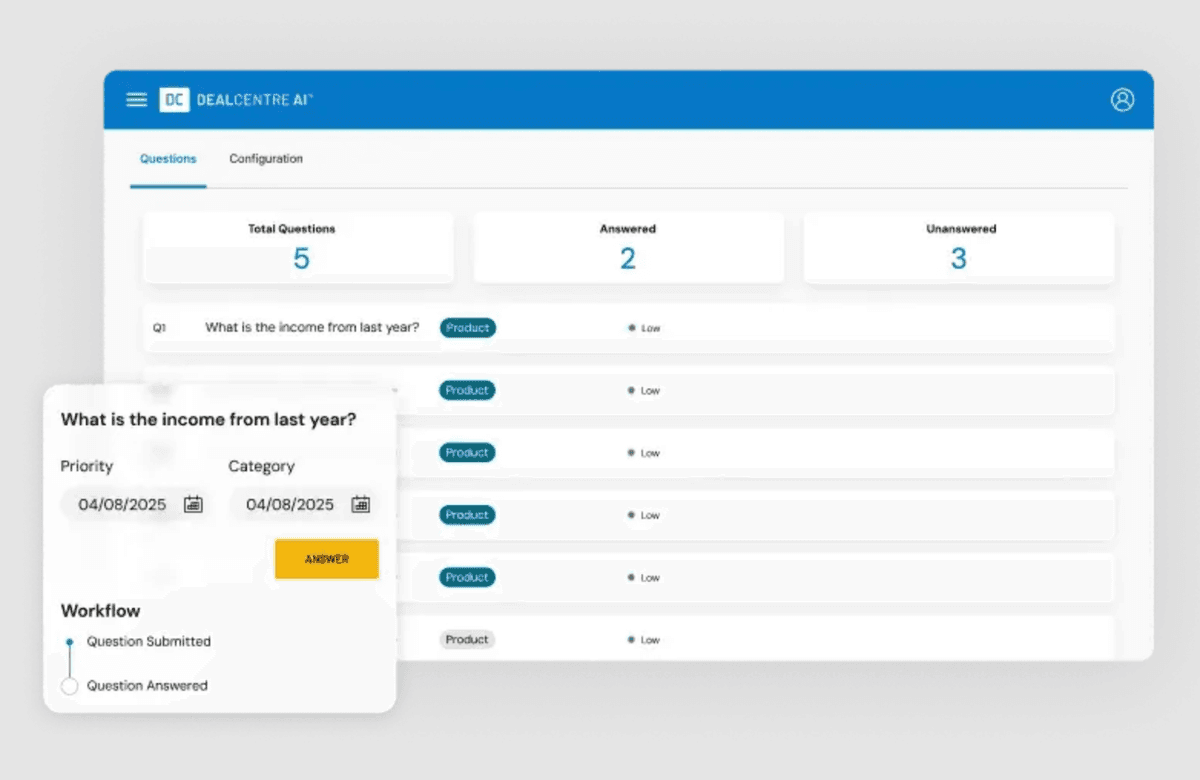

DealCentre AI (powered by Link) brings AI assistance across each phase:

- On‑demand AI assistant (Link) to summarize documents, answer specific questions, and extract key data.

- Preparation tools to auto‑organize, categorize, and validate files; “view as” checks simplify permissioning.

- Marketing workflow support for tracking outreach, bulk watermarking, and smooth handoff to diligence.

- Diligence acceleration via semantic discovery (Ask Link), consistency checks, and collaboration tooling.

- Management dashboards to spotlight bottlenecks and leverage insights from past deals.

These capabilities support real‑world use cases: rapid triage of lengthy contracts, quick Q&A answers tied to sources, bulk application of governance controls, and pipeline‑level visibility to keep deals moving.

| Capability | What it does | Primary use cases | Value |

|---|---|---|---|

| Link AI assistant | Summarize, extract data, answer questions | Speed contract/CIM review; exec briefings | Saves hours; reduces misses |

| Prep auto‑organization | Categorizes files; flags issues | Faster room setup; cleaner structure | Shorter time‑to‑live room |

| Semantic discovery (Ask Link) | Find insights beyond keywords | Locate clauses, obligations, risks | Higher review quality |

| Bulk watermarking & controls | Apply governance at scale | Outreach → diligence continuity | Consistent protection |

| Dashboards & analytics | Surface bottlenecks; reuse insights | Deal tracking; playbooks from past deals | More predictable timelines |

4. V7 (AI‑native)

Website: v7labs.com

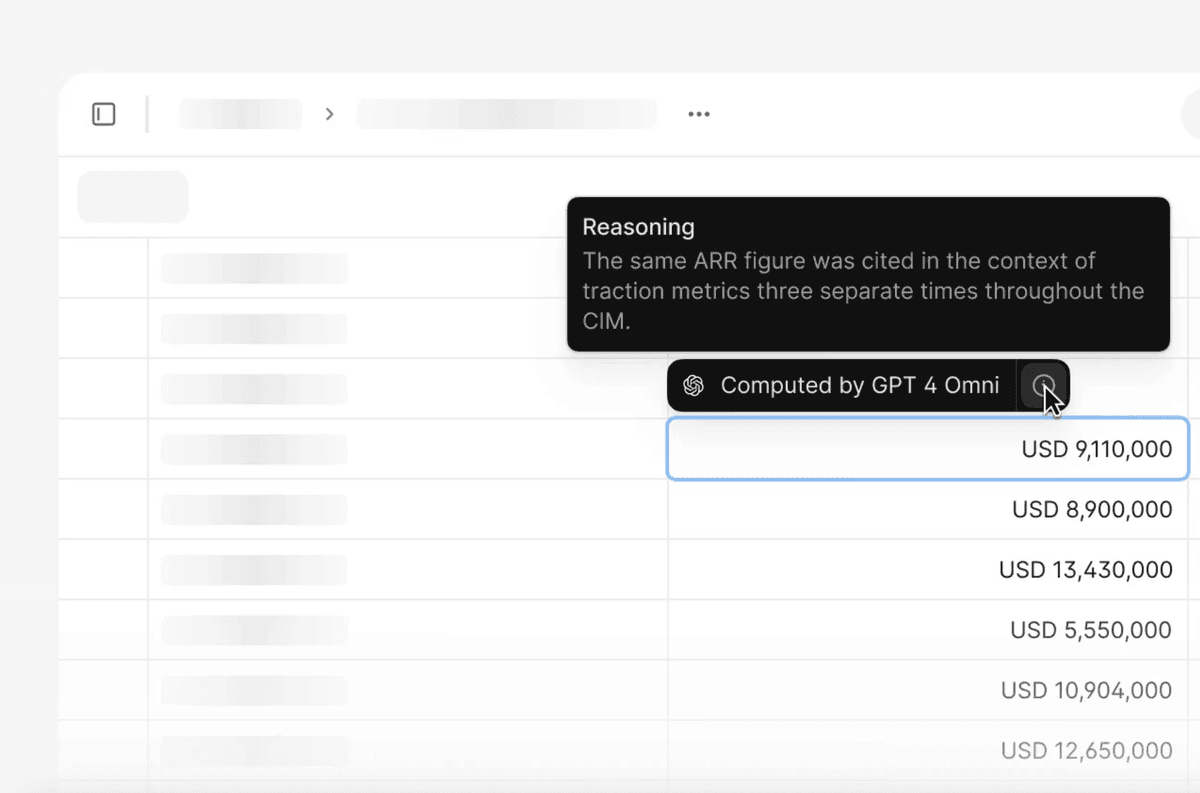

V7 Go is not a classic data room—it’s an AI automation layer built by an AI company and applied to portfolio data room analysis and due diligence. Think of it as an embedded co‑pilot that can read everything in your room, answer questions in plain English, extract KPIs, and kick off custom workflows. It’s engineered for messy, unstructured content (contracts, scans, spreadsheets, decks) using a stack of large language models, computer vision, OCR, and an agent framework.

Pros: extremely fast time‑to‑value (prototype in days), best‑in‑class handling of heterogeneous documents, and no‑code multi‑step automations with API integrations across your internal/external tools. Cons: it’s not a full VDR, so governance/room management typically rely on your existing platform and integrations; the best fit is buy‑side teams (VC/PE, corp dev) that value AI‑accelerated analysis over traditional admin features.

AI features and use cases

- AI agents to summarize lengthy files, extract key metrics, and answer natural‑language questions tied to document evidence

- Automated classification, OCR, and computer vision to structure heterogeneous uploads

- Multi‑step, no‑code automations that can integrate with existing systems via API

- Portfolio monitoring and CIM review workflows tailored for buy‑side speed

- Multi‑modal support (PDFs, spreadsheets, slides, images, audio) for cross‑format analysis

These capabilities enable fast triage of large data rooms, instant answers to diligence questions, and custom workflows (alerts, filings, updates) triggered from document content.

| Capability | What it does | Primary use cases | Value |

|---|---|---|---|

| AI agents | Summarize, extract metrics, answer questions | CIM review; portfolio room Q&A | Days → minutes for insights |

| Unstructured doc handling | LLMs + CV + OCR for varied files | Contracts, reports, scans, slides | Higher coverage; fewer misses |

| No‑code automations | Multi‑step flows; API integrations | Trigger workflows from findings | Reduce manual work by 100+ hrs |

| Multi‑modal analysis | PDF, XLSX, PPT, images, audio | Cross‑format diligence | One pipeline for all content |

5. iDeals

Website: idealsvdr.com

iDeals is a well‑established VDR used across regulated industries and cross‑border deals. It combines robust governance (permissions, audit, Q&A) with AI capabilities focused on speeding review and improving accuracy in multilingual, sensitive workflows.

Pros include bank‑grade security posture, simple admin for large teams, and practical AI that augments rather than replaces reviewer judgment. Potential cons are that advanced AI is oriented to acceleration (not agentic orchestration), and pricing is quote‑based for larger deployments.

For deeper context, see our iDeals VDR overview and iDeals pricing review.

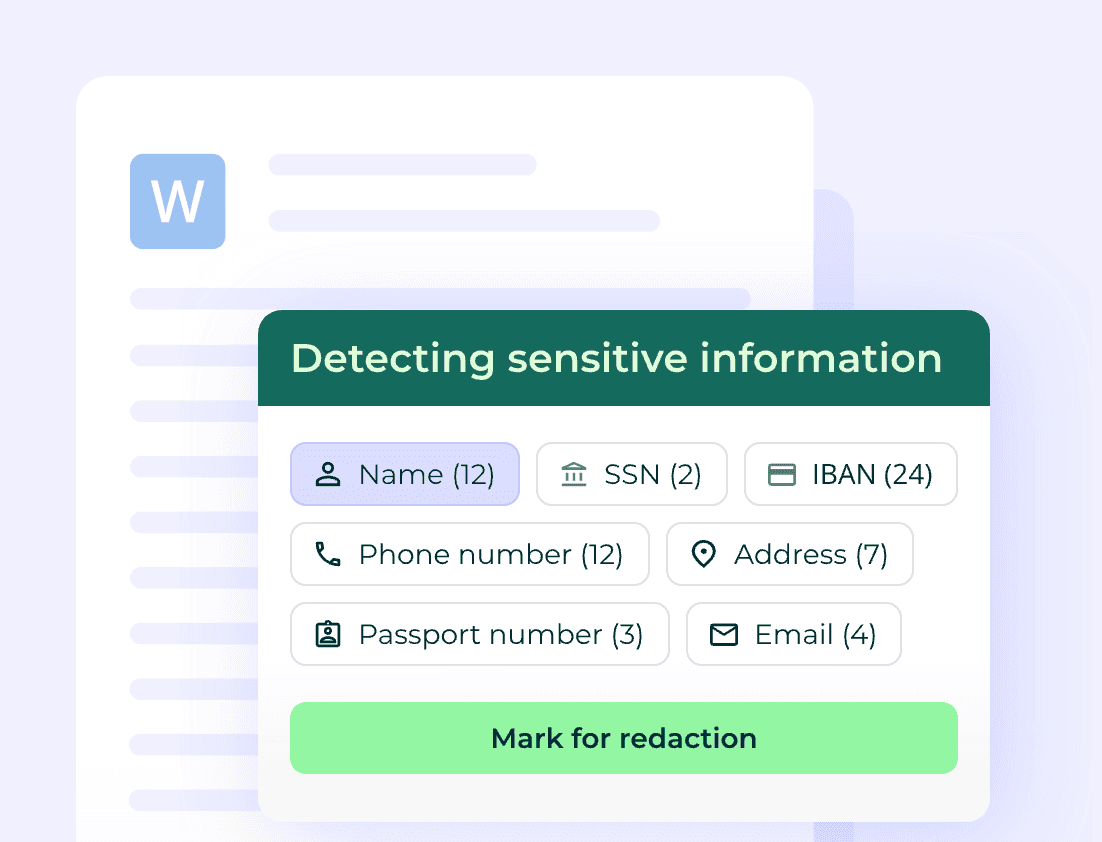

AI features and use cases

-

-

AI‑powered redaction to detect and remove PII across documents, reducing manual effort and risk

-

In‑product translation to instantly translate entire files for cross‑border diligence without leaving the room

-

Intelligent (semantic) search to surface insights by meaning, with page references for verification

-

Security‑first AI approach: no model training on client data; features can be disabled per project/user

These tools help teams clean sensitive content at scale before bidder access, review global deal rooms in preferred languages, find clauses and facts faster with verifiable references, and maintain strict privacy boundaries and compliance while using AI.

| Capability | What it does | Primary use cases | Value |

|---|---|---|---|

| AI redaction | Detects PII; bulk redacts | Pre‑release sanitization | Lower risk; save hours |

| Instant translation | Translate documents in‑room | Cross‑border review | No exports; faster clarity |

| Intelligent search | Search by meaning; page refs | Find clauses/facts fast | Quicker, verifiable answers |

| Privacy‑preserving AI | No client data used for training | Regulated workflows | Compliance confidence |

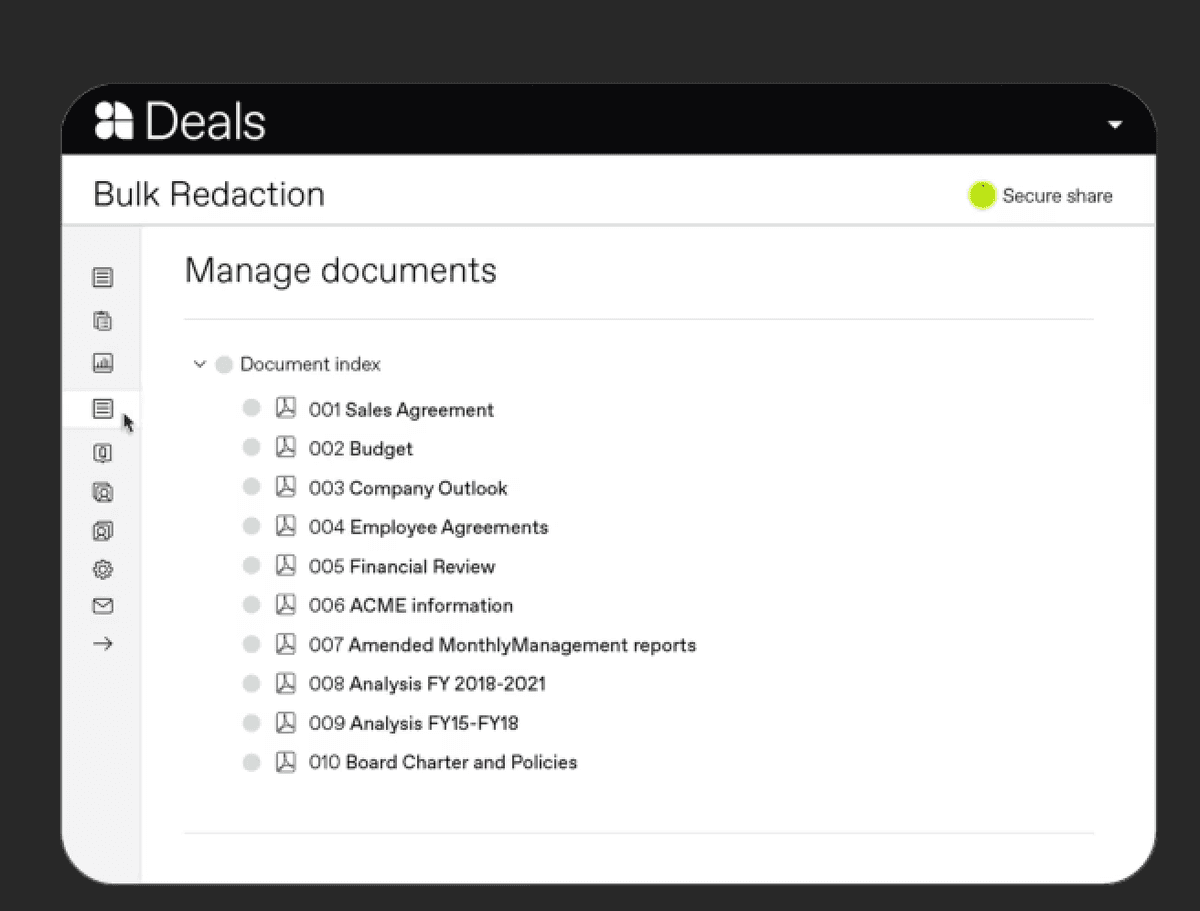

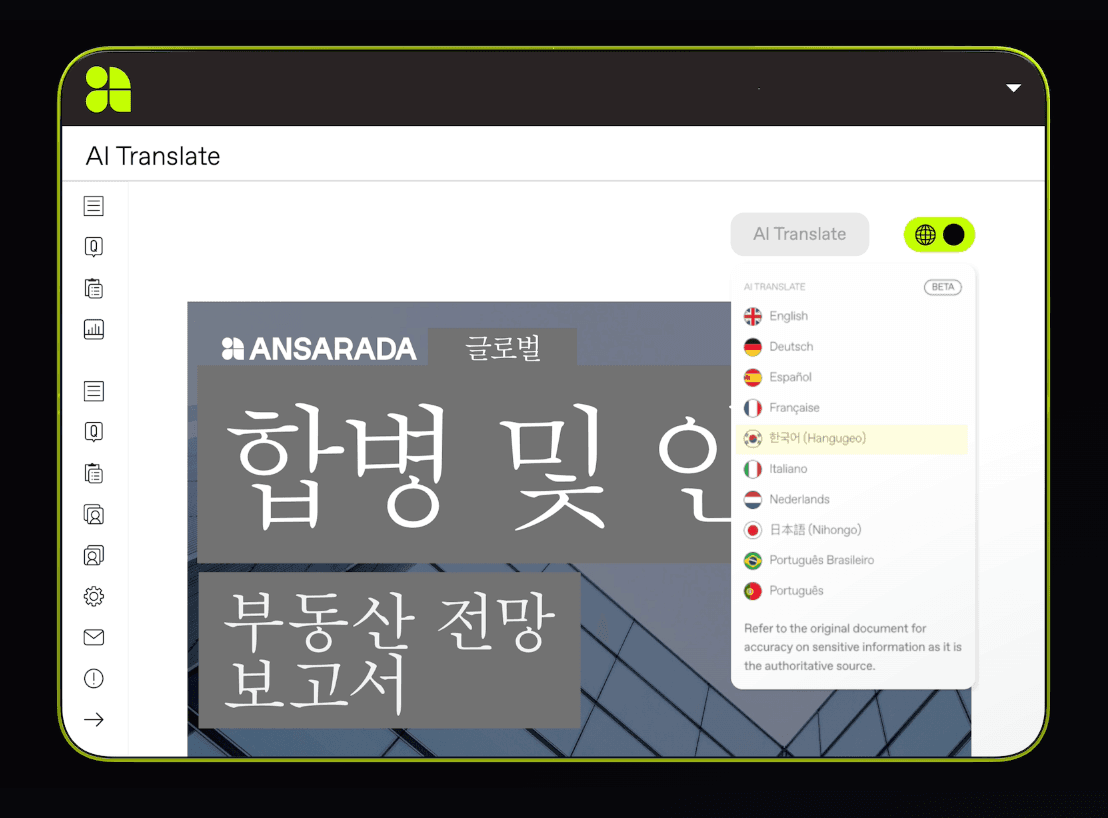

6. Ansarada

Website: ansarada.com

Ansarada is a deal platform and VDR with AI features focused on getting rooms organized fast, supporting cross‑border diligence, and guiding teams with predictive engagement insights. It’s designed for M&A workflows end‑to‑end, from prep and Q&A to bidder management and reporting.

Pros include fast auto‑organization (AI‑Sort), in‑room translation, bulk AI redaction at scale, and predictive bidder engagement scoring; it also offers structured workflows across the transaction lifecycle. Potential cons are reliance on the platform’s specific workflows and quote‑based pricing for advanced capabilities.

For deeper context, see our Ansarada data room overview and Ansarada pricing review.

AI features and use cases

-

-

AI‑Sort: auto‑organize uploads into the correct index in seconds, eliminating manual drag‑and‑drop

-

AI‑Translate: translate deal‑critical documents in seconds directly in the room for 14+ languages

-

AI‑Redact: bulk AI redaction with pattern recognition and custom terms; redact/un‑redact across 500+ docs quickly

-

AI‑Predict: bidder engagement scoring to forecast dropout risk and maintain competitive tension, with accuracy claims by day 7

-

Automated workflows and transaction lifecycle management (prep → marketing → diligence → PMI), including Q&A and dashboards

These capabilities help teams stand up organized rooms in minutes, run cross‑border processes without external tools, sanitize sensitive content at scale before bidder access, prioritize outreach and manage competitive tension using predictive signals, and keep diligence moving with structured Q&A and reporting.

| Capability | What it does | Primary use cases | Value |

|---|---|---|---|

| AI‑Sort | Auto‑indexes uploads | Instant room setup | Hours saved; fewer errors |

| AI‑Translate | In‑room translations (14+) | Cross‑border diligence | No exports; faster review |

| AI‑Redact | Bulk PII/term redaction | Pre‑release sanitization | Scale + consistency |

| AI‑Predict | Bidder engagement scoring | Spot drop‑off early; maintain tension | Better outcomes |

| Workflow & Q&A | Structured lifecycle tooling | Prep→DD→PMI continuity | Fewer bottlenecks |

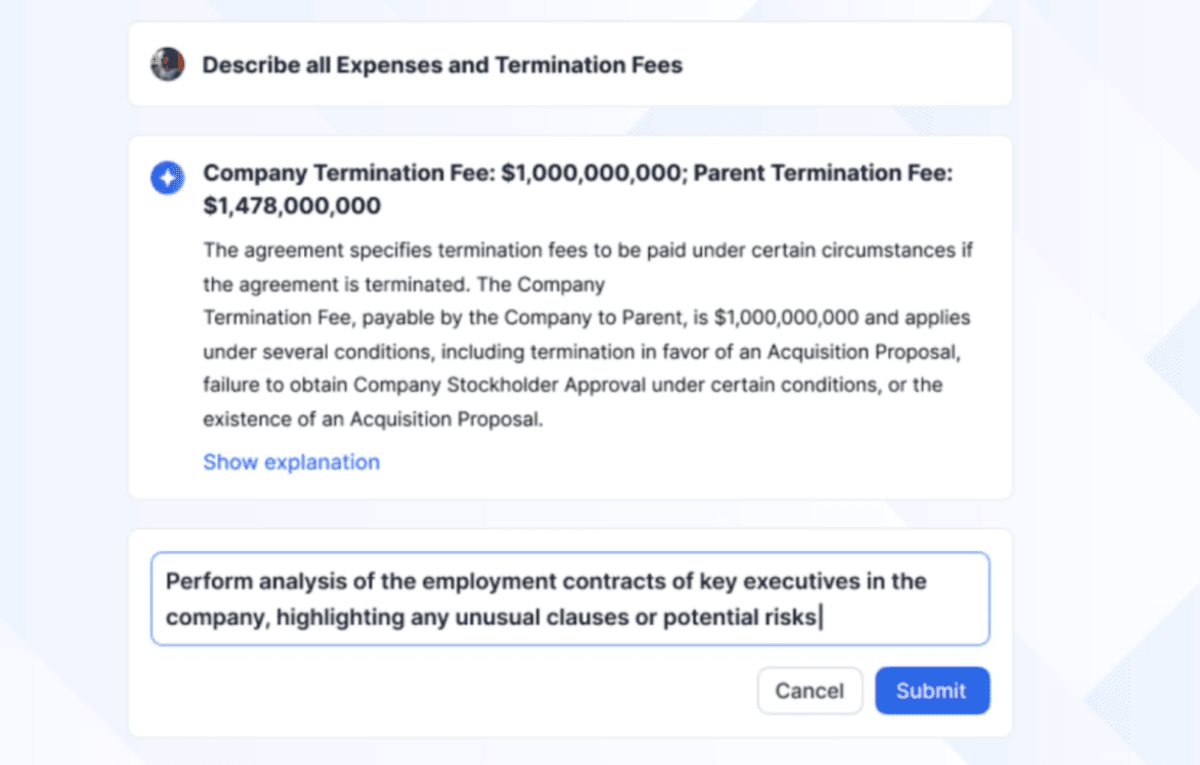

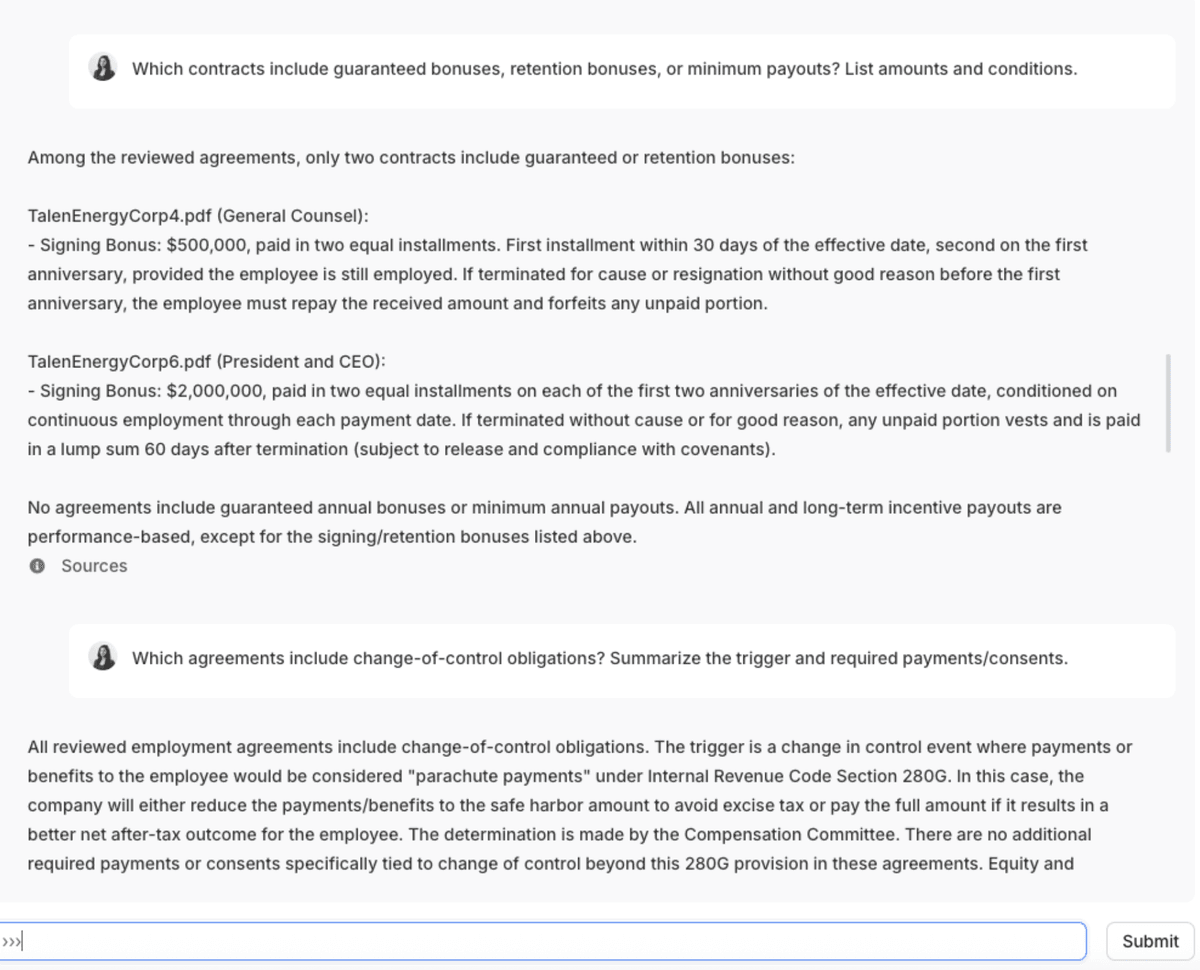

7. DealRoom

Website: dealroom.net

DealRoom is an M&A platform that blends VDR, pipeline, diligence, and integration workflows. Its AI is purpose‑built for due diligence: generate deal playbooks, extract key points across contracts, and chat across all contracts with citations back to source excerpts.

Pros include playbook generation to kick‑start trackers/folder structures, deal‑level chat with verifiable references, and bulk extraction/summarization across many contracts. Potential cons are an opinionated workflow geared to Buyer‑Led M&A and that it’s most valuable when your team fully adopts the platform.

AI features and use cases

- Build Deal Playbook: instantly generate a tailored diligence tracker and folder structure based on deal type, industry, and rationale

- Deal‑level chat across all contracts: ask questions once and surface risks/obligations with direct citations

- Contract analysis at scale: auto‑extract key terms (change of control, pricing grids, terms) and generate summaries

- Verification links: jump to the exact clause used to justify each extracted data point

- Templates library: standardized prompts and extractors for common contract categories

These capabilities help teams stand up diligence in minutes with a best‑practice playbook, cut review time by 60–80% through bulk summarization and extraction, avoid misses with deal‑level questions and evidence‑backed answers, and keep findings defensible via clause citations.

| Capability | What it does | Primary use cases | Value |

|---|---|---|---|

| Deal playbook builder | Creates tracker + folders | Kick‑start diligence setup | Faster time‑to‑live |

| Deal‑level chat | Q&A across all contracts | Surface risks/obligations | Coverage + speed |

| Bulk contract analysis | Extract + summarize key terms | Leases, MSAs, supplier contracts | 60–80% time savings |

| Verification links | Citations to clauses | Auditability of findings | Trust & defensibility |

| Templates library | Pre‑built extractors/prompts | Standardize diligence | Consistency, less rework |

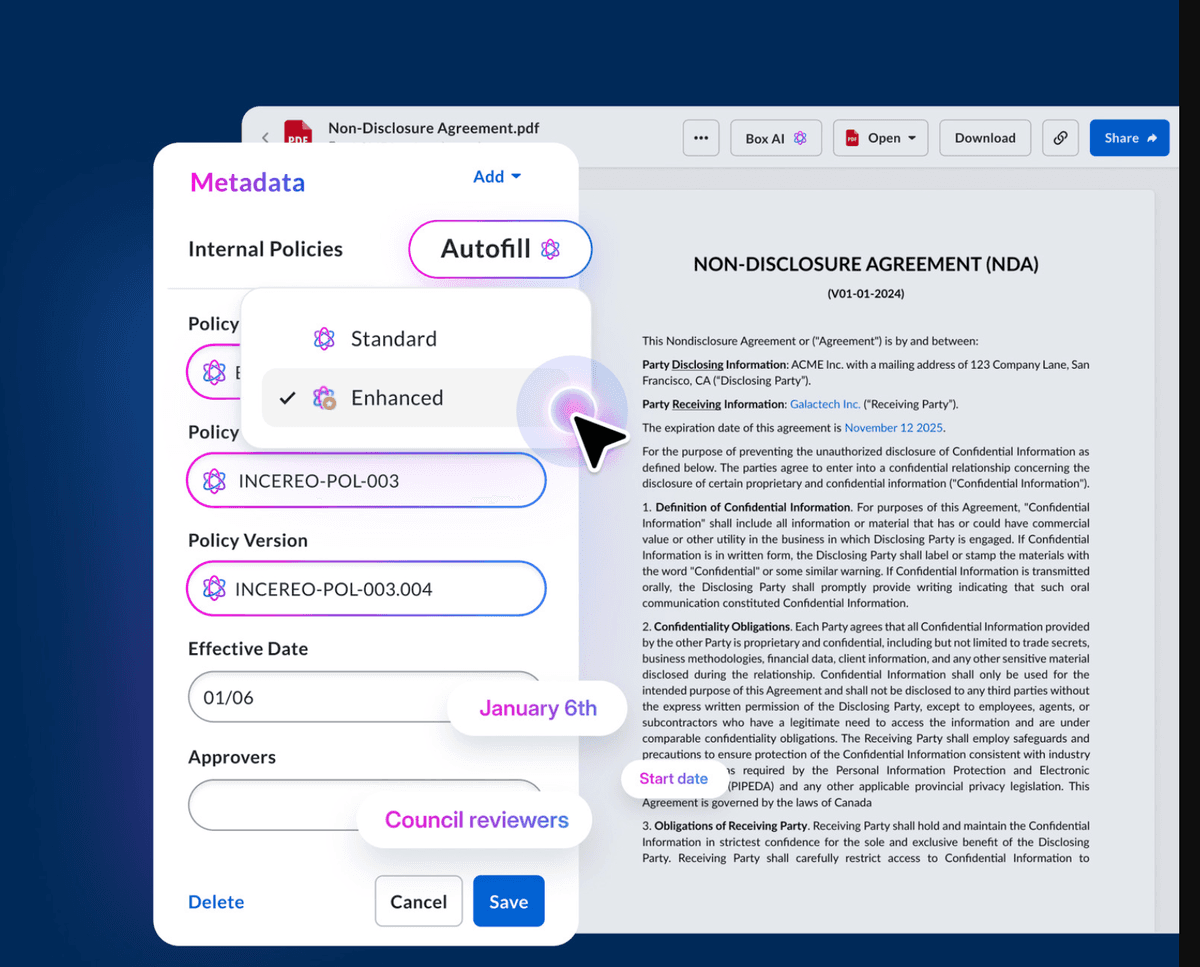

8. Box

Website: box.com

Box is a content cloud that teams often adapt for lightweight data rooms. With Box AI, users can ask questions of files, generate and summarize content, extract key fields, and classify documents—backed by governance add‑ons (e.g., Shield) and admin controls suited to enterprise IT.

Pros include ease of use, broad integrations, and AI assistance across common content tasks (summaries, Q&A, extraction). Potential cons are that it’s not a dedicated VDR (Q&A, bidder segregation, audit depth are limited without add‑ons) and advanced governance typically requires extra licensing.

AI features and use cases

-

-

Ask questions of files/folders to get instant answers with citations

-

Summarize long documents and generate outlines/briefings

-

Extract entities and key fields into structured data

-

Classify documents (e.g., contract types) to speed organization

-

Automate common content ops with templates and workflow tools

-

Enterprise controls: model choice, data residency, and no customer‑data training by default

These capabilities help teams speed read‑ins with accurate summaries and Q&A, build deal lists or trackers from extracted fields, and keep ad‑hoc rooms organized without heavy admin overhead.

| Capability | What it does | Primary use cases | Value |

|---|---|---|---|

| Q&A over content | Answers with citations | Quick read‑in; clarify terms | Time saved; fewer misses |

| Summarization | Condense long docs | Executive briefs | Faster decisions |

| Field extraction | Pull key data | Deal trackers; registers | Structured insights |

| Classification | Auto‑label files | Organize uploads | Less manual filing |

| Workflow templates | Automate ops | Repeatable tasks | Consistency & scale |

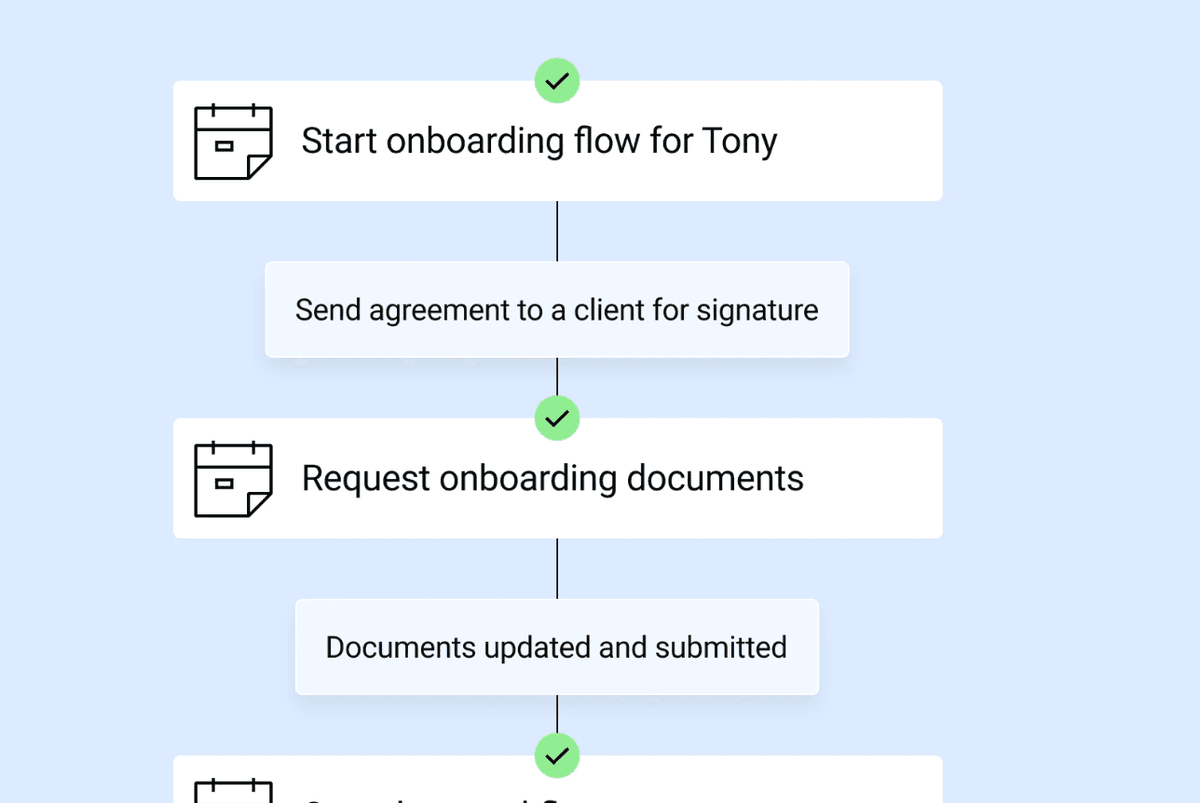

9. ShareFile (Citrix)

Website: sharefile.com

ShareFile is a client collaboration and file‑sharing platform that some teams adapt for simple data rooms. Its AI‑assisted Workflow Automation focuses on reducing repetitive tasks (form fills, e‑signature requests, file routing) with templates, reminders, and status tracking—useful for external client exchanges and lightweight diligence.

Pros include easy client portals, integrated e‑signature, and no‑code workflow automation that improves turnaround time. Potential cons are that it’s not a full VDR (granular bidder segregation/Q&A/audit depth are limited) and more advanced controls may require higher‑tier plans.

AI features and use cases

- Custom workflow automation: trigger actions (upload, e‑signature, approvals) and auto‑route documents to reduce manual steps

- Templates and reuse: save workflows as templates for consistent, repeatable processes

- Autofill from client data: prefill forms with existing ShareFile records to avoid re‑typing

- Full visibility and reminders: track statuses and auto‑nudge participants

- Security: encrypted files and compliance‑ready settings baked into workflows

- Integrated e‑signature and client portal for end‑to‑end client processes

These capabilities help teams shorten back‑and‑forth on document requests and signatures, standardize checklists and recurring processes such as onboarding and disclosures, and maintain visibility and compliance without heavy admin work.

| Capability | What it does | Primary use cases | Value |

|---|---|---|---|

| Workflow automation | Trigger + route tasks | Requests, reviews, signatures | Time saved; fewer errors |

| Templates | Reusable flows | Standardize onboarding/FAQs | Consistency |

| Autofill data | Prefill client info | Forms, disclosures | Less re‑entry |

| Status + reminders | Track + auto‑notify | Deadline management | Faster turnaround |

| E‑signature + portal | Built‑in client tools | External collaboration | Lower friction |

The future of AI for data rooms

AI in data rooms is moving from assistive add‑ons to embedded co‑pilots that understand deal context. Expect auto‑organized rooms, clause‑level verification, and multilingual review to become table stakes, while predictive signals guide outreach, bidder management, and workstream prioritization.

Governance will tighten in parallel—privacy‑preserving AI, auditability of outputs, and model controls (choice, data residency, redaction by default) will be mandatory in regulated processes.

The next wave will blend agentic workflows with enterprise systems: AI will triage and summarize across contracts, update trackers, draft diligence Q&A, and trigger downstream tasks in CRM/ERP with citations for every action. Open platforms will differentiate by offering APIs, fine‑grained permissions, and human‑in‑the‑loop checkpoints so teams can scale automation confidently without sacrificing compliance or trust.